Press release

Global FinTech Blockchain Market to Reach USD 322.27 Billion by 2030, Propelled by Rapid Adoption of Digital Financial Services

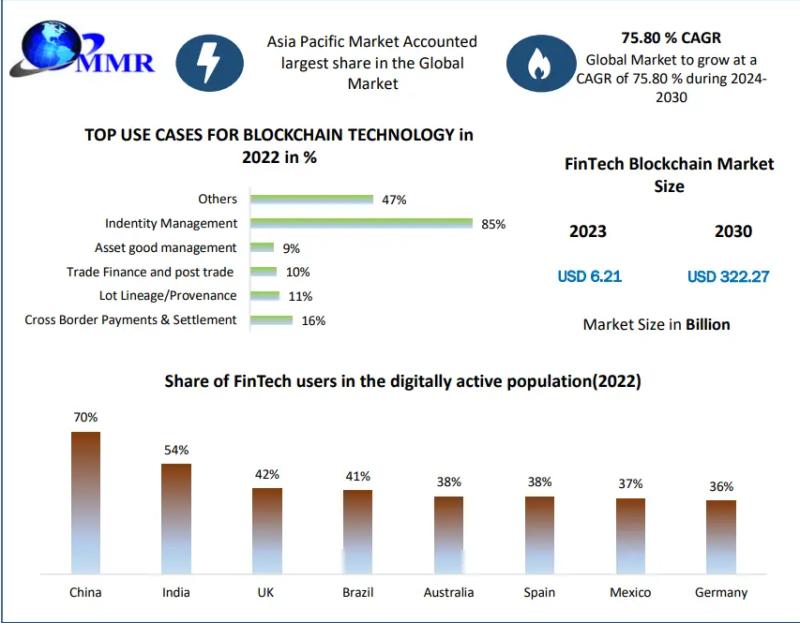

The Global FinTech Blockchain Market is poised for remarkable growth, with a valuation of USD 6.21 Billion in 2023, projected to surge to USD 322.27 Billion by 2030, exhibiting a staggering CAGR of 75.80% during the forecast period. The convergence of FinTech and blockchain technologies is reshaping traditional financial services, offering enhanced security, transparency, and efficiency to consumers and businesses worldwide.For more information or to access the full report, please visit:https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Report Scope:

Our latest report on the Global FinTech Blockchain Market provides comprehensive insights into market values, drivers, restraints, and regional dynamics. Utilizing advanced research methodologies, the report offers actionable intelligence to stakeholders seeking to capitalize on emerging opportunities in the FinTech blockchain landscape.

Research Methodology:

Combining primary and secondary research alongside advanced analytical tools, our report delivers accurate forecasts and strategic insights. By analyzing complex data in a simplified manner, we empower decision-makers with the information needed to navigate the evolving FinTech blockchain market effectively.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/13770

Market Drivers:

Enhanced Security and Transparency: Blockchain technology addresses security and transparency concerns in financial transactions, fostering confidence among users and institutions and driving adoption of FinTech blockchain solutions.

Rise of Digital Financial Services: Increasing adoption of digital financial services, including digital payments and mobile banking, is fueling demand for innovative FinTech solutions, driving market growth.

Market Restraints:

Regulatory Challenges: Complex and fragmented regulatory landscapes across jurisdictions hinder widespread adoption of blockchain in financial services, adding complexity to operations and impeding market growth.

Scalability Issues: Scalability concerns in blockchain networks, especially regarding transaction speed and network congestion, pose challenges to mainstream adoption and efficiency gains.

Regional Insights:

Asia Pacific: Home to fast-growing digital economies, Asia Pacific is witnessing a surge in FinTech and blockchain adoption, driven by high internet penetration rates and a tech-savvy population. The region's openness to innovation and willingness to adopt new technologies bodes well for market growth.

North America: With significant investment in the cryptocurrency and blockchain industry, North America remains a key market for FinTech blockchain solutions. The region's robust regulatory environment and tech-savvy consumer base contribute to market expansion.

Europe: Europe is experiencing substantial growth in digital payments and blockchain adoption, driven by advancements in technology and changing consumer preferences. The region's stringent regulatory framework and focus on financial inclusion further propel market growth.

Latin America and Middle East & Africa: These regions are witnessing growing interest and participation in decentralized finance (DeFi) applications built on blockchain, driven by the appeal of permissionless financial services and the increasing adoption of digital payments.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/13770

FinTech Blockchain Market Segmentation:

by Application

Payments, clearing, and settlement

Exchanges and remittance

Smart contracts

Identity management

Compliance management/Know Your Customer (KYC)

Others (cyber liability and content storage management

Payments, clearing, and settlement; exchanges and remittance; smart contracts; identity management; compliance management/Know Your Customer (KYC); and others (cyber liability and content storage management) are the market segments based on application. The market was led by the payments, clearing, and settlement sector in 2023, and over the forecast period, this segment is anticipated to hold the greatest share of the FinTech Blockchain Market. The FinTech Blockchain market's Payments, Clearing, and Settlement section focuses on using blockchain technology to improve and expedite the procedures involved in financial transactions, payment processing, and trade settlement. This section uses the decentralized and transparent features of blockchain to address issues and inefficiencies with traditional payment and settlement systems. Payment processing can be facilitated more quickly and effectively with the usage of blockchain technology.Several middlemen are frequently involved in traditional cross-border transfers, which increases transaction costs and causes delays. Peer-to-peer transactions are made possible by blockchain, which eliminates the need for middlemen and speeds up the payment process-particularly for cross-border transactions. Payment systems built on the blockchain can drastically lower transaction costs. Associated costs are reduced by doing away with the requirement for numerous middlemen, which benefits both customers and companies. This cost-effectiveness is especially important for cross-border payments and microtransactions.

by Provider

Application and solution providers

Middleware providers

Infrastructure and protocols providers

by Organization Size

Small and Medium-Sized Enterprises (SMEs)

Large enterprises

The market is divided into two segments based on the size of the organization: large companies and small and medium-sized enterprises (SMEs). Over the course of the forecast period, Small and Medium-Sized Enterprises (SMEs) are anticipated to dominate the FinTech Blockchain Market. Small firms go to fintech to outsource complexity and expertise since they have limited resources-time, money, and human-to dedicate to creating their own digital solutions. In general, SMEs benefit greatly from APIs and other low-code, plug-and-play solutions since they allow businesses to quickly implement digital solutions without incurring any upfront costs or affecting operations.

SMEs have different financial challenges than larger businesses. Due to their smaller size and frequently complex financial needs, smaller businesses find it challenging to get traditional Funding options include trade credit, equity, and loans. Fintech was created to address this particular business issue. By giving SMEs access to alternative capital through peer-to-peer (P2P) lending, invoice financing, and equity crowdfunding, non-traditional financing platforms like Funding Societies, SmartFunding, and FundedHere enable business owners to achieve next-stage growth, which is anticipated to accelerate the growth of the FinTech Blockchain industry.

by Industry Vertical

Banking

Non-banking financial services

Insurance

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/13770

FinTech Blockchain Market Key Players:

North America: 1. Ripple Labs Inc. (San Francisco, California, USA) 2. Coinbase (San Francisco, California, USA) 3. Gemini Trust Company (New York, New York, USA) 4. Chain Inc. (San Francisco, California, USA) 5. Digital Asset Holdings (New York, New York, USA) 6. Circle Internet Financial (Boston, Massachusetts, USA) 7. Consensys (Brooklyn, New York, USA) 8. BitPay (Atlanta, Georgia, USA) 9. Corda (R3) (New York, New York, USA) 10. Kraken (San Francisco, California, USA) Europe: 11. Adyen (Amsterdam, Netherlands) 12. Wirex (London, United Kingdom) 13. Bitstamp (Luxembourg) 14. Revolut (London, United Kingdom) 15. Blockchain.com (London, United Kingdom) 16. eToro (London, United Kingdom) 17. Santander InnoVentures London, United Kingdom 18. Fidor Bank (Munich, Germany) 19. SolarisBank (Berlin, Germany) 20. Binance (Valletta, Malta) Asia Pacific: 21. Ant Group (Hangzhou, Zhejiang, China) 22. Binance Asia Services Pte Ltd (Singapore) 23. Coinone (Seoul, South Korea) 24. QUOINE (Tokyo, Japan) 25. Huobi Global (Singapore) 26. ZebPay (Singapore) 27. OKCoin (Hong Kong) 28. Coins.ph (Manila, Philippines) 29. Liquid (Quoine) (Tokyo, Japan) 30. Korbit (Seoul, South Korea)

Table of content for the FinTech Blockchain Market includes:

Global FinTech Blockchain Market: Research Methodology

Global FinTech Blockchain Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

3.Global FinTech Blockchain Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Our Top Trending Reports:

Pension Fund Management Software Market https://www.maximizemarketresearch.com/market-report/pension-fund-management-software-market/201121/

Defense IT Spending Market https://www.maximizemarketresearch.com/market-report/defense-it-spending-market/201494/

Analog Cameras Market https://www.maximizemarketresearch.com/market-report/analog-cameras-market/203506/

4K Monitor Market https://www.maximizemarketresearch.com/market-report/4k-monitor-market/203508/

Middle East and Africa Lithium Metal Market https://www.maximizemarketresearch.com/market-report/middle-east-and-africa-lithium-metal-market/203604/

Key Offerings:

A detailed Market Overview

Market Share, Size, and Forecast by Revenue

Market Dynamics- Growth drivers, Restraints, Investment Opportunities, and key trends

Market Segmentation- A detailed analysis of each segment and their segments

Competitive Landscape - Leading key players and other prominent key players.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global FinTech Blockchain Market to Reach USD 322.27 Billion by 2030, Propelled by Rapid Adoption of Digital Financial Services here

News-ID: 3435215 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Electric Enclosure Market to Reach USD 115.16 Billion by 2032, Growing at 8.57% …

Electric enclosures are protective cabinets designed to house electrical and electronic components such as switches, circuit boards, and displays. Their primary purpose is to safeguard users from electric shocks while protecting sensitive equipment from environmental hazards. Typically installed within walls, electric enclosures offer both functional and aesthetic benefits by concealing wires and maintaining a clean, organized look.

These enclosures find widespread applications across multiple sectors including power transmission and distribution, energy…

India Automotive Aftermarket: Rising Focus on Vehicle Maintenance, Upgrades, and …

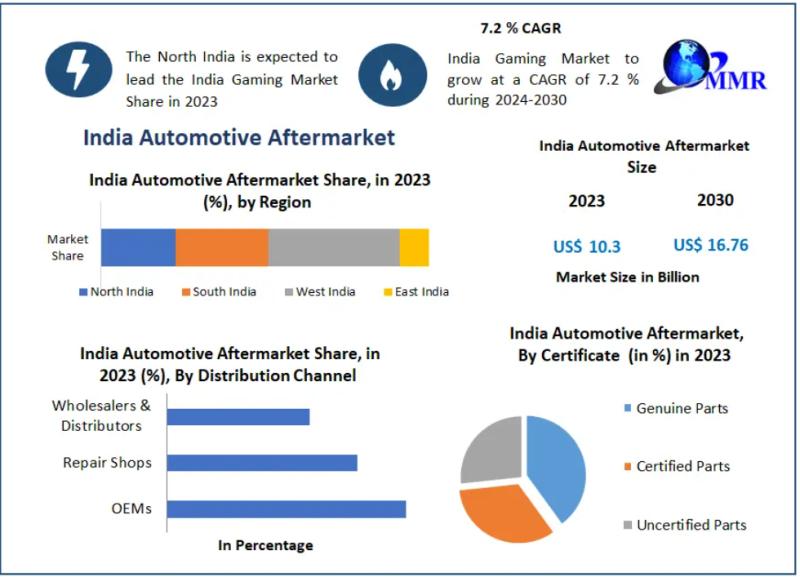

India Automotive Aftermarket - Market Overview

The India Automotive Aftermarket represents a critical pillar of the country's mobility ecosystem, encompassing replacement parts, accessories, diagnostics, maintenance, and repair services for vehicles already in operation. Valued at USD 10.3 billion in 2023, the market is benefiting from India's expanding vehicle parc of over 340 million vehicles, increasing vehicle age, and rising consumer awareness around preventive maintenance. The aftermarket plays a vital role in…

Parcel Delivery Market: Growing Demand for Fast, Reliable, and Technology-Driven …

Parcel Delivery Market Insights

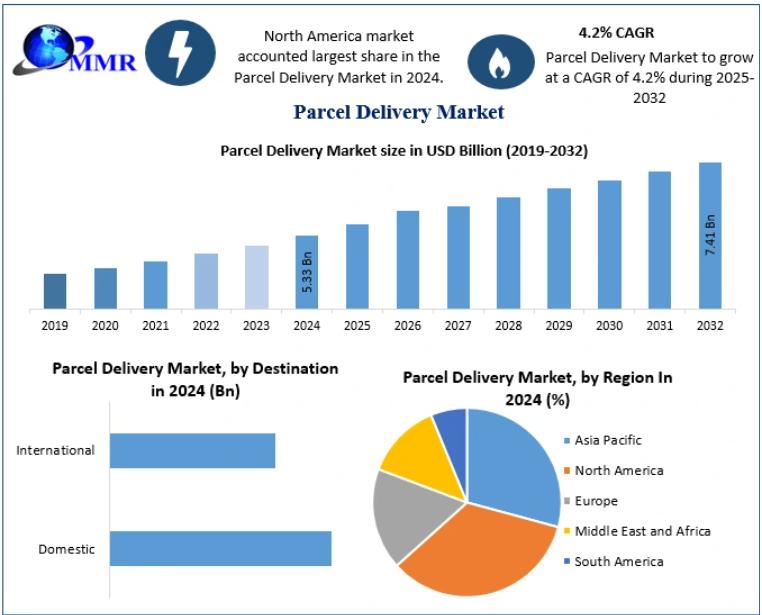

Market Overview

The Global Parcel Delivery Market is experiencing steady growth driven by increasing e-commerce adoption, internet penetration, and cross-border trade. Parcel delivery involves transporting goods via road, rail, air, or sea, with services ranging from express delivery to standard courier options. The sector benefits from technological advancements, such as GPS tracking, RFID, autonomous delivery vehicles (ADVs), and electric vehicles (EVs) for last-mile delivery, improving efficiency and customer…

Tire Retreading Market: Rising Focus on Cost-Effective, Sustainable, and High-Pe …

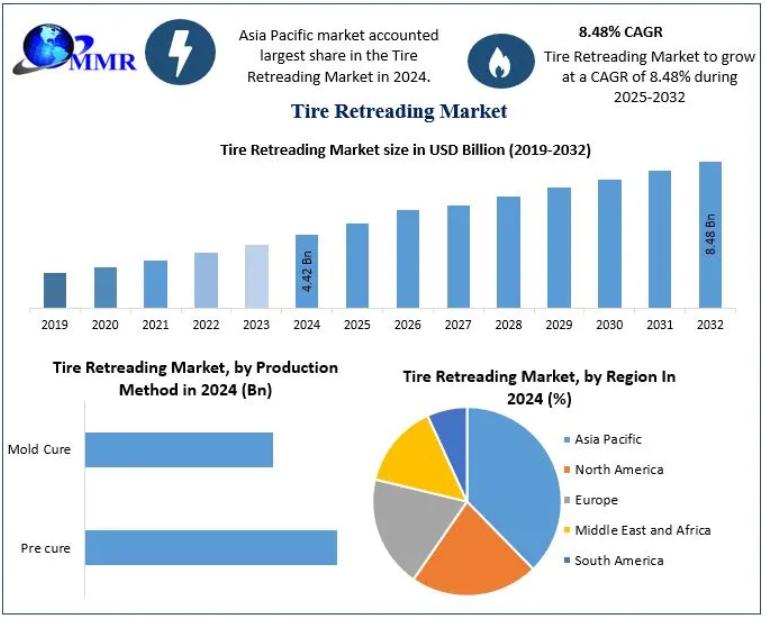

Global Tire Retreading Market - Overview

The Global Tire Retreading Market is an integral part of the circular economy, offering a sustainable alternative to new tires by reducing raw material consumption and energy usage during production. Retreaded tires are widely used in commercial and transport vehicles, providing cost-effective, environmentally friendly solutions without compromising performance or durability. The adoption of retreading technologies is transforming supply chains in the transportation sector, enabling companies…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…