Press release

Lending Market Reveals Demand, Key Trends, and Growth Rate in Modern Financing || Industrial and Commercial Bank Of China Ltd. (IDCBY), China Construction Bank Corporation

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Lending Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The lending market size has grown strongly in recent years. It will grow from $10505.27 billion in 2023 to $11325.13 billion in 2024 at a compound annual growth rate (CAGR) of 7.8%. The growth in the historic period can be attributed to strong economic growth in emerging markets, increase in internet penetration, rise in consumer spending, rise in construction activity, and increase in the number of vehicle loans.

The lending market size is expected to see strong growth in the next few years. It will grow to $15283.24 billion in 2028 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to blockchain penetration across various sectors, and increasing higher education. Major trends in the forecast period include investing in technologies to offer alternative lending services to boost profit margins, adopting digital technologies for faster approval of commercial loans and thereby enhance customer satisfaction, increasing the focus on participation lending to reduce risks and increase profitability, investing in laas platforms to capitalize on their rising popularity, and implementing the artificial intelligence in the operations for cost and time efficiency.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=3575&type=smp

Market Segmentation:

The lending market covered in this report is segmented -

1) By Type: Corporate Lending, Household Lending, Government Lending

2) By Interest Rate: Fixed Rate, Floating Rate

3) By Lending Channel: Offline, Online

Subsegments Covered: Working Capital, Short Term - Corporate Lending, Long Term - Corporate Lending, Home Loans, Personal Loans, Other Household Loans, Short Term - Government Lending, Long Term - Government Lending

Major Driver - A Rise In The Number Of Small Businesses Is Anticipated To Fuel Lending Market

The rise in the number of small businesses is expected to propel the lending market going forward. Small businesses refer to privately held entities that have fewer employees and generate less revenue compared to larger enterprises. Lending facilitates the provision of loans to businesses, whether they are just starting small businesses or expanding, as well as to consumers. This not only supports new investments but also boosts economic demand. For instance, in August 2022, according to the US Small Business Administration (SBA), a US-based office for small businesses in the federal government, the number of small businesses in the US grew to 33.2 million in 2022, marking an increase of 700,000 from the previous year, 2021. Therefore, the rise in the number of small businesses is driving the lending market.

Competitive Landscape:

Major companies operating in the lending market report are Industrial and Commercial Bank Of China Ltd. (IDCBY), China Construction Bank Corporation, Agricultural Bank of China, Bank of China ltd, JPMorgan Chase & Co. (JPM), Citi Group, Bank of America (BoA), Wells Fargo & Co., HSBC Holdings plc, BNP Paribas, Lending Kart, WeLab, Industrial and Commercial Bank of China Limited, Citibank (China) Co., Ltd. (CCCL), HSBC, Royal Bank of Scotland, Barclays, Lloyds Banking Group, Standard Chartered, Santander, Nationwide Building Society, Schroders, Close Brothers, Coventry Building Society, Deutsche Bank, Commerzbank, KFW Bankgruppe, DZ Bank, UniCredit Bank AG, NRW bank, Norddeutsche Landesbank, Credit Agricole, Danske Bank A/S, Midas Corporación Financiera S.A, European Investment Bank, Mitsubishi UFJ Financial Group, Bank of Montreal, Royal Bank of Canada (RBC), Business Development Bank of Canada, Borrowell Inc, Clearbanc, CreditSnap Inc, Dealnet Capital, Itáu Unibanco, Caixa Econômica, Celulosa argentina, Ternium argentina, Banco (BCP), BBVA Continental, Scotiabank Peru, Interbank, Red Capital, Maalem Finance Company, MoneyDila, Abu Dhabi Finance, BeeHive, Tarya, Blender, eloan.co.il, CITI, Standard Bank Group, FirstRand, ABSA Group, Nedbank Group, National Bank of Egypt, Attijariwafa Bank, Groupe Banques Populaire

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/lending-global-market-report

Top Trend - Coinbase Global Inc. Takes A Leap With The Launch Of Crypto Lending Platform

Major companies operating in the lending market are adopting innovative platforms, such as crypto lending platforms, to retain a stronghold on the market. Crypto lending platforms are online platforms that facilitate the borrowing and lending of cryptocurrencies. For instance, in September 2023, Coinbase Global Inc., a US-based company operating platforms for bitcoin exchanges, launched a crypto lending platform. The lending program is designed to provide institutions with more economic freedom and opportunity, in line with Coinbase's commitment to update the financial system using crypto. The lending program allows institutions to lend digital assets to Coinbase under standardized terms for a product that qualifies for a Regulation D exemption.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Lending Market Characteristics

3. Lending Market Trends And Strategies

4. Lending Market - Macro Economic Scenario

5. Lending Market Size And Growth

…..

27. Lending Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology. The firm has offices located in the UK, the US, and India, along with a network of proficient researchers in 28 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lending Market Reveals Demand, Key Trends, and Growth Rate in Modern Financing || Industrial and Commercial Bank Of China Ltd. (IDCBY), China Construction Bank Corporation here

News-ID: 3425699 • Views: …

More Releases from The Business research company

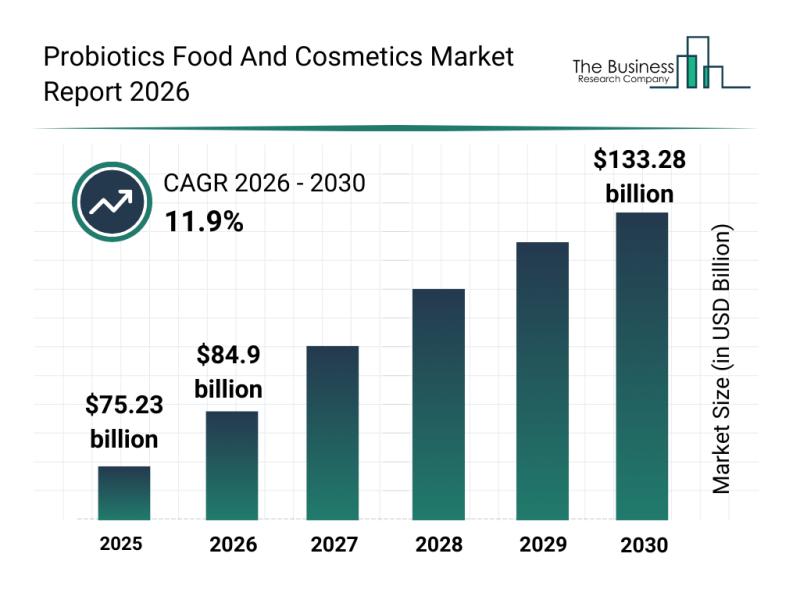

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

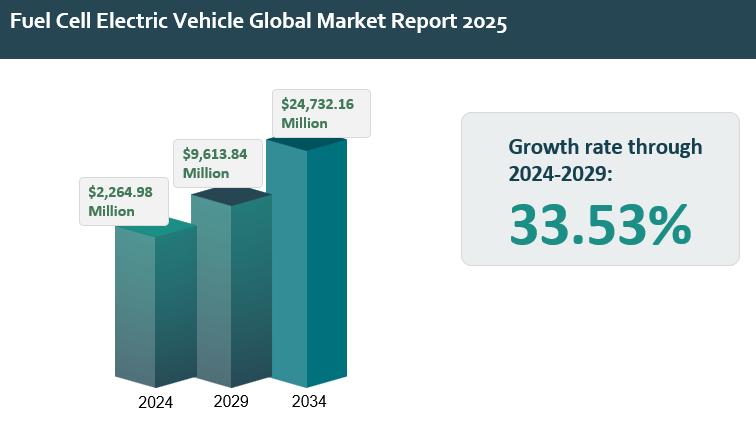

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

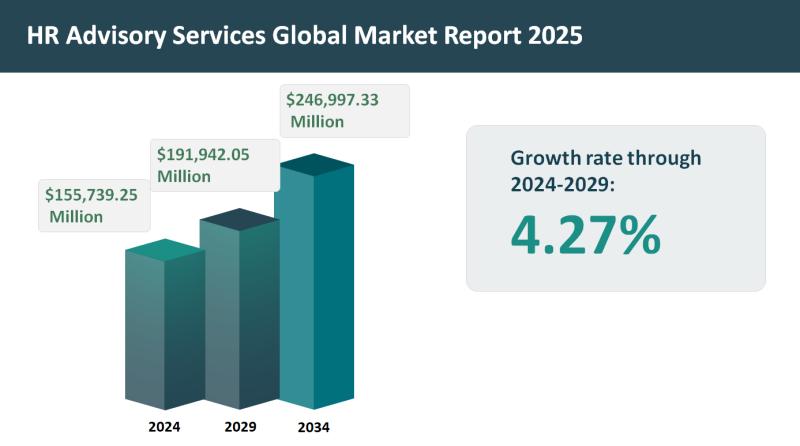

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…