Press release

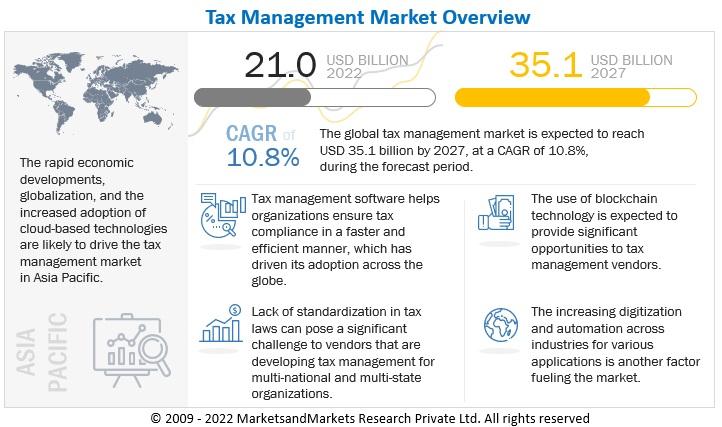

Tax Management Market Global Trends, Size, Segments and Growth by Forecast to 2027

The global Tax Management Market is projected to grow to USD 35.1 billion by 2027 from USD 21.0 billion in 2022 at a Compound Annual Growth Rate (CAGR) of 10.8% during the forecast period.Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=230446693

Standardization of tax compliance processes to scale operations globally, minimize risks, and fulfill tax obligations with lesser effort, increase in transparency for tax audits, and automation compliance tasks with AI, ML, and provision of automated compliance updates along with rules and regulations in countries are some of the key factors driving the market growth.

Software segment to continue with the larger market size during the forecast period

Tax management software facilitates the completion of tax returns for companies operating across verticals. It provides automated tax compliance with local accounting legislation and standards. Organizations across the globe have started adopting tax management software to keep up with the rapidly changing regulations and shifts in product taxability. Tax management software is experiencing an increasing demand pertaining to the ever-evolving tax and accounting laws across countries. There has to be enhanced software that can consider all of the regulatory needs and compliances put forward by the authorities of various regions. This is of utmost importance and provides alert(s) while establishing tax obligations across regions, and countries based on their nexus laws.

SMEs to record a higher CAGR during the forecast period

The increasing complexity of tax compliance has forced SMEs to adopt advanced tax management software. Cost-effectiveness is an important need for SMEs, as limited budgets always constrain them. This, in turn, leads to restricted ways adopted by SMEs to market themselves and gain visibility. SMEs have come a long way in enhancing strategic approaches including, but not limited to, service offerings, filing and reporting compliance requirements, levels of tax understanding, tax obligations complexity, and rapid changes in business ecosystems/environments. For instance, IRS (Internal Revenue Service) estimates that businesses with less than USD 1 million in revenue are to incur almost two-thirds of business compliance costs. Such costs are larger, related to revenues or assets, for SMEs than for large enterprises. Additionally, due to the complex tax codes, SMEs can understate their revenues and overstate their expenses, thus underpaying their taxes.

Inquiry Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=230446693

Manufacturing vertical to hold the second-highest market size during the forecast period

Manufacturing firms are an integral part of the supply/value chain. Hence, manufacturing firms must run smoothly so that the value chain will be stable. Globalization, eCommerce, and product shipment have reduced the gap between manufacturers and consumers. Nowadays, manufacturers have extended their market reach, resulting in more revenue and increased taxable products and services. The challenges faced while calculating tax for a manufacturer include selling to retailers or resellers, product-wise taxability, shipping or delivery, installation, and repairs. Hence, the process of tax calculation is complex and needs continuous observation. Manufacturers need to pay fines for any missing or invalid certificate. Tax management solutions can greatly help manufacturers better handle exempt or taxable transactions. Avalara and ClearTax are some of the companies providing tax management solutions to manufacturing companies.

Asia Pacific to record the highest CAGR during the forecast period

Asia Pacific is expected to have the most rapid growth rate in the tax management market during the forecast period due to its growing technology adoption and implementation at a growing scale across large enterprises and SMEs. The rise in indirect taxation is gathering pace as governments across the Asia Pacific region broaden the net of goods and services tax (GST) and value-added tax (VAT). Most of the automation, increased integration, and collaboration across international operations are essential. The outcome would ease the strains, reducing the risks and providing the agility needed to future-proof capabilities. Companies in the Asia Pacific are benefitting from the flexible economic conditions, healthy industrialization, and globalization-motivated policies of the governments practiced across different countries in the region. To match the rapid pace of technological advancement, companies are expected to use, improvise, enhance, constantly update and upgrade tax management solutions. There is a huge untapped market for tax management in India, China, Japan, and several other countries of Asia Pacific; this has proven to be a driver for the market in the region.

Get More Info - https://www.marketsandmarkets.com/Market-Reports/tax-management-market-230446693.html

The tax management market comprises major providers, such as Thomson Reuters (Canada), Intuit (US), H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), Sovos Compliance (US), SAP SE (Germany), Blucora (US), Vertex (US), DAVO Technologies (US), Sailotech (US), Defmacro Software (India), Xero (New Zealand), TaxSlayer (US), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), Taxback International (Ireland), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), SAXTAX (US,) and Shoeboxes (US)

The study includes an in-depth competitive analysis of these key players in the tax management market with their company profiles, recent developments, and key market strategies.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Global Trends, Size, Segments and Growth by Forecast to 2027 here

News-ID: 3419329 • Views: …

More Releases from Markets and Makets

Enterprise Information Archiving Market Status, Revenue, Growth Rate, Services a …

According to a research report "Enterprise Information Archiving Market with COVID-19 Impact, by Type (Content Type (Email, Database, Social Media, Instant Messaging, Mobile Communication) and Services), Deployment Mode, Organization Size, Vertical & Region - Global Forecast to 2027" published by MarketsandMarkets,

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=253224202

The global enterprise information archiving market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period, to…

Animal Wound Care Market Worth $2.0 Billion | Elanco Animal Health (US), 3M Comp …

Animal Wound Care market in terms of revenue was estimated to be worth $1.3 billion in 2023 and is poised to reach $2.0 billion by 2028, growing at a CAGR of 7.4% from 2023 to 2028 according to a latest report published by MarketsandMarkets™. The animal wound care market is poised for sustained growth by factors such as growing awareness of animal health, rising cost of veterinary care, rising pet…

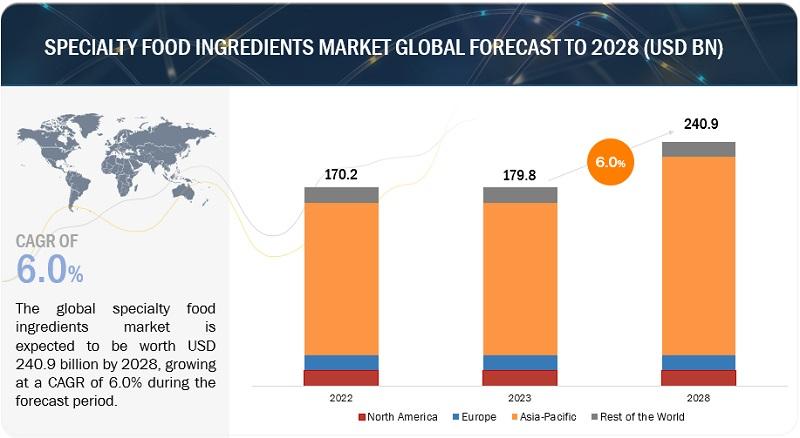

The specialty food ingredients market is poised for substantial growth driven by …

According to a comprehensive research report titled "Specialty Food Ingredients Market," published by MarketsandMarkets, the market for specialty food ingredients is anticipated to witness significant growth in the forecast period. The report projects that the market, valued at USD 179.8 billion in 2023, is expected to reach USD 240.9 billion by 2028, with a Compound Annual Growth Rate (CAGR) of 6.0% during this period. This growth is attributed to various…

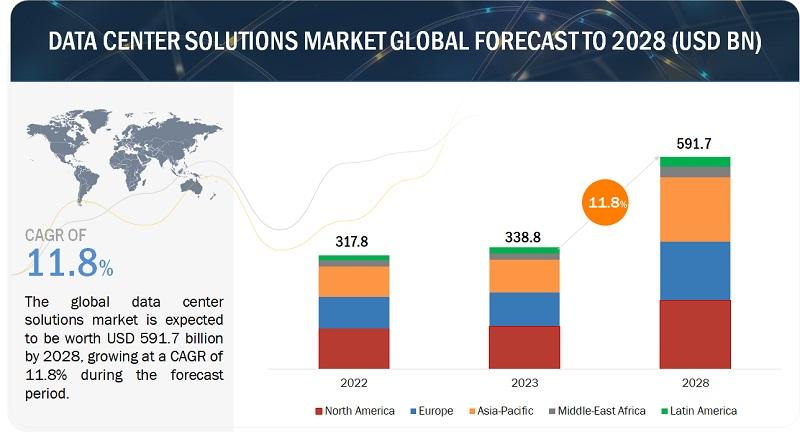

Data Center Solutions Market Trends, Size, Growth and Segments by Forecast 2028

The Data Center Solutions Market is expected to grow from USD 338.8 billion in 2023 to USD 591.7 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=232213604

The data center solutions market is fueled by the surging volume of data, accelerated adoption of cloud and edge computing, and the pervasive influence of technologies like AI and IoT. Opportunities arise from…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…