Press release

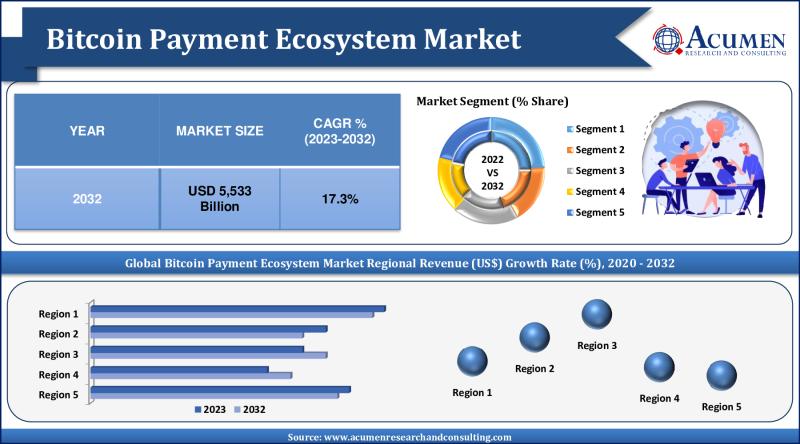

Bitcoin Payment Ecosystem Market Hits USD 5,533 Billion in 2032, Forecasts 17.3% CAGR (2023-2032)

The Bitcoin payment ecosystem has witnessed remarkable growth in recent years, driven by a convergence of factors that have propelled the adoption and integration of cryptocurrencies into mainstream financial systems. With the Bitcoin Payment Ecosystem Market Size reaching USD 1,142 Billion in 2022 and projected to achieve a market size of USD 5,533 Billion by 2032, it's evident that Bitcoin's role in global transactions is increasingly significant.Global Bitcoin Payment Ecosystem Market Trends

Market Drivers

One of the key drivers behind the growth of the Bitcoin payment ecosystem is the growing acceptance of Bitcoin by businesses and consumers alike. As more merchants embrace Bitcoin as a legitimate form of payment, the ecosystem expands, fostering greater adoption and utilization.

Moreover, institutional investors are increasingly entering the cryptocurrency space, recognizing Bitcoin as a viable investment asset. This influx of institutional capital not only adds credibility to Bitcoin but also contributes to its liquidity and market stability.

Technological advancements, such as the Lightning Network, have addressed scalability concerns, making Bitcoin transactions faster and more efficient. These developments enhance the usability of Bitcoin for everyday transactions, further driving its adoption.

Additionally, Bitcoin's status as a hedge against traditional financial uncertainties has attracted investors seeking refuge from inflation and economic instability, further fueling its growth.

Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/3501

Market Restraints

Despite its rapid growth, the Bitcoin payment ecosystem faces challenges that hinder its widespread adoption. One such challenge is the lack of clear and consistent regulations governing cryptocurrencies. Regulatory ambiguity creates uncertainty for businesses and consumers, impeding the development of robust Bitcoin payment infrastructure.

Moreover, Bitcoin's price volatility remains a concern for mainstream adoption. The fluctuating value of Bitcoin can deter merchants from accepting it as payment and consumers from using it for transactions, limiting its utility as a medium of exchange.

Market Opportunities

Despite the challenges, the Bitcoin payment ecosystem presents significant opportunities for innovation and growth. Continued advancements in blockchain and cryptocurrency technologies promise to address existing limitations and unlock new use cases for Bitcoin.

Furthermore, the integration of Bitcoin into the expanding ecosystem of decentralized financial services opens up avenues for financial inclusion and accessibility. As decentralized finance (DeFi) continues to gain traction, Bitcoin can play a pivotal role in facilitating peer-to-peer lending, decentralized exchanges, and other financial services.

Bitcoin Payment Ecosystem Market Dynamics

The Bitcoin payment ecosystem operates on a decentralized network, enabling peer-to-peer financial transactions using Bitcoin as a digital currency. This ecosystem comprises various components, including digital wallets, payment processors, and merchant services, that facilitate the sending and receiving of payments in Bitcoin.

One of the primary applications of the Bitcoin payment ecosystem is in online and in-store retail transactions. Merchants accepting Bitcoin as payment for goods and services benefit from lower transaction fees and faster processing times compared to traditional payment systems.

Additionally, Bitcoin facilitates cross-border transactions, enabling users to transfer value globally with reduced fees and greater efficiency. This feature is particularly valuable for remittances and international commerce, where traditional banking systems may be costly and slow.

Bitcoin Payment Ecosystem Market Segmentation

By Component

• Hardware: Includes devices such as Bitcoin ATMs and hardware wallets.

• Services: Encompasses payment processing, merchant services, and other related services.

• Software: Refers to digital wallets, trading platforms, and blockchain software solutions.

By Application

• Decentralized Identity: Utilizes blockchain technology for identity verification and authentication.

• Smart Contracts: Automated contracts executed on the blockchain.

• Decentralized Organization: Enables the creation and management of decentralized autonomous organizations (DAOs).

• Trading Marketplace: Platforms for buying, selling, and trading cryptocurrencies.

• ATMs: Bitcoin ATMs for purchasing or selling Bitcoin with fiat currency.

• Consumer Wallets: Digital wallets for storing and managing Bitcoin.

• Analytics and Big Data: Platforms for analyzing and monitoring Bitcoin transactions and market data.

By End User

• Enterprises: Businesses integrating Bitcoin into their operations for payments or investments.

• Government: Government agencies exploring blockchain and cryptocurrency applications.

• Others: Includes individual users and non-profit organizations utilizing Bitcoin for various purposes.

Bitcoin Payment Ecosystem Market Regional Analysis

North America emerges as a dominant region in the Bitcoin payment ecosystem, driven by several factors that foster widespread adoption and acceptance of cryptocurrencies. The region's vibrant FinTech sector, particularly in hubs like Silicon Valley, has been instrumental in developing user-friendly platforms and payment solutions for Bitcoin transactions.

Regulatory clarity in North America, particularly in the United States and Canada, has instilled confidence among businesses, investors, and consumers. Clear regulatory frameworks provide a conducive environment for the development of robust Bitcoin payment infrastructure.

Moreover, the presence of well-established financial institutions and a tech-savvy population has facilitated the integration of Bitcoin into mainstream financial services, further driving adoption.

Bitcoin Payment Ecosystem Market Players

Several companies play key roles in the Bitcoin payment ecosystem, offering a range of products and services to facilitate Bitcoin transactions. Some notable players include:

BitPay

Binance

Blockchain.com, Inc.

Coinbase Global, Inc.

OpenNode

CoinGate

PayPal Holdings, Inc.

VeriFone, Inc.

BTCPay Server

Bitcoin Payment Ecosystem Market Table of Content:

CHAPTER 1. Industry Overview of Bitcoin Payment Ecosystem Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Bitcoin Payment Ecosystem Market By Component

CHAPTER 6. Bitcoin Payment Ecosystem Market By Application

CHAPTER 7. Bitcoin Payment Ecosystem Market By End User

CHAPTER 8. North America Bitcoin Payment Ecosystem Market By Country

CHAPTER 9. Europe Bitcoin Payment Ecosystem Market By Country

CHAPTER 10. Asia Pacific Bitcoin Payment Ecosystem Market By Country

CHAPTER 11. Latin America Bitcoin Payment Ecosystem Market By Country

CHAPTER 12. Middle East & Africa Bitcoin Payment Ecosystem Market By Country

CHAPTER 13. Player Analysis Of Bitcoin Payment Ecosystem Market

CHAPTER 14. Company Profile

These companies provide a variety of services, including payment processing, digital wallets, and merchant services, contributing to the growth and development of the Bitcoin payment ecosystem.

In conclusion, the Bitcoin payment ecosystem represents a dynamic and rapidly evolving landscape, driven by technological innovation, regulatory developments, and shifting consumer preferences. Despite challenges and uncertainties, the future outlook for Bitcoin and its ecosystem remains promising, with significant opportunities for growth and expansion on the horizon.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/3501

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bitcoin Payment Ecosystem Market Hits USD 5,533 Billion in 2032, Forecasts 17.3% CAGR (2023-2032) here

News-ID: 3411632 • Views: …

More Releases from Acumen Research and Consulting

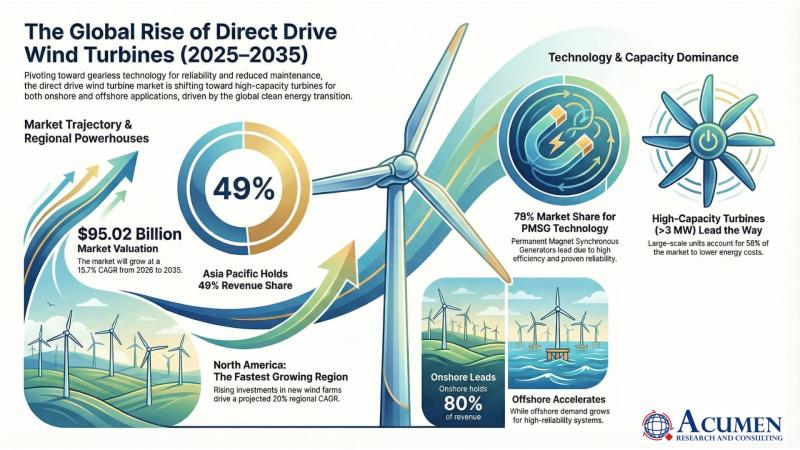

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

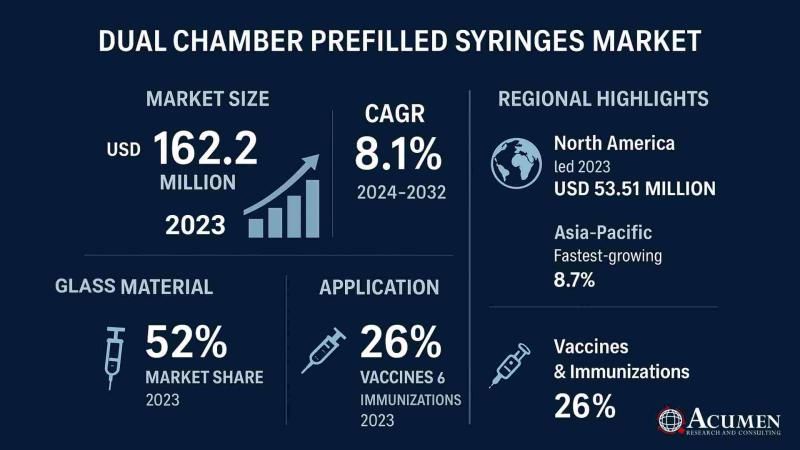

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

More Releases for Bitcoin

Bitcoin Mining and Bitcoin CloudMining Evolve with AI-Optimized Technology

Toronto, Canada - October 2025

With the world shifting towards increased use of digital resources, Hashj establishes the new trend in the sector once again, introducing an improved cloudmining platform with bitcoin. This new system has been revolutionary because anyone can engage in bitcoin mining without technical skills or costly software and hardware. Better still, users can begin to mine immediately without any registration to be given a $118 giveaway…

Loans against Bitcoin for more Bitcoin

Go VIP Worldwide, wholly owned by Matthew Barnes, drew a $100,000 loan from an FDIC Bank against Go VIP Worldwide's Bitcoin holdings on July 29, 2025 and immediately used the entire loan to buy more Bitcoin.

This is significant as Go VIP Worldwide is not a publicly traded company begging Wall Street to beg the public to buy Bitcoin for their publicly traded company, as it appears all the leveraged…

1502.app, LLC Launches 1502, The Bitcoin Messenger, Bitcoin meets mainstream fea …

1502.app, LLC is excited to announce the official launch of 1502, The Bitcoin Messenger, after a successful year of open beta testing. 1502 integrates non-custodial wallets into a private messenger environment and offers additional features for a global audience of freelancers, digital nomads, overseas workers, and small shop owners.

1502 aims to merge daily-life utility with Bitcoin, allowing direct Bitcoin transactions between two parties without any intermediary involvement.

This innovative approach is…

BITCOIN UP REVIEW 2022:IS BITCOIN UP A SAFE INVESTMENT?

Bitcoin Up Review:Despite the fact that it is a complex world, the introduction of trading robots made it easier for newcomers to understand the world of cryptocurrencies. They can open the doors for passionate investors wanting to reap the rewards of these technologies capable of forecasting price movements and making judgments without any human assistance by democratizing the use of these sorts of assets with automated algorithms and artificial intelligence.

Cryptocurrency…

What is Bitcoin? Understanding Bitcoin & Blockchain in 10 Minutes.

Bitcoin's open-source code (software), launched in 2009 by an anonymous developer, or group of developers, that are known only by the pseudonym Satoshi Nakamoto. This ingenious codebase enabled a completely trust-less network between strangers. And both sender and receiver can remain anonymous, if they so desire.

Bitcoin is not printed by a government or issued by a central bank or authority. Bitcoin is created by ingenious open-source code (software) installed on…

Bitcoin Association launches online education platform Bitcoin SV Academy

Bitcoin Association, the Switzerland-based global industry organisation that works to advance business with the Bitcoin SV blockchain, today announces the official launch of Bitcoin SV Academy – a dedicated online education platform for Bitcoin, offering academia-quality, university-style courses and learning materials.

Developed by Bitcoin Association, Bitcoin SV Academy has been created to make learning about Bitcoin – the way creator Satoshi Nakamoto designed it - accessible, accurate and understandable. Courses are…