Press release

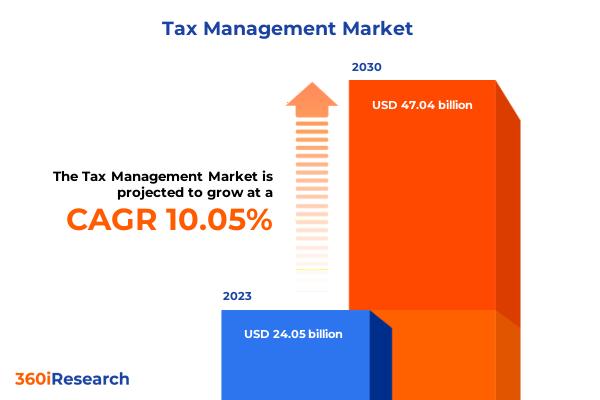

Tax Management Market worth $47.04 billion by 2030, growing at a CAGR of 10.05% - Exclusive Report by 360iResearch

The "Tax Management Market by Component (Services, Software), Tax Type (Direct Tax, Indirect Tax), Deployment, End-User, End-user Industry - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Tax Management Market to grow from USD 24.05 billion in 2023 to USD 47.04 billion by 2030, at a CAGR of 10.05%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/tax-management?utm_source=openpr&utm_medium=referral&utm_campaign=sample

The primary goal of tax management is to reduce tax liability by making tax-efficient investments or claiming deductions for specific expenses under applicable income tax laws. Tax Management is concerned with the timely filing of returns, having accounts audited, deducting tax at source, and many more. Tax management aids in the avoidance of interest, penalties, and prosecution. The emerging digital financial transaction and automated compliance have enhanced the adoption of tax management across several industries. However, data security & privacy issues and limited knowledge about tax procedures may impede the development of the tax management market. Nevertheless, the integration of advanced technologies and the surging potential of indirect tax management can create enormous opportunities. Additionally, many players are integrating sustainability agendas in their tax services, which can expand the adoption of tax management solutions among eco-consciousness end-users.

The Americas region, particularly U.S. and Canada is characterized by the significant adoption of digital technologies on an industrial scale. The presence of multiple players, and a developed and complex taxation system, which have encouraged the utilization of tax management solutions in the region. Similarly, the EMEA region has also covered a significant spectrum of the market owing to stringent regulatory norms and constant technology development in financial services. Several European software vendors have initiated collaborating with third-party developers to create API-based software to streamline the tax system, creating lucrative growth opportunities. Furthermore, growing adoption of software-based tax systems, combined with rising digitalization in the Asia-Pacific region, is expected to boost economic growth, propelling market growth in this region. Adoption of tax management solutions in the APAC region is driven by the need for cost-effective and reliable tax services.

Market Segmentation & Coverage:

This research report categorizes the Tax Management Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Component, market is studied across Services and Software. The Services is projected to witness significant market share during forecast period.

Based on Tax Type, market is studied across Direct Tax and Indirect Tax. The Indirect Tax is projected to witness significant market share during forecast period.

Based on Deployment, market is studied across On-Cloud and On-Premises. The On-Cloud is projected to witness significant market share during forecast period.

Based on End-User, market is studied across Large Enterprise, Midsize Enterprise, and Small Business & Individuals. The Midsize Enterprise is projected to witness significant market share during forecast period.

Based on End-user Industry, market is studied across BFSI, Energy & Utility, Healthcare, Manufacturing, Media & Entertainment, Retail & e-Commerce, and Telecommunication & IT. The Media & Entertainment is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 38.17% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/tax-management?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Tax Management Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Tax Management Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Tax Management Market, highlighting leading vendors and their innovative profiles. These include A. Dowl Knight & Company, PC, ADP, Inc., Aldrich Services LLP, Anrok, Inc., Asure Software, Inc., Avalara, Inc., Avantax, Inc., BDO USA, LLP, Canopy Tax, Inc., CPB Software AG, Crowe LLP, Drake Software, LLC, ECOVIS Webservice GmbH, Ernst & Young Global Limited, FastSpring, Global Tax Management, Inc., GlobalLogic, Inc. by Hitachi Ltd., Grant Thornton LLP by Guidehouse, HRB Digital LLC, Insightsoftware by GS Topco GP, LLC, Intuit, Inc., Jackson Hewitt Tax Service Inc., JPMorgan Chase & Co., KPMG International Limited, Lovat Compliance LTD, Paddle, PricewaterhouseCoopers LLP, Quaderno, Rehmann, LLC, RSM International Ltd., Ryan, LLC, SafeSend by cPaperless, LLC, Sage Group PLC, SAP SE, SAXTAX, Shield Products Limited, Sovos Compliance, LLC, Stripe, Inc., Tax Management Associates, Inc., Taxback International, TaxCloud by The Federal Tax Authority, LLC, TaxSlayer LLC, Thomson Reuters Corporation, Vertex, Inc., Washington Accounting Services Inc., Webgility, Wolters Kluwer N.V., WTS Global, and Xero Limited.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Tax Management Market, by Component

7. Tax Management Market, by Tax Type

8. Tax Management Market, by Deployment

9. Tax Management Market, by End-User

10. Tax Management Market, by End-user Industry

11. Americas Tax Management Market

12. Asia-Pacific Tax Management Market

13. Europe, Middle East & Africa Tax Management Market

14. Competitive Landscape

15. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Tax Management Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Tax Management Market?

3. What is the competitive strategic window for opportunities in the Tax Management Market?

4. What are the technology trends and regulatory frameworks in the Tax Management Market?

5. What is the market share of the leading vendors in the Tax Management Market?

6. What modes and strategic moves are considered suitable for entering the Tax Management Market?

Read More @ https://www.360iresearch.com/library/intelligence/tax-management?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market worth $47.04 billion by 2030, growing at a CAGR of 10.05% - Exclusive Report by 360iResearch here

News-ID: 3402444 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…