Press release

Buy Now Pay Later Market Size, Share, Major Drivers And Outlook 2024-2033

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company offers in-depth market insights through Buy Now Pay Later Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The buy now pay later market size has grown exponentially in recent years. It will grow from $156.58 billion in 2023 to $232.23 billion in 2024 at a compound annual growth rate (CAGR) of 48.3%. The growth in the historic period can be attributed to e-commerce growth and online shopping trends, consumer demand for flexible payment options, rise of digital wallets and mobile payments, increase in millennial and gen z consumer base, competition among payment service providers.

The buy now pay later market size is expected to see exponential growth in the next few years. It will grow to $1014.82 billion in 2028 at a compound annual growth rate (CAGR) of 44.6%. The growth in the forecast period can be attributed to expansion of bnpl services to physical retail, growth in cross-border e-commerce, adoption by traditional retailers, emphasis on responsible lending and consumer protection, rise of embedded finance and bnpl as a service. Major trends in the forecast period include integration with point-of-sale systems, personalization of bnpl offers, collaboration between bnpl providers and merchants, integration with loyalty programs, regulatory developments in the bnpl space.

Get Free Sample Of This Report-

https://www.thebusinessresearchcompany.com/sample.aspx?id=7652&type=smp

Market Segmentation:

The buy now pay later market covered in this report is segmented -

1) By Channel: Online, POS

2) By Enterprise Size: Large Enterprises, Small and Medium Enterprises

3) By End Use: Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others End-User

Major Driver - The Buy-Now-Pay-Later Market Rides The Online Payment Wave

An increase in the adoption of online payment methods is expected to propel the growth of the buy-now-pay-later market going forward. Online payments refer to payments that are made for goods or services that have been purchased online or offline. With the buy now, pay later option, customers can make small-ticket purchases both offline and online and make fast payments. For instance, in April 2021, according to Razorpay, an India-based financial services company, the rate of digital payment transactions in India during January, February, and March 2021 increased by 76% compared to the same period in 2020, whereas Buy Now Pay Later (BNPL) experienced a staggering growth of 569%. Therefore, the increase in the adoption of online payment methods is driving the buy-now-pay-later market growth.

Competitive Landscape:

Major companies operating in the buy now pay later market report are Paytm Postpaid, PayPal Holdings Inc., Affirm Inc., Klarna Inc., Splitit Ltd., Sezzle Inc., Perpay Inc., Openpay, Quadpay Inc., LatitudePay, Laybuy Group Holdings Limited, Payl8r (Social Money Ltd. ), ePayLater, Zest Money, Lazypay, Afterpay Ltd., Zip Co Ltd., FuturePay Inc., Bread Finance, PayBright, Zebit Inc., Uplift, ViaBill, Sunbit, Katapult, Credova, Acima Credit, Progressive Leasing, Flexiti Financial, LendCare, PayTomorrow, Payzer, QuickFee, SmartPay Leasing, SplitPay, Zibby

Get Access To The Full Market Report -

https://www.thebusinessresearchcompany.com/report/buy-now-pay-later-global-market-report

Top Trend - The Role Of Technological Advancements In The Buy-Now-Pay-Later Market

Technological advancement is a key trend gaining popularity in the buy-now-pay-later market. Major market players are concentrating on offering customers cutting-edge digital services to sustain their position in the buy-now-pay-later market. For instance, in January 2022, Temenos, a Switzerland-based software and apps company, launched Temenos Banking Cloud, the first AI-driven buy-now-pay-later banking service in the market. Through alternative credit products, this offering is expected to give banks and fintechs additional revenue options, assist them in expanding into new areas, and strengthen their connections with customers and business partners. By offering transparency into automated judgments and pairing BNPL customers with suitable loan offers based on their past, Temenos BNPL assists banks in developing lending programs that are driven by patented, explainable AI technology. Therefore, technological advancement is boosting the growth of the buy-now-pay-later market.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Buy Now Pay Later Market Characteristics

3. Buy Now Pay Later Market Trends And Strategies

4. Buy Now Pay Later Market - Macro Economic Scenario

5. Buy Now Pay Later Market Size And Growth

…..

27. Buy Now Pay Later Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialize in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later Market Size, Share, Major Drivers And Outlook 2024-2033 here

News-ID: 3399138 • Views: …

More Releases from The Business research company

Trends in Growth, Segment Analysis, and Competitive Strategies Influencing the M …

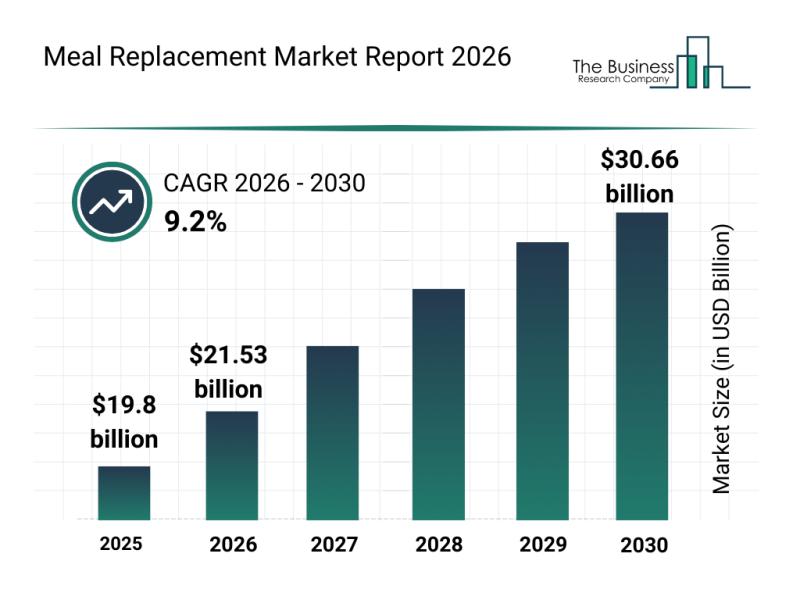

The meal replacement market is gaining significant momentum as consumer preferences shift toward convenient and health-focused nutrition solutions. With rising awareness about preventive healthcare and personalized diets, this sector is set for considerable expansion. Let's explore how the market size is expected to evolve, who the key players are, emerging trends, and the main segments driving this growth.

Projected Growth Trajectory of the Meal Replacement Market Size

The meal replacement…

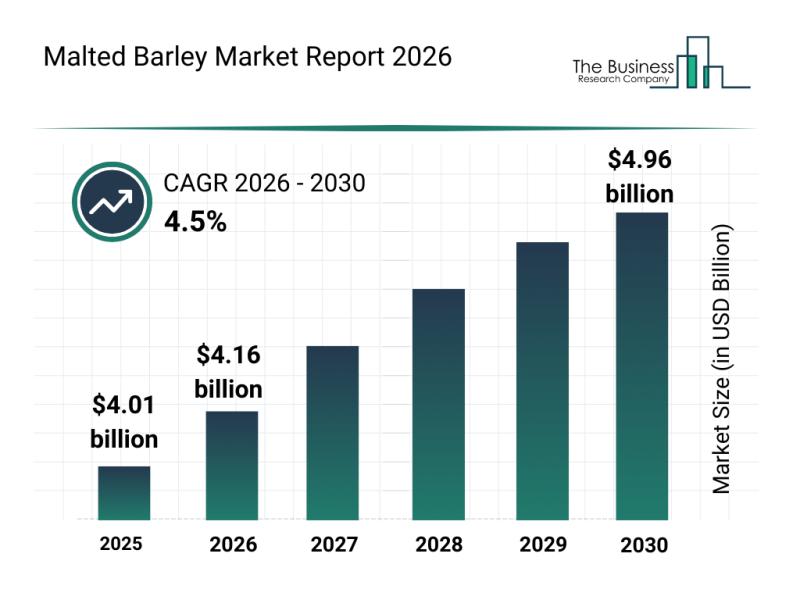

Leading Companies Reinforcing Their Presence in the Malted Barley Market

The malted barley industry is positioned for steady expansion as demand grows across various sectors. With increasing interest from craft brewers and functional food producers, this market is set to experience meaningful growth driven by innovation and sustainability efforts. Let's dive into the current market size, key players shaping the industry, trends influencing its trajectory, and detailed segment insights.

Projected Market Size and Growth Outlook of the Malted Barley Market …

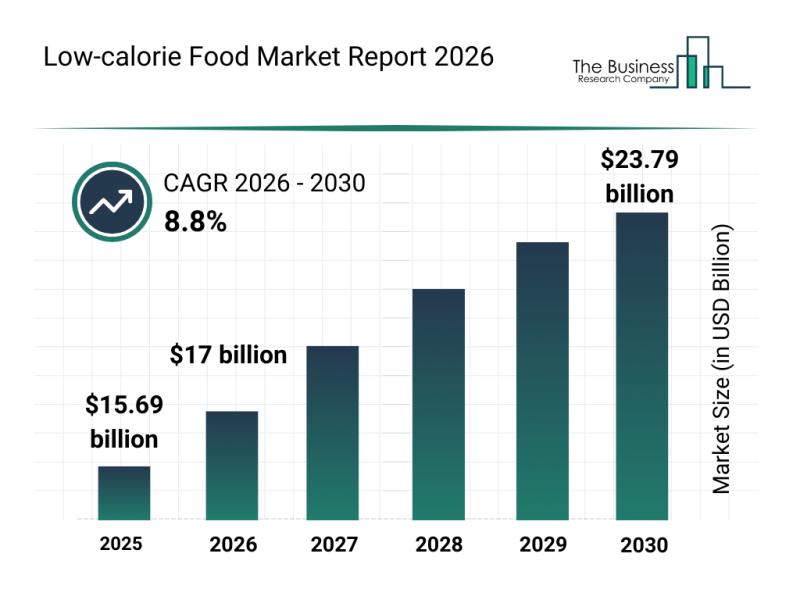

Future Perspective: Key Trends Shaping the Low-calorie Food Market up to 2030

The low-calorie food market is poised for significant expansion as consumer preferences shift toward healthier eating habits and more personalized nutrition options. Advances in product innovation and supportive regulatory frameworks are expected to drive rapid growth over the coming years. Here's an overview of the market size, key players, emerging trends, and segmentation shaping this evolving industry.

Projected Expansion of the Low-calorie Food Market Size Through 2030

The low-calorie food…

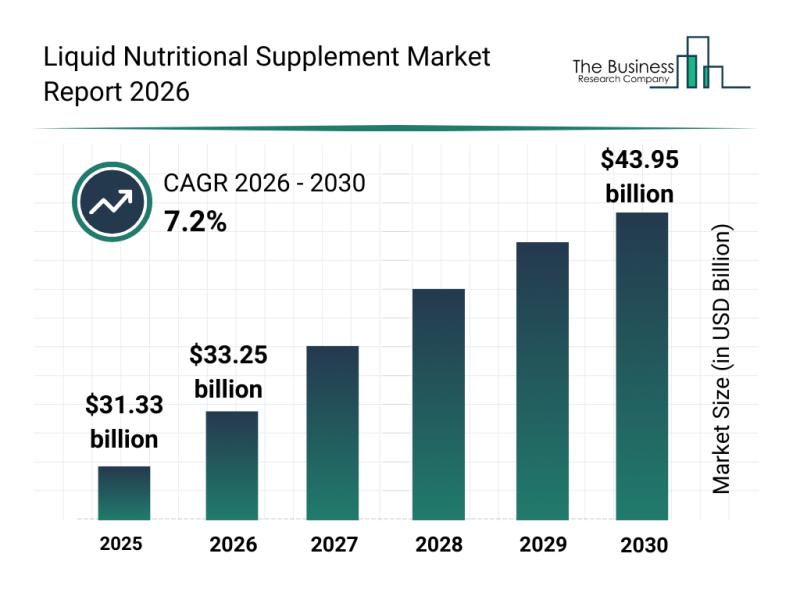

Competitive Landscape: Leading Companies and New Entrants in the Liquid Nutritio …

The liquid nutritional supplement sector is on the rise, driven by evolving consumer preferences and innovations in health and wellness. With growing awareness about personalized nutrition and preventive healthcare, this market is set to witness substantial growth over the coming years. Let's explore the market's projected size, major players, emerging trends, and key segments shaping this dynamic industry.

Projected Market Value and Growth Trajectory of the Liquid Nutritional Supplement Market …

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…