Press release

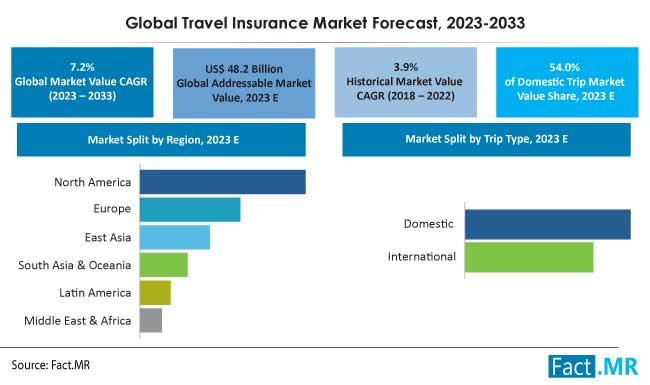

Global Travel Insurance Market is anticipated to rise at a CAGR of 7.2% during the forecast period 2023-2033

The global travel insurance market demonstrated a growth rate of 3.9% during the historical period of 2018-2022 and is anticipated to achieve a market valuation of US$ 48.2 billion in 2023. The market is poised for rapid expansion at a projected Compound Annual Growth Rate (CAGR) of 7.2% from 2023 to 2033.Travelers encounter potential issues such as luggage loss, medical emergencies, and ticket cancellations, all of which are covered by travel insurance agencies. The remarkable growth of the travel industry, coupled with stringent government regulations on insurance during travel, is a significant driving force for the travel insurance sector. Stringent government norms in countries like the United States, Russia, The United Arab Emirates, and others are fostering a global demand for travel insurance.

Download Sample Copy of This Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=8102

The travel industry has a direct impact on the demand for travel insurance across the world. A travel insurance company covers the risks that occur during travel, such as loss of passport, baggage, and money. They also provide coverage for bookings that are canceled by the customer. Apart from these services, travel insurance companies assist customers in claiming their insurance and finding a hospital in case of an emergency.

The digitalization of the travel insurance industry has simplified the process of obtaining coverage through online platforms, offering the added advantage of comparing costs across different products. The integration of automation, artificial intelligence, and IoT into services is expected to play a pivotal role in the market's expansion in the coming years.

Key Highlights from the Market Study:

Individuals constitute 66% of the market share among end-use applications.

The global market is anticipated to grow at a CAGR of 7.2% from 2023 to 2033.

East Asia is projected to exhibit the highest growth rate of 8.2% during the forecast period among regions.

The market witnessed a historical growth rate of 3.9% during the period 2018-2022.

Segmentation of Travel Insurance Industry Survey:

By Coverage Type:

Single Trip

Annual/Multiple Trip

By Trip Type:

Domestic

International

By End-use Application:

Individual

Group

By Region:

North America

Latin America

Europe

East Asia

South Asia & Oceania

Middle East & Africa

Browse Full Report: https://www.factmr.com/report/travel-insurance-market

Competitive Landscape:

Key players in the travel insurance market include Allianz Travel Insurance, Travelex Insurance Services, World Nomads Travel Insurance, Tata AIG General Insurance, Seven Corners, HTH Travel Insurance, Generali Global Assistance, IMG Travel Insurance, AXA Assistance USA, Berkshire Hathaway Travel Protection, Nationwide Insurance, Aviva, AA Travel Insurance, Staysure, Virgin Money Travel Insurance, Cover For You, and Flexicover Travel Insurance.

The market is highly fragmented with the presence of established companies and many new players entering the market. Increasing people's awareness about travel insurance and the easy availability of these services on online platforms are creating a highly competitive scenario in the market.

Recent Developments:

In September 2022, Insurtech Startup InsuranceDekho enhanced its service offerings by introducing travel insurance on its online platform. The company has partnered with leading insurance organizations such as Reliance General, Bajaj Allianz, ICICI Lombard, and others to offer travel insurance services.

In April 2022, online platform Trip.com and AXA Partners announced the expansion of a new travel insurance product in the European region that was introduced in the U.K. in 2021. It offers a wide range of benefits such as cancellation, baggage cover, medical emergency cover, and others.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=8102

More Valuable Insights:

Fact.MR, in its new offering, presents an unbiased analysis of the global travel insurance market, presenting historical market data (2018-2022) and forecast statistics for the period of 2023-2033. The study reveals essential insights on the basis of coverage type (single trip, annual/multiple trips), end-use application (individuals, groups), and trip type (domestic, international), across major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa).

Related Reports:

Sales of Reinsurance is forecasted to rise at a CAGR of 4% through 2033

https://www.factmr.com/report/reinsurance-market

Global Automobile Insurance Market is expected to reach a valuation of US$ 813.9 billion by 2032

https://www.factmr.com/report/automobile-insurance-market

About Fact.MR

Market research and consulting agency with a difference! That's why 80% of Fortune 1,000 companies trust us for making their most critical decisions. While our experienced consultants employ the latest technologies to extract hard-to-find insights, we believe our USP is the trust clients have on our expertise. Spanning a wide range - from automotive & industry 4.0 to healthcare & retail, our coverage is expansive, but we ensure even the most niche categories are analyzed. Our sales offices in United States and Dublin, Ireland. Headquarter based in Dubai, UAE. Reach out to us with your goals, and we'll be an able research partner.

Contact:

US Sales Office :

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

E-Mail: sales@factmr.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Travel Insurance Market is anticipated to rise at a CAGR of 7.2% during the forecast period 2023-2033 here

News-ID: 3379527 • Views: …

More Releases from Fact.MR

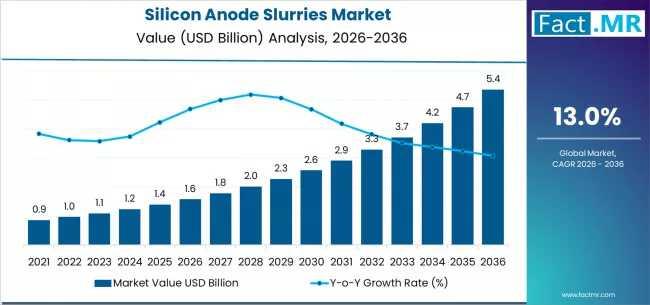

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

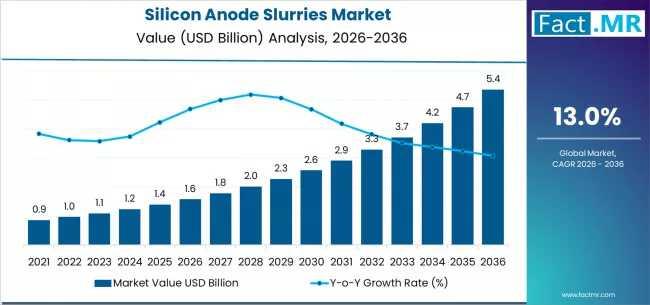

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

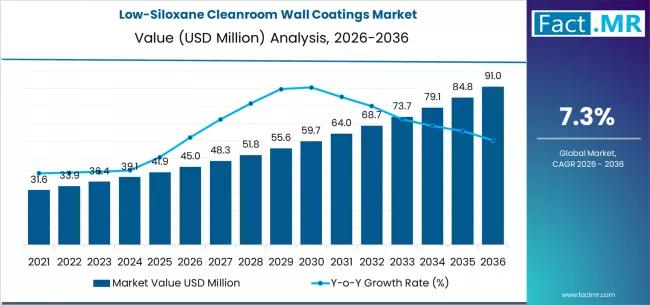

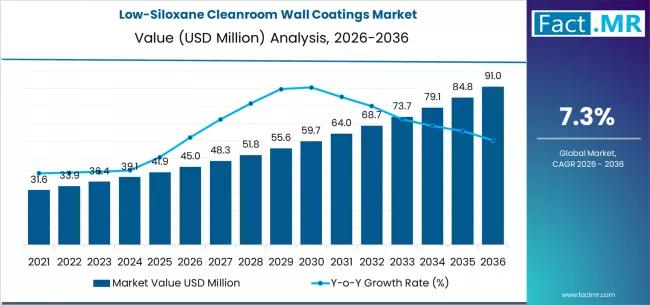

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…