Press release

Digital Payment Market Trends 2024, Size, Growth, Industry Statistics and Forecast to 2032

According to IMARC Group, the global digital payment market size is expected to exhibit a growth rate (CAGR) of 15.62% during 2024-2032. The report has segmented the market by component (solutions, services), payment mode (bank cards, digital currencies, digital wallets, net banking, and others), deployment type (cloud-based, on-premises), end use industry (BFSI, healthcare, IT and telecom, media and entertainment, retail and e-commerce, transportation, and others), and region.Global Digital Payment Market Trends:

The increasing penetration of smartphones and internet connectivity has made digital payment methods accessible to a wider population, fostering convenience and ease of use. Moreover, a growing emphasis on financial inclusion and the digitization of previously cash-based economies are driving the adoption of digital payments, enabling individuals who were previously unbanked to participate in the formal economy. Additionally, the COVID-19 pandemic accelerated the shift towards contactless and online transactions, further fueling the growth of digital payments. Enhanced security measures, such as biometrics and encryption, have instilled trust in digital payment systems. Furthermore, the rise of e-commerce and the demand for seamless, instant, and cashless transactions have solidified digital payments as the preferred mode of conducting financial transactions.

Get Sample Copy of Report at - https://www.imarcgroup.com/digital-payment-market/requestsample

Factors Affecting the Growth of the Digital Payment Industry:

• Technological Advancements:

The growth of digital payment companies is significantly influenced by technological advancements. Innovations like blockchain, contactless payments, mobile wallets, and real-time processing have revolutionized the way transactions are conducted. These technologies enhance the speed, security, and convenience of digital payments, making them more appealing to consumers and businesses. The integration of artificial intelligence and machine learning for fraud detection and personalized customer experiences further boosts this sector. As technology evolves, it opens new opportunities for digital payment companies to expand their offerings, streamline payment processes, and penetrate new markets.

• Regulatory Environment:

The regulatory environment plays a crucial role in shaping the growth of digital payment companies. Regulations concerning data security, consumer protection, and anti-money laundering are pivotal. Stringent regulations can ensure the safety and reliability of digital payment systems, thereby increasing consumer trust and adoption. Conversely, overly restrictive policies might hinder innovation and expansion. Moreover, harmonization of regulations across different regions can either facilitate or complicate the global expansion of these companies. Adapting to these regulatory changes and working in compliance with local and international laws remains a critical challenge for the growth and sustainability of digital payment firms.

• Consumer Behavior and Market Dynamics:

Consumer behavior and market dynamics are key factors affecting the growth of digital payment companies. The increasing preference for online shopping, mobile banking, and the desire for quick and convenient transaction methods drive the demand for digital payments. The shift towards a cashless society, particularly in urban areas, further propels this trend. Additionally, demographic factors like the tech-savviness of younger generations contribute to the growing adoption of digital payments. Market competition, characterized by the entry of new players and the innovation of existing ones, also shapes the landscape. Companies that continuously evolve to meet changing consumer needs and preferences tend to succeed in this competitive environment.

Digital Payment Market Report Segmentation:

By Component:

• Solutions:

o Application Program Interface

o Payment Gateway

o Payment Processing

o Payment Security and Fraud Management

o Transaction Risk Management

o Others

• Services:

o Professional Services

o Managed Services

Solutions represented the largest segment due to their comprehensive offerings in facilitating and managing digital transactions.

By Payment Mode:

• Bank Cards

• Digital Currencies

• Digital Wallets

• Net Banking

• Others

Digital wallets represented the largest segment because of their convenience, security, and widespread acceptance among consumers.

By Deployment Type:

• Cloud-Based

• On-Premises

On-premises represented the largest segment, reflecting a preference for controlled, secure, and customizable payment infrastructures by businesses.

By End Use Industry:

• BFSI

• Healthcare

• IT and Telecom

• Media and Entertainment

• Retail and E-commerce

• Transportation

• Others

BFSI represented the largest segment, as these industries are primary facilitators and adopters of digital payment technologies.

Regional Insights:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America emerged as the largest market due to its advanced technological infrastructure, high digital literacy, and the early adoption of digital payment solutions.

Competitive Landscape:

The competitive landscape of the digital payment market has been studied in the report with the detailed profiles of the key players operating in the market.

Some of these key players include:

• ACI Worldwide Inc.

• Adyen N.V.

• Aliant Payment Systems Inc.

• Amazon.com Inc.

• American Express Company

• Apple Inc.

• Fiserv Inc.

• Mastercard Incorporated

• Novetti Group Limited

• Paypal Holdings Inc.

• Stripe Inc.

• Total System Services Inc.

• Visa Inc.

• Wirecard AG

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2473&flag=C

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Trends 2024, Size, Growth, Industry Statistics and Forecast to 2032 here

News-ID: 3375258 • Views: …

More Releases from IMARC Group

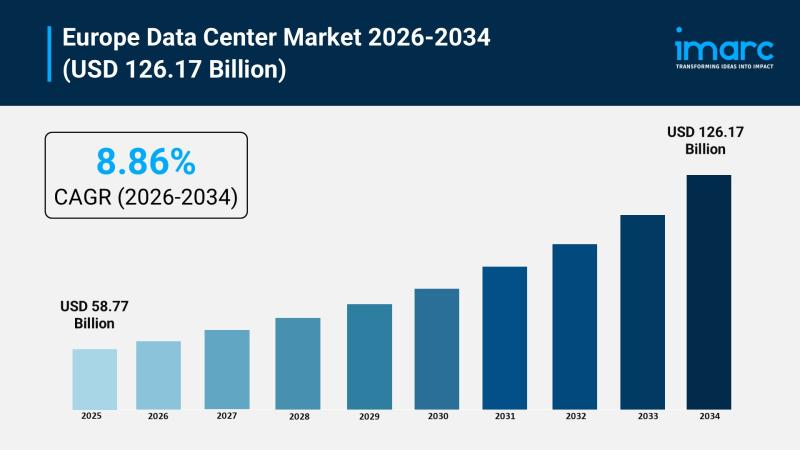

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

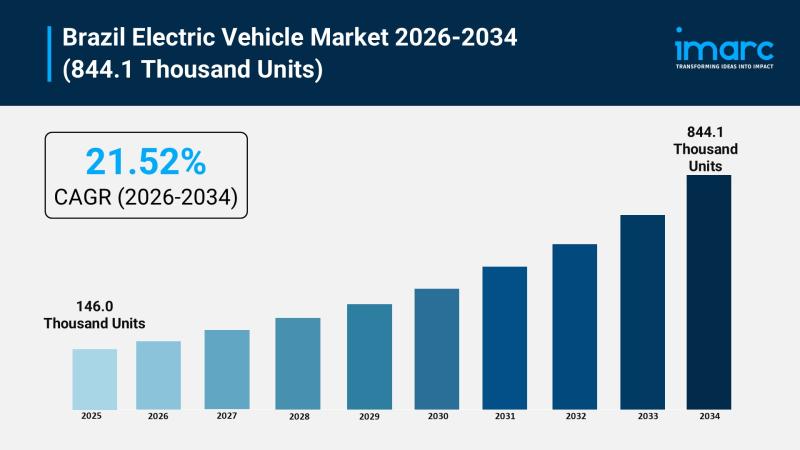

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…