Press release

Digital Lending Platform Global Market Set to Skyrocket to $34.6 Billion By 2032 with an Impressive CAGR 21.9% | Fiserv Inc., HES FinTech POS, Wipro Limited, DocuSign Inc., Temenos AG

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2340The Business Research Company presents an extensive market research report on the Digital Lending Platform Global Market Report 2024, furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities, providing all necessary data for thriving in the industry. This report market research offers a comprehensive perspective, including an in-depth analysis of the present and future scenarios within the industry.

Market Sizing:

The digital lending platform market size has grown exponentially in recent years. It will grow from $13 billion in 2023 to $15.65 billion in 2024 at a compound annual growth rate (CAGR) of 20.4%. The growth in the historic period can be attributed to rise of fintech companies, mobile and internet penetration, data analytics and credit scoring, need for speed and convenience, economic inclusion initiatives, peer-to-peer lending growth.

The digital lending platform market size is expected to see exponential growth in the next few years. It will grow to $34.6 billion in 2028 at a compound annual growth rate (CAGR) of 21.9%. The growth in the forecast period can be attributed to open banking initiatives, rise of decentralized finance, focus on customer experience, continued regulatory support, global economic recovery. Major trends in the forecast period include cross-border lending, digitization in financial services, mobile-first approaches, blockchain technology for security, customer-centric approaches, partnerships with fintech startups.

Request for free sample report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=7633&type=smp

Key Market Players:

Major companies operating in the digital lending platform market report are Nucleus Software Exports Limited, Fiserv Inc., Fidelity National Information Services Inc. (FIS), One97 Communications Ltd., HES FinTech POS, Wipro Limited, DocuSign Inc., Finastra Limited, Pegasystems Inc., Black Knight Inc., LendingTree LLC, Temenos AG, Ellie Mae Inc., ICE Mortgage Technology Inc., Tavant Technologies Inc., EdgeVerve Systems Limited, BlendLabs Inc., Teylor AG, Intellect Design Arena Ltd., Mambu GmbH, Newgen Software Technologies Ltd., Sigma Infosolutions Ltd., Auxmoney GmbH, Roostify Inc., DocuTech Corporation, Built Technologies lnc., Decimal Technologies Pvt Ltd., CU Direct Corporation, Swiss Fintech AG, Upstart Network Inc., ZestFinance Inc.

Market Drivers:

The surge in the use of smartphones is expected to propel the growth of the digital lending platform market going forward. The smartphone is a mobile device that has a touchscreen interface, an operating system capable of running downloaded apps, and internet access. Due to the surge in the use of smartphones, users and borrowers are applying for instant loans using digital lending. For instance, according to DataReportal, a Singapore-based online reference library, in 2022, the number of smartphones in use is rising at a 5.1 percent annual rate, with an average of 1 million smartphones coming into use every day. Therefore, the surge in the use of smartphones is driving the growth of the digital lending platform market.

Learn More About The Market Report -

https://www.thebusinessresearchcompany.com/report/digital-lending-platform-global-market-report

The digital lending platform market covered in this report is segmented -

1) By Type: Loan Origination, Decision Automation, Collections And Recovery, Risk And Compliance Management, Other Types

2) By Component: Software, Service

3) By Deployment Model: On-Premise, Cloud

4) By Industry Vertical: Banks, Insurance Companies, Credit Unions, Savings And Loan Associations, Peer-To-Peer Lending, Other Industry Verticals

The report answers the following questions:

What are the primary factors propelling the market during the projected period?

In which region is the most substantial growth expected?

Which trend will take center stage in the upcoming period?

Want To Know More About The Business Research Company?

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Global Market Set to Skyrocket to $34.6 Billion By 2032 with an Impressive CAGR 21.9% | Fiserv Inc., HES FinTech POS, Wipro Limited, DocuSign Inc., Temenos AG here

News-ID: 3367176 • Views: …

More Releases from The Business research company

Competitive Landscape: Leading Companies and New Entrants in the Transient Elast …

The transient elastography market is poised for substantial expansion as advancements in healthcare diagnostics continue to evolve. Increasing emphasis on non-invasive techniques and early disease detection is driving widespread adoption, setting the stage for strong market growth in the coming years. Let's explore the current market valuation, leading players, emerging innovations, and key segments shaping this industry.

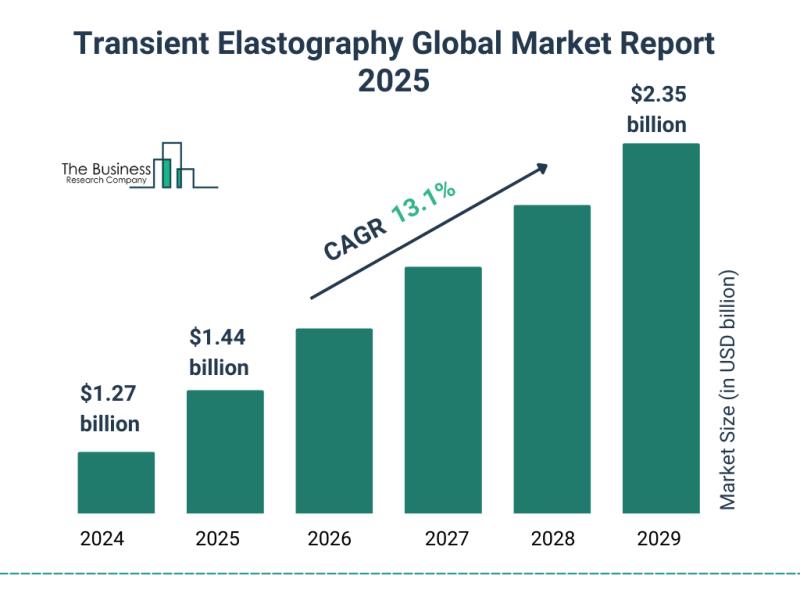

Projected Market Value and Growth of the Transient Elastography Market

The transient elastography market is…

Future Perspectives: Key Trends Shaping the Supply Chain Digital Twin Market Unt …

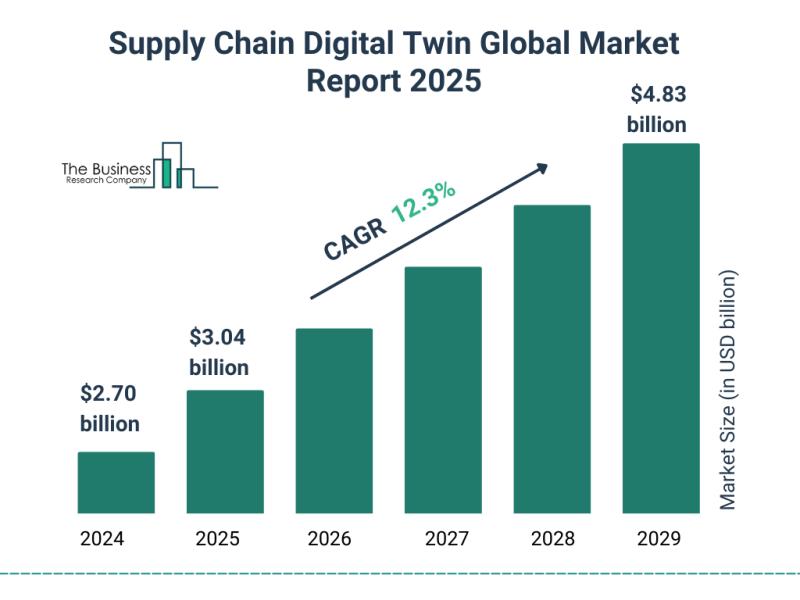

The supply chain digital twin market is gaining significant attention as companies look to improve operational efficiency and resilience through advanced technologies. This market is set to experience substantial growth in the coming years, driven by increasing digital transformation initiatives and the need for more agile supply chain management. Let's delve into the market's size, key players, driving trends, and segmentation to understand the future outlook.

Projected Market Size and Growth…

Leading Companies Reinforce Their Roles in the Stem Cell Therapy Market for Mult …

The field of stem cell therapy for multiple sclerosis is rapidly advancing, offering new hope for patients affected by this challenging neurological condition. As research and technology evolve, the market for these innovative treatments is expected to grow substantially. This overview explores the market size, key players, emerging trends, and segmentation of the stem cell therapy landscape for multiple sclerosis.

Projected Market Size and Growth Outlook for Stem Cell Therapy for…

Global Factors Driving the Rapid Evolution of the Stem Cell Antibody Market

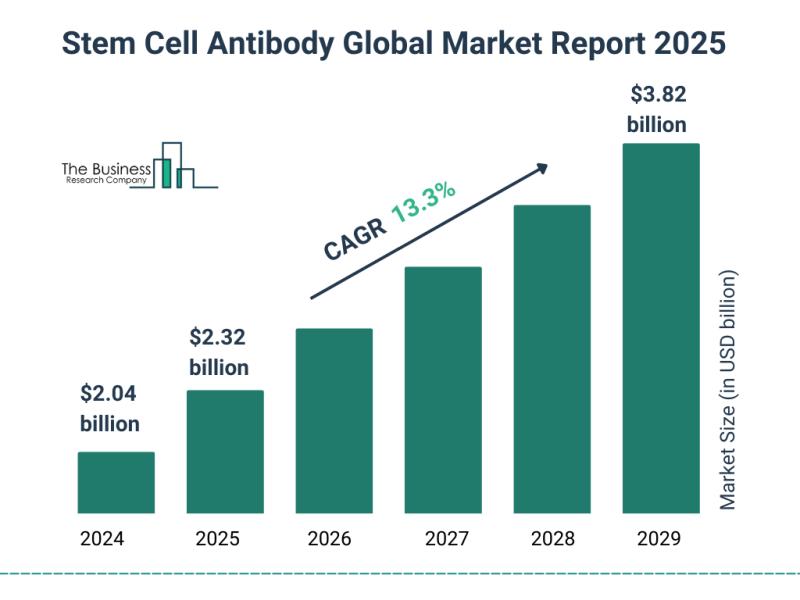

The stem cell antibody market is gaining significant traction as advancements in biotechnology and research efforts continue to expand. With growing demand across various sectors including healthcare and pharmaceuticals, this market is poised for substantial growth in the coming years. Let's explore the current market size, key players, segmentation, and trends shaping the future of the stem cell antibody industry.

Projected Size and Growth of the Stem Cell Antibody Market

The stem…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…