Press release

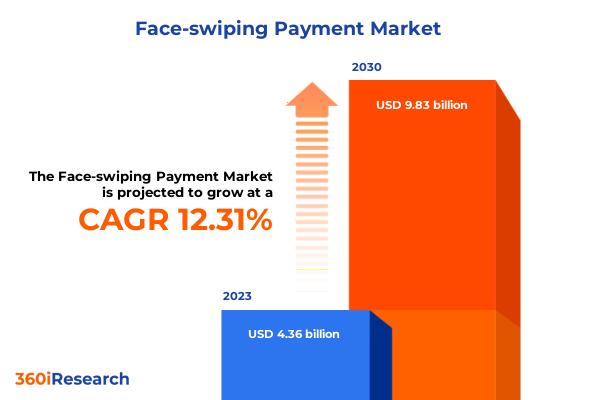

Face-swiping Payment Market worth $9.83 billion by 2030, growing at a CAGR of 12.31% - Exclusive Report by 360iResearch

The "Face-swiping Payment Market by Type (Payment Equipment, Payment System), Application (Restaurant, Retail, Travel), End-Use - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.The Global Face-swiping Payment Market to grow from USD 4.36 billion in 2023 to USD 9.83 billion by 2030, at a CAGR of 12.31%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/face-swiping-payment?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Face-swiping payment, also referred to as facial recognition payment, enables users to complete payments and digital transactions using their faces. It is an emerging technology that utilizes advanced software algorithms and hardware, such as cameras and sensors, to authenticate the identity of the user for a quick and secure payment process. Consumers, in recent years, have shown an inclination towards seamless digital payments through their smartphone applications, which has cemented the demand for face-swiping payment. Furthermore, fintech industries and banking and governance operations have demanded advanced, frictionless transactions. However, the possibility of biases and failure of the technology to recognize certain facial features limits the application of face-swiping payment. Additionally, several concerns have been raised regarding privacy issues of biometric data and the possibility of cyberattacks and data breaches of platforms that provide face-swiping payment services, which impedes the adoption of the technology among end-users. However, players have explored the integration of AI/ML algorithms and data analytics technologies to tackle privacy challenges while maximizing the accuracy and reliability of the technology. Blockchain, due to its advanced security and decentralized architecture, provides a safe avenue to ensure that financial transactions are transparent and reliable, and players can investigate the benefits of blockchain technology for face-swiping payment to create new opportunities for growth.

Type: Advancements to improve the functionality of payment equipment

Payment equipment is integral to the infrastructure needed for face-swiping payments. This category encompasses the hardware, such as cameras and sensors utilized for facial recognition and transaction processing at point-of-sale (POS) terminals. Businesses seeking high-security standards with quick and convenient customer service tend to prefer robust payment equipment. Payment systems refer to the software solutions that manage and process the data involved in face-swiping payments. This includes the user interface, transaction processing backend, and security protocols.

End-Use: Growing ownership of smartphones driving the preference for mobile payments

In the ATMs & banking sector, face-swiping payment technology enhances security and user experience by allowing customers to access their accounts and complete transactions without physical cards or PINs. The preference for this technology is strong in scenarios where high security is essential and where contactless methods are valued to reduce potential fraud or virus transmission. The application of face-swiping payment in e-commerce realms is on the rise due to its convenience and as an attempt to reduce cart abandonment rates. Customers can complete purchases rapidly using facial recognition, which is gradually gaining popularity for its improved checkout experience. This need is driven by the demand for faster, frictionless transactions. Mobile payment solutions increasingly include face-swiping payment options for authentication. The preference here is mainly for convenience and speed, where users pay for goods and services with a glance at their devices. Payment terminals equipped with facial recognition are utilized in various retail and service environments, enabling merchants to validate customers' identities and process payments without physical cards. Face-swiping technology is increasingly integrated into point-of-sale (POS) systems to provide a secure and contactless payment option for in-store purchases. Retailers' preference for this technology stems from the need to increase transaction efficiency and reduce the time customers spend in queues. Self-service kiosks with face-swiping technology cater to customers who appreciate autonomy and expedited service, commonly found in fast food restaurants, airports, and hotels. This need is driven by consumer expectations for quick and efficient service, especially in high-traffic areas.

Application: Expanding usage of face-swiping payment in the retail sector to improve customer satisfaction and comfort

Face-swiping payment technology facilitates a swift and secure transactional experience for customers within the restaurant sector. Establishments that adopt this technology typically prioritize enhancing the customer experience, reducing wait times, and minimizing error rates associated with traditional payment methods. Customers often prefer contactless, quick service, especially in fast-food chains, casual dining, and high-end restaurants. The retail industry utilizes face-swiping payments to create a personalized shopping experience, increase security, and streamline the checkout process. This technology is particularly useful in high-volume stores or environments where a hands-free experience is advantageous, such as when customers carry multiple items. Integration of this technology in the retail sector is strongly influenced by the need for efficiency and enhanced security against fraud. In the travel and hospitality industry, face-swiping payment technology offers significant benefits in terms of streamlining transactions and providing a seamless customer experience. This application is need-based due to the heavy emphasis on security concerns and quick processing in airports, hotels, and travel agencies. The travel sector is highly invested in offering sophisticated and secure payment solutions to cater to an international clientele who value speed and convenience.

Regional Insights:

The Americas region, particularly the US and Canada, has a robust technological architecture and several key players invested in the sphere of digital payments, which has driven several innovations in face-swiping payment. Additionally, developed financial institutions and banks across the Americas have recognized the need for enhanced security during payment transactions. In Europe, stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), are primarily responsible for shaping consumer preference for face-swiping payment. Economies such as the UK, Germany, and France are involved in multinational collaborations to facilitate digital payments, which has created a significant demand for face-swiping payment. APAC region represents an evolving market with a rapidly growing middle-class population that prefers contactless digital payments. In India, the presence of a unified payment interface (UPI) for making digital payments has seen considerable growth, and China has encouraged the adoption of face-swiping payment for retail shopping.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Face-swiping Payment Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Face-swiping Payment Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Face-swiping Payment Market, highlighting leading vendors and their innovative profiles. These include Alibaba Group, Apple Inc., CloudWalk Technology Co. Ltd., Clover Network, LLC by Fiserv, Facepay, Mastercard Inc., NEC Corporation, PAX Global Technology Limited, PayByFace B.V., PopID, Inc., Scheidt & Bachmann GmbH, SnapPay Inc., Stripe, Inc., Telepower Communications Co., Ltd., Tencent Holdings Ltd., and VisionLabs.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/face-swiping-payment?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Face-swiping Payment Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Type, market is studied across Payment Equipment and Payment System. The Payment Equipment is projected to witness significant market share during forecast period.

Based on Application, market is studied across Restaurant, Retail, and Travel. The Retail is projected to witness significant market share during forecast period.

Based on End-Use, market is studied across ATMs & Banking, E-Commerce, Mobile Payments, Payment Terminals, Point-of-Sale (POS), and Self-Service Kiosks. The E-Commerce is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 43.74% in 2023, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Face-swiping Payment Market, by Type

7. Face-swiping Payment Market, by Application

8. Face-swiping Payment Market, by End-Use

9. Americas Face-swiping Payment Market

10. Asia-Pacific Face-swiping Payment Market

11. Europe, Middle East & Africa Face-swiping Payment Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Face-swiping Payment Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Face-swiping Payment Market?

3. What is the competitive strategic window for opportunities in the Face-swiping Payment Market?

4. What are the technology trends and regulatory frameworks in the Face-swiping Payment Market?

5. What is the market share of the leading vendors in the Face-swiping Payment Market?

6. What modes and strategic moves are considered suitable for entering the Face-swiping Payment Market?

Read More @ https://www.360iresearch.com/library/intelligence/face-swiping-payment?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Face-swiping Payment Market worth $9.83 billion by 2030, growing at a CAGR of 12.31% - Exclusive Report by 360iResearch here

News-ID: 3365401 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…