Press release

Asset-Based Lending Market 2024| Technology, Development Trends and Business Opportunities 2033

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033The Business Research Company presents an extensive market research report on the Asset-Based Lending Global Market Report 2024, furnishing businesses with a competitive edge through a detailed examination of the market structure, encompassing estimates for various segments and sub-segments.

Furthermore, the report highlights on emerging trends, significant drivers, challenges, and opportunities, providing all necessary data for thriving in the industry. This report market research offers a comprehensive perspective, including an in-depth analysis of the present and future scenarios within the industry.

Market Sizing:

The asset-based lending market size has grown rapidly in recent years. It will grow from $697.75 billion in 2023 to $787.28 billion in 2024 at a compound annual growth rate (CAGR) of 12.8%. The growth in the historic period can be attributed to economic downturns and credit challenges, need for working capital financing, cyclical nature of industries, corporate restructuring and turnarounds, asset-rich, cash-poor situations..

The asset-based lending market size is expected to see rapid growth in the next few years. It will grow to $1262.76 billion in 2028 at a compound annual growth rate (CAGR) of 12.5%. The growth in the forecast period can be attributed to global economic trends and volatility, increased demand for non-traditional financing, expanding role in cross-border transactions, focus on working capital optimization, industry-specific tailoring.. Major trends in the forecast period include expansion of cross-border asset-based lending, application of artificial intelligence (ai) in credit decisioning, collaboration between traditional lenders and fintechs, focus on non-traditional collateral types, integration of risk management analytics..

Request for free sample report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=13118&type=smp

Key Market Players:

JPMorgan Chase and Co., Wells Fargo And Company, HSBC Holdings plc, Goldman Sachs Group Inc., BMO Harris Bank N.A., Barclays Bank PLC, Hilton-Baird Group, KeyCorp Limited, Huntington Business Credit, Lloyds Bank plc, BB&T Corporation, CoreVest Finance, Crystal Financial LLC, Triumph Commercial Finance, CIT Group, Bibby Financial Services, Sterling National Bank, Berkshire Bank N.A., White Oak Financial LLC, Porter Capital Corporation, First Capital Federal Credit Union, LSQ Funding Group L.C., Action Capital Corporation, LQD Business Finance LLC, Capital Funding Solutions Inc. are prominent players in the industry.

Market Drivers:

The increasing demand for loans is expected to propel the growth of the asset-based lending market going forward. A loan is a financial arrangement in which one party, typically a lender such as a bank or financial institution, provides a specific amount of money or other assets to another party, the borrower. Asset-based lending offers various benefits in delivering loans with flexible financing, enhanced liquidity, and scalability. For instance, in June 2023, according to ABL Advisor, a US-based online platform that offers news, information, and viewpoints on the commercial finance and asset-based lending (ABL) industries, the total number of loans made in the US for 2021 was $502.3 billion, a 10% increase from 2020. Therefore, the increasing demand for loans is driving the growth of the asset-based lending market.

Market Segments Include:

1) By Type: Inventory Financing, Receivables Financing, Equipment Financing, Other Types

2) By Interest Type: Fixed Rate, Floating Rate

3) By End User: Large Enterprises, Small And Medium-Sized Enterprises

The report answers the following questions:

What are the primary factors propelling the market during the projected period?

In which region is the most substantial growth expected?

Which trend will take center stage in the upcoming period?

Learn More About The Market Report -

https://www.thebusinessresearchcompany.com/report/asset-based-lending-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market 2024| Technology, Development Trends and Business Opportunities 2033 here

News-ID: 3357687 • Views: …

More Releases from The Business research company

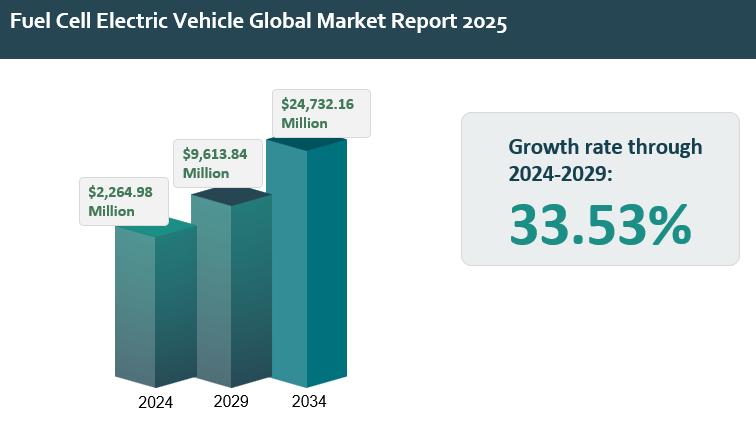

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

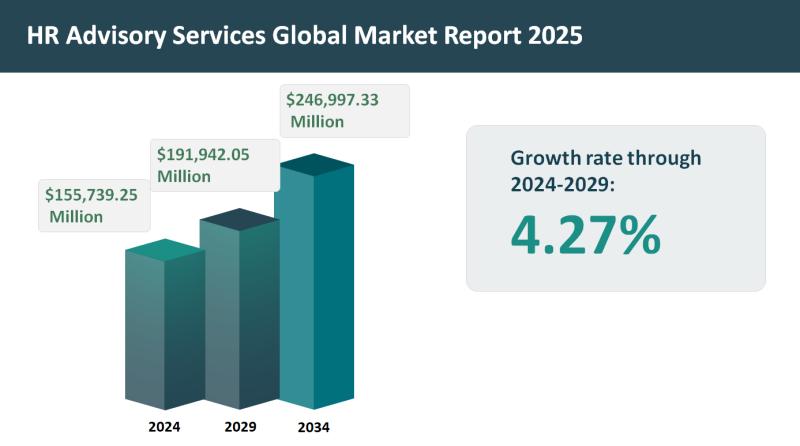

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…