Press release

Mobile Payment Market Report 2024-2032, Global Size, Share, Growth and Industry Statistics

According to IMARC Group, the global mobile payment market size reached US$ 2,276.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 9,821.4 Billion by 2032, exhibiting a growth rate (CAGR) of 17.1% during 2024-2032.The report has segmented the market by mode of transaction (WAP (wireless application protocol), NFC (near field communications), SMS (short message service), USSD (unstructured supplementary service data), and others), application (entertainment, energy and utilities, healthcare, retail, hospitality and transportation, and others), and region.

Factors Affecting the Growth of the Mobile Payment Industry:

• Technological Advancements:

The growth of mobile payment companies is heavily influenced by technological advancements. Innovations in mobile technology, such as the development of NFC (Near Field Communication) and RFID (Radio Frequency Identification), have streamlined mobile transactions, making them more efficient and user-friendly. Furthermore, enhanced security features like biometrics and two-factor authentication have increased consumer trust in mobile payments. The integration of AI and machine learning for personalized customer experiences and fraud detection also plays a significant role. As technology continues to evolve, mobile payment solutions become more accessible and appealing to a broader consumer base, driving the expansion of this sector.

Request to Get the Sample Report: https://www.imarcgroup.com/mobile-payment-market/requestsample

• Regulatory Environment:

The regulatory environment is a critical factor affecting the growth of mobile payment companies. Regulations concerning data security, privacy, and financial transactions significantly impact how these companies operate and scale. In regions with stringent regulations, mobile payment providers must invest in compliance and data protection measures, which can be costly but are essential for consumer trust and legal operations. Conversely, a supportive regulatory framework can foster innovation and competition in the mobile payments market. Additionally, cross-border regulations affect international expansion strategies of these companies, as they must navigate varying legal landscapes in different countries.

• Consumer Behavior and Adoption:

Consumer behavior and adoption are paramount in determining the success of mobile payment companies. The willingness of consumers to adopt new payment technologies depends on factors like ease of use, perceived security, and the availability of value-added services. Demographic factors, such as age and income level, also influence adoption rates; younger, tech-savvy generations are more likely to use mobile payments. Moreover, cultural attitudes towards cash and digital transactions vary globally, affecting market penetration in different regions. Companies that understand and adapt to these behavioral patterns and preferences are more likely to succeed in expanding their user base and market share.

Mobile Payment Market Report Segmentation:

Breakup by Mode of Transaction:

• WAP (Wireless Application Protocol)

• NFC (Near field communications)

• SMS (Short Message Service)

• USSD (Unstructured Supplementary Service Data)

• Others

WAP (Wireless Application Protocol) represented the largest segment attributed to its widespread adoption in mobile banking and online transactions, offering secure, convenient, and user-friendly platforms for mobile payments.

Breakup by Application:

• Entertainment

• Energy and Utilities

• Healthcare

• Retail

• Hospitality and Transportation

• Others

Retail represented the largest segment driven by increasing consumer preference for cashless transactions, ease of use, and the growing integration of mobile payment options in retail services.

Breakup by Region:

• Asia Pacific

• North America

• Europe

• Middle East and Africa

• Latin America

Asia Pacific emerged as the largest market due to high mobile penetration, rapid adoption of mobile payment technologies, and strong support from governments and financial institutions in the region.

Competitive Landscape with Key Players:

The competitive landscape of the mobile payment market has been studied in the report with the detailed profiles of the key players.

• FIS

• Gemalto (Thales Group)

• MasterCard

• Alipay (Ant Group)

• Visa

• Apple

• Samsung Electronics

• Bharti Airtel

• American Express

• Bank of America

• Citrus Payment Solutions

• LevelUp (Grubhub Inc.)

• MobiKwik

• One97 Communication

• Orange

• Oxigen

• Square

• Venmo (PayPal, Inc.)

• ZipCash Card Services

Ask Analyst for Customization and Explore Full Report With TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=1106&flag=C

Global Mobile Payment Market Trends:

The widespread adoption of smartphones and the increasing digitalization of financial services have created a fertile ground for mobile payment solutions. Consumers now have the convenience of making secure payments using their mobile devices, eliminating the need for physical cash or cards. Moreover, the emphasis on contactless and touchless transactions, accelerated by the COVID-19 pandemic, has propelled mobile payments into the spotlight. These solutions offer a hygienic and efficient way to complete transactions, fostering their acceptance among businesses and consumers alike. Furthermore, the rapid expansion of e-commerce and online shopping has boosted mobile payment adoption, as consumers seek seamless and secure ways to make digital purchases.

Key Highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• Market Trends

• Market Drivers and Success Factors

• Impact of COVID-19

• Value Chain Analysis

• Comprehensive mapping of the competitive landscape

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Market Report 2024-2032, Global Size, Share, Growth and Industry Statistics here

News-ID: 3344900 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

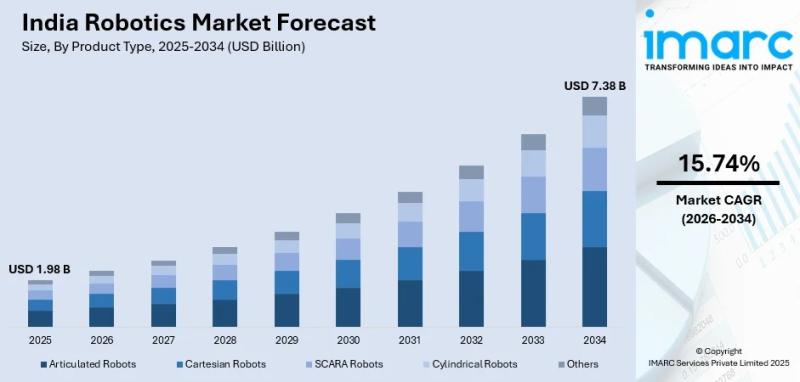

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

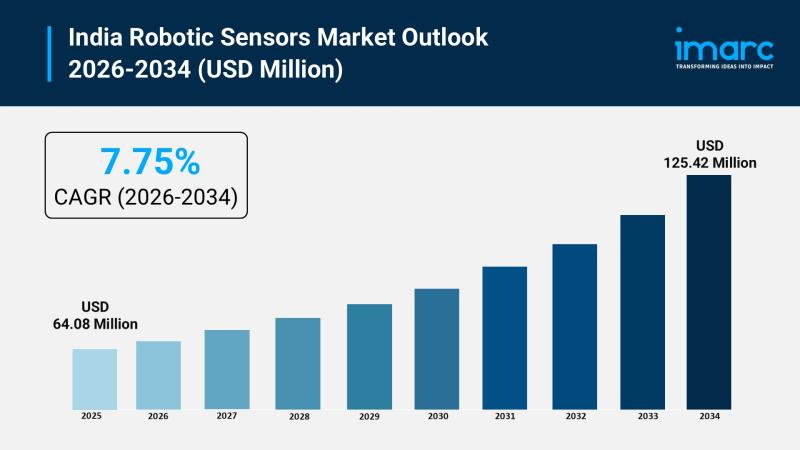

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

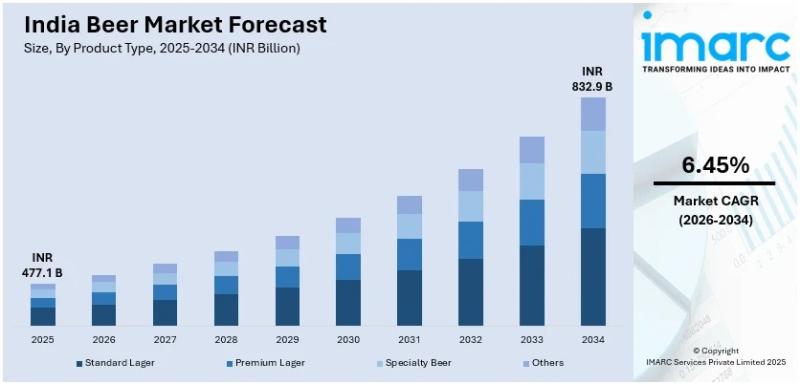

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…