Press release

Fintech Market Size To Reach US$ 764.4 Billion, Globally by 2032 | CAGR of 17%

IMARC Group, a leading market research company, has recently releases report titled "Fintech Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032" the global fintech market size reached US$ 187.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 764.4 Billion by 2032, exhibiting a growth rate (CAGR) of 17% during 2024-2032.The increasing requirement for advanced solutions in the banking process to enhance efficiency, rising adoption of digital payment methods, and the growing demand for mobile-centric solutions are some of the major factors propelling the market.

Request For Sample Copy of Report: https://www.imarcgroup.com/fintech-market/requestsample

Factors Affecting the Growth of the Fintech Industry:

• Increasing Consumer Demand:

People are increasingly looking for digital and hassle-free financial services. Fintech firms offer user-friendly apps and platforms for activities, such as online payments, budgeting, investing, and peer-to-peer lending, aligning with preferences of people for convenience and accessibility. Fintech companies use advanced data analytics to offer tailored financial services in the country. This personalization resonates with individuals who appreciate solutions that cater to their individual financial goals and circumstances. Fintech solutions often provide cost-effective alternatives to traditional banking services. People are attracted to lower fees, competitive interest rates, and transparent pricing models offered by many fintech providers.

• Enhanced Tech Infrastructure:

The enhanced tech infrastructure allows people to have access to high-speed internet. This widespread connectivity ensures that fintech services can reach a broad audience, enabling seamless online interactions between consumers and financial platforms. The proliferation of smartphones and the availability of 4G and 5G networks are creating a mobile-friendly environment. Fintech companies leverage this trend by developing mobile apps and platforms, catering to people who prefer conducting financial transactions on their mobile devices.

• Cybersecurity Awareness:

Rising awareness about cybersecurity instills trust and confidence among consumers and businesses when using fintech services. People are more conscious about the importance of data protection, and fintech companies are responding by implementing robust security measures. This includes encryption, secure authentication methods, and data encryption technologies to safeguard sensitive information. Cybersecurity awareness is leading to the introduction of stringent regulations in the fintech sector. Fintech companies are required to comply with cybersecurity standards and regulations, further enhancing the security of financial transactions and data.

Explore Full Report: https://www.imarcgroup.com/fintech-market

Leading Companies Operating in the Global Fintech Industry:

• Adyen N.V.

• Afterpay Limited (Block Inc.)

• Avant LLC

• Cisco Systems Inc.

• Google Payment Corp.

• International Business Machines Corporation

• Klarna Bank AB

• Microsoft Corporation

• Nvidia Corporation

• Oracle Corporation

• Paypal Holdings, Inc.

• Robinhood Markets Inc.

• SoFi Technologies Inc

• Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

• On-premises

• Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

• Application Programming Interface

• Artificial Intelligence

• Blockchain

• Robotic Process Automation

• Data Analytics

• Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

• Payment and Fund Transfer

• Loans

• Insurance and Personal Finance

• Wealth Management

• Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

• Banking

• Insurance

• Securities

• Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Market Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Global Fintech Market Trends:

Governing agencies of several countries are implementing open banking regulations, which allow people to share their financial data securely with third-party fintech providers. The adoption of digital payment solutions and mobile wallets is rising due to increasing consumer demand for convenient and contactless payment methods. Robo-advisors and wealthtech platforms are gaining traction, offering automated investment advice and portfolio management services. This trend aligns with consumers seeking simplified and cost-effective investment options.

Moreover, interest in cryptocurrencies and blockchain technology is growing, with fintech companies exploring applications beyond traditional finance, such as supply chain management and digital identity verification.

Other Key Points Covered in the Report:

• COVID-19 Impact

• Porters Five Forces Analysis

• Value Chain Analysis

• Strategic Recommendations

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Email: sales@imarcgroup.com

Follow us on Twitter: @imarcglobal

LinkedIn: https://www.linkedin.com/company/imarc-group/mycompany/

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech Market Size To Reach US$ 764.4 Billion, Globally by 2032 | CAGR of 17% here

News-ID: 3333657 • Views: …

More Releases from IMARC Group

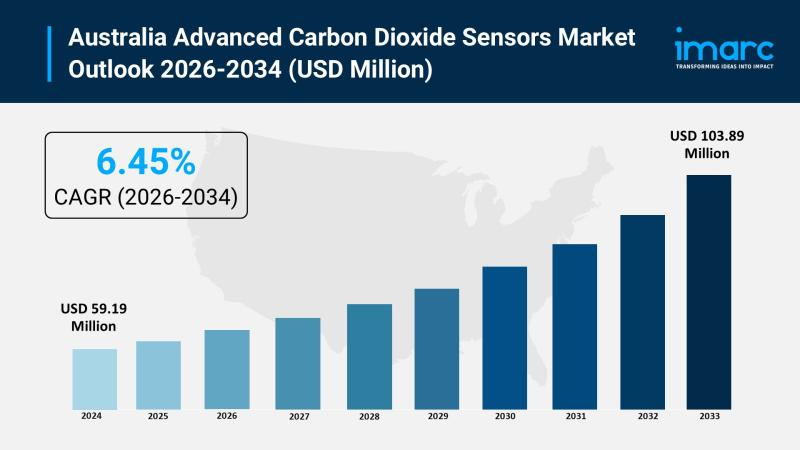

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

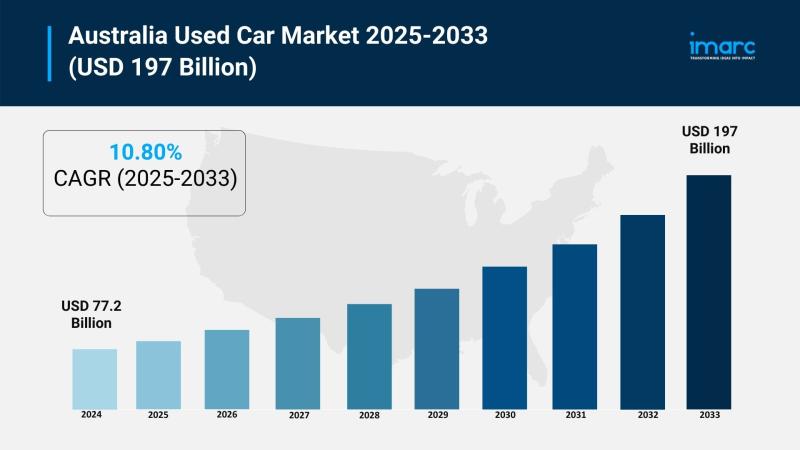

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

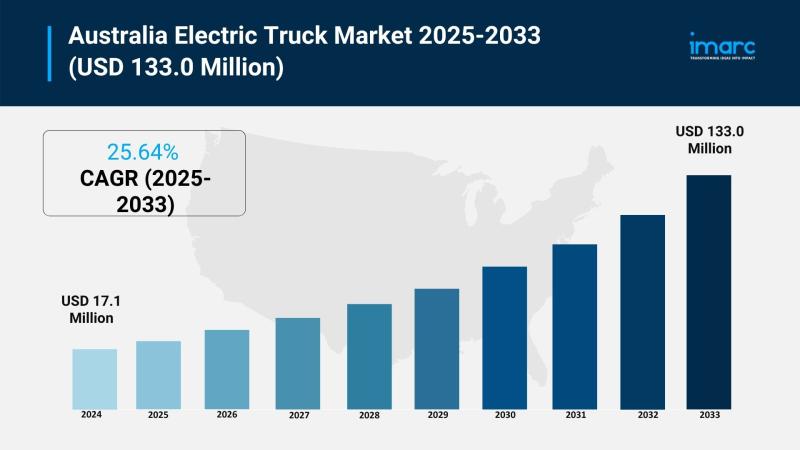

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

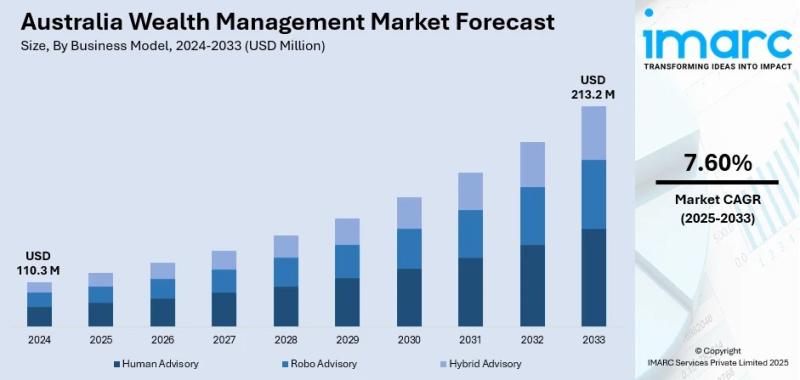

Australia Wealth Management Market Projected to Reach USD 213.2 Million by 2033

Market Overview

The Australia Wealth Management Market reached a size of USD 110.3 Million in 2024 and is projected to grow to USD 213.2 Million by 2033. The market is expected to expand during its forecast period with a CAGR of 7.60% from 2025 to 2033. Key growth factors include rising high-net-worth individuals, digital financial transformation, regulatory reforms like FOFA, and a robust superannuation system. For more details, visit the Australia…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…