Press release

Fintech-as-a-Service Market Trends 2023 | Growth, Share, Size, Demand and Future Scope 2028

IMARC Group, a leading market research company, has recently releases report titled "Fintech-as-a-Service Market Report by Type (Payment, Fund Transfer, Loan, and Others), Technology (API, Artificial Intelligence, RPA, Blockchain, and Others), Application (KYC Verification, Fraud Monitoring, Compliance and Regulatory Support, and Others), End Use (Banks, Financial Lending Companies, Insurance, and Others), and Region 2023-2028". The study provides a detailed analysis of the industry, including the global fintech-as-a-service market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.Report Highlights

How big is the fintech-as-a-service market?

The global fintech-as-a-service market size reached US$ 261.12 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 687.93 Billion by 2028, exhibiting a growth rate (CAGR) of 17.80% during 2023-2028.

What is fintech-as-a-service?

Fintech-as-a-Service (FaaS) refers to a model in which financial technology companies provide their specialized digital financial services and solutions to other businesses through an integrated platform or application programming interfaces (APIs). It allows non-financial entities, such as e-commerce platforms, retail businesses, or technology startups, to access and incorporate various fintech functionalities seamlessly into their operations without the need for extensive development or financial expertise. FaaS offerings typically encompass a wide range of services, including payment processing, lending, risk management, compliance, and digital banking solutions. By leveraging FaaS, businesses can enhance their customer experiences, streamline financial processes, and expand their service offerings without the need for significant investment in infrastructure or technical capabilities. At present, Fintech-as-a-Service is gaining immense traction across the globe as it plays a critical role in democratizing access to innovative financial services, fostering digital transformation, and promoting financial inclusion across diverse industries and market segments.

Request for a sample copy of this report: https://www.imarcgroup.com/fintech-as-a-service-market/requestsample

What are the growth prospects and trends in the fintech-as-a-service industry?

The global fintech-as-a-service market is primarily driven by the increasing adoption of digital payment solutions and the rising demand for seamless financial transactions across various industries as businesses seek to integrate efficient and user-friendly fintech services into their operations. Additionally, the heightened focus on enhancing customer experiences and optimizing financial processes has augmented the demand for customizable and easily deployable Fintech solutions, thereby fostering market growth. Moreover, the growing preference for cost-effective and scalable financial management tools among small and medium enterprises (SMEs) and startups has fueled the adoption of fintech-as-a-service platforms, enabling these businesses to access sophisticated financial services without significant upfront investments. Furthermore, ongoing innovations in fintech offerings, including the integration of advanced analytics and artificial intelligence (AI) that cater to the evolving requirements of the financial services industry, are contributing to market growth. Other factors, including the emerging trend of financial inclusion, escalating demand for integrated and comprehensive financial solutions among enterprises, and rising investments by key players and venture capitalists in FaaS startups, are also anticipated to stimulate market growth in the coming years.

What is included in market segmentation?

The report has segmented the market into the following categories:

Breakup by Type:

Payment

Fund Transfer

Loan

Others

Breakup by Technology:

API

Artificial Intelligence

RPA

Blockchain

Others

Breakup by Application:

KYC Verification

Fraud Monitoring

Compliance and Regulatory Support

Others

Breakup by End Use:

Banks

Financial Lending Companies

Insurance

Others

Breakup by Region:

North America (U.S. Canada)

Europe (Germany, United Kingdom, France, Italy, Spain, Russia, and Others)

Asia Pacific (China, India, Japan, South Korea, Indonesia, Australia, and Others)

Latin America (Brazil, Mexico)

Middle East Africa

Who are the key players operating in the industry?

The report covers the major market players including:

Block Inc.

FIS, Inc.

Fiserv, Inc.

Mastercard Inc.

PayPal Holdings, Inc.

Railsbank Technology Limited

Rapyd Financial Network Ltd.

Solid Financial Technologies, Inc.

Synctera Inc.

Ask Analyst for Customization and Browse full report with TOC List of Figure: https://www.imarcgroup.com/request?type=report&id=13041&flag=C

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

USA: +1-631-791-1145 | Asia: +91-120-433-0800

Email: sales@imarcgroup.com

Follow us on Twitter: @imarcglobal

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC Group's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fintech-as-a-Service Market Trends 2023 | Growth, Share, Size, Demand and Future Scope 2028 here

News-ID: 3327822 • Views: …

More Releases from IMARC Group

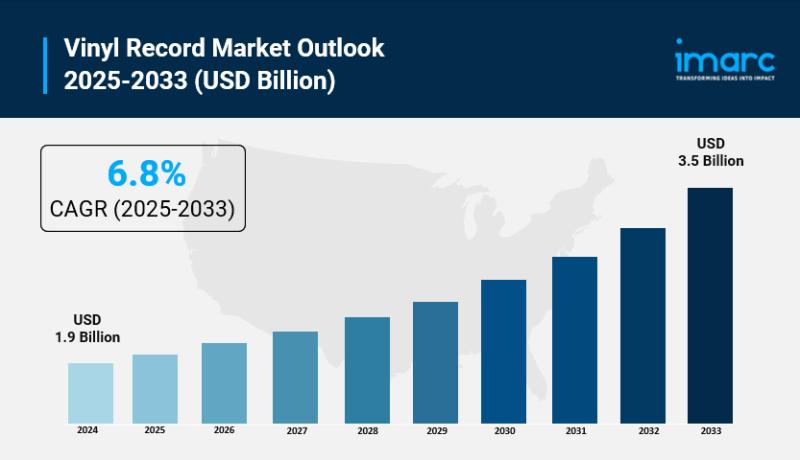

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

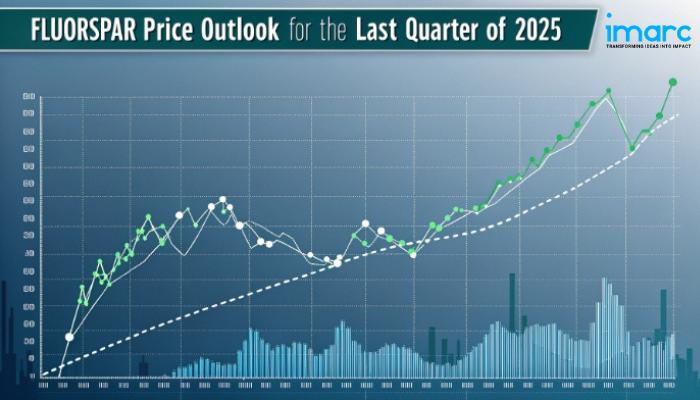

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

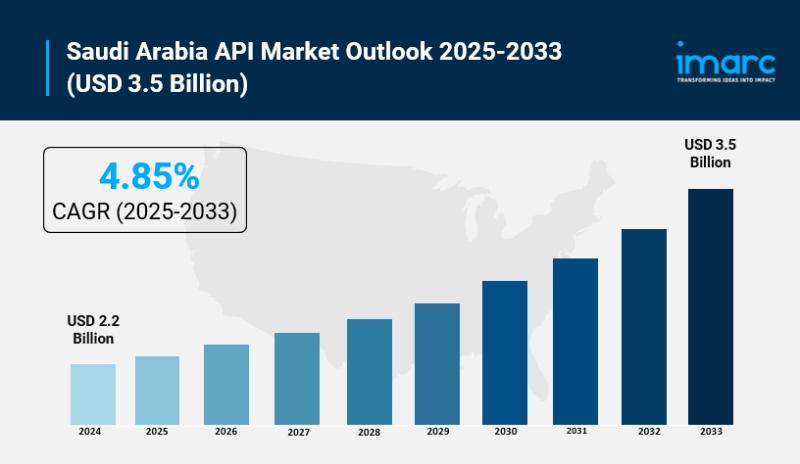

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for Fintech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…