Press release

Payment Security Software Market is expected to grow at a CAGR of 15.1% during the forecasted period | Evolve Business Intelligence

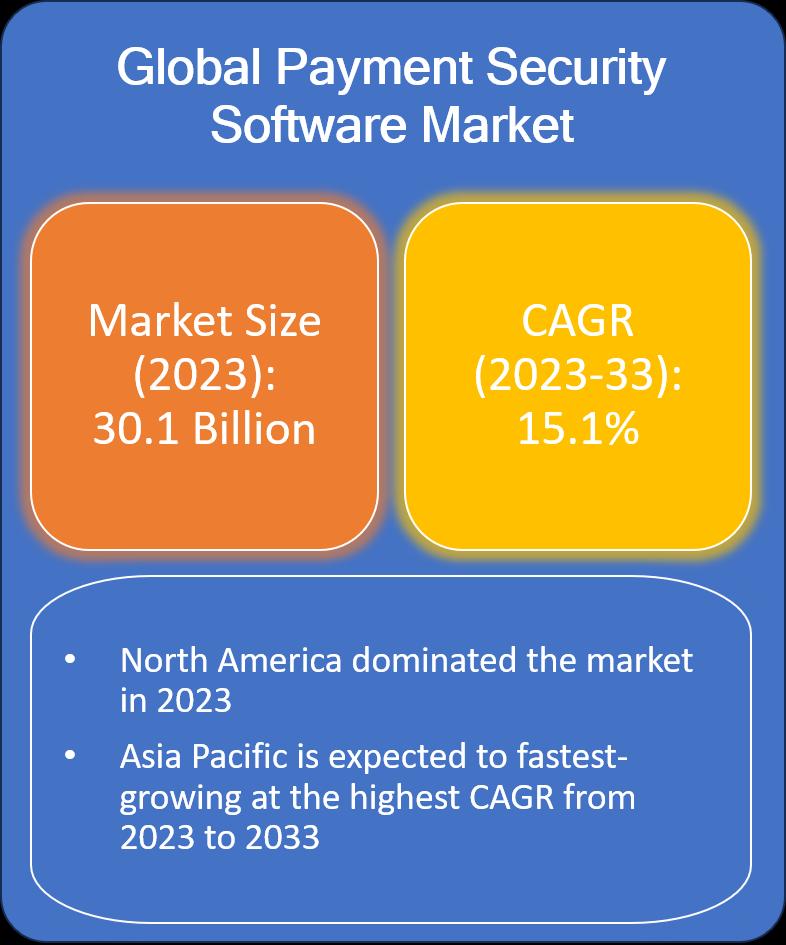

Key Highlights:• The global Payment Security Software Market size was valued at USD 30.1 billion in 2023 growing at a CAGR of 15.1% from 2023 to 2033.

• North America dominated the market in 2023

• Asia Pacific is expected to grow at the highest CAGR from 2023 to 2033

As per the study initiated by Evolve Business Intelligence, the global Payment Security Software Market size accounted for USD 30.1 Billion in 2023, growing at a CAGR of 15.1% from 2023 to 2033. Payment security software refers to a set of tools and technologies designed to secure online transactions, protect sensitive payment information, and prevent fraud in electronic payment systems. These solutions are crucial in ensuring the integrity and confidentiality of financial transactions conducted over various channels, including online shopping, mobile payments, and other electronic payment methods.

Request/Download PDF Sample: https://report.evolvebi.com/index.php/sample/request?referer=openpr.com&reportCode=021757

The rise of e-commerce, mobile banking, and digital payment methods has led to an increase in online transactions, creating a greater need for robust payment security solutions. With the growing sophistication of cyber threats and attacks, organizations and consumers alike are increasingly concerned about the security of their financial transactions, driving the demand for advanced payment security measures. Stringent regulations and compliance requirements, such as PCI DSS, mandate the implementation of secure payment systems, prompting organizations to invest in payment security software to meet these standards. Continuous advancements in technology, including artificial intelligence and machine learning, enable payment security solutions to evolve and adapt to emerging threats more effectively.

Key Players

Some of the major Payment Security Software Market players holding high market shares include Bluefin Payment Systems, Cybersource, and Elavon Inc. These players use partnership and collaboration as a key strategy to gain significant market share to compete with market leaders. Some of the other major market players include Ingenico, Intelligent Payment Solutions Pvt Ltd., Paypal, Shift4 Payments, LLC, SISA, Signifyd, and Tokenex.

For More Information: https://report.evolvebi.com/index.php/sample/request?referer=openpr.com&reportCode=021757

Segmental Analysis

Based on components, the Payment Security Software market is segmented into Solutions and Services. The Solution segment holds the largest share in the Payment Security Software market. This dominance is attributed to the growing demand for comprehensive security solutions that encompass various functionalities, such as data encryption, tokenization, fraud prevention, and access control. Organizations are increasingly opting for integrated solutions that provide holistic protection against evolving cyber threats, rather than relying on fragmented tools that address specific security concerns.

Based on the platform, the Payment Security Software market is Web-based and POS-based. The Web-based segment dominates the Payment Security Software market. This dominance stems from the widespread adoption of e-commerce and online payment transactions. Web-based platforms offer the flexibility and scalability required to secure online transactions across multiple devices and channels. Additionally, web-based solutions often provide centralized management and reporting capabilities, making them more efficient and cost-effective for organizations.

Based on enterprise size, the Payment Security Software market is Large Enterprises and Small & Medium Enterprises. Large enterprises hold the largest share in the Payment Security Software market. This dominance is attributed to the complex and sophisticated payment infrastructures of large enterprises, which demand robust and comprehensive security solutions. Large enterprises are also more likely to invest in advanced security technologies and services due to their higher exposure to financial losses and reputational damage from cyberattacks.

Based on the industry vertical, the Payment Security Software market is BFSI, Government and utilities, IT and telecom, Healthcare, Retail and e-commerce, Media and entertainment, Travel and hospitality, and Others. The BFSI (Banking, Financial Services, and Insurance) industry holds the largest share in the Payment Security Software market. This dominance is driven by the stringent regulatory requirements and the high value of financial data handled by BFSI organizations. These organizations are also prime targets for cybercriminals due to the potential for significant financial gains. Therefore, BFSI organizations are willing to invest heavily in payment security software to protect their sensitive data and comply with regulations.

Key Region/ Countries Covered

• North America (US, Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Spain, Russia, Nordic Countries, BeNeLux, Rest of Europe)

• Asia-Pacific (China, India, Japan, South Korea, Indonesia, Malaysia, Rest of Asia Pacific)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, South Africa, Rest of MEA)

• Latin America (Mexico, Brazil, Argentina, Rest of Latin America)

Address

Evolve Business Intelligence

C-218, 2nd floor, M-Cube

Gujarat 396191

India

Email: sales@evolvebi.com

Website: https://evolvebi.com/

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from Fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Security Software Market is expected to grow at a CAGR of 15.1% during the forecasted period | Evolve Business Intelligence here

News-ID: 3312079 • Views: …

More Releases from Evolve Business Intelligence

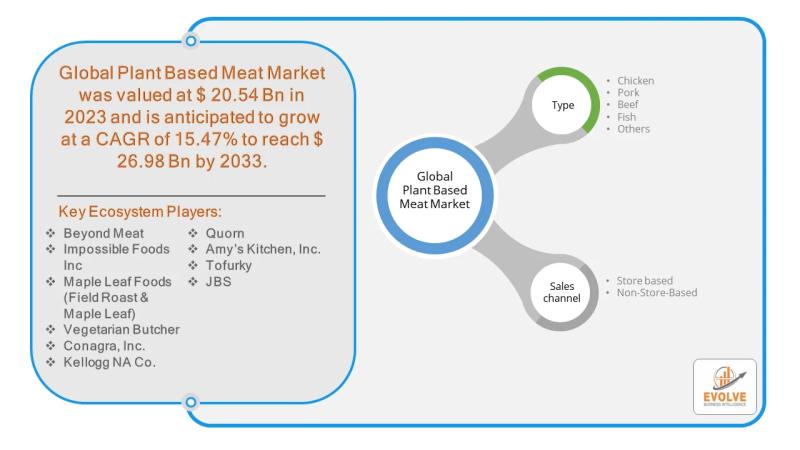

Plant-Based Meat Market Forecast to Reach USD 26.98 Billion by 2033

The plant-based meat market is at a pivotal point, marked by strong growth in the past decade but now facing headwinds. While traditional retail channels have seen recent slowdowns, the non-store-based segment, which includes direct-to-consumer (D2C) e-commerce, meal kits, and food service, presents a significant and largely untapped opportunity. This channel allows brands to bypass the challenges of traditional retail, such as intense competition for shelf space and high listing…

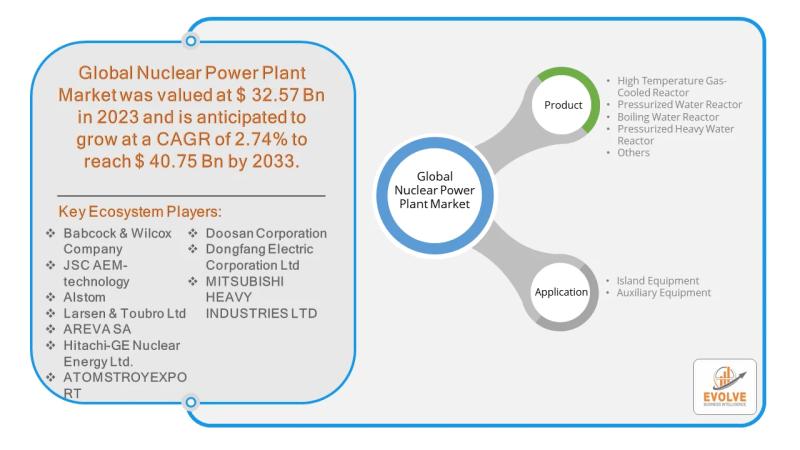

Nuclear Power Plant Market Forecast to Reach USD 40.75 Billion by 2033

As the world seeks a clean, reliable, and sustainable energy future, High Temperature Gas-Cooled Reactors (HTGRs) are emerging as a prime candidate to lead the next generation of nuclear power. This advanced reactor technology, which uses a graphite-moderated core and inert helium coolant, offers a unique blend of inherent safety and versatility that extends well beyond traditional electricity generation. While challenges remain, the opportunity for HTGRs to transform the nuclear…

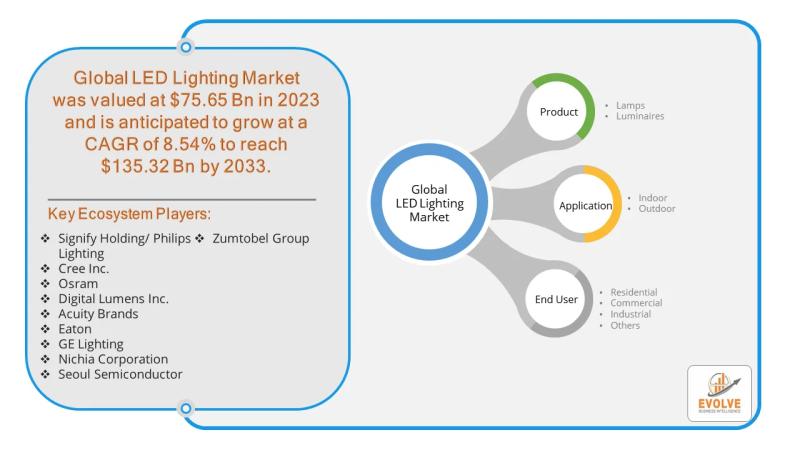

LED Lighting Market Forecast to Reach USD 255.92 Billion by 2035

The global LED lighting market is on a trajectory of significant expansion, fueled by the rising demand for energy-efficient and sustainable lighting solutions. While the market for LED lamps remains strong, luminaires-complete lighting fixtures with integrated LEDs-are emerging as the primary driver of future growth. Valued at an estimated USD 71.59 billion in 2023, the market is projected to surge to over USD 255.92 billion by 2035, with a compound…

Sensor Market Forecast to Reach USD 457.26 Billion by 2032

The global sensor market is at a pivotal point, poised for remarkable growth driven by the proliferation of smart devices, industrial automation, and the Internet of Things (IoT). The market, valued at an estimated USD 241.06 billion in 2024, is projected to expand significantly to approximately USD 457.26 billion by 2032, demonstrating a robust Compound Annual Growth Rate (CAGR) of about 8.5%. Within this dynamic landscape, a key player is…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…