Press release

Revenue-Based Financing Market 2023 - Growth By Segments, Upcoming Business Trends, Industry Analysis And Forecast by 2032

The Business Research Company's global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032The Business Research Company's Revenue-Based Financing Global Market Report 2023 identifies rising number of startups as the major driver for the Revenue-Based Financing market's growth in the forecast period. Startups refer to newly formed companies that are usually started by one or more entrepreneurs who focus on capitalizing upon a perceived market demand by developing a viable product, service, or platform. Startups help build the revenue-based financing industry by delivering innovative financial products and platforms that cater to the needs of small businesses, such as providing them with accessible and flexible finance options to help them grow and increase revenue streams.

The global revenue-based financing market is expected to grow from $1.98 billion in 2022 to $3.38 billion in 2023 at a compound annual growth rate (CAGR) of 71.2%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic. The war between these two countries has led to economic sanctions on multiple countries, surge in commodity prices, and supply chain disruptions, causing inflation across goods and services and resulted in increased interest rates affecting many markets across the globe. The revenue-based financing market is expected to reach $25.94 billion in 2027 at a CAGR of 66.4%.

Download Free Sample Of Revenue-Based Financing Market Report - https://www.thebusinessresearchcompany.com/sample_request?id=12681&type=smp

Major competitors in the Revenue-Based Financing market are Silvr Co, Wayflyer, Funding Circle Holdings PLC, NerdWallet, Novel Capital, Kapitus, Saratoga Investment Corp, Decathlon Capital Partners LLC.

A key trend in the Revenue-Based Financing market includes integration with technology. Major companies operating in the revenue-based financing market are adopting new technologies to sustain their position in the market. For instance, in August 2021, Uncapped Ltd., a UK-based provider of revenue-based financing, launched an innovative funding and growth platform to provide access to unbiased and remote capital to local early-stage founders. This prompted Uncap to create a new, entirely remote, data-driven, and highly simplified funding strategy, as well as an innovative investment concept. They will provide current enterprises needing funding ranging from $10,000 to $50,000.

Read More On The Global Revenue-Based Financing Market Report Here:

https://www.thebusinessresearchcompany.com/report/revenue-based-financing-global-market-report

The Revenue-Based Financing market is segmented -

• By Enterprise Size: Micro Enterprises, Small-Sized Enterprises, Medium-Sized Enterprises

• By Mode: Online, Offline

• By Industry Vertical: Information Technology and Telecommunication, Healthcare, Media And Enterprises, Banking, Financial Services And Insurance (BSFI), Consumer Goods, Energy And Utilities, Other Industry Verticals

• By Geography: Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. North America was the largest region in the Revenue-Based Financing market.

The Business Research Company's "Global Revenue-Based Financing Market Report 2023" provides a thorough understanding of the market across 60 geographies. The report covers market size, growth rate, segments, drivers and trends in every region and country. In addition, the report offers insights on historical and forecast growth, helping players analyze and strategize better.

Explore Buying Options For The Revenue-Based Financing Market Report Here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=12681

The Table Of Content For The Revenue-Based Financing Market Include:

1. Executive Summary

2. Revenue-Based Financing Market Characteristics

3. Revenue-Based Financing Market Trends And Strategies

4. Revenue-Based Financing Market - Macro Economic Scenario

5. Global Revenue-Based Financing Market Size and Growth

…………………………………………

32. Global Revenue-Based Financing Market Competitive Benchmarking

33. Global Revenue-Based Financing Market Competitive Dashboard

34. Key Mergers And Acquisitions In The Revenue-Based Financing Market

35. Revenue-Based Financing Market Future Outlook and Potential Analysis

36. Appendix

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Latest Trending Press Releases: https://www.thebusinessresearchcompany.com/press-release.aspx

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Revenue-Based Financing Market 2023 - Growth By Segments, Upcoming Business Trends, Industry Analysis And Forecast by 2032 here

News-ID: 3310553 • Views: …

More Releases from The Business research company

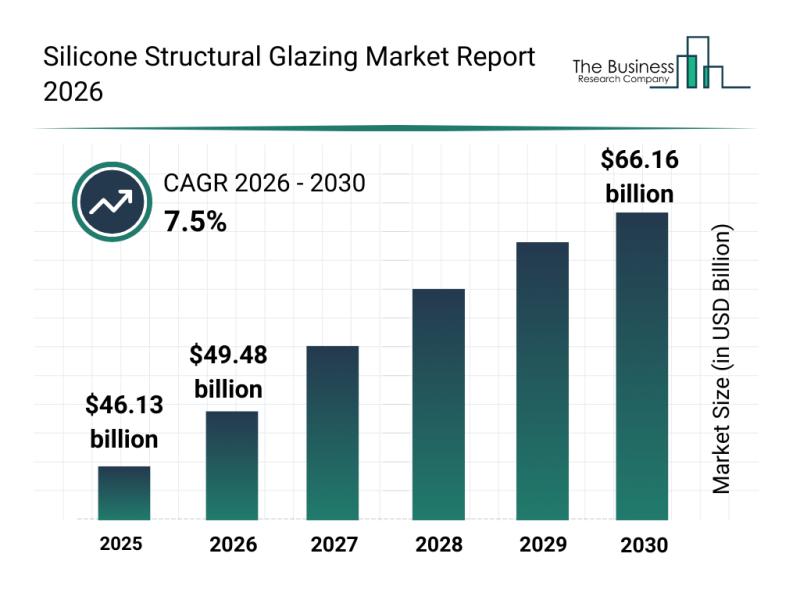

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

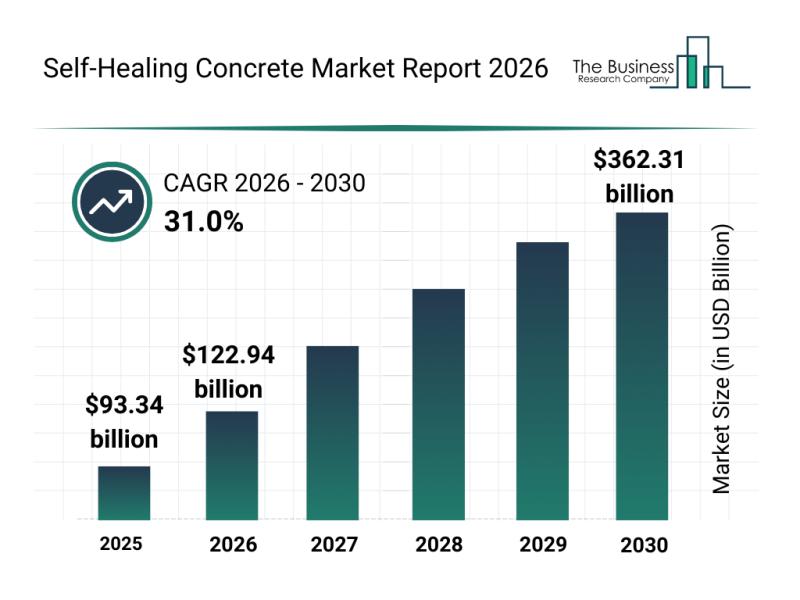

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

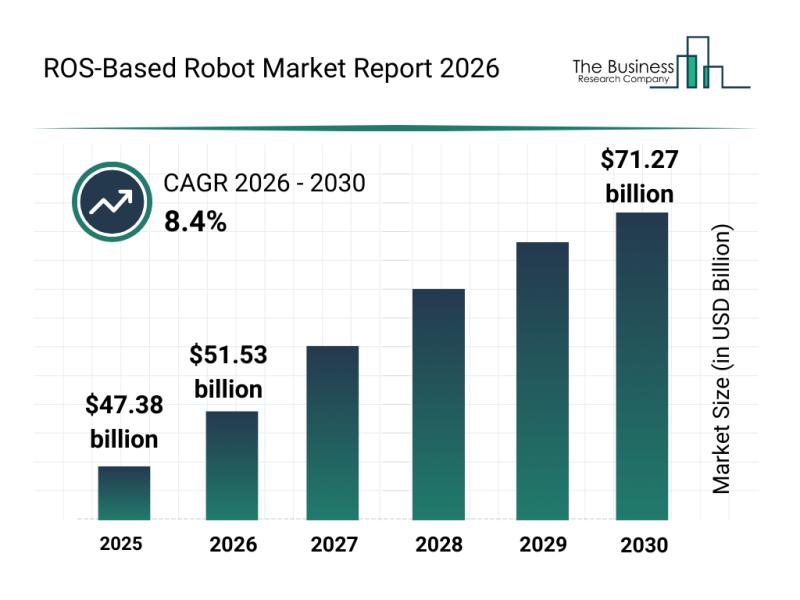

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

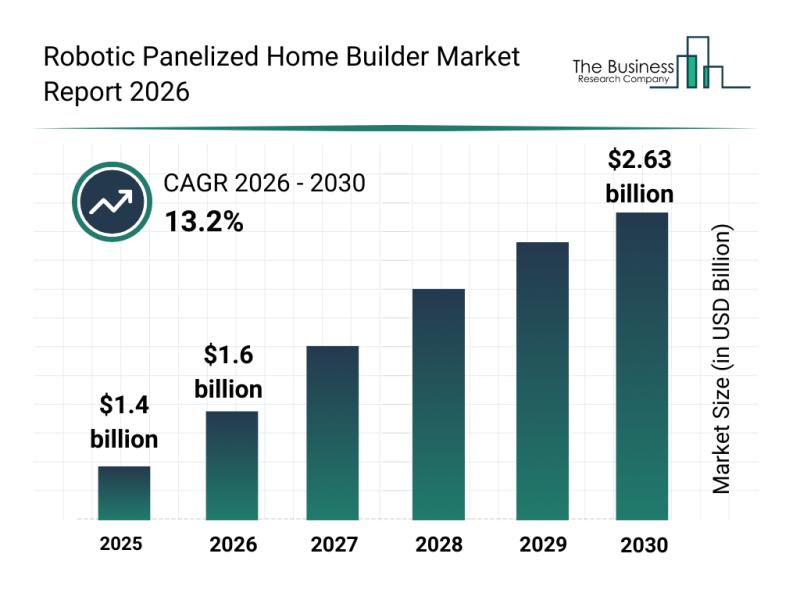

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Financing

Financing and digitalization: CONFIDEX builds a networked financing system

Companies rely on system financing instead of individual products

With an integrated financing system, CONFIDEX combines consulting, technology and access to capital directly at the digital interfaces of the industry. Through platform partners and the subsidiary VENDORMAX, a closed financial ecosystem is created that enables financing where investments are made - quickly, transparently and efficiently.

Combining experience and real time

CONFIDEX GmbH has been supporting companies from industry and SMEs in structuring complex…

Education Financing Platforms Market Is Going to Boom | Major Giants MPOWER Fina …

HTF MI just released the Global Education Financing Platforms Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2024-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Education Financing Platforms Market are: MPOWER…

Revenue-Based Financing Market Report 2024 - Revenue-Based Financing Market Size …

"The Business Research Company recently released a comprehensive report on the Global Revenue-Based Financing Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Efficient real estate financing: Wandl.Immobilien presents new financing calcula …

Munich, May 23, 2024 - Wandl.Immobilien, a family-run real estate agency that has been successfully selling residential properties in Munich and the surrounding area for over 30 years, has introduced an impressive new addition to its range of services. An innovative real estate financing tool has been added to the extensive portfolio, which now also covers this increasingly important area.

Charting New Territories in real estate financing

The introduction of the new…

Film Marketing & Film Financing

Film Sales Agency TheMovieAgency.com is now offering extra assistance to filmmakers. If you are looking for raising funds for your next feature film or simply looking for assistance in marketing your completed feature film on the road to distribution, The Movie Agency might be able to help you with no upfront fee and no hidden fee!!!

We offer:

Free consultation.

Sourcing investors and future distributors, film buyers.

North American Distribution for the feature…

INVESTOR LOAN FINANCING PRODUCTS NATIONWIDE

We at KIS Lending believe in the art of word of mouth recommendations. Please see below with a variety of programs clients can take advantage of. We can assist in a variety of ways to finance the next home purchase or investment property NATIONWIDE for you or your clients. DSCR is the latest best option for investors.

• RESIDENTIAL FIX & FLIP + BRRRR LOANS: 90% of purchase, 100% of…