Press release

Insurance Analytics Market Soaring at 14% CAGR to Reach US$ 49 Billion by 2033

The insurance analytics market share is prominently held by North America, with the region expected to witness a growth rate of 12.5% CAGR. Simultaneously, the Asia Pacific market is projected to experience substantial advancement, charting an impressive trajectory through the year 2033.The worldwide insurance analytics market size is US$ 13.15 billion in 2023, with a projected valuation of US$ 49 billion by the conclusion of 2033. This signifies a robust compound annual growth rate (CAGR) of 14% anticipated between 2023 and 2033.

Download a Sample Copy of This Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9006

In an era defined by technological innovation and data-driven decision-making, the insurance industry is experiencing a profound transformation with the advent of advanced analytics. The Insurance Analytics Market is rapidly gaining momentum, offering a glimpse into the future of risk management that is both dynamic and predictive.

Unleashing the Power of Data:

Traditionally, insurers have relied on historical data and actuarial models to assess risks and set premiums. However, the Insurance Analytics Market is ushering in a new era by leveraging big data and cutting-edge analytics tools. Insurers can now harness the power of real-time data streams, enabling them to make more informed and timely decisions.

Predictive Modeling for Precise Risk Assessment:

One of the key drivers of the surge in the Insurance Analytics Market is the adoption of predictive modeling techniques. Insurers can now go beyond historical trends and anticipate future risks with greater accuracy. Machine learning algorithms analyze vast datasets to identify patterns and correlations, empowering insurers to proactively manage risks and minimize potential losses.

Enhanced Underwriting Processes:

The underwriting process, a critical component of the insurance industry, is undergoing a significant transformation. Insurance analytics allows for a more granular assessment of risk factors, enabling underwriters to tailor policies to individual needs. This personalized approach not only improves customer satisfaction but also enhances the overall efficiency of underwriting operations.

Fraud Detection and Prevention:

Insurance fraud has long been a challenge for the industry, leading to significant financial losses. The advanced analytics capabilities of the Insurance Analytics Market are proving instrumental in detecting and preventing fraudulent activities. Machine learning algorithms can analyze patterns in claims data to identify irregularities and flag potentially fraudulent cases, enabling insurers to take swift action.

Competitive Landscape

The insurance analytics market presents a highly competitive environment, featuring both well-established industry leaders and innovative startups. As businesses undergo technological transformations, there is ample room for expansion, emphasizing the need for greater cohesion within the insurance analytics industry.

To meet the evolving demands of the insurance sector, key players typically invest in enhancing their product offerings. Industry giants such as IBM, SAS, and Oracle offer comprehensive analytics solutions tailored for the insurance industry. Disruptive startups like DataRobot and Shift Technology specialize in areas such as fraud detection and claims processing. The competitive landscape is continually shaped by mergers, acquisitions, partnerships, and strategic collaborations.

An example of such collaboration occurred in October 2022 when Guidewire and One Inc. joined forces to provide insurers with a ready-to-use solution, expediting the delivery of a seamless payment experience for clients, adjusters, agents, and suppliers.

Several notable developments highlight the industry's dynamism:

• IBM introduced IBM Risk Analytics, a novel risk-based solution, in September 2020.

• WNS unveiled EXPIRIUS in August 2020, an AI and analytics-driven customer experience solution designed to meet the changing needs of the insurance sector.

Among the top players in the insurance analytics market are IBM, Salesforce, Oracle, Microsoft, Sapiens, Open Text, SAP, Verisk Analytics, SAS Institute, Vertafore, TIBCO, Qlik, Board International, BRIDGEi2i, and Microstrategy, each contributing to the industry's vibrant and evolving landscape.

Segmentation of Insurance Analytics Market Research

• By Component :

o Tools

o Services

• By Application :

o Claims Management

o Risk Management

o Customer Management and Personalization

o Process Optimization

o Others

• By Deployment :

o Cloud

o On-premise

• By Enterprise Size :

o Small & Medium Enterprises

o Large Enterprises

• By End User :

o Insurance Companies

o Government Agencies

o Third-party Administrators, Brokers, and Consultancies

• By Region :

o North America

o Latin America

o Europe

o East Asia

o South Asia & Oceania

o Middle East & Africa

Get Customization on this Report:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=9006

The surge of the Insurance Analytics Market signals a transformative period for the insurance industry, where data-driven insights and predictive analytics redefine the landscape of risk management. As technology continues to advance, insurers embracing these innovations are better positioned to navigate an increasingly complex and dynamic environment. The future of risk management is not only about mitigating uncertainties but about leveraging data to make strategic decisions that propel the industry forward into a new era of efficiency and customer-centricity.

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client's satisfaction.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market Soaring at 14% CAGR to Reach US$ 49 Billion by 2033 here

News-ID: 3290937 • Views: …

More Releases from Fact.MR

Organic Rice Syrup Market is forecasted to increase at a CAGR of 5.1% and US$ 1. …

The global Organic Rice Syrup Market is projected to expand steadily over the coming decade, driven by rising consumer demand for natural, clean-label sweeteners and growing awareness of health and wellness trends. Industry analysts estimate that the organic rice syrup market, valued at approximately USD 450 million in 2025, is expected to reach nearly USD 880 million by 2035, registering a compound annual growth rate (CAGR) of about 7.1% during…

Compound Horse Feedstuff Market is Estimated to Grow at a CAGR of 4.6%, Reaching …

The global compound horse feedstuff market is galloping toward steady growth, projected to expand from a valuation of USD 3.8 billion in 2026 to approximately USD 5.4 billion by 2036. This represents a compound annual growth rate (CAGR) of 3.6% over the ten-year forecast period.

The market is being driven by the "humanization" of equine companions, the professionalization of equestrian sports, and a significant shift toward specialized performance nutrition that…

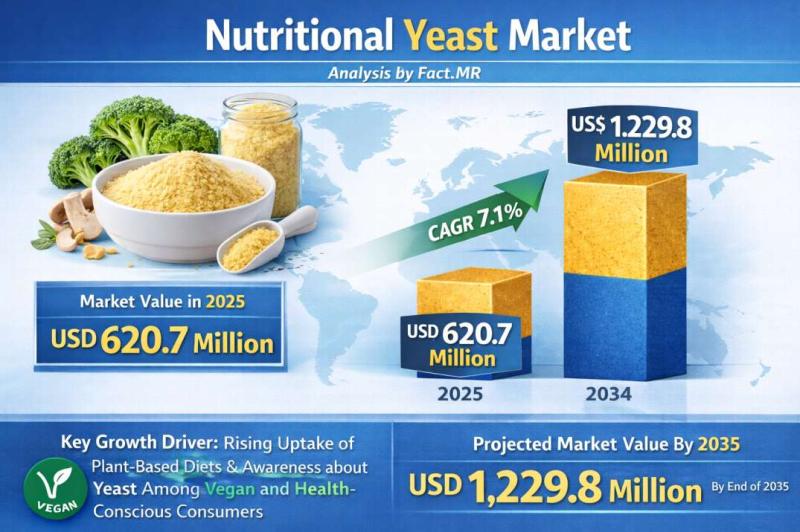

Nutritional Yeast Market Forecasted CAGR is 7.1% by 2035 | Fact.MR Report

The global nutritional yeast market is experiencing a significant surge in demand, projected to grow from a valuation of USD 515.2 million in 2026 to approximately USD 1.2 billion by 2036. This represents a robust compound annual growth rate (CAGR) of 8.8% over the ten-year forecast period.

The market is being propelled by the global explosion of plant-based diets and the "clean-label" movement, with nutritional yeast emerging as the primary…

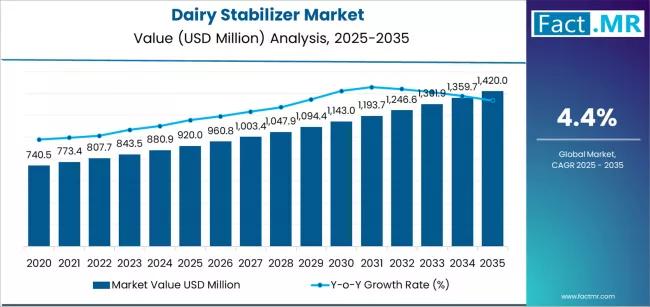

Dairy Stabilizer Market is Expected to Reach USD 1,420.0 million by 2035 | Resea …

The global Dairy Stabilizers Market is projected to sustain solid growth over the next decade as consumer demand for high-quality dairy and dairy-based products continues to expand across foodservice and retail sectors. Industry analysts estimate that the dairy stabilizers market, valued at approximately USD 2.4 billion in 2025, is expected to reach around USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of about 6.5% during the…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…