Press release

Payment as a Service Market Size Surges Globally, Unveiling Lucrative Opportunities for FinTech Innovators

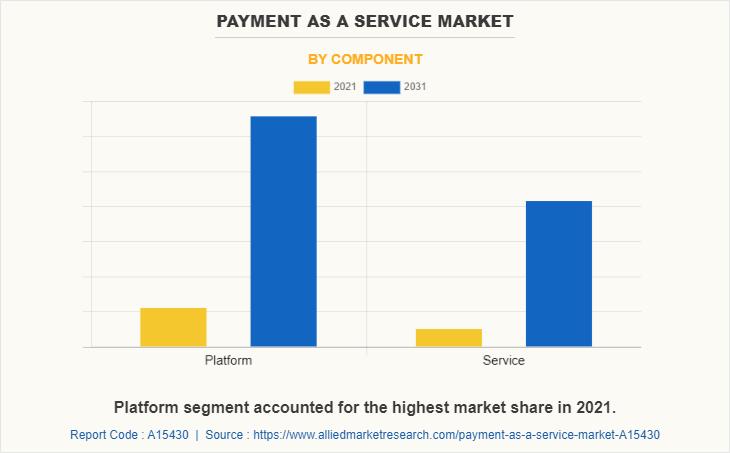

The payment as a service market was valued at $8 billion in 2021, and is estimated to reach $53.6 billion by 2031, growing at a CAGR of 21.4% from 2022 to 2031.Payment as a service providing companies are increasingly designing next-generation solutions for consumer and enterprise-oriented services. Moreover, government agencies also demand for a need to shift toward modern payment tools and techniques. The payment services companies integrate several emerging technologies such as Europay, Mastercard and Visa cards (EMV), blockchain, near field communication (NFC), and integrates Payment Card Industry Data Security Standard (PCI DSS) compliance to maintain a secured payment environment.

Request Sample PDF Report at: https://www.alliedmarketresearch.com/request-sample/15799

Factors such as increased smartphone penetration & incorporation of online payment services, rise in e-commerce sales, and increase in reliance on cloud technologies propel the payment as a service market growth. In addition, support & initiatives of the government toward payment as a service market and untapped potential of emerging economies are expected to provide lucrative opportunities for the payment as a service market in the coming years.

Moreover, the global payment as a service market is in its developing phase, and exhibits high growth potential, due to rise in need for operational efficiency & transparency during transactions and surge in demand for customized digitalized payment options globally. For instance, according to a study conducted by Mastercard in 2020, about 95% of South African consumers consider using at least one emerging payment method, such as contactless, mobile payments, cryptocurrency, or QR code in the next year.

If you have any special requirements, please let us know: https://www.alliedmarketresearch.com/request-for-customization/15799

On the basis of payment method, the cards segment acquired major share. This is attributed to the fact that card payment services provide convenient payment options for customers along with security. In addition, it offers a range of payment solutions to help merchants for analyzing customer behavior & metrics.

On the basis of region, North America dominated the payment as a service market share in 2021 during the forecast period. This is attributed to growth in technology adoption in the payment industry and rise in online transactions.

Buy Now & Get Exclusive Discount on this Report (427 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/payment-as-a-service-market/purchase-options

The demand for payment as a service has increased considerably during the COVID-19 pandemic. This is attributed to increased familiarity toward digital payments among consumers and initiatives by governing bodies across the globe to curb the spread of virus by initiating various policies for conducting payments. Moreover, payment as a service method is expected to be intact by economic downturn and is anticipated to remain high during the forecast period. These factors, thus promote the growth of the payment as a service industry during the pandemic situation.

Inquire Here Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/15799

The key players operating in the payment as a service market analysis include Aurus, Inc., Alpha Fintech, ACI Worldwide, Apple Inc., First Data (Fiserv, Inc.), Google, LLC, Ingenico, Mastercard, Paysafe, PayPal Holdings, Inc., Paystand, Pineapple payments (Fiserv, Inc.), VeriFone, Inc., Visa Inc., Valitor, PayU, and Obopay. These players have adopted various strategies to increase their market penetration and strengthen their position in the payment as a service industry.

Access Summary of Full Report: https://www.alliedmarketresearch.com/payment-as-a-service-market-A15430

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising of 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients' requirements is complemented with analyst support and customization requests.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment as a Service Market Size Surges Globally, Unveiling Lucrative Opportunities for FinTech Innovators here

News-ID: 3286432 • Views: …

More Releases from Allied Market Research

Amphibious Vehicle Market Scenario Highlighting Major Drivers & Growth, 2027

According to the report, the global amphibious vehicle industry generated $2.70 billion in 2019, and is expected to garner $5.02 billion by 2027, witnessing a CAGR of 8.5% from 2020 to 2027.

Surge in investment in the defense sector to increase adoption and demand in commercial applications drive the growth of the global amphibious vehicle market. However, high initial investment and rise in operational costs along with seasonal serviceability hinder the…

Baby Infant Formula Market to Witness Huge Growth by 2031 | Danone, D-Signstore, …

According to the report, the global baby infant formula industry was valued at $25.5 billion in 2021, and is estimated to reach $56.6 billion by 2031, registering a CAGR of 8.1% from 2022 to 2031.

The global baby infant formula market is experiencing growth due to various factors, such as an increase in the number of women participating in the labor force, the high nutritional value of infant formula, and the…

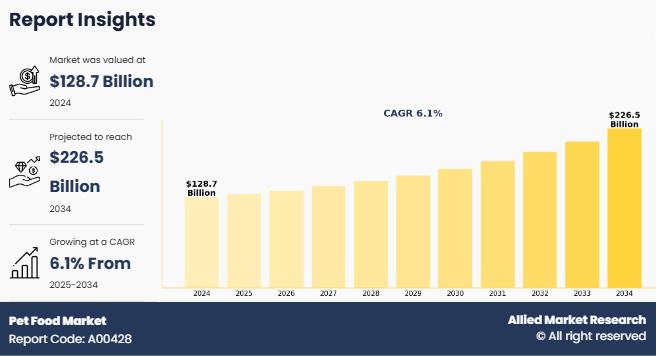

Pet Food Market Size to Hit US$ 133,430.9 million by 2030 at 4.6% CAGR

According to a report published by Allied Market Research, the global pet food market was valued at $87,268.2 million in 2020 and is estimated to generate $133,430.9 million by 2030, manifesting a CAGR of 4.6% from 2021 to 2030. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscapes, and competitive scenarios.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/530 …

Luxury Yacht Market Size to Exceed USD 12.8 billion by 2031 | CAGR of 8.0%

According to a new report published by Allied Market Research, titled, "Luxury Yacht Market by Size, Type, and Material: Global Opportunity Analysis and Industry Forecast, 2022-2031," the luxury yacht market size was valued at $5.8 billion in 2020 and is expected to reach $12.8 billion by 2031, registering a CAGR of 8.0% from 2022 to 2031.In terms of volume, Europe occupied around two-thirds of the market share for 2020.

Get…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…