Press release

Tax Management Market growing at a remarkable CAGR of 11.3%. This growth trajectory is expected to continue, with the market projected to reach US45.21 billion by 2029.

Tax Management Market Report Scope and Research MethodologyMaximize Market Research Pvt. Ltd., a leading market research company based in Pune, India, is pleased to announce the release of its comprehensive market research report on the Tax Management Market for the year 2022. The report reveals valuable insights into the global Tax Management Market, highlighting its size, dynamics, architecture, segment analysis, regional insights, and recent developments.

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/global-tax-management-market/116778/

The report offers insights into market size, trends, competitive analysis, and the impact of micro-economic factors, helping decision-makers navigate the industry's dynamics effectively.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/116778

What are Tax Management Market Dynamics?

The Tax Management Market primarily revolves around the utilization of tax management software, enabling users to effortlessly monitor their finances, transactions, and income. This software equips individuals and businesses alike with the essential tools needed for tax compliance across various tax types, including income tax, corporate tax, customs, VAT, sales tax, service tax, and more. The software's primary objective is to simplify tax filing processes, reduce the risk of human error, and ensure accurate tax calculations.

The demand for tax software continues to surge across diverse industries due to its ability to streamline tax return submissions and payments, driving global market growth. Moreover, the BFSI sector's increased adoption of tax software for data analysis and loss prevention is a significant contributing factor. The ongoing advancements in tax software automation technology and substantial investments in automated tax calculation systems also fuel market expansion, albeit concerns related to cloud application networking and data security pose some constraints.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/116778

What is Tax Management Market Regional Insight?

North America emerged as the dominant market in 2022, with the United States and Canada leading in tax management software adoption. The region's developed economies have embraced tax management systems, recognizing their benefits, including reduced errors and streamlined tax calculation.

Request For Free Sample Report:https://www.maximizemarketresearch.com/request-sample/116778

What is Tax Management Market Segmentation?

by Component

Software

Services

by Tax Type

Indirect Tax

Direct Tax

by Deployment

Cloud

On-premises

by End-User BFSI

IT and Telecom

Manufacturing

Energy and Utilities

Retail

Healthcare and Life Sciences

Media and Entertainment

Others

Purchase Report : https://www.maximizemarketresearch.com/market-report/global-tax-management-market/116778/

Who are Tax Management Market Key Players?

1. Avalara

2. ADP

3. Automatic Data Processing

4. Wolters Kluwer N.V

5. Thomson Reuters

6. Intuit

7. H&R Block

8. SAP SE

9. Blucora

10. Sovos Compliance

11. Vertex

12. Sailotech

13. Defmacro Software

14. DAVO Technologies

15. Xero

16. TaxSlayer

17. Taxback International

18. TaxCloud

19. Drake Enterprises

20. Canopy Tax

21. TaxJar

Table of content for the Tax Management Market includes:

Global Tax Management Market: Research Methodology

Global Tax Management Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Tax Management Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape

Market Size, Share, Size & Forecast by different segment |

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Software Consulting Market https://www.maximizemarketresearch.com/market-report/global-software-consulting-market/115784/

Intellectual Property Software Market https://www.maximizemarketresearch.com/market-report/global-intellectual-property-software-market/42291/

Mobile Accelerator Market https://www.maximizemarketresearch.com/market-report/global-mobile-accelerator-market/23440/

Software Defined Storage Market https://www.maximizemarketresearch.com/market-report/global-software-defined-storage-market/54891/

Online Banking Market https://www.maximizemarketresearch.com/market-report/global-online-banking-market/84177/

Data Privacy Software Market https://www.maximizemarketresearch.com/market-report/data-privacy-software-market/145730/

Online Lottery Market https://www.maximizemarketresearch.com/market-report/online-lottery-market/145747/

Global 3D Glass Market https://www.maximizemarketresearch.com/market-report/global-3d-glass-market/65773/

Aged Care Market https://www.maximizemarketresearch.com/market-report/global-aged-care-market/92733/

Coiled Tubing Market https://www.maximizemarketresearch.com/market-report/global-coiled-tubing-market/118821/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market growing at a remarkable CAGR of 11.3%. This growth trajectory is expected to continue, with the market projected to reach US45.21 billion by 2029. here

News-ID: 3226861 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

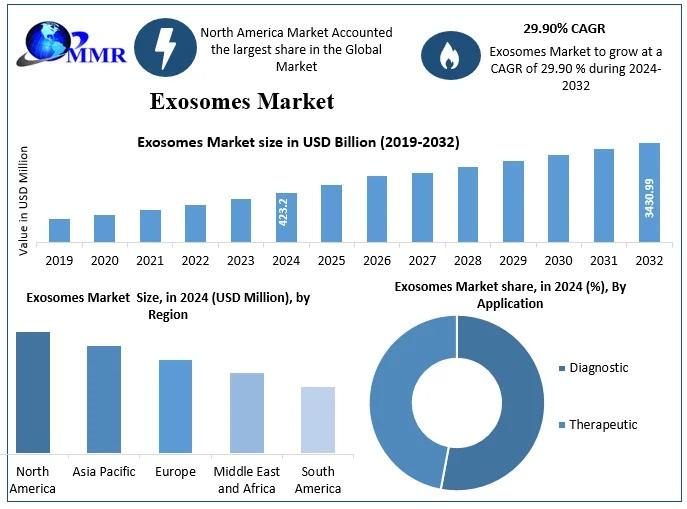

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…