Press release

Future Market Insights Unveils Latest Report on Peer-to-Peer Lending Market, Unraveling Growth Trajectory

Low operational expenses and reduced market risk for lenders and borrowers are to blame for the market's expansion. During the projected period, increased digitization in the banking industry is anticipated to present the market with sizable business prospects. By the end of 2032, the worldwide "peer-to-peer lending market" is predicted to have grown from US$ 407.2 billion in 2022 to US$ 1.3 trillion. From 2022 to 2032, the market is anticipated to grow at a CAGR of 12.7%.P2P lending is also being effectively utilised by a variety of end users, including the real estate industry, as its popularity has grown. Additionally, it is anticipated that increased player initiatives to work together will eventually help the market.

For instance, in May 2022, Fable Fintech, an eminent banking infrastructure enterprise, announced its strategic partnership with XeOPAR. XeOPAR is ready to make the most of the Fable Growth Suite (Retail) by establishing its first P2P remittances corridor from the United Kingdom to India, among others in SE Asia, East Africa, West Africa, the USA, Singapore, and the Middle East.

Request a Sample of this Report @

https://www.futuremarketinsights.com/reports/sample/rep-gb-14675

Owing to such initiatives, the market is anticipated to expand significantly in the forecast period. On the contrary, risks associated with peer-to-peer lending are expected to limit the market growth in the forecast period. Also, with less awareness about P2P lending, the market is expected to suffer.

However, with rising development in APAC along with the increasing number of small business entities, the market will counter the inhibiting factors, thus, supporting the industry expansion.

Key Takeaways from the Market Study:

Market in the U.S to value US$ 568.2 Billion by 2032

Chinese market to expand at a CAGR of 11.3% from 2022- to 2032

By end-user, the small business segment is expected to exhibit a CAGR of 10.3% during the assessment period

The marketplace lending model segment to exhibit a CAGR of 12.9% in the assessment period

Market in France to garner US% 39.7 Billion by 2032

S to exhibit a CAGR of 14% from 2022 to 2032

Competitive Landscape

With the help of alternative distribution channels such as online sales, Players in the global peer-to-peer lending market are focusing to enhance their market presence across the globe. Major players in the market include Prosper Marketplace, Inc., LendingClub Corporation, CommonBond Inc., Funding Circle Limited, and Upstart Network Inc. among others.

In August 2021, CRED, an eminent player in the peer-to-peer lending market rolled out a new peer-to-peer lending platform called CRED Mint. It can be used as a cred-card repayment platform, and it allows members to earn interest on money by lending to other high-earning consumers.

In January 2021, LendingClub, an eminent peer-to-peer lending market player, announced the acquisition of Radius Bancorp, Inc, and its digital bank subsidiary to expand the revenue of the company.

Empower Your Strategy: Acquire Our Comprehensive Report Today. @

https://www.futuremarketinsights.com/checkout/14675

More Valuable Insights

Future Market Insights, in its new offering, presents an unbiased analysis of the global peer-to-peer lending market, presenting a historical analysis from 2015 to 2021 and forecast statistics for the period of 2022-2032.

Key Segments Profiled in the Peer-to-Peer Lending Market Analysis

Peer-to-Peer Lending by End User:

Peer-to-Peer Lending for Consumer Credit

Peer-to-Peer Lending for Small Business

Peer-to-Peer Lending for Student Loans

Peer-to-Peer Lending for Real Estate

Peer-to-Peer Lending by Business Model:

Traditional Peer-to-Peer Lending Model

Marketplace Peer-to-Peer Lending Model

Peer-to-Peer Lending by Region:

North America Peer-to-Peer Lending Market

Europe Peer-to-Peer Lending Market

Asia Pacific Peer-to-Peer Lending Market

Middle East & Africa Peer-to-Peer Lending Market

Latin America Peer-to-Peer Lending Market

Request for Methodology @

https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14675

Contact Us:

Nandini Singh Sawlani

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 5000 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Market Insights Unveils Latest Report on Peer-to-Peer Lending Market, Unraveling Growth Trajectory here

News-ID: 3213912 • Views: …

More Releases from Future Market Insights Inc.

Olive Phenolic Complexes for Metabolic Health Market to Surpass USD 2,420 Millio …

The global olive phenolic complexes for metabolic health market is set for robust expansion, rising from USD 710 million in 2026 to USD 2,420 million by 2036, reflecting a strong compound annual growth rate (CAGR) of 12.4%. Growth momentum is fueled by rising global awareness of metabolic health and increasing adoption of plant-based bioactive compounds in preventive nutrition.

Olive phenolic complexes, rich in bioactive compounds such as oleuropein and hydroxytyrosol, are…

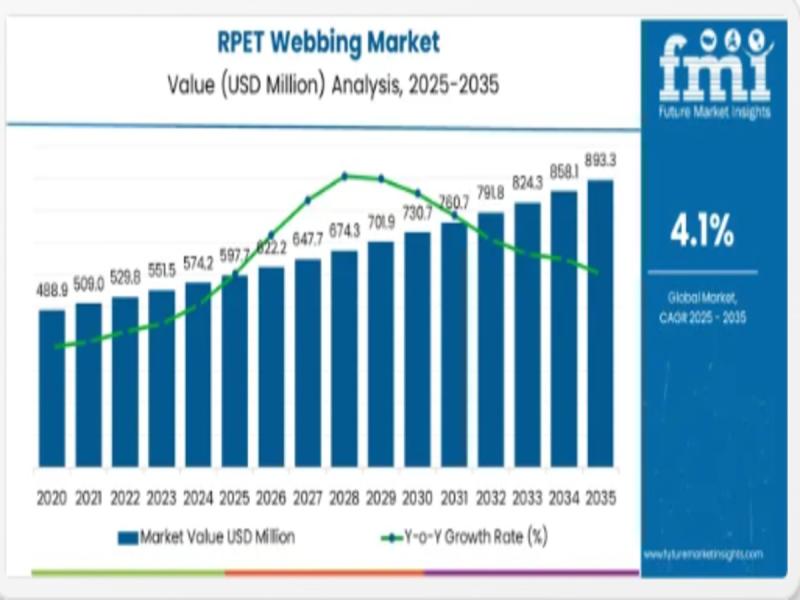

Global RPET Webbing Market Set to Surge to Nearly USD 893 Million by 2035 as Sus …

The global Recycled Polyethylene Terephthalate (RPET) webbing market is projected to expand from an estimated USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, reflecting robust momentum in recycled materials adoption across key industrial and consumer sectors and underscoring sustainability as a core manufacturing imperative. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % during this forecast period, driven by…

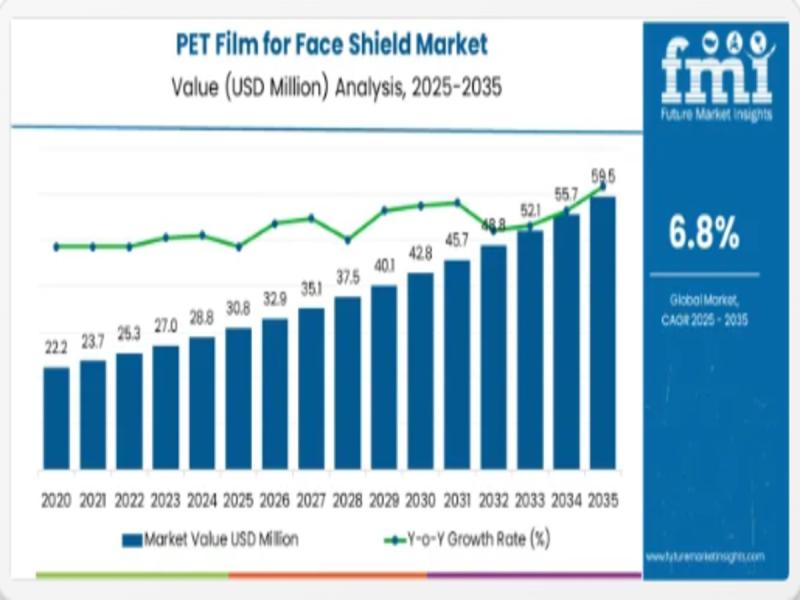

PET Film for Face Shield Market - Strategic Growth, Innovation & Forecasted Surg …

The global PET film for face shield market is set to expand from an estimated USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, representing strong demand for high-clarity protective materials across healthcare and industrial safety sectors with a compound annual growth rate (CAGR) of 6.8% over the decade. This growth underscores the rising prioritization of personal protective equipment (PPE) globally, especially where transparent barrier films combine…

Middle East and North Africa Frozen Food Market Poised for Steady Growth Through …

Middle East and North Africa Frozen Food Market

The Middle East and North Africa (MENA) frozen food market is set for consistent and resilient growth over the next decade, supported by shifting consumer lifestyles, expanding modern retail infrastructure, and rising demand for long-shelf-life food solutions suited to the region's climate. The market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…