Press release

Peer-to-Peer Lending Market to reach USD 758.44 Bn by 2029, emerging at a CAGR of 27.56 percent and forecast 2023-2029

Peer-to-Peer Lending Market Report Scope:This comprehensive report provides valuable insights into the Peer-to-Peer Lending Market, covering factors such as market dynamics, research methodology, and regional analysis. It sheds light on key drivers and restraints, offering a detailed understanding of this thriving industry.

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/54358

Peer-to-Peer Lending Market Research Methodology:

Our research methodology employs a rigorous analysis of growth drivers, restraining factors, challenges, and future opportunities within the global Peer-to-Peer Lending Market. With a growing adoption of online applications and a shift away from traditional banking systems, the market is experiencing substantial growth. Peer-to-peer lending offers advantages such as higher returns for investors, increased funding accessibility, and lower interest rates, thereby propelling its expansion. Furthermore, its flexibility sets it apart from other lending platforms.

However, it's important to acknowledge the potential downsides of peer-to-peer lending, including credit risks, lack of insurance, limited government protection, and strict regulatory frameworks. Additionally, the absence of tax-free interest is a significant restraining factor for the market's growth.

What are Peer-to-Peer Lending Market Dynamics:

Key drivers for the Peer-to-Peer Lending Market include the rising adoption of online applications and demand for technology in traditional banking systems. P2P lending offers attractive benefits such as higher investor returns, increased funding accessibility, and lower interest rates. Its flexibility also differentiates it from other lending platforms.

Peer-to-Peer Lending Market Regional Insights:

The Asia Pacific region has emerged as a dominant force in the P2P lending market and is poised for continued growth with a projected CAGR of xx% during the forecast period. Developing economies such as China, India, and Japan have played pivotal roles in the market's recent success. Notably, China has seen the rise of numerous microloan companies serving its 40 million SMEs, while India's peer-to-peer lending platforms are filling the gap for borrowers seeking alternatives to traditional banks.

The report aims to provide a comprehensive analysis of the Global Peer-to-Peer Lending Market, catering to all industry stakeholders. It includes an examination of the industry's historical and current status, along with forecasted market size and trends. The report employs easy-to-understand language to analyze complex data, covering all facets of the industry, including key players, market leaders, followers, and new entrants.

Get Full Report: https://www.maximizemarketresearch.com/market-report/global-peer-to-peer-lending-market/54358/

What is Peer-to-Peer Lending Market Segmentation:

by Business Model

• Alternate marketplace lending

• Traditional lending

by End User

• Small business loans

• Consumer credit loans

• Real estate loans

• Student loans

Request a Free Sample Copy or View Report Summary: https://www.maximizemarketresearch.com/request-sample/54358

Who are Peer-to-Peer Lending Market Key Players:

• Lending Club Corporation

• Funding Circle Limited

• Marketplace, Inc.

• Upstart Network Inc

• Common Bond Inc

• Pave, Inc

• Daric Inc.

• Social Finance Inc.

• Prosper Marketplace, Inc.

• Daric Social Finance, Inc.

• Zopa Limited

• Avant, Inc.

• onDeck Capital, Inc.

• RateSetter

• Kabbage, Inc.

• LendUp

• Peerform

• Circleback Lending, LLC.

• Isepankur

• Auxmoney GmbH

• Lendingtree Inc.

• On Deck Capital Inc.

• Retail Money Market Ltd.

• Social Finance Inc.

• Zopa Limited

Table of content for the Peer-to-Peer Lending Market includes:

Global Peer-to-Peer Lending Market: Research Methodology

Global Peer-to-Peer Lending Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Peer-to-Peer Lending Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

MandA by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

4.Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size and Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

More Related Reports:

Global Luxury Handbag Market https://www.maximizemarketresearch.com/market-report/global-luxury-handbag-market/18338/

Global System Integrator Market https://www.maximizemarketresearch.com/market-report/global-system-integrator-market/34603/

Food Automation Market https://www.maximizemarketresearch.com/market-report/food-automation-market/535/

Water Pump Market https://www.maximizemarketresearch.com/market-report/water-pump-market/12429/

Antimony Market https://www.maximizemarketresearch.com/market-report/global-antimony-market/25745/

Global Vision Care Market https://www.maximizemarketresearch.com/market-report/global-vision-care-market/72274/

Herbal Medicine Market https://www.maximizemarketresearch.com/market-report/herbal-medicine-market/148333/

Global Business Analytics Market https://www.maximizemarketresearch.com/market-report/global-business-analytics-market/24183/

Biosensors Market https://www.maximizemarketresearch.com/market-report/global-biosensors-market/34375/

Halal Food Market https://www.maximizemarketresearch.com/market-report/global-halal-food-market/28343/

Herbicides Market https://www.maximizemarketresearch.com/market-report/global-herbicides-market/25943/

global DNA Sequencing Market https://www.maximizemarketresearch.com/market-report/global-dna-sequencing-market/21790/

Biotechnology Market https://www.maximizemarketresearch.com/market-report/global-biotechnology-market/10844/

Manufacturing Execution System Market https://www.maximizemarketresearch.com/market-report/global-manufacturing-execution-system-market/55027/

Quality Management Software Market https://www.maximizemarketresearch.com/market-report/global-quality-management-software-market/64194/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT and telecom, chemical, food and beverage, aerospace and defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Market to reach USD 758.44 Bn by 2029, emerging at a CAGR of 27.56 percent and forecast 2023-2029 here

News-ID: 3206105 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Commercial Kitchen Appliances Market Poised for Robust Growth, Expected to Reach …

The global Commercial Kitchen Appliances Market, valued at US$ 101.65 billion in 2023, is witnessing strong momentum driven by the rapid expansion of the foodservice industry, technological innovation, and evolving consumer lifestyles. According to the latest market analysis, the industry is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030, reaching nearly US$ 160.05 billion by the end of the forecast period.

Commercial kitchen…

E-Bike Market Poised for Robust Expansion, Projected to Reach USD 153.42 Billion …

The global E-Bike Market is entering a transformative growth phase, underpinned by accelerating demand for eco-friendly transportation, rapid advances in battery and motor technologies, and strong policy support for sustainable urban mobility. Valued at USD 60.65 Billion in 2024, the market is projected to expand at a compound annual growth rate (CAGR) of 12.3% from 2025 to 2032, reaching nearly USD 153.42 Billion by 2032. As cities worldwide seek to…

Data Center Liquid Immersion Cooling Market Set for Rapid Expansion, Driven by H …

Data Center Liquid Immersion Cooling Market to Grow from USD 640.94 Million in 2023 to USD 3,340.83 Million by 2030, Registering a Robust CAGR of 26.6% (2024-2030)

The global Data Center Liquid Immersion Cooling Market is witnessing a transformative phase as data center operators worldwide seek advanced, energy-efficient cooling solutions to address rising power densities, sustainability mandates, and escalating operational costs. Valued at USD 640.94 million in 2023, the market…

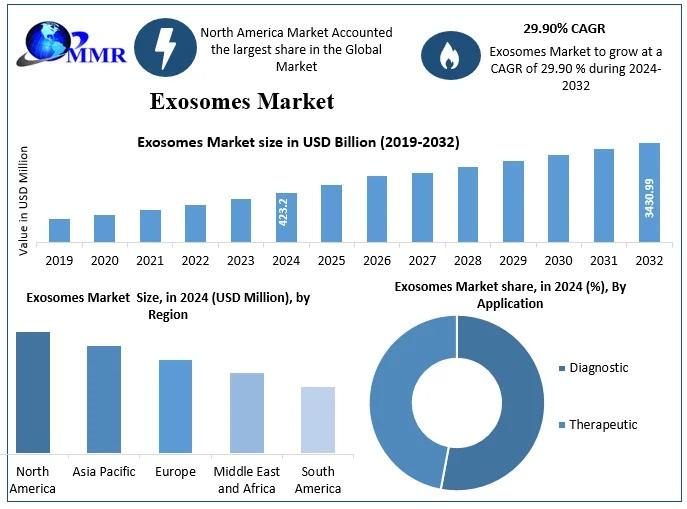

Exosomes Market Forecast: USD 3,430.99 Million Opportunity by 2032

Exosomes Market size was valued at USD 423.2 Mn in 2024 and is expected to reach USD 3430.99 Mn by 2032, at a CAGR of 29.90

The global exosomes market is currently poised for explosive growth, fundamentally driven by the paradigm shift toward non-invasive diagnostics and the rising prominence of "liquid biopsies" in oncology. Once considered mere cellular waste, these extracellular vesicles are now recognized as critical mediators of intercellular communication,…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…