Press release

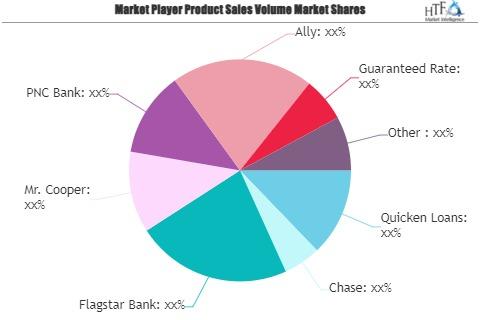

Mortgage Loan Service Market looks to expand its size in Overseas Marketplace

The "Mortgage Loan Service Market by Player, Region, Type, Application and Sales Channel" Study has been added to the HTF MI repository. The Market study is a perfect mix of qualitative and quantitative Market data collected and validated majorly through primary data and secondary sources. The market Study is segmented by key a region that is accelerating the marketization. Some of the major and emerging players identified are Quicken Loans, Chase, Flagstar Bank, Mr. Cooper, PNC Bank, Ally, Guaranteed Rate, Northpointe Bank, Better, PenFed Credit Union, Rocket Mortgage, Truist, New American Funding, LoanDepot .Get Sample PDF Here 👉 https://www.htfmarketreport.com/sample-report/3969633-global-mortgage-loan-service-market

Global Mortgage Loan Service Market Development Scenario by Players:

Financials Information, Business Overview, and Product Specification Matrix

Patent Analysis Briefing* [if applicable]

No. of Patents Issuance by Year / by Players / By Issuing Office

Key Development - Product/Service Launch, Mergers & Acquisition, Joint Ventures

Mortgage Loan Service Market Competition:

Each company profiled in the research document is studied considering various factors such as product and its application portfolios, market share, growth potential, future plans, and development activity. Readers will be able to gain a complete understanding and knowledge of the competitive landscape. Most importantly, the report sheds light on important strategies that key and emerging players are taking to maintain their ranking in the Global Mortgage Loan Service Market. It shows how the Market Competition: will change in the next few years and how players are preparing themselves to stay ahead of the curve.

Order Global Mortgage Loan Service Market study full copy now 👉 https://www.htfmarketreport.com/buy-now?format=1&report=3969633

Important Features that are under offering & key highlights of the report:

1) How companies are selected or profiled in the report?

A list of some players that are profiled in the report includes "Quicken Loans, Chase, Flagstar Bank, Mr. Cooper, PNC Bank, Ally, Guaranteed Rate, Northpointe Bank, Better, PenFed Credit Union, Rocket Mortgage, Truist, New American Funding, LoanDepot ". Usually, we follow NAICS Industry standards and validate company profiles with product mapping to filter relevant Industry players, furthermore, the list is sorted to come up with a sample size of at least 50 to 100 companies having greater topline value to get their segment revenue for market estimation.

** List of companies mentioned may vary in the final report subject to Name Change / Merger etc.

2) Is it possible to add more lists of companies and customize the study as per our needs?

Yes, we can add or profile new companies as per client need in the report, provided it is available in our coverage list as mentioned in answer to Question 1 after the feasibility run final confirmation will be provided by the research team checking the constraints related to the difficulty of the survey.

3) Can we narrow the available business segments?

Yes, depending upon the data availability and feasibility check by our Research Analyst, a further breakdown in business segments by end-use application or product type can be provided (If applicable) by Revenue Size or Volume*.

4) Can a specific country of interest be added? What all regional slits are covered with covid impact analysis?

Yes, Country level splits can be modified in the study as per objectives. Currently, the research report gives special attention and focuses on the following regions with the covid outbreak and impact analysis:

North America, Europe, Asia-Pacific etc

** One country of specific interest can be included at no added cost. The inclusion of more regional segment quotes will vary.

Enquire for customization or check for any discount if available 👉https://www.htfmarketreport.com/enquiry-before-buy/3969633-global-mortgage-loan-service-market

on, Individual, Enterprise are the segments analyzed and sized in this study by application/end-users, displaying the potential growth and various shift for the period 2018 to 2029. The changing dynamics supporting the growth make it critical for businesses in this space to keep abreast of the moving pulse of the market. Check which segment will bring in healthy gains adding significant momentum to overall growth. , Residential & Commercial Estate have been considered for segmenting Mortgage Loan Service market by type.

With the multiple advantages of technology, cost, and service, many major developed rapidly. They kept leading the domestic market and on the other way actively developing the international market and seizing market share, becoming the backbone of Global Mortgage Loan Service industry. It is understood that currently domestic players have been massively used by operators in China.

***Sub Regions Included: North America [United States, Canada, Mexico], Asia-Pacific [China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam], Europe [Germany, France, UK, Italy, Russia, Rest of Europe], South America [Brazil, Argentina, Rest of South America], Middle East & Africa [GCC Countries, Turkey, Egypt, South Africa, Rest of the Middle East & Africa]

*** Unless specified in Original TOC of Global Mortgage Loan Service Market Study

To know more about the table of contents, you can click 👉 https://www.htfmarketreport.com/reports/3969633-global-mortgage-loan-service-market

Research Objectives

• To analyze and forecast the Global Mortgage Loan Service market, in terms of value and volume.

• Which segment has the potential to gain the highest market share?

• To help decision makers from a new offer perspective and benchmark existing marketing strategy.

• Correlate cost structure historical data with key business segments.

• Analyse marketing contribution and customer acquisition by up-selling and cross-selling.

• Identifying Influencing factors keeping Global Mortgage Loan Service Market Intense, factored with periodic analysis of CR4 & CR8 concentration ratio & HHI Index.

HTF MI also offers Custom Research services providing focused, comprehensive, and tailored research according to clientele objectives; you can also get an individual chapter-wise section or region-wise reports like North America, Europe, or Southeast Asia.

Contact Us :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +1 434 322 0091

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Intelligence consulting is uniquely positioned empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist in decision making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Loan Service Market looks to expand its size in Overseas Marketplace here

News-ID: 3196085 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Heating Coil for Heat Treatment Market to See Revolutionary Growth: Watlow, Chro …

HTF MI just released the Global Heating Coil for Heat Treatment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Watlow, Chromalox, NIBE Induction,…

CAD-CAM Dental Systems Market to Witness Phenomenal Growth |Medit, 3Shape, Planm …

HTF MI just released the Global CAD-CAM Dental Systems Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Dentsply Sirona, Straumann, 3Shape, Ivoclar Vivadent,…

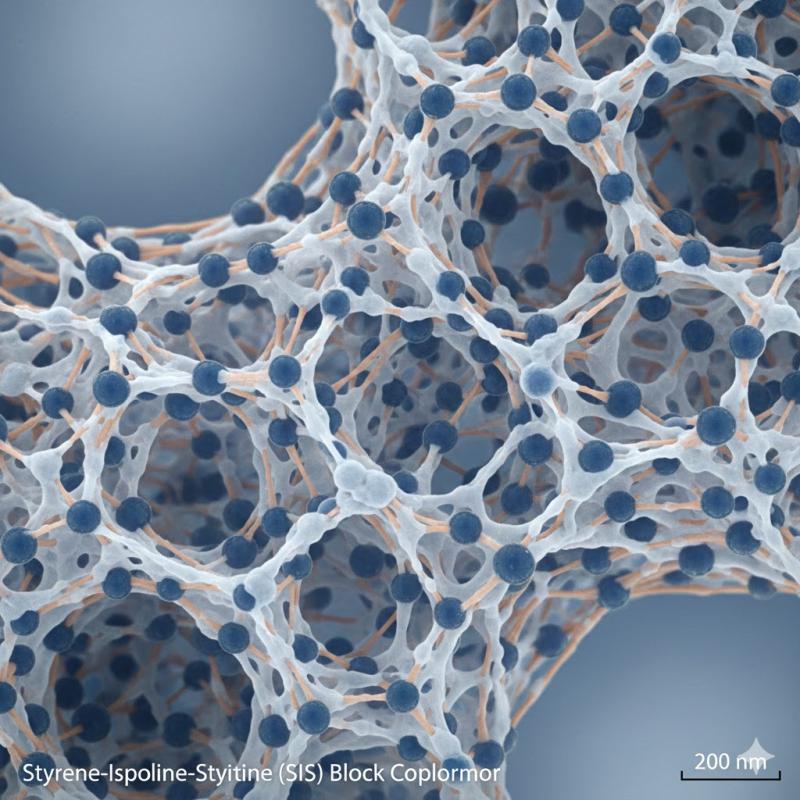

Styrene-Isoprene-Styrene (SIS) Market is Booming Worldwide | Major Giants Arlanx …

HTF MI just released the Global Styrene-Isoprene-Styrene (SIS) Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2026-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Manufacturers are covered: Kraton Polymers, Sinopec, LCY Chemical, TSRC, Zeon…

Smokeless Gunpowder Market Is Going to Boom | Major Giants Hodgdon, Alliant Powd …

HTF MI just released the Global Smokeless Gunpowder Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Smokeless Gunpowder Market are:

Hodgdon, Alliant Powder, IMR…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…