Press release

Mobile Payment Transaction Industry: Redefining Payments with Seamless Mobility (2023-2033)

By the end of 2033, it is anticipated that the mobile payment transaction market would have increased to US$ 7,36,798.1 Mn from its 2022 valuation of US$ 43,312.1 Mn. In 2023, it is predicted that the market for mobile payment transactions will be worth US$55,396.2 Mn. From 2023 to 2033, the market for mobile payment transactions is anticipated to expand at a CAGR of 29.5%.The mobile payment transaction market is experiencing significant growth as mobile wallets and contactless payments gain widespread popularity among consumers and businesses. With the increasing adoption of smartphones and the convenience they offer, more people are embracing mobile payment solutions for their everyday transactions, driving the market's expansion.

Request the sample copy of report @ https://www.persistencemarketresearch.com/samples/12937

One of the key drivers behind the market's surge is the convenience and simplicity of mobile wallets. Mobile payment apps enable users to store their payment information securely on their smartphones, eliminating the need to carry physical wallets or cards. With a simple tap or scan, consumers can make payments at retail stores, restaurants, online platforms, and even peer-to-peer transfers, enhancing the overall payment experience.

Moreover, the COVID-19 pandemic has further accelerated the adoption of contactless payments. As hygiene and safety became paramount concerns, consumers and businesses embraced contactless payment methods to minimize physical contact. Mobile payment transactions allow for seamless and secure transactions without the need for physical cash or touching payment terminals, making it an ideal choice in the current environment.

Furthermore, the widespread acceptance of mobile payment transactions by businesses across industries has fueled market growth. Retailers, restaurants, and service providers are increasingly integrating mobile payment options into their point-of-sale systems to offer greater convenience and flexibility to their customers. By accepting mobile payments, businesses can cater to the preferences of tech-savvy consumers and provide a seamless and efficient payment experience.

For In-Depth Competitive Analysis, Buy Now @ https://www.persistencemarketresearch.com/checkout/12937

As the market continues to surge, mobile payment transactions are expected to become the norm rather than the exception. With ongoing advancements in security measures, payment technologies, and the growing acceptance of digital payments worldwide, the mobile payment transaction market is poised for sustained growth in the foreseeable future.

Companies Covered in This Report -

• Paypal

• MasterCard

• Google Wallet

• LevelUp

• Braintree

• Visa

• MoneyBookers

• WorldPay

• CLINKLE

• SinglePoint

• Venmo

Request For Report Customization @ https://www.persistencemarketresearch.com/request-customization/12937

Key Segments of Mobile Payment Transaction Market Industry Research

By Technology:

• SMS

• WAP/ WEB

• USSD

• NFC

By Purpose:

• Merchandise

• Money Transfer

• Bill Payment

• Ticketing

• Other

By Region:

• North America

• Latin America

• Europe

• East Asia

• South Asia Pacific

• Middle East and Africa

About us:

Persistence Market Research is a U.S.-based full-service market intelligence firm specializing in syndicated research, custom research, and consulting services. Persistence Market Research boasts market research expertise across the Healthcare, Chemicals and Materials, Technology and Media, Energy and Mining, Food and Beverages, Semiconductor and Electronics, Consumer Goods, and Shipping and Transportation industries. The company draws from its multi-disciplinary capabilities and high-pedigree team of analysts to share data that precisely corresponds to clients' business needs.

Contact us:

Persistence Market Research

Address - 305 Broadway, 7th Floor, New York City,

NY 10007 United States

U.S. Ph. - +1-646-568-7751

USA-Canada Toll-free - +1 800-961-0353

Sales - sales@persistencemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Payment Transaction Industry: Redefining Payments with Seamless Mobility (2023-2033) here

News-ID: 3187592 • Views: …

More Releases from Persistence Market Research

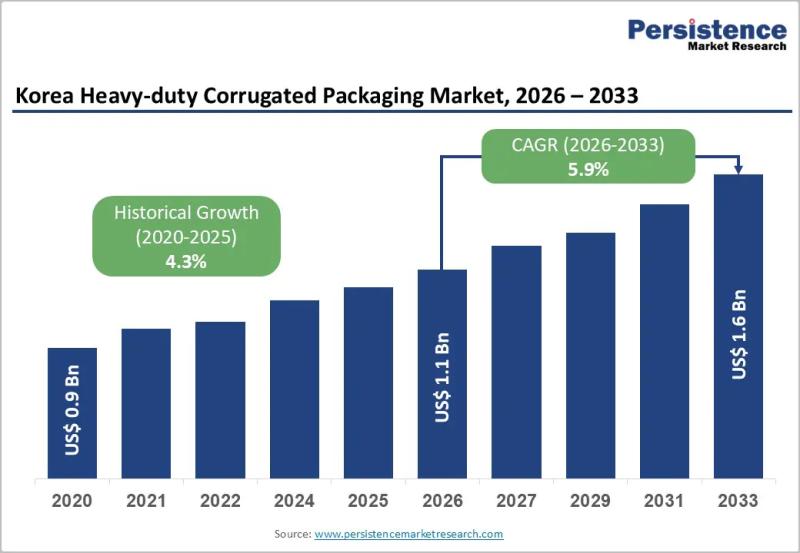

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…