Press release

Tax Management Market Size to Meet Compliance Challenges | Forecast to Hit USD 56.532 Billion by 2030

The size of the global tax management market, which was estimated to be worth $16,455.20 million in 2020, is expected to increase to $56,531.80 million by 2030, with a CAGR of 13.6% over that time.Continuous improvements in commercial-grade digital technology, a strong preference for cloud-based tax management software, and a rise in the demand for better tax planning and financial management techniques all significantly contribute to the market's expansion. The developing countries' lack of IT infrastructure and rising security and privacy concerns, however, restrain the expansion of the tax management industry.

Request Sample PDF Report at: https://www.alliedmarketresearch.com/request-sample/6631

The Tax Management market is undergoing a significant transformation driven by automation and digitization. With the advent of advanced technologies like artificial intelligence (AI) and machine learning (ML), tax professionals are now able to streamline and automate various tax-related processes. From data collection and analysis to compliance reporting, these technologies are reducing manual errors, improving accuracy, and enhancing overall efficiency. As a result, businesses are adopting automated tax management solutions to navigate complex tax codes, minimize risks, and optimize their financial strategies.

In recent years, there has been a growing emphasis on real-time tax compliance and reporting. Tax authorities in many jurisdictions are implementing stricter regulations that require businesses to report their financial data more frequently and accurately. This trend has led to the development of tax management solutions that can integrate with various financial systems and provide real-time insights into tax liabilities. Companies are increasingly adopting these solutions to avoid penalties, mitigate risks associated with non-compliance, and maintain transparent financial practices.

Inquire Here Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/6631

The constantly evolving landscape of global tax policies is impacting how businesses manage their taxes. International efforts, such as the Base Erosion and Profit Shifting (BEPS) initiative and digital services taxes, are prompting companies to adapt their tax strategies to remain compliant and competitive. Tax Management solutions are evolving to accommodate these changes, offering features that help companies navigate the complexities of cross-border taxation. Businesses are seeking solutions that can accurately calculate tax liabilities in different jurisdictions while ensuring compliance with local laws and international standards.

As tax management processes become increasingly digitized, data security and privacy have emerged as critical concerns. The handling of sensitive financial information requires robust cybersecurity measures to prevent unauthorized access, data breaches, and potential financial fraud. Tax management solution providers are focusing on enhancing data encryption, secure authentication methods, and compliance with data protection regulations like GDPR. Businesses are carefully evaluating the security features of tax management solutions to ensure the confidentiality of their financial data throughout the tax management process.

If you have any special requirements, please let us know: https://www.alliedmarketresearch.com/request-for-customization/6631

This report gives an in-depth profile of some key market players in the tax management market are Avalara Inc., Blucora, Inc., Thomson Reuters, HRB Digital LLC., Intuit Inc, SAP SE, Sovos Compliance, LLC , TaxJar, TaxSlayer, Wolters Kluwer N.V. This study includes tax management market trends, tax management market analysis, and future estimations to determine the imminent investment pockets

Buy Now & Get Exclusive Discount on this Report (305 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/tax-management-software-market/purchase-options

Access to Summary of Full Report: https://www.alliedmarketresearch.com/tax-management-software-market-A06266

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have any special requirements, please let us know and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising of 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients' requirements is complemented with analyst support and customization requests.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Management Market Size to Meet Compliance Challenges | Forecast to Hit USD 56.532 Billion by 2030 here

News-ID: 3185997 • Views: …

More Releases from Allied Market Research

Winter Footwear Market 2026 : Expeditious Growth Expected in 2021 - 2031 | UGG, …

According to a new report published by Allied Market Research, titled, "Winter Footwear Market," The winter footwear market was valued at $8.6 billion in 2021, and is estimated to reach $13.6 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

"Numerous varieties of winter footwear are expected to boost the market growth in the foreseeable future. Moreover, incorporation of customization, as well as innovative winter footwear is…

Ergonomic Chair Market Research Insights: Uncovering CAGR and USD Growth Drivers …

An ergonomic office chair is mostly utilized in different firms and other business areas where employees operate in a sitting position for extended hours. Adjustable seats, brackets and natural postures, which minimize back discomfort and stress in the lengthy seating time, are the ergonomic chairs. Currently, the offices are selecting ergonomic office chairs over the standard office chair to make the workplace healthier, happier, and to boost employer productivity. The…

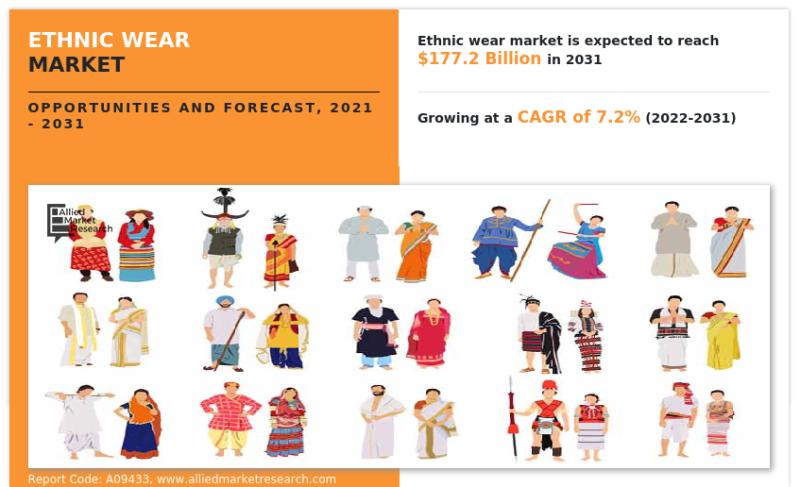

Ethnic Wear Market Forecasting Essentials: Interpreting CAGR and USD Projections …

According to a new report published by Allied Market Research, titled, "Ethnic Wear Market," The ethnic wear market size was valued at $89.3 billion in 2021, and is estimated to reach $177.2 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031.

The market for ethnic wear is mostly driven by the rising number of fashion influencers across the globe. It is difficult to overlook the importance of…

$8.9+ Billion Commercial Janitorial Equipment Market Value by 2031 with a 4.6% C …

According to a new report published by Allied Market Research, titled, "Commercial Janitorial Equipment Market," The commercial janitorial equipment market size was valued at $5.7 billion in 2021, and is estimated to reach $8.9 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. There has been a surge in the number of restaurants, hotels, and hospitals across the globe, which further contribute to the demand for…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…