Press release

Digital Banking Platform Market Size 2023: Global Share, Trends, Growth Analysis and Forecast by 2028

How big is the Digital Banking Platform Market?The global digital banking platform market size reached US$ 5.8 Billion in 2022. Looking forward, IMARC Group expects the market to reach US$ 12.2 Billion by 2028, exhibiting a growth rate (CAGR) of 12.5% during 2023-2028.

Industry Overview of Digital Banking Platform Market

The digital banking platform represents a transformative leap in the world of finance, reshaping how individuals and businesses interact with their money. It encompasses a range of technologies and services that enable financial institutions to provide seamless, secure, and personalized banking experiences to their customers through digital channels. It also enables individuals to perform a wide range of transactions, such as checking account balances, transferring funds, paying bills, applying for loans, and managing investments, all from the comfort of their electronic devices. It also offers personalized insights, tailored product recommendations, and real-time notifications, empowering customers to manage their finances efficiently and make informed decisions.

Request For Sample Report: https://www.imarcgroup.com/digital-banking-platform-market/requestsample

Digital Banking Platform Market Trends and Drivers:

At present, the increasing demand for digital banking platforms, as they provide the convenience of managing finances on the go, enabling quick and secure transactions anytime and anywhere, represents one of the primary factors supporting the growth of the market. Besides this, the rising popularity of digital banking platforms, as they play a crucial role in promoting financial inclusion by reaching underserved populations, is contributing to the growth of the market. In addition, the growing utilization of big data and analytics to examine customer behavior and preferences is offering a favorable market outlook. Apart from this, the increasing utilization of smartphones, tablets, and laptops to make online payments and browse the internet is bolstering the growth of the market.

What Is Included In Market Segmentation?

The report has been segmented the market into following categories:

Breakup by Component:

• Solutions

• Services

Breakup by Type:

• Retail Banking

• Corporate Banking

Breakup by Deployment Mode:

• On-premises

• Cloud-based

Breakup by Banking Mode:

• Online Banking

• Mobile Banking

Breakup by Region:

• North America

o United States

o Canada

• Asia-Pacific

o China

o Japan

o India

o South Korea

o Australia

o Indonesia

o Others

• Europe

o Germany

o France

o United Kingdom

o Italy

o Spain

o Russia

o Others

• Latin America

o Brazil

o Mexico

o Others

• Middle East and Africa

Who Are The Key Players/Companies In Home Medical Equipment Market?

Appway AG (FNZ (UK) Ltd.), Fidelity Information Services (FIS), Finastra Limited, Fiserv Inc., Infosys Limited, nCino, NCR Corporation, Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited, Temenos AG, The Bank of New York Mellon Corporation and Worldline.

Ask Analyst for 10% free customized report: https://www.imarcgroup.com/request?type=report&id=5816&flag=C

Related Posts:

Railroad Market: https://newscast.jp/news/8776696

Solid State Transformer Market: https://newscast.jp/news/4858811

LNG Bunkering Market: https://newscast.jp/news/6516522

Outdoor Sports Apparel Market: https://newscast.jp/news/5154865

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market Size 2023: Global Share, Trends, Growth Analysis and Forecast by 2028 here

News-ID: 3181775 • Views: …

More Releases from IMARC Group

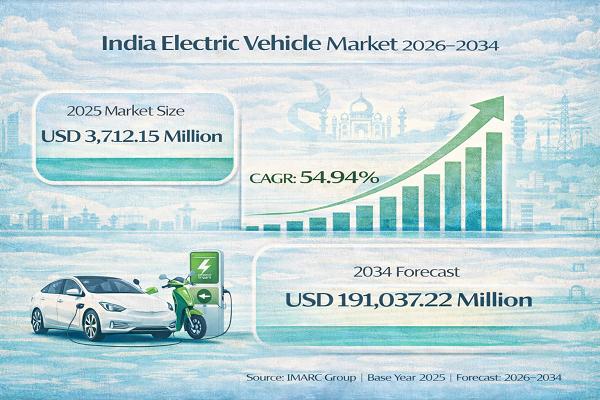

India Electric Vehicle Market Set to Reach USD 191,037.22 Million by 2034, Expan …

India Electric Vehicle Market : Report Introduction

According to IMARC Group's report titled "India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email) : https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Overview

The India electric vehicle market size was valued at…

United States Revenue Cycle Management Market Size, Trends, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Connect with a Research Analyst Now:

https://www.imarcgroup.com/united-states-revenue-cycle-management-market/requestsample

United States Revenue Cycle Management Market Summary:

The United States revenue cycle…

LED Chip Manufacturing Plant Cost Report 2026: Demand Analysis, CapEx/OpEx & ROI …

Setting up an LED chip manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of semiconductor fabrication technologies. These high-performance components power everything from general illumination and displays to automotive lighting and consumer electronics. Success requires careful site selection, advanced epitaxial growth processes, sophisticated cleanroom facilities, reliable raw material sourcing, and compliance with stringent quality and environmental regulations to ensure profitable and sustainable operations.

IMARC Group's report, "LED Chip…

Eyewear Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, …

Setting up an eyewear manufacturing plant positions investors within a strategically important segment of the global optical and fashion accessories industry, driven by increasing demand for vision correction solutions, rising awareness of eye health, and growing fashion consciousness. As modern lifestyles advance, digital device usage expands, and the need for protective and corrective eyewear grows, eyewear continues to gain traction across prescription glasses, sunglasses, safety eyewear, and fashion accessories worldwide.…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…