Press release

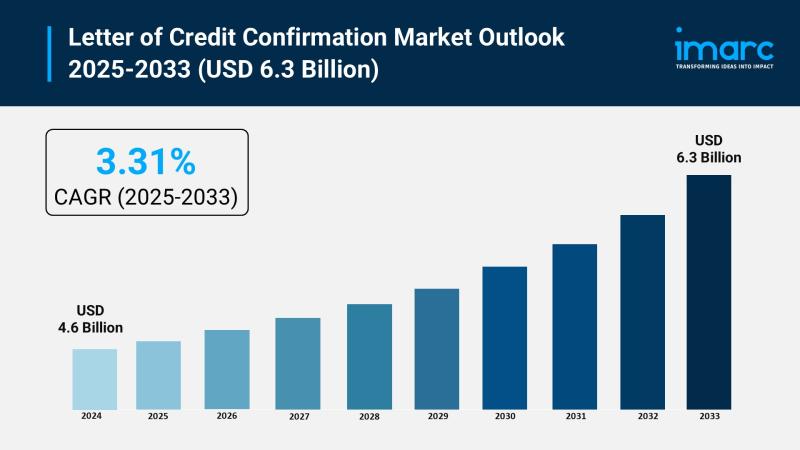

Letter of Credit Confirmation Market Size to Hit USD 6.3 Billion by 2033 | With a 3.31% CAGR

Market Overview:The letter of credit confirmation market is experiencing rapid growth, driven by rising international trade and risk mitigation needs, digital transformation and process streamlining, and increased focus on regulatory compliance and security. According to IMARC Group's latest research publication, "Letter of Credit Confirmation Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global letter of credit confirmation market size reached USD 4.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.31% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/letter-of-credit-confirmation-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Letter of Credit Confirmation Market

● Rising International Trade and Risk Mitigation Needs

The sustained expansion of cross-border trade transactions is the fundamental driver for the Letter of Credit (LC) Confirmation market. As businesses increasingly engage with international suppliers and buyers, the risk of non-payment due to commercial, political, or economic instability in the buyer's country becomes a major concern for exporters. LC Confirmation addresses this by adding a second, highly-rated bank's guarantee to the payment, shifting the risk away from the exporter. For instance, The United Nations Conference on Trade and Development (UNCTAD) has previously reported significant increases in the global value of trade, highlighting the massive scale of commercial activity that requires secure financial instruments. This heightened volume of global commerce necessitates reliable risk management tools, directly fueling the demand for confirmed LCs, especially in high-value or first-time international shipments across various sectors, including raw materials and finished goods.

● Digital Transformation and Process Streamlining

Technological advancements within the trade finance ecosystem are acting as a powerful growth catalyst by enhancing the efficiency and security of LC confirmation. Banks and FinTech firms are leveraging tools like blockchain and distributed ledger technology (DLT) to create real-time, digitalized letter of credit contracts. This digital shift reduces the reliance on cumbersome paper-based documentation, which is historically prone to errors and delays. For example, major financial institutions like Citi India have pioneered blockchain-enabled LC transactions to streamline global trade processes. The adoption of these technologies, coupled with automated platforms for compliance checks and document validation, dramatically cuts down processing times and operational costs for confirming banks, making the service more accessible and attractive for a broader range of enterprises, including small and medium-sized businesses (SMEs) involved in exports.

● Increased Focus on Regulatory Compliance and Security

Stricter global regulatory environments, particularly concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) standards in cross-border finance, encourage the use of formal, documented, and bank-guaranteed instruments like confirmed LCs. Government and international bodies, such as the International Chamber of Commerce (ICC) which manages the Uniform Customs and Practice for Documentary Credits (UCP), constantly work to set robust rules that govern world trade transactions and reduce fraud. The involvement of a confirming bank provides an additional layer of due diligence and transaction security, satisfying the enhanced compliance requirements of trading nations. This institutional support and the need for rigorous fraud prevention measures-such as validation sites launched by banks like Bank Windhoek to enhance security-make the highly regulated confirmed LC an essential tool for maintaining financial integrity in the global supply chain.

Key Trends in the Letter of Credit Confirmation Market

● Blockchain and Distributed Ledger Technology Integration

A significant emerging trend is the accelerated integration of Blockchain and DLT into the LC confirmation workflow. This technology allows for the creation of an immutable, shared record of the transaction, from issuance to payment, among all authorized parties. This dramatically improves transparency and reduces the potential for fraud or disputes arising from document discrepancies. For instance, multiple trade consortiums and major banks are actively testing and implementing platforms that host digital LCs, effectively replacing traditional paper documents. This notional "digital original" reduces processing from days to hours, mitigating the substantial risks and costs associated with manual documentation and fostering a future where the confirmation process is nearly instantaneous and entirely paperless, enhancing trust even when trading in complex regions.

● Strategic Partnerships Between Banks and FinTechs

The market is witnessing a rise in collaborative efforts between traditional confirming banks and innovative financial technology (FinTech) providers. These partnerships are focused on embedding trade finance solutions, including LC confirmation, directly into digital trade platforms used by importers and exporters. This collaboration allows large global banks to leverage FinTech agility and technological expertise to offer a superior, digitally-enabled client experience, while FinTechs gain access to the banks' immense network and capital. A practical example involves banks offering confirmation services via digital platforms, which use Artificial Intelligence (AI) for faster risk scoring and dynamic assessment of the issuing bank's credit exposure. This fusion of services makes risk mitigation more accessible, especially for SMEs looking to secure their transactions without navigating purely legacy banking systems.

● Green Trade Finance and ESG-Linked Confirmations

A growing trend is the introduction of Environmental, Social, and Governance (ESG)-linked trade finance, where the confirmation process is tied to verifiable sustainability criteria. Banks are starting to offer preferential pricing or dedicated credit lines for LC confirmations that support trade in ethically sourced goods or environmentally sustainable projects, such as renewable energy equipment or certified green commodities. This aligns trade finance with global sustainability goals, encouraging more responsible sourcing and supply chain practices. This development requires banks to integrate ESG criteria into their transaction due diligence, allowing exporters to demonstrate their commitment to sustainability. As global regulatory and consumer pressure for ethical commerce increases, the confirmation of LCs becomes not just a risk tool but also a mechanism to incentivize and validate trade that meets specific social and environmental impact standards.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6461&flag=E

Leading Companies Operating in the Global Letter of Credit Confirmation Industry:

● Citigroup Inc.

● DBS Bank Ltd.

● JPMorgan Chase & Co

● Mizuho Bank Ltd.

● Standard Chartered plc

● Sumitomo Mitsui Banking Corporation

● The Bank of Nova Scotia

● The PNC Financial Services Group Inc.

Letter of Credit Confirmation Market Report Segmentation:

By L/C Type:

● Sight L/C

● Usance L/C

By End User:

● Small-sized Businesses

● Medium-sized Businesses

● Large Enterprises

Region Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Letter of Credit Confirmation Market Size to Hit USD 6.3 Billion by 2033 | With a 3.31% CAGR here

News-ID: 4263798 • Views: …

More Releases from IMARC Group

Supercapacitor Market Size to Reach $31.07B by 2033: Trends & Opportunities

Market Overview:

The supercapacitor market is experiencing rapid growth, driven by electrification of automotive systems, renewable energy and grid stabilization, and expansion of industrial automation and robotics. According to IMARC Group's latest research publication, "Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033", the global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group…

Bicycle Market Size to Surpass $102.05B by 2033: Growth & Insights

Market Overview:

The bicycle market is experiencing rapid growth, driven by global expansion of cycling infrastructure, rising health consciousness and preventative wellness, and technological advancements in e-bike propulsion. According to IMARC Group's latest research publication, "Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033", The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates…

Baby Food and Infant Formula Market to Reach USD 84.06 Billion by 2033, Growing …

Market Overview:

The Baby Food and Infant Formula Market is experiencing steady expansion, driven by Increasing Awareness of Nutritional Needs for Infants, Rising Number of Working Women, and Technological Advancements and Product Innovation. According to IMARC Group's latest research publication, "Baby Food and Infant Formula Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global baby food and infant formula market size reached USD 53.73 Billion in 2024.…

Breakfast Cereals Market to Reach USD 149.07 Billion by 2033, Growing at a CAGR …

Market Overview:

The Breakfast Cereals Market is experiencing rapid growth, driven by Health and Wellness Awareness, Busy Lifestyles and On-the-Go Demand and Rising Disposable Incomes and Global Market Expansion . According to IMARC Group's latest research publication, "Breakfast Cereals Market : Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The global breakfast cereals market size was valued at USD 108.89 Billion in 2024. Looking forward, IMARC Group estimates…

More Releases for Confirmation

Letter Of Credit Confirmation Market is Going to Boom: HSBC • JPMorgan Chase � …

Coherent Market Insights' most recent research study, "Global Letter Of Credit Confirmation Market Size, Share, Pricing, Trends, Growth, Opportunities and Forecast 2026-2033," provides a thorough overview of the market for Letter Of Credit Confirmation Market on a global scale. The research contains future sales projections, consumer demand, regional analyses, and other crucial data about the target market, as well as the numerous motivators, inhibitors, opportunities, and dangers. In addition to…

Emerging Growth Trends Driving Expansion in the Letter of Credit Confirmation Ma …

The letter of credit confirmation market is set for substantial expansion in the coming years, driven by evolving financial and trade environments. As businesses and banks adapt to new technologies and shifting global dynamics, this sector is poised to experience notable growth and innovation. Let's explore the current market size, key players, influential trends, and significant segments shaping this industry.

Forecasted Growth and Market Size of the Letter of Credit Confirmation…

Implementing Custom Conditional Logic in WooCommerce Order Confirmation Emails

The order confirmation email using WooCommerce is the first and only digital handshake that happens after a purchase is made, and as such, it is an interaction that carries a significant strategic value. It goes beyond the simple default email that is generated after completing a purchase; it is crucial for a company in sustaining ongoing interaction and strengthening the brand.

Meeting the purchase decision is one of the essential criteria…

Letter of Credit Confirmation Market In-depth Analysis 2023 to 2029

The Letter of Credit Confirmation market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Letter of Credit Confirmation Market

Letter of Credit Confirmation Market

The letter of credit confirmation market was valued at USD 3918.8 million in 2020, and it is anticipated to reach USD 5094.7 million by 2030, registering a CAGR of about 2.72% during the forecast period (2021-2030). Key drivers of the letter of credit confirmation market include increased risk of non-payment of dues and strict regulatory guidelines for a secured letter of credit confirmation services.

Download Free…

New Advances in Pain Management Drug Market Screening and Confirmation

Pain is a complex medical condition, which not only affects the physical but also mental well-being of an individual. It is caused due to trauma or tissue damage, and its intensity varies from person to person. Based on the cause of pain, the treatment provided can be a simple or complex. Pain can be managed with the help of a variety of pharmacological and non-pharmacological therapies.

Download Updated Edition Available…