Press release

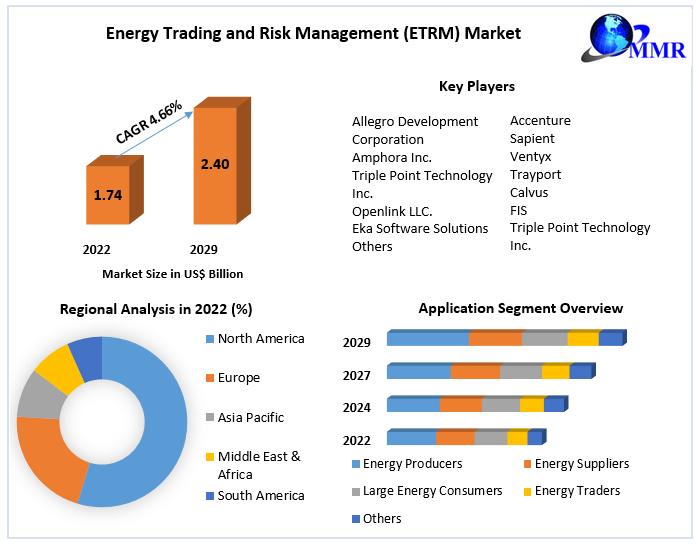

Energy Trading and Risk Management (ETRM) Market size is expected to reach USFD 2.40 billion by 2029, with a steady Compound Annual Growth Rate (CAGR) of 4.66% during the forecast period.

Energy Trading and Risk Management (ETRM) Market Report Scope and Research MethodologyMaximize Market Research Pvt. Ltd., a renowned market research company based in Pune, India, has released a comprehensive market research report on the Global Energy Trading and Risk Management (ETRM) Market.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/electric-two-wheeler-lithium-ion-battery-management-system-market/168385/

The report encompasses a thorough analysis of the impact of the COVID-19 lockdown on market leaders, followers, and disruptors within the Energy Trading and Risk Management (ETRM) Market. Given the varied implementation of lockdown measures across regions and countries, the report delves into the distinct impacts on different segments and regions. By providing insights into both short-term and long-term market impacts, the report empowers decision-makers to formulate strategic outlines and strategies tailored to specific regions.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/168385

What are Energy Trading and Risk Management (ETRM) Market Dynamics?

ETRM stands as a pivotal tool for executing market operations and commercial decisions within an integrated system. By facilitating data exchange among operations, trade floors, credit, contracts, and accounting functions, ETRM systems play a critical role in the energy sector. Organizations are increasingly adopting ETRM systems to address needs such as risk reduction, regulatory compliance, and acceleration of trading activities.

The report highlights the importance of ETRM players diversifying beyond conventional oil and gas into renewable energy, particularly to support their existing client base. The demand for ETRM products is in sync with the rise of collateral and trading management platforms for large sell-side firms. However, regulatory compliance gaps pose a challenge to new entrants. Furthermore, significant market opportunities lie in the realm of growing financial risks and the expansion of major business organizations. Despite these opportunities, a shortage of technical expertise is anticipated to hinder the global growth of the ETRM market.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/168385

What is Energy Trading and Risk Management (ETRM) Market Regional Insight?

In terms of geographical distribution, the Asia-Pacific region is anticipated to hold the largest market share, accounting for xx% of the market. This can be attributed to the burgeoning new market for energy trading in the region, fostering a demand for ETRM solutions between 2023 and 2029. Additionally, the report underscores the high demand for ETRM software in developing countries.

Request For Free Sample Report:https://www.maximizemarketresearch.com/request-sample/168385

What is Energy Trading and Risk Management (ETRM) Market Segmentation?

by Application

Energy Producers

Energy Suppliers

Large Energy Consumers

Energy Traders

Others

by Operation

Front Office

Back Office

Middle Office

by Type

Software

Service

Other

Purchase Report : https://www.maximizemarketresearch.com/market-report/electric-two-wheeler-lithium-ion-battery-management-system-market/168385/

Who are Energy Trading and Risk Management (ETRM) Market Key Players?

1. Allegro Development Corporation

2. Amphora Inc.

3. Triple Point Technology Inc.

4. Openlink LLC.

5. Eka Software Solutions

6. SAP

7. Sapient

8. Ventyx

19. Trayport

10. Calvus

11. FIS

12. Others

Table of content for the Energy Trading and Risk Management (ETRM) Market includes:

Global Energy Trading and Risk Management (ETRM) Market: Research Methodology

Global Energy Trading and Risk Management (ETRM) Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

Global Energy Trading and Risk Management (ETRM) Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape

Market Size, Share, Size & Forecast by different segment |

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Global Pharmaceutical Grade Sodium Chloride Market https://www.maximizemarketresearch.com/market-report/global-pharmaceutical-grade-sodium-chloride-market/70360/

Global Phosphorus Trichloride Market https://www.maximizemarketresearch.com/market-report/global-phosphorus-trichloride-market/55540/

Damino Acid Market https://www.maximizemarketresearch.com/market-report/d-amino-acid-market/45471/

North America Recreational Vehicle Market https://www.maximizemarketresearch.com/market-report/north-america-recreational-vehicle-market/21576/

Induction Furnace Market https://www.maximizemarketresearch.com/market-report/induction-furnace-market/146962/

Global Generation IV Reactors Market https://www.maximizemarketresearch.com/market-report/global-generation-iv-reactors-market/83301/

Global Magnesium Metal Market https://www.maximizemarketresearch.com/market-report/global-magnesium-metal-market/65286/

Global Nitrocellulose Market https://www.maximizemarketresearch.com/market-report/global-nitrocellulose-market/118721/

Global Methacrylate Copolymer Market https://www.maximizemarketresearch.com/market-report/global-methacrylate-copolymer-market/84048/

Global Bike and Scooter Rental Market https://www.maximizemarketresearch.com/market-report/global-bike-and-scooter-rental-market/75164/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Energy Trading and Risk Management (ETRM) Market size is expected to reach USFD 2.40 billion by 2029, with a steady Compound Annual Growth Rate (CAGR) of 4.66% during the forecast period. here

News-ID: 3176479 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

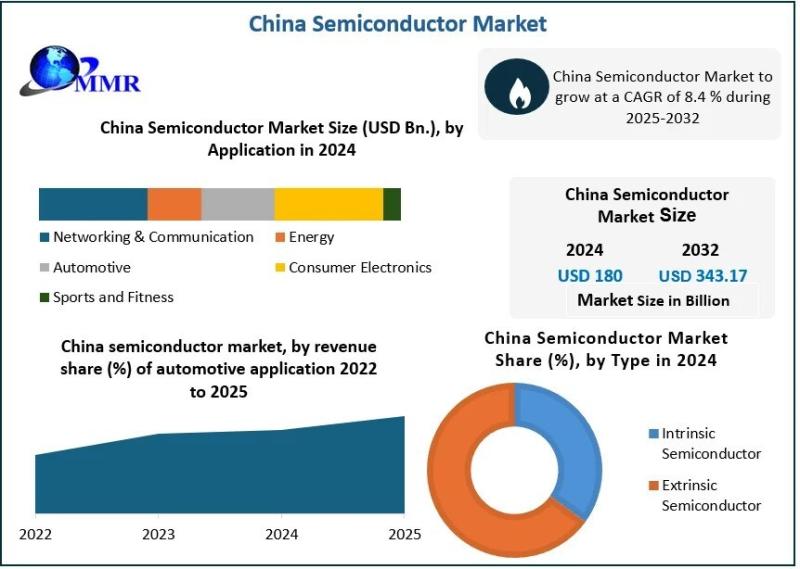

China Semiconductor Market Analysis: Projected to Grow from USD 180 Billion in 2 …

China Semiconductor Market size was valued at USD 180 Bn. in 2024, and the total China Semiconductor revenue is expected to grow by 8.4 % from 2025 to 2032, reaching nearly USD 343.17 Bn.

china-semiconductor-market Overview:

The China semiconductor market is one of the largest and most dynamic in the world, driving significant growth in the global tech industry. As China continues to expand its influence in high-tech manufacturing, the semiconductor market…

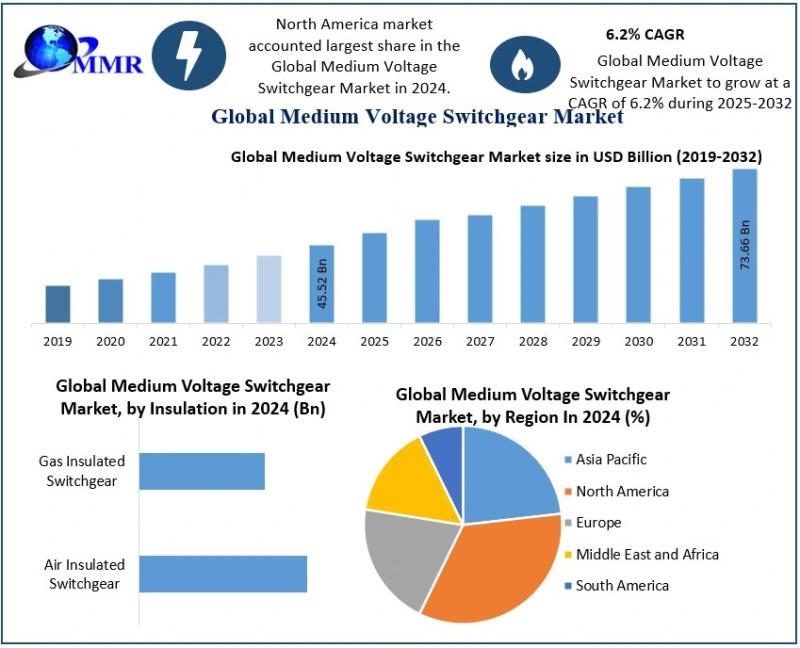

Medium Voltage Switchgear Market Analysis: 6.2% CAGR Driving Growth from USD 48. …

Medium Voltage Switchgear Market size was valued at USD 48.34 Billion in 2025 and the total Medium Voltage Switchgear revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 73.65 Billion by 2032.

Medium-voltage Switchgear Market Overview:

The medium-voltage switchgear market plays a pivotal role in the global energy distribution landscape. These switchgear devices, typically operating between 1 kV and 72.5 kV, are critical for…

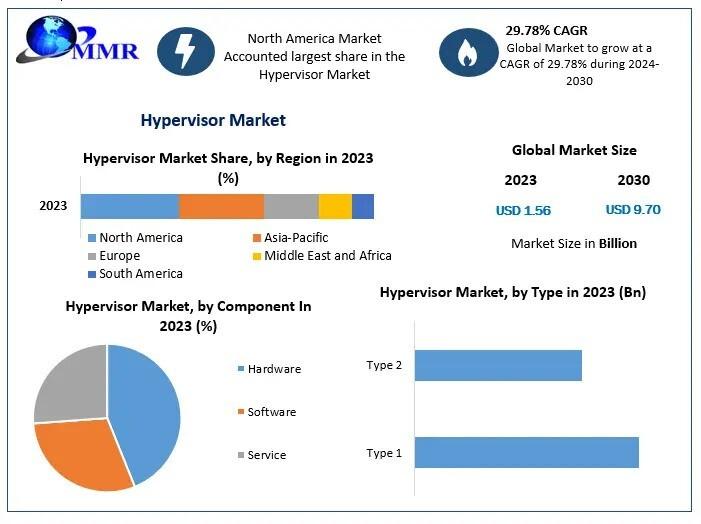

Hypervisor Market Analysis 2025-2030: Growth Rate of 29.78% and Market Value of …

Hypervisor Market size is estimated to grow at a CAGR of 29.78%. The market is expected to reach a value of US $ 9.70 Bn. in 2030.

Hypervisor Market Overview:

The hypervisor market, a critical component of virtualization technology, plays an essential role in the expansion of cloud computing, data centers, and IT infrastructure. By enabling multiple operating systems to run concurrently on a single physical machine, hypervisors streamline resource allocation and…

Cider Market Poised for Steady Growth, Expected to Reach USD 26.90 Billion by 20 …

The global Cider Market is witnessing a significant transformation driven by evolving consumer preferences, premiumization trends, and innovation in flavors and formats. Valued at USD 17.42 Billion in 2025, the market is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032, reaching nearly USD 26.90 Billion by 2032. This growth reflects cider's rising appeal as a refreshing, gluten-free, and lower-calorie alcoholic beverage alternative…

More Releases for ETRM

Intellimachs Offers Targeted ETRM Services and Training Solutions for Energy Mar …

Image: https://www.globalnewslines.com/uploads/2025/11/1762411878.jpg

Intellimachs is a technology services company that supports businesses across software development, along with artificial intelligence and enterprise systems. The company works with energy trading firms and risk management teams that need reliable systems to track trades and manage exposure. Intellimachs focuses on delivering solutions that reduce complexity and help teams make better decisions faster. The company has built its reputation by solving real problems for organizations that cannot…

Global CTRM-ETRM Software Market Size, Share and Forecast By Key Players-Openlin …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global CTRM-ETRM Software market is projected to grow at a robust compound annual growth rate (CAGR) of 12.05% from 2024 to 2031. Starting with a valuation of 10.56 Billion in 2024, the market is expected to reach approximately 20.9 Billion by 2031, driven by factors such as CTRM-ETRM Software and CTRM-ETRM Software. This significant growth underscores the expanding demand for…

Energy Trading and Risk Management (ETRM) Market Size

According to a new market research report published by Global Market Estimates, the Global Energy Trading and Risk Management (ETRM) Market is projected to grow at a CAGR of 6.5% from 2023 to 2028.

Allegro Development Corporation, Amphora Inc., Triple Point Technology Inc., Openlink LLC., Eka Software Solutions, SAP, Sapient, Ventyx and Trayport among others, are some of the key players in the global energy trading and risk management (ETRM) market.…

INPEX ENERGY TRADING SINGAPORE PTE. LTD. selects ENTRADE® for ETRM

Singapore (November 2020) — Enuit, LLC announced today that INPEX ENERGY TRADING SINGAPORE PTE. LTD. (IETS) has begun implementing its flagship product, ENTRADE® to manage their trading risk and derivatives for crude oil.

INPEX CORPORATION (INPEX), the ultimate parent company of IETS, is a leading energy company that proactively undertakes oil & gas exploration, development and production activities to contribute to a stable and efficient supply of energy. INPEX is currently…

Energy Trading and Risk Management (ETRM) Market Trends, Insights, Analysis, For …

"Energy Trading and Risk Management (ETRM) Market Scope

“Energy Trading and Risk Management (ETRM) Market is expected to see huge growth opportunities during the forecast period, i.e., 2020 – 2027”, Says Decisive Markets Insights.

The report covers market size and forecast, market share, market share of the key players in the global market, current growth trends and future trends, market segmentation, value chain analysis, market dynamics which includes market drivers, restraints and…

Energy Trading and Risk Management (ETRM) Market 2020 Real Time Analysis And For …

This report studies the Energy Trading and Risk Management (ETRM) Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Energy Trading and Risk Management (ETRM) Market analysis segmented by companies, region, type and applications in the report.

“The final report will add…