Press release

Steady Fintech as a Service (FaaS) Market Growth Despite Pandemic Headwinds: Comprehensive Global Appraisal by ReportsnReports, Market Trends, and Major Players

"𝐓𝐡𝐞 𝐠𝐫𝐨𝐰𝐭𝐡 𝐩𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐨𝐟 𝐭𝐡𝐞 𝐅𝐚𝐚𝐒 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐬 𝐟𝐮𝐞𝐥𝐞𝐝 𝐛𝐲 𝐤𝐞𝐲 𝐟𝐚𝐜𝐭𝐨𝐫𝐬 𝐬𝐮𝐜𝐡 𝐚𝐬 𝐭𝐡𝐞 𝐚𝐝𝐯𝐞𝐧𝐭 𝐨𝐟 𝐜𝐥𝐨𝐮𝐝 𝐜𝐨𝐦𝐩𝐮𝐭𝐢𝐧𝐠 𝐭𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐞𝐧𝐚𝐛𝐥𝐢𝐧𝐠 𝐟𝐥𝐞𝐱𝐢𝐛𝐢𝐥𝐢𝐭𝐲 𝐚𝐧𝐝 𝐬𝐜𝐚𝐥𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐢𝐧 𝐨𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬 𝐚𝐧𝐝 𝐢𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐀𝐈 𝐚𝐧𝐝 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧. 𝐓𝐨𝐠𝐞𝐭𝐡𝐞𝐫, 𝐭𝐡𝐞𝐬𝐞 𝐟𝐚𝐜𝐭𝐨𝐫𝐬 𝐰𝐢𝐥𝐥 𝐛𝐨𝐨𝐬𝐭 𝐭𝐡𝐞 𝐨𝐯𝐞𝐫𝐚𝐥𝐥 𝐝𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐅𝐚𝐚𝐒 𝐦𝐚𝐫𝐤𝐞𝐭."🔥 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 + 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐓𝐎𝐂 ➡️ https://www.reportsnreports.com/contacts/requestsample.aspx?name=7212543

𝐌𝐚𝐣𝐨𝐫 𝐯𝐞𝐧𝐝𝐨𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐅𝐚𝐚𝐒 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐜𝐥𝐮𝐝𝐞 PayPal (US), Mastercard (US), Fiserv (US), Block (US), Rapyd (UK), Envestnet (US), Upstart (US), Solid Financial Technologies (US), FIS (US), Synctera (US), Stripe (US), Adyen (Netherlands), Dwolla (US), Finastra (UK), Revolut (UK), Fispan (Canada), NIUM (SG), Airwallex (AUS), SoFi (US), Marqeta (US), Finix (US), Synapse (US).

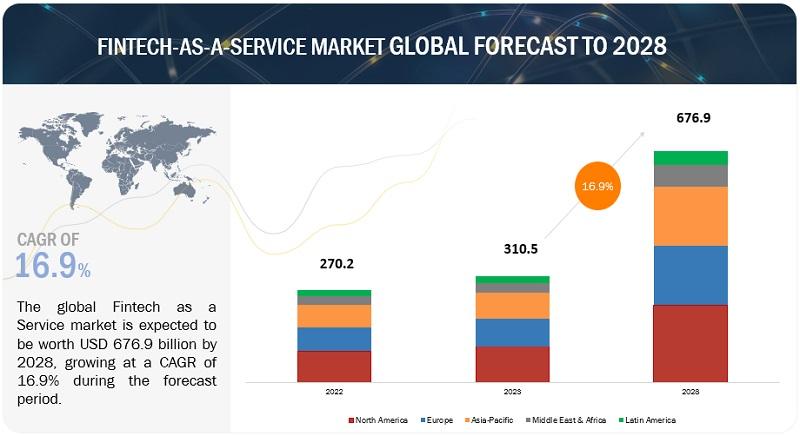

During the forecast period, the global FaaS market is anticipated to experience significant growth, with its market size expected to increase from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, reflecting a robust compound annual growth rate of 16.9%.The growth trajectory of the FaaS market is being influenced by crucial factors driving its expansion. These include the AI and Blockchain technologies fueling the drive for innovation in the business landscape. Furthermore, the growing demand for compliance and regulatory solutions has fueled the adoption of FaaSsolutions, providing organizations with the expertise and support needed to mitigate risks.

The increasing use of cloud computing technology has also driven the market, as organizations seek Faas solutions to meet the challenging requirements.

By type, the Payment segment holds the largest market size

The increasing adoption of digital payments and the rise of e-commerce have led to a surge in demand for efficient and secure payment solutions. Additionally, the shift towards cashless transactions and the growing popularity of mobile payment platforms have further propelled the growth of the payments segment. Moreover, advancements in technology, such as real-time payments, mobile wallets, and peer-to-peer transfers, have revolutionized the way people conduct financial transactions, driving the demand for fintech solutions in the payments sector.

Fintech payment solutions have promoted financial inclusion, particularly in under served or unbanked populations. By leveraging mobile devices and digital platforms, fintech companies have enabled individuals to access financial services and participate in the digital economy. Consumer preferences have shifted towards convenient, fast, and secure payment options. Digital payment solutions are replacing traditional methods such as cash and checks due to their ease of use and accessibility.This has further fueled the growth of the payments segment in the FaaS market.

By technology, the blockchain segment to hold the largest market size during the forecast period

Blockchain provides transparency, immutability, and decentralization, making it highly appealing for fintech applications. These features are particularly beneficial in secure data storage, smart contracts, and digital identity verification. The potential cost savings, efficiency gains, and enhanced security provided by blockchain have propelled its adoption within the fintech sector. Furthermore, blockchain technology has gained significant traction in the financial industry, especially in transactions and settlements. By leveraging blockchain, fintech companies can offer faster, more secure, and cost-effective cross-border payments, remittances, and other financial transactions. The ability to streamline and secure financial operations has contributed to the growing market size of the blockchain segment.

Blockchain eliminates the need for intermediaries in financial transactions, reducing costs and enhancing operational efficiency. This decentralized approach to financial processes appeals to businesses and consumers alike, leading to increased adoption of blockchain solutions within the FaaS market.

By application, KYC verification to have the highest CAGR during the forecast period

Financial authorities across the globe impose strict KYC regulations to combat money laundering, fraud, and illicit activities. Fintech companies offering KYC verification services play a crucial role in helping financial institutions adhere to these regulatory requirements. As the regulatory landscape becomes more complex and stringent, there is a growing need for advanced and efficient KYC solutions, leading to the expansion of the market. Moreover, the increasing incidence of financial crimes and identity theft has necessitated enhanced customer identification and verification processes. Traditional manual methods for KYC checks are time-consuming, prone to errors, and expensive. Fintech companies leverage innovative technologies, such as artificial intelligence, machine learning, and biometric authentication, to provide automated and efficient KYC verification services. These solutions enable faster customer on boarding, reduced costs, and improved accuracy, making them highly attractive to financial institutions seeking streamlined compliance processes. The digital transformation in the financial industry has fueled the demand for remote and online services. With the rise of digital banking, fintech platforms, and mobile applications, there is a need for seamless and frictionless customer on boarding experiences. KYC verification services offered by fintech companies help facilitate secure and convenient customer identification and verification remotely. The combination of regulatory compliance, the need for advanced verification methods, and the demand for seamless digital on boarding experiences have propelled the KYC verification segment to become the largest market within the FaaS industry.

➡️ 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 @ https://www.reportsnreports.com/contacts/inquirybeforebuy.aspx?name=7212543

𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞:

The report segments the FaaS market and forecasts its size by Type (Banking, Payment, Insurance, Investment, Lending, and Others), by Technology (AI, Blockchain, RPA, API, and Others), by Application (Fraud Monitoring, KYC Verification, Compliance & Regulatory Support and Others), by End User (Banks, Financial Institutes, Insurance Companies, and Others), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

𝐊𝐞𝐲 𝐛𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐛𝐮𝐲𝐢𝐧𝐠 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall FaaS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Steady Fintech as a Service (FaaS) Market Growth Despite Pandemic Headwinds: Comprehensive Global Appraisal by ReportsnReports, Market Trends, and Major Players here

News-ID: 3166470 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

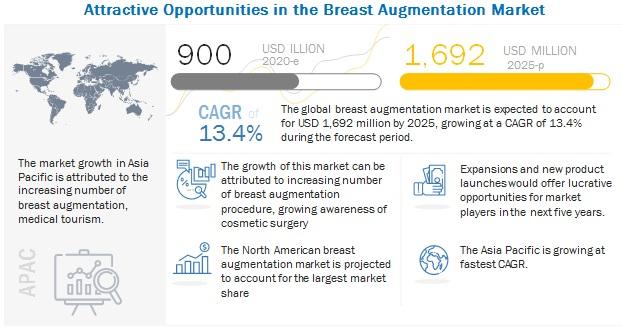

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for FaaS

Farming As A Service (FaaS) Market Size & Forecast to 2031

The Farming-as-a-Service (FaaS) market is rapidly gaining prominence as a key driver of agricultural innovation and efficiency around the world. This evolution of traditional farming into a modern, service-oriented ecosystem is enabling stakeholders - from small‐scale farmers to large agribusinesses - to adopt advanced technologies, improve productivity, and connect more effectively with markets. Recent industry activity underscores the growing importance of FaaS in reshaping how agriculture operates in a digitally…

Financial accounting advisory services (FAAS) Market Size And Global Industry Fo …

Digitalization, Regulatory Complexity, and Strategic Consulting Drive Market Momentum

Introduction

The global financial accounting advisory services (FAAS) market has emerged as a critical segment within the financial services industry, catering to evolving needs in corporate governance, compliance, digital finance transformation, and business restructuring. Organizations across sectors are increasingly relying on financial advisory firms to navigate the complexities of accounting regulations, enhance transparency, and ensure resilience in a volatile global economy. The Exactitude…

Fintech as a Service (FaaS) Market Size, Industry Share, Sales Revenue Analysis …

The Fintech as a Service (FaaS) Market is expected to experience substantial growth, with projections indicating a rise from USD 310.5 billion in 2023 to USD 676.9 billion by 2028, exhibiting a compound annual growth rate of 16.9%, during the forecast period.

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9388805

The growth of the FaaS market is driven by factors such as the emergence of cloud computing technology which will facilitate operational flexibility and scalability…

FAAS Market Regional Developments, Industry Future Demands and Competitive Lands …

The FAAS market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects.…

India FaaS Market Size, Status, Top Players, Trends in Upcoming Years

The government of India has set up the Agricultural Technology Management Agency (ATMA) to strengthen research–extension–farmer linkages, improve the quality and type of technologies being distributed, offer an effective mechanism for management and coordination of activities of multiple agencies involved in technology validation/adaption and dispersion at the district level and below, and march toward shared ownership of the agricultural technology systems among prominent shareholders.

Get the Free Sample Pages: https://www.psmarketresearch.com/market-analysis/india-farming-as-a-service-faas-market/report-sample

The…

India FaaS Market Size, Share, Growth, Trends, Applications, and Industry Strate …

Factors such as the increasing implementation of government initiatives to support the farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMSY) and Soil Health Card Scheme, and improving internet connectivity in rural areas will fuel the Indian farming as a service (FaaS) market growth during the forecast period (2021–2030). Moreover, the rising efforts made by private companies to enhance the productivity and efficiency of the agriculture sector will also…