Press release

Embedded Lending Market to surpass US$ 32.5 Bn by 2032 driven by constant growth in Fintech companies and customer demand for quick and easy lending process

According to the embedded lending industry analysis carried out by Future Market Insights (FMI), the demand registered in the embedded lending market will grow at a noteworthy CAGR of around 19.4% from 2022-2032.The report states that the market is expected to reach a valuation of ~US$ 5.5 Bn by the end of 2022. As per Future Market Insights, the pandemic has impacted millions of people all over the world, bankrupted businesses, thrown the international economy into chaos and has had a substantial impact on different industries. The widespread switch from traditional to embedded lending among consumers and businesses has been made possible by the pandemic. The emergence of embedded lending models is being fueled by a perfect storm of factors, including a company cash flow problem brought on by a pandemic, the advent of fintech, and challenger banks.

Opportunities are created through embedded lending, a type of funding that offers money, additional services, and a platform to businesses and individuals without requiring them to go to a "conventional" bank. It has the ability to boost choice and competition, diversify the financial industry, increase economic inclusion, and diversify the financial sector in order to spur more innovation across all financial products and services.

Thus, the usage of embedded lending has seen an increase in demand as firms have needed loans and other services to operate more. With the rise in digitalization and constant growth in Fintech companies and customer demand for quick and easy lending processes has propelled the growth of the embedded lending market.

Request Sample Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-15702

Key Takeaways: Embedded Lending Market

· By solution, the embedded lending platform segment accounts for the highest market share of around 61.2% for embedded lending market in the year 2021. However, the embedded lending services segment is estimated to grow at a robust CAGR of 18.1% through 2032.

· By deployment, the on-premise segment had the highest market share of around 52.8% in the embedded lending market in 2021.

· By enterprise size, the large enterprises segment had the highest market share of around 59.4% in the embedded lending market in 2021.

· By industry, the education segment is predicted to grow at a CAGR of around 21.3% between 2022 & 2032.

· By region, North America had the largest market share of around 30.2% in embedded lending market in 2021, whereas the South Asia & Pacific region is showing the highest growth of around 21.3% CAGR during the forecast period.

"Rising number of fintech companies are expanding their roots in areas like loans, payments, insurance etc. Data driven innovation and technological advancement are giving customers credit at the point of purchase with no additional hassle. This accelerates the growth of embedded lending in new market spaces". says FMI analyst.

Enormous Growth in Fintech Companies and Customer Demand for Quick and Easy Lending Process to Boost Embedded Lending Market

Since the commencement of the COVID-19 pandemic, which limited mobility and accelerated adoption of digital technology, fintech have expanded significantly across the globe. They have gotten inside many financial services sectors, upending established procedures and offering better client support and service. The rapid expansion of FinTech has been facilitated by a sizable underserved and aspirational client base, a supportive regulatory environment, a thriving talent pool, expanding access to funding, and exceptional public internet infrastructure.

Although the pandemic's restrictions caused a pause in economic activity, the fintech sector continued to advance in terms of investment, adoption, and top-line growth and is predicted to expand even further and more quickly. One of the fastest-growing subsectors in the global financial services industry is fintech. FinTech have developed as a center for customer-focused innovation during the last ten years. Offerings that are simple, quick, and efficient in the areas of payments, loans, insurance, wealth management, and brokerage have disrupted markets and changed the way that financial services are delivered.

Customers are looking for straightforward, all-encompassing, entrenched, and direct experiences. Before making a purchase, about 64% of consumers actively investigate the interest rate, EMI, and processing charge online. It links digital platforms to numerous lenders, ensuring that customers can select from a wide

network of lenders and gain access to reduced interest rates which results in growth of embedded lending market.

Ask an Analyst @ https://www.futuremarketinsights.com/askus/rep-gb-15702

Embedded Lending Outlook by Category

By Solution, Embedded Lending Market is segmented as:

-Embedded Lending Platform

-Embedded Lending Services

By Deployment, Embedded Lending Market is segmented as:

-Cloud / Web Based

-On-Premise

By Enterprise Size, Embedded Lending Market is segmented as:

-Small & Mid-sized Enterprises (SMEs)

-Large Enterprises

By Industry, Embedded Lending Market is segmented as:

-Retail

-Education

-Medical & Healthcare

-IT / IT Services

-Real Estate

-Manufacturing

-Transportation

-Others

By Region, Embedded Lending Market is segmented as:

-North America

-Latin America

-Europe

-East Asia

-South Asia & Pacific

-Middle East and Africa (MEA)

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

About Future Market Insights, Inc.

Future Market Insights, Inc. is an ESOMAR-certified business consulting & market research firm, a member of the Greater New York Chamber of Commerce and is headquartered in Delaware, USA. A recipient of Clutch Leaders Award 2022 on account of high client score (4.9/5), we have been collaborating with global enterprises in their business transformation journey and helping them deliver on their business ambitions. 80% of the largest Forbes 1000 enterprises are our clients. We serve global clients across all leading & niche market segments across all major industries.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Embedded Lending Market to surpass US$ 32.5 Bn by 2032 driven by constant growth in Fintech companies and customer demand for quick and easy lending process here

News-ID: 3165045 • Views: …

More Releases from Future Market Insights Inc.

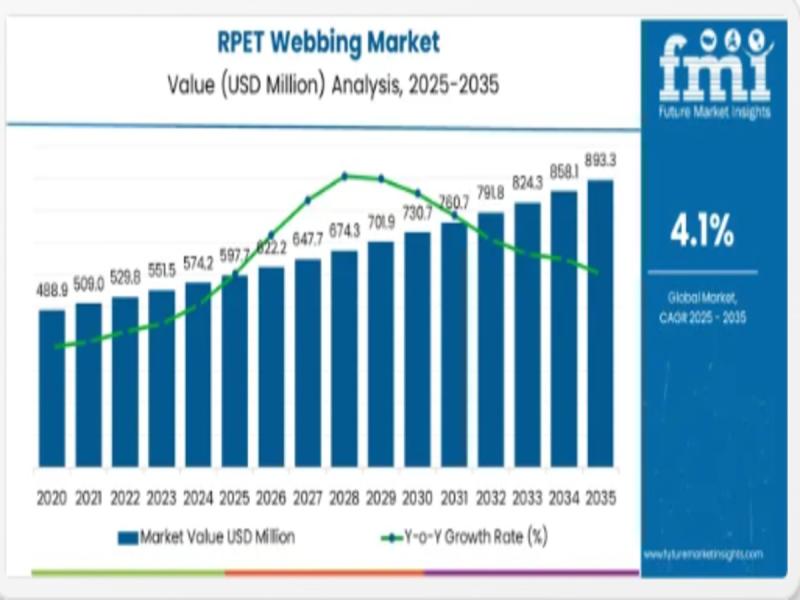

Global RPET Webbing Market Set to Surge to Nearly USD 893 Million by 2035 as Sus …

The global Recycled Polyethylene Terephthalate (RPET) webbing market is projected to expand from an estimated USD 597.7 million in 2025 to approximately USD 893.2 million by 2035, reflecting robust momentum in recycled materials adoption across key industrial and consumer sectors and underscoring sustainability as a core manufacturing imperative. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1 % during this forecast period, driven by…

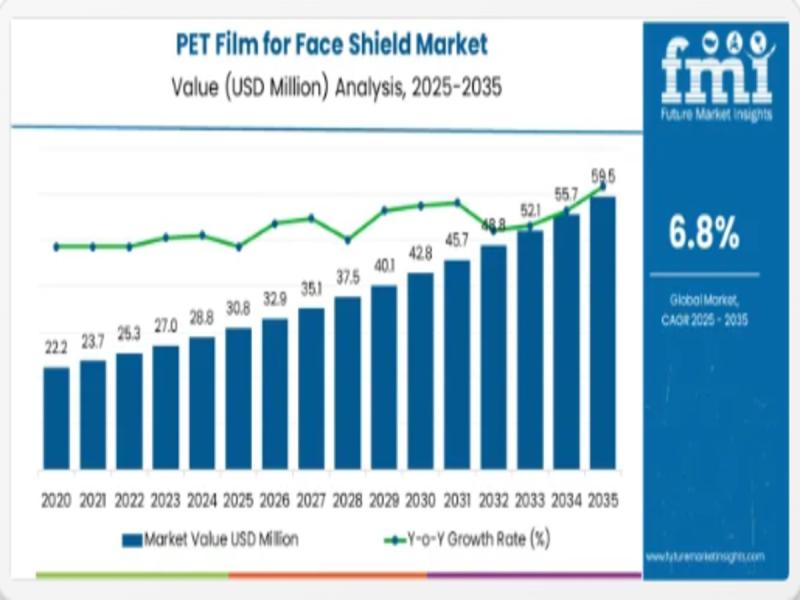

PET Film for Face Shield Market - Strategic Growth, Innovation & Forecasted Surg …

The global PET film for face shield market is set to expand from an estimated USD 30.8 million in 2025 to approximately USD 59.5 million by 2035, representing strong demand for high-clarity protective materials across healthcare and industrial safety sectors with a compound annual growth rate (CAGR) of 6.8% over the decade. This growth underscores the rising prioritization of personal protective equipment (PPE) globally, especially where transparent barrier films combine…

Middle East and North Africa Frozen Food Market Poised for Steady Growth Through …

Middle East and North Africa Frozen Food Market

The Middle East and North Africa (MENA) frozen food market is set for consistent and resilient growth over the next decade, supported by shifting consumer lifestyles, expanding modern retail infrastructure, and rising demand for long-shelf-life food solutions suited to the region's climate. The market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion…

Soluble Corn Fiber Market Forecast and Outlook 2026 to 2036 | FMI

Soluble Corn Fiber Market Outlook

The global soluble corn fiber market is gaining steady momentum as food, beverage, and nutrition manufacturers intensify reformulation strategies aimed at reducing sugar while preserving taste, texture, and consumer appeal. Valued at USD 54.9 billion in 2026, the market is projected to reach USD 78.6 billion by 2036, expanding at a compound annual growth rate (CAGR) of 4.6% over the forecast period.

Soluble corn fiber has evolved…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…