Press release

Philippines' Economic Boom Ignites Home Finance Revolution: Unlocking The Door To Affordable Homeownership, Reaching A CAGR Of 12.0% By 2027. Will Philippines Stand On This Expected Figure? Ken Research

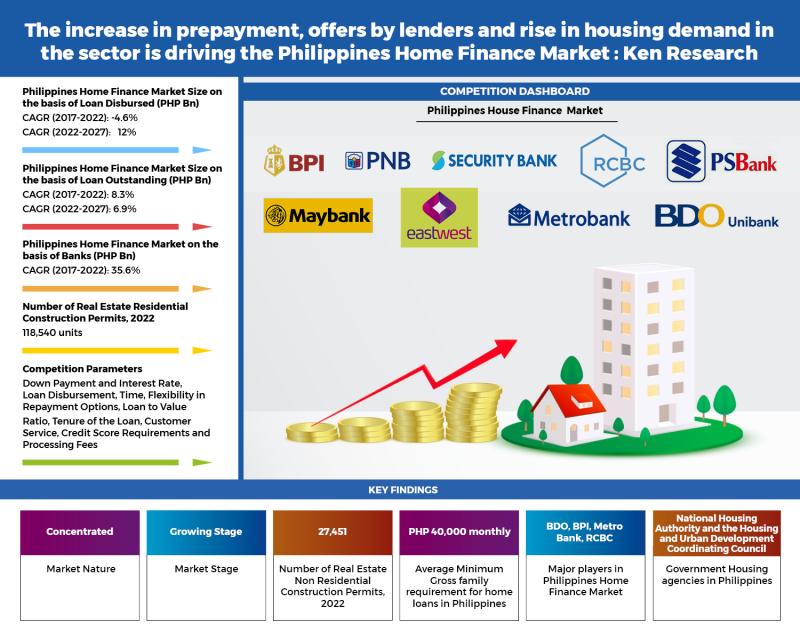

The Philippines House Finance market is concentrated. The nature of competition is high. Philippine home finance market by banks making it moderately consolidated with competitive rivalry among the competitors. Some of the popular players are Bank of the Philippine Islands, Security Bank, Banco de Oro (BDO), Metro Bank, East West Bank, LANDBANK of the Philippines, Philippine National Bank and China Bank Corporation.For more information, request a free sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2NDgw

1. Philippines' Economic Boom Ignites Home Finance Revolution: Unlocking the Door to Affordable Homeownership.

PHILIPPINES GDP GROWTH FORECAST

The development of the home financing market is significantly influenced by overall economic growth and stability. When the economy is booming, individuals have more money to spend and more confidence in making long-term commitments like house purchases. Demand for house loans is increased by a healthy economy with growing salaries and employment possibilities that encourage more people and families to think about buying a home.

2. Prepayment Surge in Philippines' Home Loans Signals Accelerated Path to Debt-Free Homeownership

Visit A link Request for Custom Report @ https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2NDgw

Covid-19 and increase in POGOs led to a lot of fluctuations in the real estate market before 2022, but as the market has started to recover the average repayment rate is back at 11%.

Pag-IBIG also recorded a higher performing loans ratio of 89.96% in October, 2022.

3. Attractive offers by lenders luring Filipino's to go for house financing

https://www.kenresearch.com/book-a-discovery-call.php?Frmdetails=NTk2NDgw to know more about the business model

With more banks, non-bank lenders and other financial institutions entering the market, borrowers are now able to access more financing options. This increased competition has resulted in more competitive interest rates, lower origination fees, and a wider range of loan products.

For more insights on market intelligence, refer to the link below: -

https://www.kenresearch.com/industry-reports/philippines-home-finance-market

Related Reports By Ken Research

https://www.kenresearch.com/industry-reports/global-auto-finance-market

https://www.kenresearch.com/industry-reports/global-auto-finance-market

Ken Research

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines' Economic Boom Ignites Home Finance Revolution: Unlocking The Door To Affordable Homeownership, Reaching A CAGR Of 12.0% By 2027. Will Philippines Stand On This Expected Figure? Ken Research here

News-ID: 3144711 • Views: …

More Releases from Ken Research Pvt .Ltd

Indonesia Plant-Based Dairy Alternatives Market Surpasses USD 540 million Milest …

Comprehensive market analysis outlines exponential growth prospects, investment opportunities, and strategic actions for industry players in the rapidly expanding Indonesian plant-based dairy alternatives sector.

Jakarta, Indonesia - February 6, 2026 - Ken Research released its comprehensive market analysis titled "Indonesia Plant-Based Dairy Alternatives Market," revealing that the current market size is valued at USD 540 million, based on a detailed five-year historical analysis. The study highlights how the market is positioned…

Ken Research Stated India's Online Furniture Rental & Leasing Platforms Market t …

Comprehensive market analysis outlines exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in India's rapidly evolving online furniture rental ecosystem.

Delhi, India - February 6, 2026 - Ken Research released its strategic market analysis titled "India Online Furniture Rental & Leasing Platforms Market," revealing that the current market size is valued at USD 4.1 million, based on a five-year historical analysis. The detailed study outlines how the market…

Ken Research Stated Middle East & Africa's Energy Drink Market to Reach USD 4.5 …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the region's rapidly evolving energy drink ecosystem.

Delhi, India - February 5, 2026 - Ken Research released its strategic market analysis titled "Middle East & Africa Energy Drink Market Outlook to 2030," revealing that the current market size is valued at USD 4.5 billion, based on a five-year historical analysis. The detailed study outlines how…

Saudi Arabia Aquaculture Market - Ken Research Stated the Sector Valued at ~ USD …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the Kingdom's rapidly evolving aquaculture ecosystem.

Delhi, India - February 5, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Aquaculture Market," revealing that the current market size is valued at USD 385 million, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven…

More Releases for Philippine

Kantar Group - Entering the Philippine Market in 2024

Kantar Group is an international market research company headquartered in London, UK, founded in 1992. Over the years, the company has become a pioneer in the market research industry through continuous innovative ideas and technological development. Through a series of mergers and acquisitions, Kantar has rapidly expanded globally. Since July 2019, Kantar is majority owned by Bain Capital Private Equity. Kantar currently has offices in 90 markets around the world,…

Boosting Philippine E-commerce with E-Signature Technology

Introduction

In the era of digital transformation, e-signature Philippines plays a pivotal role in modernizing business operations. Recognized under Republic Act No. 8792, electronic signatures and digital signatures offer a secure and efficient alternative to traditional paper-based processes. This guide explores the intricacies of e-signature Philippines, including its legal standing, benefits, and the top solutions driving this digital evolution.

Legal Framework for E-Signatures in the Philippines

Republic Act No. 8792: The E-Commerce Act

Enacted…

New Era in Consumer Lending Market is growing in Huge Demand in 2020 | Philippin …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

Global Consumer Lending Market is Booming Across the Globe Explored in Latest Re …

The Consumer Lending Market is expected to reach +19% CAGR during forecast period 2020-2026.

Consumer lending provides financing for personal, family, or household purposes. The loans can come from a variety of places, including financial institutions or lending platforms, like the aforementioned Prosper and Lending Club. Increase in government initiative toward Consumer lending, and surge in need of reduced loan management time among borrowers and lenders have boosted the growth of…

SOFITEL PHILIPPINE PLAZA MANILA WINS MULTIPLE AWARDS IN THE 2018 PHILIPPINE CULI …

Sofitel Philippine Plaza Manila won several awards spanning various categories in the recently concluded Philippine Culinary Cup 2018 (PCC). Held at the SMX Convention Center last August 1 – 4, 2018, Sofitel Philippine Plaza Manila’s master chefs secured multiple awards in the PCC’s Professional Division.

Led by Executive Chef Nicholas Shadbolt and under the instruction of team leaders Chinese Chef Michale Tai and Sous Chef Regine Lee, the Sofitel culinary…

Sourcing Destination Snapshot: The Emerging Philippine Value Proposition

“The Philippines offers many opportunities as an offshore sourcing destination as well as being well positioned as a regional hub for Asia Pacific.” - Ralph Schonenbach (CEO, Trestle Group)

In designing sourcing models, IT and BPO decision-makers literally have a “world” to choose from when it comes to competitive country locations. The unique needs of a business will clearly drive managers to seek out sites capable of satisfying a range…