Press release

Digital Lending Platform Market Predicted to See a Surge as a Result of Increasing Proliferation of Smartphones and Widespread Digitization

Digital Lending Platform Market Overview:This in-depth market study evaluates the industry's current and future market prospects in developed and emerging markets, as well as recent changes such as market drivers, opportunities, challenges, and market restraints. This Digital Lending Platform Market study is a one-of-a-kind representation of Porter's five forces analysis, a comprehensive examination of market views. The value chain provides market information. It also includes information on the industry landscape, market dynamics, and future growth possibilities.

The Digital Lending Platform market study examines the competition landscape, product market sizing, product benchmarking, market trends, product advancements, financial analysis, strategic analysis, and other factors to determine the market's effect forces and opportunities. Aside from that, the report examines important market developments such as product launches, agreements, acquisitions, partnerships, and mergers, among other things, to have a deeper understanding of current market dynamics and their impact over the forecast period.

"According to SNS Insider, the Digital Lending Platform Market size was estimated at US$ 13.18 Bn in 2022, and is expected to reach US$ 34.07 Bn by 2030, with a growing healthy CAGR of 12.6% over the forecast period 2023-2030."

Get a Sample Report of Digital Lending Platform Market 2023 @ https://www.snsinsider.com/sample-request/1785

Major Key Players Included are:

• Black Knight

• Ellie Mae

• Finastra

• Fis

• Fiserv

• Intellect Design Arena Ltd

• Nucleus Software Exports Ltd

• Tavant

• Temenos

• Wipro Limited

• Others

Market Research Outlook:

The research team conducted thorough primary and secondary research for the Digital Lending Platform market analysis. Secondary research was carried out to refine the present data and segment the market in order to calculate the total market size, forecast, and growth rate. The market value and market growth rate were calculated using a variety of approaches. To provide a more comprehensive regional picture, the team compiles market figures and data from a variety of sources. The country-level analysis of the paper is based on an examination of a number of regional players, policies, consumer behavior, and macroeconomic factors.

Get Free Quarterly Updates. Click on the link to enquire more: https://www.snsinsider.com/enquiry/1785

The numbers obtained through secondary research have been verified by appropriate primary research. To validate the facts, it will be necessary to track down and interview key industry executives. This allows the analyst to produce the most accurate data possible, with the fewest potential variations from the true value. As many executives, managers, key opinion leaders, and industry specialists as possible are interviewed by the analysts. Because the reports are based on multi-level Digital Lending Platform market research, they are more trustworthy.

Segmentation and Sub-Segmentation included are:

On The Basis of Solution:

• Business Process Management

• Lending Analytics

• Loan Management

• Loan Origination

• Risk & Compliance Management

• Others

On The Basis of Service:

• Design and Implementation

• Training and Education

• Risk Assessment

• Consulting

• Support and Maintenance

On The Basis of Deployment Mode:

•Cloud

•On-premises

On The Basis of Vertical:

• Banking

• Financial Services

• Insurance

• Credit Unions

• Retail Banking

• P2P Lenders

Competitive Outlook:

This study does an in-depth examination of the market size, various services provided by enterprises, and market opportunity. The research will give firms a 360-degree industry picture as well as insights to help them make better decisions. An in-depth examination of the macro and micro elements that influence the market, as well as critical advice. The impact of regional restrictions and other government acts on the Digital Lending Platform market is explored. It also looks at a few key market strategies used by the industry's top players, such as partnerships, business expansions, and acquisitions by the companies covered in the study.

Get complete report details @ https://www.snsinsider.com/reports/digital-lending-platform-market-1785

Table of Contents - Major Key Points:

1. Introduction

2. Research Methodology

3. Market Dynamics

4. Impact Analysis

4.1. COVID-19 Impact Analysis

4.2. Impact of Ukraine- Russia war

4.3. Impact of ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Digital Lending Platform Market Segmentation, by Solution

9. Digital Lending Platform Market Segmentation, by Service

10. Digital Lending Platform Market Segmentation, by Deployment Mode

11. Digital Lending Platform Market Segmentation, by Vertical

12. Regional Analysis

13. Company Profiles

14. Competitive Landscape

15. Conclusion

Buy Single User PDF of Digital Lending Platform Market Report 2023 @ https://www.snsinsider.com/checkout/1785

Contact US:

Akash Anand

Head of Business Development & Strategy

Ph: +1-415-230-0044 (US)

Email: info@snsinsider.com

Office No.305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market Predicted to See a Surge as a Result of Increasing Proliferation of Smartphones and Widespread Digitization here

News-ID: 3118178 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

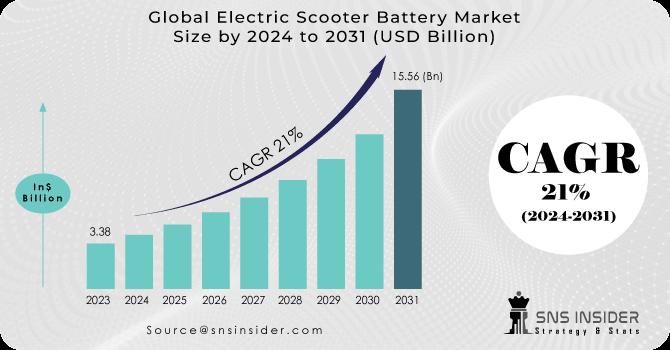

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…