Press release

Loan Origination Software Market Size, Share, Price, Trends, Growth, Analysis and Forecast 2028

Loan Origination Software Market Research Report efficiently gathers information about target markets or customers. It consists of qualitative including focus groups, in-depth interviews as well as quantitative techniques that include customer survey and analysis of secondary data. Market report aids in planning business by providing information about the market. Up-to-date marketing reports help companies to have in depth analysis of industry and future trends. In this Loan Origination Software market report, data collection modules with large sample sizes are used to collect data and perform base year analysis. The market drivers and restraints have been explained in the report using SWOT analysis.Get a Sample Copy of Report, Click Here: https://www.theinsightpartners.com/sample/TIPRE00012335/?utm_source=OpenPR&utm_medium=10183

Company Profiles:

• Calyx Technology, Inc.

• Comarch SA.

• Ellie Mae, Inc.

• Finastra

• Fiserv, Inc.

• LeadSquared

• LendingQB

• Mortgage Builder

• Turnkey Lender

Based on deployment type, the global loan origination software market is segmented into cloud, on-premise. On the basis of end user, the market is segmented into banks, credit unions, mortgage lenders and brokers, others.

Key Offerings:

• Market Size & Forecast by Revenue | 2028

• Market Dynamics - Leading trends, growth drivers, restraints, and investment opportunities

• Market Segmentation - A detailed analysis by product, types, end-user, applications, segments, and geography

• Competitive Landscape - Top key vendors and other prominent vendors.

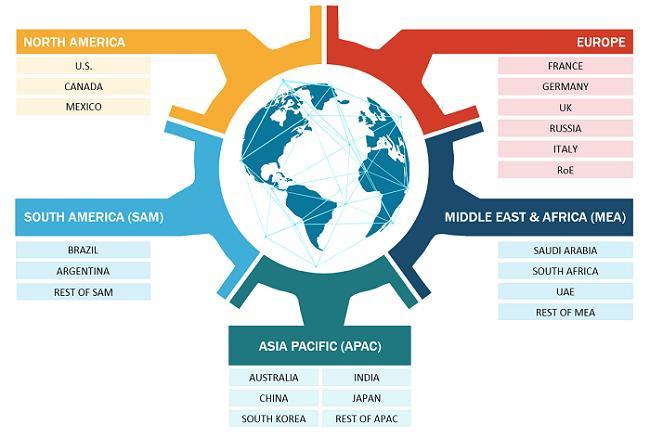

Loan Origination Software Market Regional and Country-wise Analysis:

• North America (U.S., Canada, Mexico)

• Europe (U.K., France, Germany, Spain, Italy, Central & Eastern Europe, CIS)

• Asia Pacific (China, Japan, South Korea, ASEAN, India, Rest of Asia Pacific)

• Latin America (Brazil, Rest of Latin America)

• The Middle East and Africa (Turkey, GCC, Rest of the Middle East and Africa)

Inquire before Buying Copy of Loan Origination Software Market: https://www.theinsightpartners.com/inquiry/TIPRE00012335/?utm_source=OpenPR&utm_medium=10183

Key Factors covered are:

1. To characterize, portray, and check the Loan Origination Software market based on product type, application, and region.

2. To estimate and inspect the size of the Loan Origination Software market (in terms of value) in six key regions, specifically, North and South America, Western Europe, Central & Eastern Europe, the Middle East, Africa, and the Asia-Pacific.

3. To estimate and inspect the Loan Origination Software markets at country-level in every region.

4. To strategically investigate every sub-market about personal development trends and its contribution to the Loan Origination Software market.

5. To look at possibilities in the Loan Origination Software market for shareholder by recognizing excessive-growth segments of the market.

Key Highlights & Touch Points of the Loan Origination Software Market Worldwide for the Forecast Year 2028

• Broad data on variables that will enhance the development of the Loan Origination Software market over the forthcoming years

• Precise assessment of the worldwide Loan Origination Software market size exact assessments of the forthcoming patterns and changes saw in the customer conduct

• Development of the worldwide Loan Origination Software market across the North and South America, Asia Pacific, EMEA, and Latin America

• Data about Loan Origination Software market development potential

• Top to bottom investigation of the business' serious scene and itemized data opposite on different merchants

• Outfitting of itemized data on the elements that will control the development of the Loan Origination Software markets

Purchase a copy of Loan Origination Software Market research report @ https://www.theinsightpartners.com/buy/TIPRE00012335/?utm_source=OpenPR&utm_medium=10183

Contact Us:

If you have any queries about this report or if you would like further information, please

Contact Person: Ankit Mathur

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Origination Software Market Size, Share, Price, Trends, Growth, Analysis and Forecast 2028 here

News-ID: 3105577 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Loan

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

New Jersey Loan Modification Lawyer Daniel Straffi Releases Insightful Article o …

New Jersey loan modification lawyer Daniel Straffi (https://www.straffilaw.com/loan-modifications) of Straffi & Straffi Attorneys at Law has recently published an informative article addressing the complexities and solutions surrounding loan modifications in New Jersey. The piece, aimed at helping homeowners understand their options to prevent foreclosure, sheds light on the legal avenues available to modify loan terms effectively.

In the article, the New Jersey loan modification lawyer explores various scenarios that may lead…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…