Press release

New Trends of Asset-Based Lending Market To Receive Overwhelming Hike In Revenue That Will Boost Overall Industry Growth, Forecast 2029

The Asset-Based Lending market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development prospects. Additionally, the report displays potential opportunities in the Asset-Based Lending market and also it features the effect of the different elements bringing about preventing or boosting the market analysisGet Upto 25% Discount on Report @ https://www.deepresearchreports.com/contacts/inquire-before-buy.php?name=2963615

The research report includes specific segments by region (country), company, Type, and Application. This study provides information about the sales and revenue during the historical and forecasted period. Understanding the segments helps identify the factors that aid the market growth. The Asset-Based Lending research report provides information about the market area, which is further subdivided into sub-regions and countries/regions. In addition to the market share in each country and sub-region, this report chapter also contains information on profit opportunities.

The Asset-Based Lending research report is an expert's analysis that mainly includes companies, types, applications, regions, countries, etc. Also, the reports analyse sales, revenue, trade, competition, investment, and forecasts. Industrial Analytics market research covers COVID-19 impacts on the upstream, midstream, and downstream industries. Also, this study offers detailed market estimates by emphasising statistics on several aspects covering market dynamics like drivers, barriers, opportunities, threats, and industry news & trends.

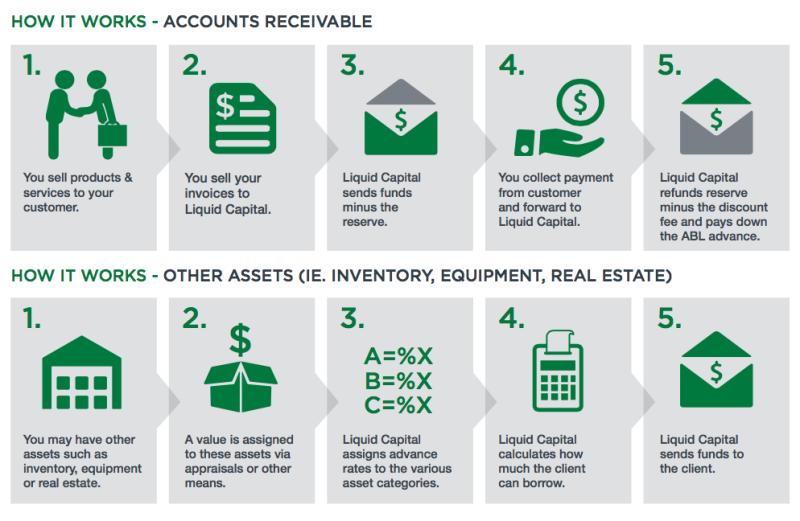

The future of asset-based lending is set to undergo remarkable advancements, transforming the way businesses access capital. Asset-based lending is a financing method that utilizes a company's assets, such as accounts receivable, inventory, and equipment, as collateral for a loan. Looking ahead, the future of asset-based lending will see the integration of innovative technologies and data analytics. Machine learning algorithms will enhance risk assessment and enable lenders to make more accurate lending decisions. Real-time monitoring of collateral value and cash flow will provide greater visibility into the borrower's financial health, ensuring timely and informed lending decisions. Furthermore, blockchain technology will enhance transparency, security, and efficiency in asset-based lending transactions.

Another key aspect of the future of asset-based lending lies in its expanding scope. Traditionally, asset-based lending has been associated with distressed or credit-challenged companies. However, in the future, asset-based lending will increasingly be embraced by healthy and growing businesses seeking flexible working capital solutions. This shift will be driven by the recognition of asset-based lending as a strategic tool for unlocking liquidity, funding growth initiatives, and optimizing capital structures.

Moreover, asset-based lending will become more accessible to small and medium-sized enterprises (SMEs) as technology streamlines processes and reduces costs. Online platforms and digital lenders will provide SMEs with faster access to capital, minimizing the time and effort required for traditional loan applications.

Overall, the future of asset-based lending holds immense potential for businesses, offering tailored financing options, improved risk management, and faster access to capital. As technology continues to advance, asset-based lending will become a more integral part of the financial landscape, supporting the growth and prosperity of businesses across various industries.

Overview of the market:

The report presents the overview of the market with the production of the cost, dispatch, application, use volume and arrangement. The Asset-Based Lending research report offers significant bits of information into the business focus from the early stage including some steady techniques chalked out by perceptible market pioneers to develop a strong foothold and development in the business. Moreover, the important areas of the Asset-Based Lending market are also assessed on the basis of their performance.

This Asset-Based Lending research report delivers key insights and gives clients a competitive advantage through a detailed report This report focuses on the key global players, defining, describing, and analyzing the market value, market share, market competition landscape, SWOT analysis, and development plans over the next few years. Also the report provides a detailed analysis of global market size, regional and country-level market size, segmentation market growth, market share, competitive Landscape, sales analysis, impact of domestic and global market players, value chain optimization, trade regulations, recent developments, opportunities analysis, strategic market growth analysis, product launches, area marketplace expanding, and technological innovations.

The report provides an in-depth assessment of the growth and other aspects of key countries (regions), such as the United States, Canada, Mexico, Germany, France, the United Kingdom, Russia, Italy, China, Japan, Korea, India, Southeast Asia, Australia, Brazil, and Saudi Arabia, among others. It also sheds light on the progress of key regional, including those in North America, Europe, Asia-Pacific, South America, and the Middle East and Africa.

Buy Complete Report @ https://www.deepresearchreports.com/contacts/purchase.php?name=2963615

Segmentation Analysis of the market

The market is segmented on the basis of the product, type, end users and application. Segmentation is considered to be the most vital part of the report which helps the reader to understand the market in précised way.

By Manufacturers

Alcentra

State Street Corporation

AEGON

Northern Trust Corporation

Kames Capital

The Vanguard Group

Charles Schwab & Co.

UBS

Credit Suisse

HSBC

By Type

Mutual Funds

Precious Metals

Venture Capital

Others

By End users

Individual

Organization

Download Free PDF Brochure at https://www.deepresearchreports.com/contacts/request-sample.php?name=2963615

Geographical Segmentation

• North America

• South America

• Asia and Pacific

• Middle East and Africa

• Europe

Reasons to buy Report

• The report offers in depth analysis of the market by providing the definition, application and classifications.

• The SWOT analysis and strategies of each vendor in the market in provided in the report.

• The offers comprehensive insights into current industry trends, trend forecast and growth drivers.

• The report provides a detailed overview of the vendor landscape, competitive analysis and key market strategies to gain competitive landscape.

DeepResearchReports

Your Market Research Librarian

Corporate Headquarters

Tower B5, office 101, Magarpatta SEZ,

Hadapsar, Pune-411013, India.

+ 1 888 391 5441

sales@deepresearchreports.com

Deep Research Reports is digital database of syndicated market reports for global and China industries. These reports offer competitive intelligence data for companies in varied market segments and for decision makers at multiple levels in these organizations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Trends of Asset-Based Lending Market To Receive Overwhelming Hike In Revenue That Will Boost Overall Industry Growth, Forecast 2029 here

News-ID: 3072183 • Views: …

More Releases from DeepResearchReports

Todays Trending Report on 08 Sep 2023

Edge Computing Market to Reach USD 111.3 billion by 2028

"The rise in IoT technology adoption to drive the growth of edge computing market".

The edge computing market size is expected to grow from USD 53.6 billion in 2023 to USD 111.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 15.7% during the forecast period. The requirement of companies to collect and analyze data at the very…

Plasma Knives Market 2023: Sales, Revenue and Future Growth- Medtronic, US Medic …

The Plasma Knives market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Venipuncture Needle Market 2023: Sales, Revenue and Future Growth- BD, Greiner B …

The Venipuncture Needle market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Emergency Tourniquets Market 2023: Sales, Revenue and Future Growth- HERSILL SL, …

The Emergency Tourniquets market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…