Press release

Global Indirect Tax Management Market Analysis and Forecast, 2019-2028

The global indirect tax management market was valued at US$ 17.2 billion in 2022 and is expected to grow at a significant CAGR of over 11.6% over the forecast period of 2023-2028.Market Scope and Report Overview

According to a deep-dive market assessment by RationalStat, the global indirect tax management market has been analyzed based on market segments, including type, application, and geography/regions (incl. North America, Latin America, Western Europe, Eastern Europe, Middle East & Africa, and Asia Pacific). The report also offers global and regional market sizing for the historical period of 2019-2022 and the forecast period of 2019-2028.

Market intelligence for the global indirect tax management market covers market sizes on the basis of market value (US$/EUR Million) and volume ('000 units/tons/liters) by various products/services/equipment, demand assessment across the key regions, customer sentiments, price points, cost structures, margin analysis across the value chain, financial assessments, historical and forecast data, key developments across the industry, import-export data, trade overview, components market by leading companies, etc.

In addition, the long-term sector and products/services 10-year outlook and its implications on the global indirect tax management market. It also includes the industry's current state - Production Levels, Capacity Utilization, Tech quotient, etc. Key information will be manufacturing capacity by country, installed base, import volumes, market size, key players, market size, dynamics, market data, insights, etc.

Period Covered include data for 2019-2028 along with year-wise demand estimations

The global indirect tax management market report analyzes the market on the basis of global economic situations, regional geopolitics, import-export scenarios, trade duties, market developments, organic and inorganic strategies, mergers and acquisitions, product launches, government policies, new capacity addition, technological advancements, R&D investments, and new market entry, replacement rates, penetration rates, installed base/fleet size, global and regional production capacity, among others.

RationalStat offers market analysis and consulting studies on the basis of dedicated and robust desk/secondary research supported by a strong in-house data repository. In addition, the research leverages data based on the real-time insights gathered from primary interviews. Market estimations and insights are based on primary research (covering more than 240 entities) and secondary research by leveraging international benchmarking.

The global indirect tax management market report also covers value chain and supply chain analysis that provides in-depth information about the value chain margins and the role of various stakeholders across the value chain. Market dynamics provided in the market study include market drivers, restraints/challenges, trends, and their impact on the market throughout the analysis period.

In the competition analysis section, the global indirect tax management market provides a detailed competition benchmarking analysis based on the market share of the leading companies/brands/producers/suppliers, a market structure overview with detailed company profiles of more than 25 players with their financials, product/service offerings, major developments, business models, etc. This enables, clients and report buyers to make strong, precise, and timely decisions.

Explore more about this report - Request for Sample and Scope of the Study

https://store.rationalstat.com/store/global-indirect-tax-management-market/#tab-ux_global_tab

Macroeconomic Scenario and the Impact of COVID-19 on Regional Economic Sentiment

In the latest RationalStat analysis, geopolitical conflicts and inflation are the cited economic risks, while concerns about the volatility across energy sectors prevail in Europe and other parts of the world. Some of the potential risks to the economic growth in the leading regions, including Asia Pacific, Europe, North America, the Middle East & Africa, and other developing regions, are inflation, volatile energy prices, supply chain disruptions, geopolitical instability, labor shortages, rising interest rates, and COVID-19 pandemic.

The global economy experienced heavy headwinds, throughout 2019-2021, as some countries witnessed subdued growth, while other countries continued to grapple with economic slowdowns. The COVID-19 pandemic has levied undue pressure across the majority of industries globally and has caused a major economic crisis in the US, India, Italy, the UK, Germany, India, Japan, South Korea, the UK, and many others. Besides, the exit of the UK from the European Union earlier in 2020 and the Russo-Ukraine war in 2022 exacerbated the ever-heightened global uncertainty.

In addition to this, the global economic growth slowed in 2022 to 3.3%, weaker than expected at the end of 2021, mainly weighed down by Russia's war in Ukraine and the associated cost-of-living crisis in many countries. However, improvement in economic activities during the forecast period is expected. Growth is projected to remain at lower rates in 2023 and 2024, at 2.6% and 2.9% respectively.

Competition Analysis and Market Structure

These players adopt various strategies in order to reinforce their market share and gain a competitive edge over other competitors in the market. Mergers & acquisitions, partnerships and collaborations, and product launches are some of the strategies followed by industry players. Some of the key developments in the global indirect tax management market include,

Some of the prominent players that contribute significantly to the global indirect tax management market growth include SAP SE, Wolters Kluwer N.V, Alvara, Inc., Thomson Reuters Corporation, Sovos Compliance, LLC, Drake Enterprises, Inc., Canopy Tax, Inc., DAVO Technologies, LLC, TPS Unlimited, Inc., and Intuit Inc. among others.

RationalStat has segmented the global indirect tax management market based on type, application, and region

• Global Indirect Tax Management Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2019-2028) Analysis by Type

o Cloud-based

o On-premise

• Global Indirect Tax Management Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2019-2028) Analysis by Application

o Banking Financial Services and Insurance (BFSI)

o Information Technology (IT) and Telecom

o Energy & Utilities

o Healthcare

o Government

o Retail

o Others

• Global Indirect Tax Management Market Value (US$ Million), Volume ('000 units/tons), and Market Share (2019-2028) Analysis by Region

• North America Global Indirect Tax Management Market

US

Canada

• Latin America Global Indirect Tax Management Market

Brazil

Mexico

Rest of Latin America

• Western Europe Global Indirect Tax Management Market

Germany

UK

France

Spain

Italy

Benelux

Nordic

Rest of Western Europe

• Eastern Europe Global Indirect Tax Management Market

Russia

Poland

Hungary

Other CIS Countries

Rest of Eastern Europe

• Asia Pacific Global Indirect Tax Management Market

China

Japan

India

South Korea

Australia

ASEAN

• Indonesia

• Thailand

• Philippines

• Vietnam

• Malaysia

• Rest of ASEAN

Rest of Asia Pacific

• Middle East & Africa Global Indirect Tax Management Market

GCC

• Saudi Arabia (KSA)

• United Arab Emirates (UAE)

• Rest of the GCC

South Africa

Nigeria

Turkey

Rest of the Middle East & Africa

• Leading Companies and Market Players

o SAP SE

o Wolters Kluwer N.V

o Alvara, Inc.

o Thomson Reuters Corporation

o Sovos Compliance, LLC

o Drake Enterprises, Inc.

o Canopy Tax, Inc.

o DAVO Technologies, LLC

o TPS Unlimited, Inc.

o Intuit Inc.

For more information about this report https://store.rationalstat.com/store/global-indirect-tax-management-market/

Key Questions Answered in the Indirect Tax Management Report

• What will be the market value of the global indirect tax management market by 2028?

• What is the market size of the global indirect tax management market?

• What are the market drivers of the global indirect tax management market?

• What are the key trends in the global indirect tax management market?

• Which is the leading region in the global indirect tax management market?

• What are the major companies operating in the global indirect tax management market?

• What are the market shares by key segments in the global indirect tax management market?

Kimberly Shaw,

Content and Press Manager

RationalStat LLC

sales@rationalstat.com

Phone: +1 302 803 5429

RationalStat is an end-to-end global market intelligence and consulting company that provides comprehensive market research reports, customized strategy, and consulting studies. The company has sales offices in India, Mexico, and the US to support global and diversified businesses. The company has over 80 consultants and industry experts, developing more than 850 market research and industry reports for its report store annually.

RationalStat has strategic partnerships with leading data analytics and consumer research companies to cater to the client's needs. Additional services offered by the company include consumer research, country reports, risk reports, valuations and advisory, financial research, due diligence, procurement and supply chain research, data analytics, and analytical dashboards.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Indirect Tax Management Market Analysis and Forecast, 2019-2028 here

News-ID: 3071998 • Views: …

More Releases from RationalStat LLC

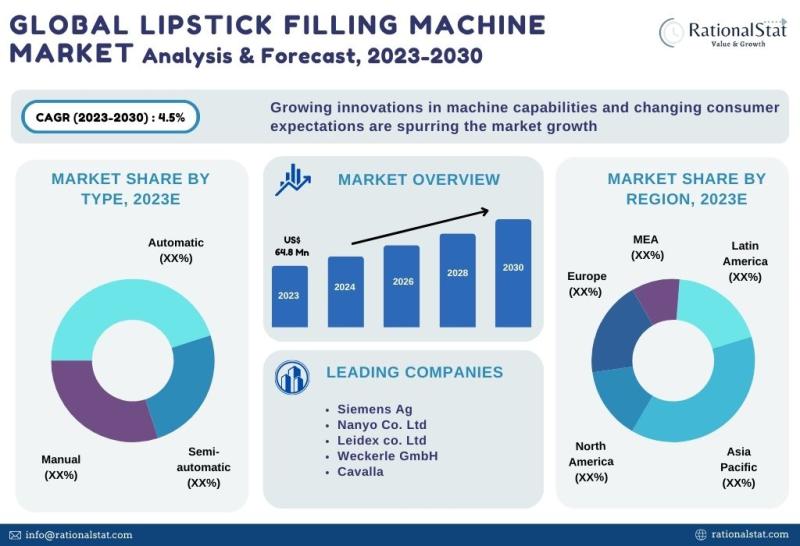

Latest Market Study | Global Lipstick Filling Machine Market Size, Share, & Fore …

The global lipstick filling machine market is expected to reach US$ 88.2 million by 2030, with an annual growth rate of more than 4.5%.

According to RationalStat's recent industry analysis, the Global Lipstick Filling Machine Market value is estimated at US$ 64.8 million in 2023 and is expected to rise at a strong CAGR of over 4.5% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

A lipstick…

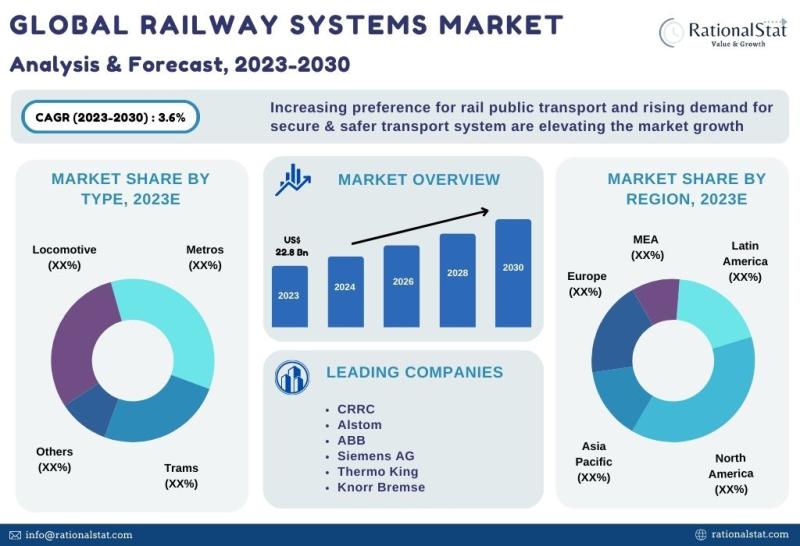

Published Market Report | Global Railway Systems Market Size, Share, & Forecast …

The global railway systems market is expected to reach US$ 29.2 billion by 2030, with an annual growth rate of more than 3.6%.

According to RationalStat's recent industry analysis, the Global Railway Systems Market value is estimated at US$ 22.8 billion in 2023 and is expected to rise at a strong CAGR of over 3.6% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Railway systems, also known…

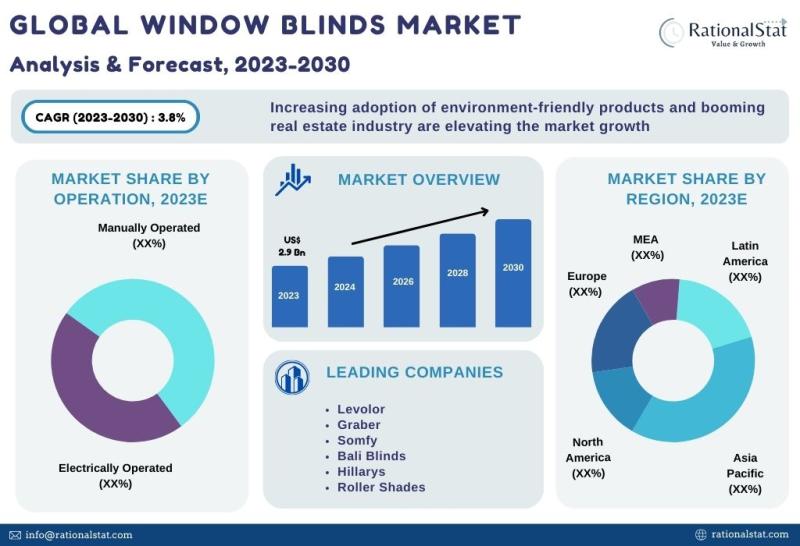

Published Market Report | Global Window Blinds Market Size, Share, & Forecast 20 …

The global window blinds market is expected to reach US$ 3.7 billion by 2030, with an annual growth rate of more than 3.8%.

According to RationalStat's most recent industry analysis, the Global Window Blinds Market value is estimated at US$ 2.9 billion in 2023 and is expected to rise at a strong CAGR of over 3.8% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Window blinds are…

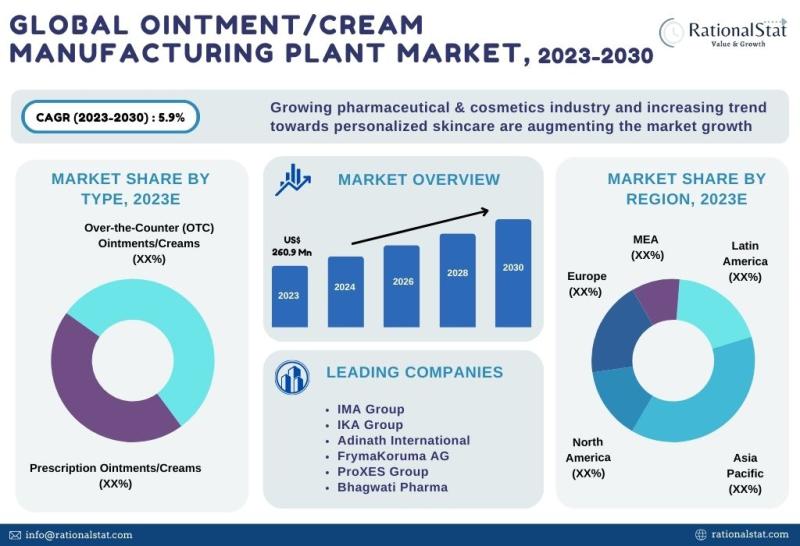

Ointment and Cream Manufacturing Plant Market Report 2023 | Ointment and Cream M …

The global ointment and cream manufacturing plant market is expected to approach US$ 388.7 million by 2030, with an annual growth rate of more than 5.9%

Global Ointment and Cream Manufacturing Plant Market is valued at US$ 260.9 million in 2023 and is expected to grow at a significant CAGR of over 5.9% over the forecast period of 2023-2030, according to the published market report by RationalStat

Market Definition, Market…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…