Press release

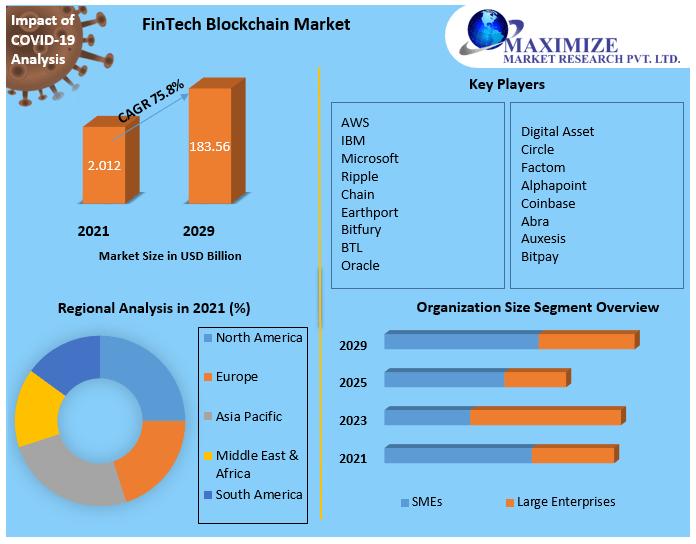

FinTech Blockchain Market was valued at USD 2.012 billion in 2021, with a projected revenue growth rate of 75.80% from 2022 to 2029, reaching nearly USD 183.56 billion.

FinTech Blockchain Market Report Scope and Research MethodologyThe report provides a detailed overview of the FinTech ecosystem, highlighting the various players involved, such as fintech start-ups, technology developers, government entities, financial stakeholders, and conventional financial institutions. It emphasizes the significant role of blockchain technology in revolutionizing the industry by enhancing transparency and eliminating the need for third-party facilitators.

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Commenting on the release of the report, a spokesperson for Maximize Market Research Pvt. Ltd. stated, "We are excited to present this comprehensive market research report on the FinTech Blockchain Market. Our aim is to provide industry stakeholders with valuable insights and analysis to make informed business decisions and capitalize on the market's potential."

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/13770

What are FinTech Blockchain Market Dynamics?

Growing Demand for Smart Contracts: Smart contracts, which are automated, tamper-proof agreements based on blockchain technology, are driving market growth. These contracts eliminate the need for intermediaries and provide secure and efficient transaction processes. The demand for smart contracts is increasing across various industries, including finance, supply chain management, and healthcare.

Integration Challenges of Big Data and AI: While big data and artificial intelligence (AI) offer immense potential for the FinTech Blockchain market, their integration presents challenges. Implementing these technologies requires expertise and ongoing maintenance. Moreover, integrating them with existing legacy systems can be complex. Overcoming these challenges and harnessing the power of big data and AI is crucial for market growth.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/13770

Disintermediation and Transparency: Blockchain technology enables disintermediation by removing the need for intermediaries in financial transactions. This decentralization improves transparency, as transactions recorded on the blockchain are visible to all participants and cannot be altered unilaterally. The desire for transparency and the elimination of intermediaries are driving the adoption of blockchain in the FinTech industry.

Increasing Adoption of Cryptocurrencies: The rise of cryptocurrencies, such as Bitcoin and Ethereum, has had a significant impact on the FinTech Blockchain market. Individuals and businesses are increasingly using cryptocurrencies for financial transactions, investments, and wealth management. This adoption of cryptocurrencies is fueling the demand for blockchain technology as a secure and transparent infrastructure for these digital assets.

What are FinTech Blockchain Market regional insights?

North America has been at the forefront of FinTech and blockchain innovation. The region has a well-developed financial sector, supportive regulatory frameworks, and a high level of technological advancement. Major FinTech hubs, such as Silicon Valley and New York, have witnessed significant investments in blockchain technology. The United States is home to several blockchain startups and has seen increased adoption of cryptocurrencies. Additionally, Canada has emerged as a hotspot for blockchain development and has implemented progressive regulations to encourage blockchain innovation.

Request For Free Sample Report:https://www.maximizemarketresearch.com/request-sample/13770

What is FinTech Blockchain Market Segmentation?

by Application

• Payments, clearing, and settlement

• Exchanges and remittance

• Smart contracts

• Identity management

• Compliance management/Know Your Customer (KYC)

• Others (cyber liability and content storage management

by Provider

• Application and solution providers

• Middleware providers

• Infrastructure and protocols providers

by Organization Size

• Small and Medium-Sized Enterprises (SMEs)

• Large enterprises

by Industry Vertical

• Banking

• Non-banking financial services

• Insurance

Purchase Report : https://www.maximizemarketresearch.com/market-report/fintech-blockchain-market/13770/

Who are FinTech Blockchain Market Key Players?

• AWS

• IBM

• Microsoft

• Ripple

• Chain

• Earthport

• Bitfury

• BTL

• Oracle

• Digital Asset

• Circle

• Factom

• Alphapoint

• Coinbase

• Abra

• Auxesis

• Bitpay

• Blockcypher

• Applied Blockchain

• Recordskeeper

• Symboint

• Guardtime

• Cambridge Blockchain

• Tradle

• Robinhood

• Veem

• Stellar

Table of content for the FinTech Blockchain Market includes:

1. Global FinTech Blockchain Market: Research Methodology

2. Global FinTech Blockchain Market: Executive Summary

• Market Overview and Definitions

• Introduction to the Global Market

• Summary

• Key Findings

• Recommendations for Investors

• Recommendations for Market Leaders

• Recommendations for New Market Entry

3. Global FinTech Blockchain Market: Competitive Analysis

• MMR Competition Matrix

• Market Structure by region

• Competitive Benchmarking of Key Players

• Consolidation in the Market

• M&A by region

• Key Developments by Companies

• Market Drivers

• Market Restraints

• Market Opportunities

• Market Challenges

• Market Dynamics

• PORTERS Five Forces Analysis

• PESTLE

• Regulatory Landscape by region

• North America

• Europe

• Asia Pacific

• Middle East and Africa

• South America

• COVID-19 Impact

4. Global FinTech Blockchain Market Segmentation

• Global Market, by Application (2021-2029)

• Global Market, by Provider(2021-2029)

• Global Market, by Organization Size(2021-2029)

• Global Market, by Industry Vertical(2021-2029

5. Regional FinTech Blockchain Market(2021-2029)

• Regional Market, by Application (2021-2029)

• Regional Market, by Provider(2021-2029)

• Regional Market, by Organization Size(2021-2029)

• Regional Market, by Industry Vertical(2021-2029)

• Regional Market, by Country (2021-2029)

6. Company Profile: Key players

• Company Overview

• Financial Overview

• Global Presence

• Capacity Portfolio

• Business Strategy

• Recent Developments

Key Offerings:

• Past Market Size and Competitive Landscape (2018 to 2021)

• Past Pricing and price curve by region (2018 to 2021)

• Market Size, Share, Size & Forecast by different segment | 2022-2029

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

Energy bar Market: https://www.maximizemarketresearch.com/market-report/energy-bar-market/129300/

Cultivated Meat https://www.maximizemarketresearch.com/market-report/cultivated-meat-straight-to-kitchen-from-lab/139257/

Food E-Commerce Market: https://www.maximizemarketresearch.com/market-report/food-e-commerce-market-global-market/147963/

Global Herbal Extract Market: https://www.maximizemarketresearch.com/market-report/global-herbal-extract-market/98637/

Global Food Acidulates Market: https://www.maximizemarketresearch.com/market-report/global-food-acidulates-market/105090/

Global Sulphite Ammonia Caramel Market: https://www.maximizemarketresearch.com/market-report/global-sulphite-ammonia-caramel-market/83727/

Global Coconut Derived Emollients Market: https://www.maximizemarketresearch.com/market-report/global-coconut-derived-emollients-market/81628/

Global Ready To Drink (RTD) Tea And Coffee Market: https://www.maximizemarketresearch.com/market-report/global-ready-to-drink-rtd-tea-and-coffee-market/91107/

Global Food Fortifying Agents Market: https://www.maximizemarketresearch.com/market-report/global-food-fortifying-agents-market/94013/

Global Algae Protein Market: https://www.maximizemarketresearch.com/market-report/global-algae-protein-market/28581/

global celery oil Market: https://www.maximizemarketresearch.com/market-report/global-celery-oil-market/67270/

Global Fermented Non-Dairy Non-Alcoholic Beverages Market: https://www.maximizemarketresearch.com/market-report/global-fermented-non-dairy-non-alcoholic-beverages-market/78917/

Global Inulinase Market: https://www.maximizemarketresearch.com/market-report/global-inulinase-market/111240/

Global Duty-Free Liquor Market: https://www.maximizemarketresearch.com/market-report/global-duty-free-liquor-market/94512/

Global Low Carbohydrate Bars Market: https://www.maximizemarketresearch.com/market-report/global-low-carbohydrate-bars-market/115950/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release FinTech Blockchain Market was valued at USD 2.012 billion in 2021, with a projected revenue growth rate of 75.80% from 2022 to 2029, reaching nearly USD 183.56 billion. here

News-ID: 3067510 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

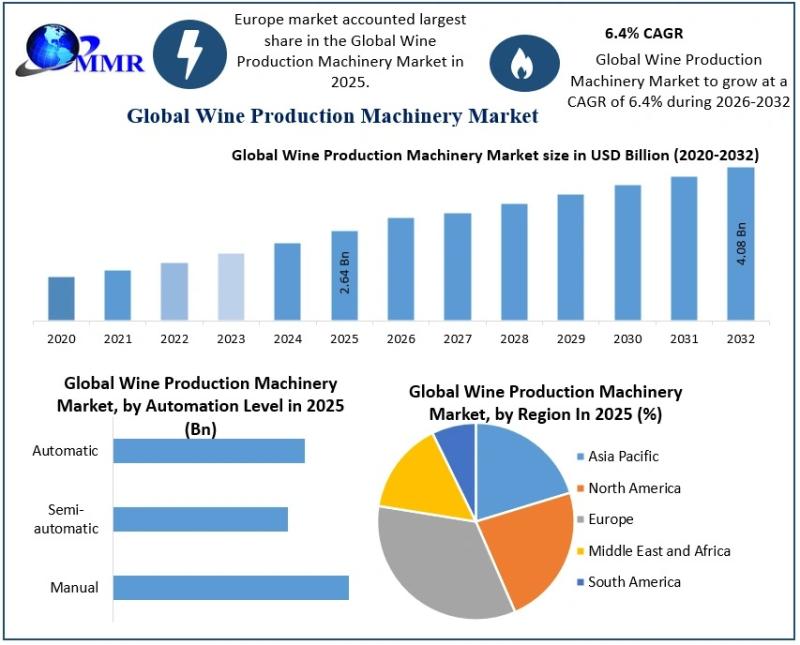

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

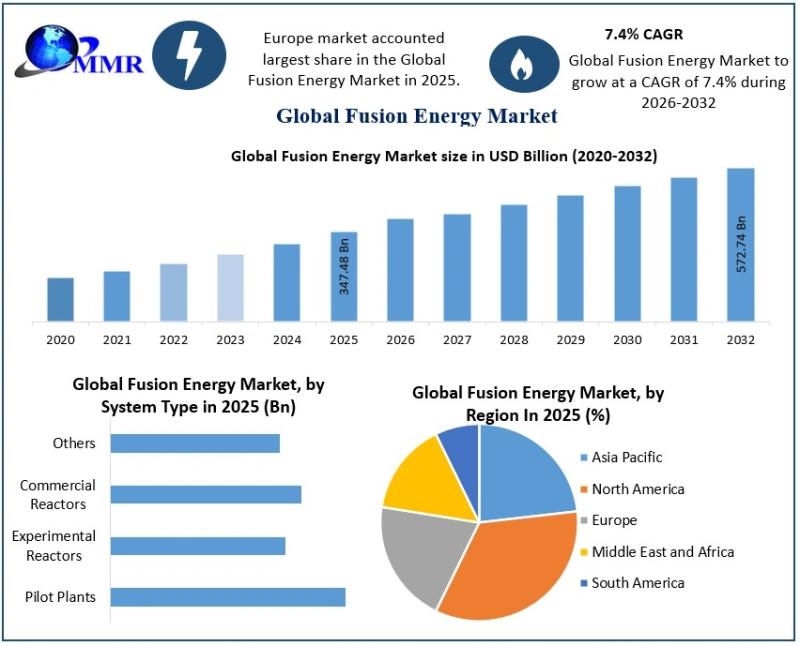

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for FinTech

EMBank Reinforces Fintech Leadership at Baltic Fintech Days 2025

As fintech innovation accelerates across Europe, Vilnius once again positioned itself as a central hub for forward-thinking financial dialogue during Baltic Fintech Days 2025. Held over two impactful days, the conference attracted over 1,000 stakeholders, bringing together startup leaders, financial institutions, regulators, and technology innovators from across the Baltics and beyond.

The event's agenda was shaped by more than 60 expert speakers who addressed emerging topics such as AI-powered banking, embedded…

Seoul Fintech Lab Accelerates Global Expansion with Participation in Singapore F …

Image: https://www.getnews.info/uploads/5b520c858c856e54cadb7d57558b7209.jpg

Seoul Fintech Lab successfully participated in the Singapore Fintech Festival from November 6 to 8, 2024. The event was organized to promote overseas investment and market entry for its resident, membership, and graduate companies, with a particular focus on Seoul-based fintech companies established within the last seven years.

A total of 10 companies participated in the event. The five resident companies were Antok, Whatssub, Ipxhop, MerakiPlace, and Korea Securities Lending,…

Seoul Fintech Lab and 2nd Seoul Fintech Lab Successfully Participate in Korea Fi …

Seoul Fintech Lab and 2nd Seoul Fintech Lab achieved great success by showcasing innovative solutions from 22 resident companies, attracting approximately 1,000 visitors to their booth during Korea Fintech Week 2024.

Image: https://www.getnews.info/uploads/e73eea3a5c8a6a46e5b43375b2a156be.jpg

Seoul Fintech Lab and the 2nd Seoul Fintech Lab jointly participated in the 'Korea Fintech Week 2024,' held at Dongdaemun Design Plaza (DDP) in Seoul, South Korea, from August 27 to 29. The event was a huge success, with…

FinTech in Insurance

The market for "FinTech in Insurance Market" is examined in this report, along with the factors that are expected to drive and restrain demand over the projected period.

Introduction to FinTech in Insurance Market Insights

The futuristic approach to gathering insights in the FinTech in Insurance sector integrates advanced technologies such as artificial intelligence, big data analytics, and blockchain. These tools enhance data collection from diverse sources, enabling insurers to gain deeper,…

BW Festival Of Fintech: A Comprehensive Fintech Colloquy

Business World’s Festival of Fintech is a two-day informative summit that will inform, illustrate and recognize the changes in the dynamic Fintech industry.

Business World brings forth Festival of Fintech, an exclusive conclave on Fintech innovation and growth on the 12th and 13th of February, 2021. The event will include expert panels and an industry award ceremony that recognizes excellence in all the ambits of the Fintech field.

The…

Bouchard Fintech

Information provided by Bouchard Fintech

The US, at least this current administration, has mystified its European Union business and political partners. The EU represents one of the very largest economies on the planet. The EU is also very much a trusted ally of the US. The EU market continues to be a fertile ground for US exports. So, it was quite a surprise that the US seemed to be picking a…