Press release

Asset-Based Lending Market New Highs - Current Trends and Growth Drivers Along with Key Industry Players

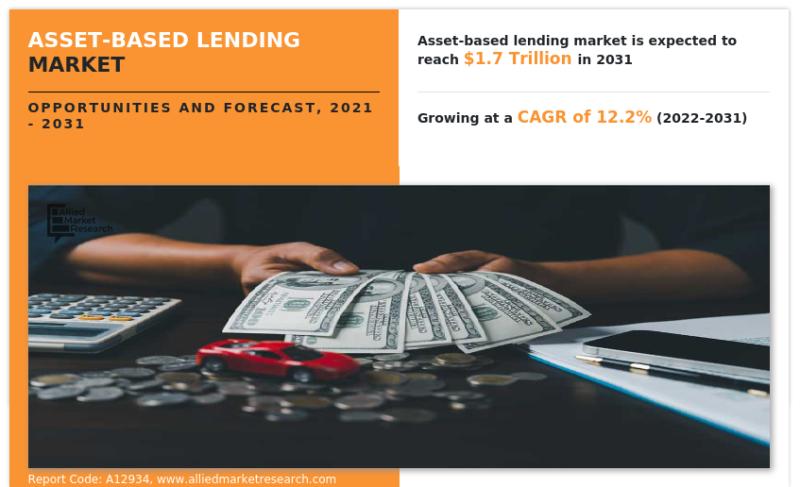

Allied Market Research published a new report, titled," Asset-Based Lending Market: Global Opportunity Analysis and Industry Forecast, 2021-2031." The research offers a thorough analysis of important segments, competitive environment, main investment pockets, drivers and prospects, and investment viability.The global asset-based lending market was valued at $561.5 billion in 2021, and is projected to reach $1,721.38 billion by 2031, growing at a CAGR of 12.2% from 2022 to 2031.

At the same time, restraining factors that are expected to obstruct or hold the growth of the industry are also presented by our expert analysts in order to provide the key market players with a detailed scenario of future threats in advance. Furthermore, the report provides a quantitative and qualitative analysis of the market and outlines the pain point analysis, value chain analysis, and key regulations.

To Get a Sample Copy of this Strategic Report (Use Corporate Mail ID for Top Priority)@ https://www.alliedmarketresearch.com/request-sample/13299

The worldwide Asset-Based Lending marketplace record gives a complete observation of the dynamic driving and restraining factors, major challenges, and lucrative opportunities. Moreover, the study covers a SWOT analysis that aids in recognizing the restraining and driving factors in the market. Furthermore, the report outlines market segmentation and growth analysis of the top 10 market players that are currently active in the industry. The drivers and opportunities help in grasping the dynamic market trends and how market players can leverage such trends.

A comprehensive analysis of each segment and sub-segment is provided in the research. In addition, the tabular and graphical representation of each segment and sub-segment will assist Asset-Based Lending market players in understanding the largest revenue-generating segments and driving factors thoroughly. This analysis is valuable in identifying the fastest-growing segments as well as strategizing to gain long-term growth.

Leading market players in the global Asset-Based Lending Market include:

Lloyds Bank, Barclays Bank PLC, Hilton-Baird, JPMorgan Chase & Co., Berkshire Bank, White Oak Financial, LLC, Wells Fargo, Porter Capital, Capital Funding Solutions Inc., and Crystal Financial

Inquiry Before Buying@ https://www.alliedmarketresearch.com/purchase-enquiry/13299

By Region:

1) North America- (U.S., Canada, Mexico)

2) Europe- (Germany, UK, France, Spain, Italy, Rest of Europe)

3) Asia-Pacific- (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific)

4) LAMEA- (Brazil, Saudi Arabia, South Africa, Rest of LAMEA)

The Covid-19 outbreak has had a significant effect on the world. Some sectors thrived during the pandemic while some faced tremendous losses. As per the restrictions and guidelines issued by World Health Organization (WHO), the majority of the manufacturing and production facilities were closed or working at low potential. Moreover, the prolonged lockdown created challenges in the procurement of raw materials. These factors create a huge gap in supply and demand and disrupted the supply chain. However, as the world is recovering from the pandemic, the Asset-Based Lending market is expected to get back on track.

If you have any special requirements, please let us know@ https://www.alliedmarketresearch.com/request-for-customization/13299

We assist our clients with acquiring an upper hand in a market space by offering counseling administrations that incorporate however are not restricted to:

• Talent and engagement consulting services.

• Market expansion and vertical tagging.

• 3 Business process and transformation consulting services.

• Governance, risk, fraud, and compliance consulting.

• Business and transformation consulting.

• Customer acquisition and synergy planning.

• Digital business strategy.

• Strategic advisory and operational excellence consulting services.

Benefits of Purchasing Asset-Based Lending Market Reports:

• Customer Satisfaction: Our team of experts assists you with all your research needs and optimizes your reports.

• Analyst Support: Before or after purchasing the report, ask a professional analyst to address your questions.

• Assured Quality: Focuses on the accuracy and quality of reports.

• Incomparable Skills: Analysts provide in-depth insights into reports.

Want to Access the Statistical Data and Graphs, Key Players' Strategies@ https://www.alliedmarketresearch.com/asset-based-lending-market/purchase-options

More Reports in BFSI Industry:

Corporate Lending Market https://www.alliedmarketresearch.com/corporate-lending-market-A12960

Auto Finance Market https://www.alliedmarketresearch.com/auto-finance-market-A10390

Umbrella Insurance Market https://www.alliedmarketresearch.com/umbrella-insurance-market-A14761

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

Property Insurance Market https://www.alliedmarketresearch.com/property-insurance-market-A05998

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Based Lending Market New Highs - Current Trends and Growth Drivers Along with Key Industry Players here

News-ID: 3039087 • Views: …

More Releases from Allied Market Research

Renal Denervation Market to Exceed USD $4.5 Billion by 2030 | Allied Market Rese …

Renal denervation is a medical procedure that uses radiofrequency ablation or other methods to disrupt the activity of nerves that surround the kidneys. These nerves are part of the sympathetic nervous system, which controls various bodily functions, including blood pressure regulation. During renal denervation, upper chamber and lower chamber of the heart beat irregularly, chaotically, and out of sync, which can cause shortness of breath, chest pain, weakness, lightheadedness, or…

The Booming Surgical Equipment Market Is Projected to Reach $59 Billion by 2032

Allied Market Research recently said the surgical equipment industry has been growing steadily in recent years, driven by advances in technology, increasing demand for minimally invasive surgeries, and rising healthcare expenditures. The global surgical equipment market size was valued at $35.6 billion in 2022, and is projected to reach $59 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. Surgical equipment refers to the various tools,…

ALS Treatment Market to Reach US$ 1.04 Billion by 2032, Growing at 4.6% CAGR

The global amyotrophic lateral sclerosis (ALS) treatment market is entering a critical phase of growth as unmet therapeutic needs and research momentum converge. Current figures indicate a market value of US$ 662.3 million in 2022, with a projected increase to US$ 1,038.94 million by 2032, which equates to a CAGR of 4.6% from 2023 to 2032. ALS is a severe neurodegenerative disease affecting nerve cells in the brain and spinal…

Aircraft Engine Forging Market to Garner $5 Billion, Globally, By 2032 At 6.9% C …

Aircraft engine forging industry size was valued at $2.6 billion in 2022, and is estimated to garner $5 billion by 2032, growing at a CAGR of 6.9% from 2023 to 2032.

The demand for lightweight materials, such as titanium, aluminum, and advanced alloys, aimed at improving fuel efficiency and overall performance of aircraft engines. Moreover, there is surge in air travel demand that led airlines to expand their fleets, necessitating the…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…