Press release

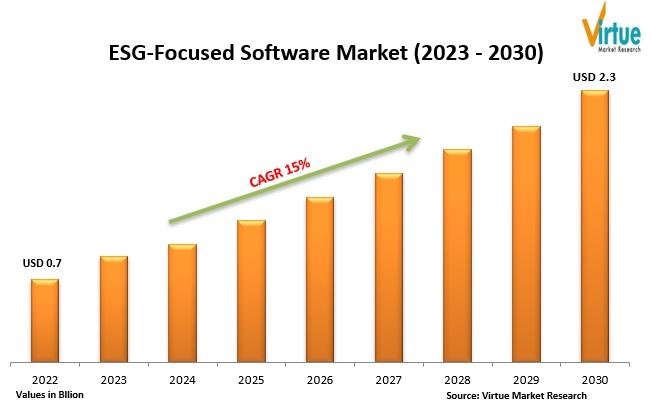

ESG-Focused Software Market is projected to reach the value of $2.3 billion by 2030

According to the report published by Virtue Market Research, the Global ESG-Focused Software Market was valued at $0.7 billion in 2022 and is projected to reach a market capitalization of $2.3 billion by 2030. Over the forecast period of 2023-2030, market is estimated to grow at a CAGR of 15%.Read More @ https://virtuemarketresearch.com/report/global-esg-focused-software-market

The ESG (Environmental, Social, and Governance)-focused software market has been witnessing a significant growth trajectory over the past few years, and it is expected to continue in the long run. One of the primary long-term market drivers is the increasing emphasis on sustainable investing. Investors across the globe are becoming more conscious of the ESG risks associated with the investments they make. This is mainly due to the growing awareness of the adverse effects of climate change and the need to address the social and governance issues in the corporate world.

In the wake of the COVID-19 pandemic, the ESG-focused software market has witnessed a significant surge in demand. The pandemic has brought to the fore the need for companies to focus on sustainability and resilience. With remote work becoming the new norm, companies are increasingly adopting technology solutions to monitor and manage their ESG risks. The pandemic has also led to a renewed focus on the social aspect of ESG, with companies taking proactive measures to ensure the safety and well-being of their employees.

In the short term, one of the key market drivers for the ESG-focused software industry is the increasing regulatory pressure. Governments across the globe are introducing regulations to ensure companies comply with ESG standards. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires asset managers to disclose the ESG impact of their investments. This has led to an increased demand for ESG-focused software solutions that help companies comply with these regulations.

One of the key opportunities in the ESG-focused software market is the growing demand for data analytics and visualization tools. With companies generating large volumes of data related to their ESG risks and opportunities, there is a need for software solutions that can help them analyze and visualize this data. These tools enable companies to identify key trends and patterns in their ESG data, which can help them make more informed decisions.

A key trend observed in the ESG-focused software industry is the increasing adoption of AI and machine learning. These technologies enable companies to automate their ESG risk assessment processes, making them more efficient and effective. AI and machine learning algorithms can analyze large volumes of data and identify patterns and trends that may not be visible to human analysts. This can help companies identify potential ESG risks and opportunities, allowing them to take proactive measures to mitigate risks and capitalize on opportunities.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/global-esg-focused-software-market/request-sample

Segmentation Analysis:

The global ESG-Focused Software Market segmentation includes:

By Components:

• Software

• Services

he ESG-focused software market comprises two main components - software and services. The software segment includes various solutions such as ESG data management software, sustainability reporting software, and carbon accounting software. The services segment includes consulting, implementation, and training services related to ESG management.

Among these two components, the software segment is the largest, accounting for the majority of the revenue generated in the ESG-focused software market. The increasing adoption of ESG reporting standards and regulations across industries has led to a growing demand for ESG software solutions. These software solutions help companies manage and report their ESG data in a more efficient and streamlined manner. The software segment is expected to continue its dominance during the forecast period.

On the other hand, the services segment is expected to witness the fastest growth during the forecast period. This can be attributed to the increasing complexity of ESG reporting and the growing need for specialized expertise in this area. SMEs and other organizations with limited resources may not have the in-house expertise to manage their ESG reporting requirements. As a result, they are increasingly turning to ESG service providers to help them manage their ESG data and report on their ESG performance.

By Enterprise Size:

• Large Corporations

• SME's

When it comes to enterprise size, large corporations currently account for the majority of the revenue generated in the ESG-focused software market. This can be attributed to the fact that large corporations have more resources to invest in ESG management and reporting. Moreover, regulatory requirements related to ESG reporting are often more stringent for large corporations, driving the demand for ESG software solutions.

However, SMEs are expected to be the fastest-growing segment during the forecast period. This can be attributed to the increasing awareness of ESG risks and opportunities among SMEs. SMEs are increasingly realizing the importance of ESG management and reporting in attracting investment and maintaining their social license to operate. As a result, they are investing in ESG software solutions to help them manage their ESG data and report on their ESG performance.

Regional Analysis:

Europe is currently the largest market for ESG-focused software, accounting for a significant share of the global market. This can be attributed to the growing focus on sustainable investing and the increasing regulatory pressure on companies to disclose their ESG performance in the region. European companies are also increasingly adopting ESG reporting standards and guidelines, driving the demand for ESG software solutions.

However, the Asia-Pacific region is expected to be the fastest-growing market for ESG-focused software during the forecast period. This can be attributed to the increasing awareness of ESG risks and opportunities among companies in the region, coupled with the growing regulatory pressure to comply with ESG standards. Moreover, the region is home to a large number of companies operating in industries that have a significant impact on the environment and society, such as manufacturing, energy, and mining. As a result, the demand for ESG software solutions is expected to grow significantly in the region.

North America is another significant market for ESG-focused software, driven by the increasing emphasis on sustainable investing and the growing awareness of ESG risks and opportunities among companies in the region. The region is home to a large number of asset managers and investors that are actively seeking to incorporate ESG factors into their investment decisions, driving the demand for ESG software solutions.

The rest of the world, comprising regions such as South America, the Middle East, and Africa, is also witnessing a growing adoption of ESG-focused software. The region is characterized by a diverse set of economies and industries, each with its own set of ESG challenges and opportunities. However, the lack of a comprehensive regulatory framework for ESG reporting in many of these regions is hindering the growth of the ESG software market to some extent.

Customize the Full Report Based on Your Requirements @ https://virtuemarketresearch.com/report/global-esg-focused-software-market/customization

Latest Industry Developments:

• In August 2021, Ethos ESG and Alchemy Acquisition Corp announced a joint venture partnership to rank and rate public companies based on ESG impact utilizing proprietary data and analysis.

• In April 2021, Enablon and EY launched an ESG reporting and management alternative built on Enablon's cloud technology platform to assist enterprises with end-to-end ESG data tracking and reporting.

• In August 2021, FiscalNote announced its acquisition of Equilibrium, an ESG software company.

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ESG-Focused Software Market is projected to reach the value of $2.3 billion by 2030 here

News-ID: 3033660 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

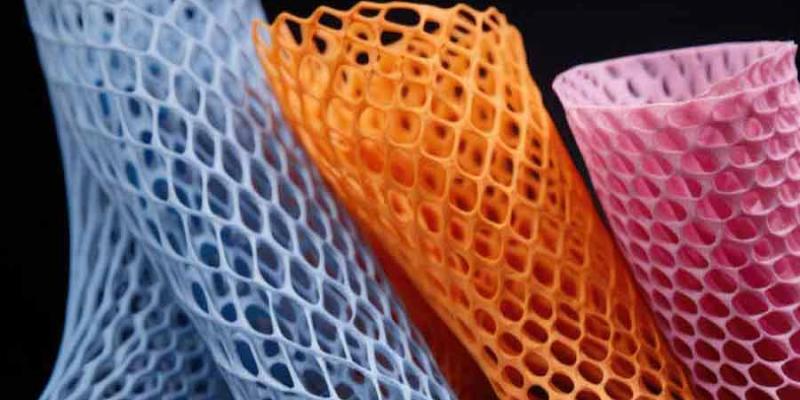

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for ESG

CARE ESG Awards 2025 highlights outstanding achievements in sustainability, clim …

Dubai, UAE, 29th November 2025, ZEX PR WIRE, The CARE ESG Awards by Trescon and ESG Mena recognised the region's most outstanding leaders, changemakers, and industry shapers driving sustainability, clean energy, climate resilience, and responsible growth. Held during the inaugural edition of climate action, renewable energy & sustainability forum, CARE 2025, the awards spotlighted high-impact contributions driving measurable progress across environmental stewardship, renewable energy deployment, resource efficiency, social value creation,…

APAC Investor ESG Software Market Rises at 16.5% CAGR Amid Regional Push for ESG …

The Asia Pacific (APAC) Investor ESG Software market is poised for a decade of robust expansion, projected to grow from US$ 214.91 million in 2024 to an estimated US$ 756.92 million by 2031. This represents a significant Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period of 2024-2031, according to a new market research report published by The Insight Partners.

Download PDF Sample Copy @ https://www.theinsightpartners.com/sample/TIPRE00023473/?utm_source=OpenPR&utm_medium=10813

The report, titled "Asia-Pacific…

Global ESG Reporting Software Market Size by Application, Type, and Geography: F …

USA, New Jersey- According to Market Research Intellect, the global ESG Reporting Software market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for clear and consistent sustainability disclosures is driving the market for ESG (Environmental, Social, and Governance) reporting software, which is expanding…

ZeeDimension Wins ESG Data Company Award at the 5th World ESG Summit in Riyadh

Riyadh, Saudi Arabia - February 12, 2025 - ZeeDimension, a leading provider of ESG, GRC, and data analytics solutions, has been honored with the prestigious ESG Data Company Award at the 5th World ESG Summit, held on February 10-11, 2025, in Riyadh, Saudi Arabia.

The World ESG Summit is one of the most influential global gatherings for sustainability leaders, investors, and policymakers, dedicated to advancing Environmental, Social, and Governance (ESG) initiatives.…

Transforming the Environmental, Social And Governance (ESG) Investment Analytics …

What Is the Expected Size and Growth Rate of the Environmental, Social And Governance (ESG) Investment Analytics Market?

The market size for investment analytics related to environmental, social, and governance (ESG) has been on a rapid surge over the recent years. The market estimation is to rise from $1.7 billion in 2024 to $2.01 billion in 2025 with a compound annual growth rate (CAGR) of 18.1%. Growth in the past can…

Inrate Unveils New ESG Data Platform for Transparent and Traceable ESG Data Insi …

Zurich, Oct 22, 2024 - Inrate, a leading impact rating and ESG data company, is thrilled to announce the release of CLIF, its new ESG data platform, designed to provide transparent and traceable ESG data to simply investment analysis. With expanded features and seamless functionality, CLIF allows investors to gain enhanced visibility into the sustainability performance of over 10,000 companies and 190 sovereigns worldwide.

Empowering Data-Driven ESG Decisions

The CLIF…