Press release

Asia-Pacific Digital Payment Market Size, Growth 20.70%, Industry Analysis, Trends, Major Players and Forecast 2022-2029

The study and estimations of Asia-Pacific Digital Payment Market report helps to figure out types of consumers, their views about the product, their buying intentions and their ideas for the step up of a product. With the market data of this report, emerging trends along with major drivers, challenges, and opportunities in the market for This industry can be identified and analysed. For the clear and better understanding of facts and figures, the data is represented in the form of graphs and charts. With the studies, insights, and analysis mentioned in the finest Asia-Pacific Digital Payment report, get comprehensible idea about the marketplace with which business decisions can be taken quickly and easily.Leading players of the Asia-Pacific Digital Payment Market are analyzed taking into account their market share, recent developments, new product launches, partnerships, mergers or acquisitions, and markets served. We also provide an exhaustive analysis of their product portfolios to explore the products and applications they concentrate on when operating in the Endpoint Detection and Response market. Furthermore, the report offers two separate market forecasts - one for the production side and another for the consumption side of the Endpoint Detection and Response market. It also provides useful recommendations for new as well as established players of the Endpoint Detection and Response market.

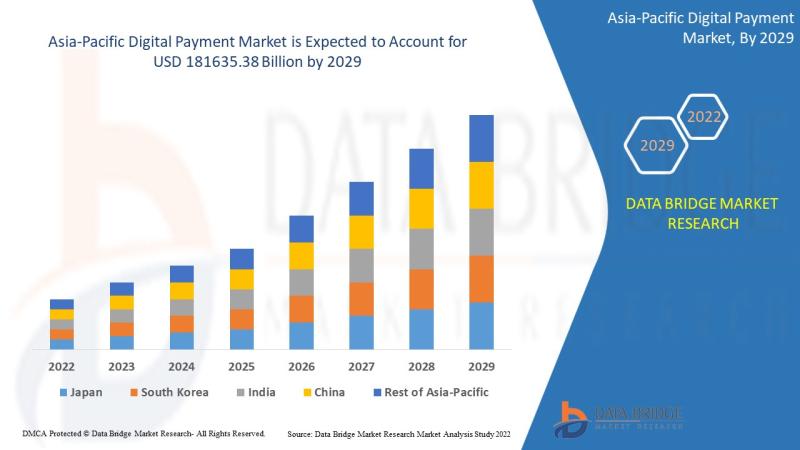

Global digital payment market was valued at USD 40322.02 million in 2021 and is expected to reach USD 181635.38 billion by 2029, registering a CAGR of 20.70% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ :

https://www.databridgemarketresearch.com/request-a-sample/?dbmr=asia-pacific-digital-payment-market

Key Players Mentioned in the Asia-Pacific Digital Payment market Research Report:

ACI Worldwide (U.S.), PayPal, Inc. (U.S.), Novatti Group Ltd (Australia), Global Payments Inc. (U.S.), Visa (U.S.), Stripe, Inc. (Ireland), Google, LLC (U.S.), Finastra. (U.K.), SAMSUNG (South Korea), Amazon Web Services, Inc. (U.S.), Financial Software & Systems Pvt. Ltd. (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Apple Inc. (U.S.), Fiserv, Inc. (U.S.), WEX Inc. (U.S.), wirecard (U.S.), Mastercard. (U.S.) among many others.

The comprehensive Asia-Pacific Digital Payment market report helps achieve valuable trends, an insight into consumer behavior, and visualizations that will empower to conduct effective competitor analysis. This full market report brings the results of market-driven research to life, giving users a data analysis tool to create actionable strategies from a range of consumer-driven insights. With such market document, businesses can be made more intelligent and more efficient that ultimately meet the needs of target audience and that leads to accelerate the commercial success significantly. An international Asia-Pacific Digital Payment market research report works the best in providing the holistic view of the market.

Read Detailed Index of full Research Study @

https://www.databridgemarketresearch.com/reports/asia-pacific-digital-payment-market

Asia-Pacific Digital Payment Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

Emerging initiatives to adopt digital payments interface globally

The global efforts to adopt unified payments interface in combination with escalating rate of digitization especially in Asia-Pacific region is bolstering the growth of the market. Further, growing awareness about these interfaces' safety and security will drive the market growth. Additionally, the increasing trend of digitalization further offers numerous growth opportunities within the market.

Increased support by the government

Rising number of government initiatives and supportive policies by the central and state government in regards to promoting the growth of the market especially in APAC region will widen the scope of growth to a great extent. Asia-Pacific Digital Payment is one of the primary growth imperatives for countries in this region. Therefore, increased focus by the government will create numerous opportunities.

Furthermore, the factors such as rising urbanization, industrialization and growing number of smartphone users globally have further contributed to the overall market expansion during the forecast period. Additionally, growing number of payment interfaces on a daily basis and rising personal disposable income are anticipated to drive the market's growth rate.

Opportunities

Rising trend of e-commerce shopping

Growing number of e-commerce channels, changing customers fashion tastes and preferences and rising westernization will positively influence the market growth rate. The increasing proliferation of major e-commerce channels, especially Amazon, is fueling the growth rate.

Increasing internet adoption

Growing access to high speed internet and improving internet infrastructure in the developing economies will yet again propel the market growth rate. Penetration of 4G and 5G internet services will widen the scope of growth and expansion globally.

Asia-Pacific Digital Payment Market Regional Analysis:

North America: (United States, Canada, Europe, Germany, France, U.K., Italy, Russia)

Asia-Pacific: (China, Japan, South Korea, Australia, Taiwan, Indonesia, Thailand, Malaysia)

Latin America: (Mexico, Brazil, Argentina, Colombia)

Middle East & Africa: (Turkey, Saudi Arabia, UAE)

Based on the Asia-Pacific Digital Payment Industry Market Segmentations:

Offering

Solutions

Payment Gateway Solutions

Payment Processing Solutions

Payment Wallet Solutions

Payment Security and Fraud Management Solutions

Point of Sale (POS) Solutions

Services

Professional Services

Consulting

Implementation

Support and Maintenance

Managed Services

Deployment Model

On Premises

Cloud

Organization Size

Large Enterprises

Small & Medium Enterprises (SMEs)

Mode of Payment

Payment Cards

Point of Sale

Unified Payments Interface (UPI) Service

Mobile Payment

Online Payment

Mode of Usage

Mobile Application

Desktop/Web Browser

Technology

Application Programming Interface (API)

Data Analytics and ML

Digital Ledger Technology (DLT)

AI and IoT

Biometric Authentication

Use Case

Person (P/C)

Merchant/ Business

Government

End User

Commercial

Consumer

Asia-Pacific Digital Payment Market Report Objectives

Analyzing the size of the Asia-Pacific Digital Payment market on the basis of value and volume

Accurately calculating the market shares, consumption, and other vital factors of different segments of the Asia-Pacific Digital Payment market

Exploring key dynamics of the Asia-Pacific Digital Payment market

Highlighting important trends of the Asia-Pacific Digital Payment market in terms of production, revenue, and sales

Deeply profiling top players of the Asia-Pacific Digital Payment market and showing how they compete in the industry

Studying manufacturing processes and costs, product pricing, and various trends related to them

Showing the performance of different regions and countries in the Asia-Pacific Digital Payment market

Forecasting the market size and share of all segments, regions, and the market.

Make an Enquiry before Buying@

https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=asia-pacific-digital-payment-market

Recent Developments

Fiserv will introduce EnteractSM, a brand-new cloud-based customer relationship management (CRM) platform for financial institutions, in November 2021. A Microsoft Azure-based integration framework offered by Enteract allows for real-time process integration across core banking, enterprise content management, and digital channels. It also synchronises consumer data with back-end systems.

Virgin Money and Global Payments Inc. signed a contract in September 2021 to use Global Payments' distinctive two-sided network to give Virgin Money consumers access to industry-leading Asia-Pacific Digital Payment experiences worldwide.

RealNet is a new cloud-based software as a service (SaaS) platform that will enable account-to-account (A2A) transactions for companies, individuals, and governments across real-time payment networks. RealNet was introduced by FIS in April 2021.

Some of the key questions answered in these Asia-Pacific Digital Payment market reports:

What will the market growth rate, growth momentum or acceleration market carries during the forecast period?

Which are the key factors driving the Asia-Pacific Digital Payment ?

Which region is expected to hold the highest market share in the Asia-Pacific Digital Payment ?

What trends, challenges and barriers will impact the development and sizing of the Global Asia-Pacific Digital Payment ?

What is sales volume, revenue, and price analysis of top manufacturers of Asia-Pacific Digital Payment ?

What are the Asia-Pacific Digital Payment opportunities and threats faced by the vendors in the global Asia-Pacific Digital Payment Industry?

Table of Contents

Report Overview: It includes major players of the Asia-Pacific Digital Payment market covered in the research study, research scope, and Market segments by type, market segments by application, years considered for the research study, and objectives of the report.

Growth Trends: This section focuses on industry trends where market drivers and top market trends are shed light upon. It also provides growth rates of key producers operating in the Asia-Pacific Digital Payment market. Furthermore, it offers production and capacity analysis where marketing pricing trends, capacity, production, and production value of the Asia-Pacific Digital Payment market are discussed.

Market Share by Manufacturers: Here, the report provides details about revenue by manufacturers, production and capacity by manufacturers, price by manufacturers, expansion plans, mergers and acquisitions, and products, market entry dates, distribution, and market areas of key manufacturers.

Market Size by Type: This section concentrates on product type segments where production value market share, price, and production market share by product type are discussed.

Market Size by Application: Besides an overview of the Asia-Pacific Digital Payment market by application, it gives a study on the consumption in the Asia-Pacific Digital Payment market by application.

Production by Region: Here, the production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Consumption by Region: This section provides information on the consumption in each regional market studied in the report. The consumption is discussed on the basis of country, application, and product type.

Company Profiles: Almost all leading players of the Asia-Pacific Digital Payment market are profiled in this section. The analysts have provided information about their recent developments in the Asia-Pacific Digital Payment market, products, revenue, production, business, and company.

Market Forecast by Production: The production and production value forecasts included in this section are for the Asia-Pacific Digital Payment market as well as for key regional markets.

Market Forecast by Consumption: The consumption and consumption value forecasts included in this section are for the Asia-Pacific Digital Payment market as well as for key regional markets.

Value Chain and Sales Analysis: It deeply analyzes customers, distributors, sales channels, and value chain of the Asia-Pacific Digital Payment market.

Key Findings: This section gives a quick look at important findings of the research study.

New Business Strategies, Challenges & Policies are mentioned in Table of Content, Request TOC @ https://www.databridgemarketresearch.com/toc/?dbmr=asia-pacific-digital-payment-market

Top Trending Reports by DBMR:

https://waoop.com/read-blog/64390

https://waoop.com/read-blog/64391

https://waoop.com/read-blog/64393

https://waoop.com/read-blog/64394

https://waoop.com/read-blog/64396

https://waoop.com/read-blog/64397

https://waoop.com/create-blog//

https://waoop.com/read-blog/64399

https://waoop.com/read-blog/64400

https://waoop.com/read-blog/64401

https://waoop.com/read-blog/64402

https://waoop.com/read-blog/64403

https://waoop.com/read-blog/64404

https://waoop.com/read-blog/64405

https://waoop.com/read-blog/64389

https://wo.lyoncat.com/read-blog/3534

https://wo.lyoncat.com/read-blog/3535

https://wo.lyoncat.com/read-blog/3536

https://wo.lyoncat.com/read-blog/3537

https://wo.lyoncat.com/read-blog/3538

https://wo.lyoncat.com/read-blog/3539

https://wo.lyoncat.com/read-blog/3541

https://wo.lyoncat.com/read-blog/3543

https://wo.lyoncat.com/read-blog/3544

https://wo.lyoncat.com/read-blog/3545

https://wo.lyoncat.com/read-blog/3546

https://wo.lyoncat.com/read-blog/3548

https://wo.lyoncat.com/read-blog/3549

https://wo.lyoncat.com/read-blog/3550

https://wo.lyoncat.com/read-blog/3533

https://ertaza.com/read-blog/5824

https://ertaza.com/read-blog/5825

https://ertaza.com/read-blog/5826

https://ertaza.com/read-blog/5827

https://ertaza.com/read-blog/5828

https://ertaza.com/read-blog/5829

https://ertaza.com/read-blog/5830

https://ertaza.com/read-blog/5831

https://ertaza.com/read-blog/5833

https://ertaza.com/read-blog/5834

https://ertaza.com/read-blog/5835

https://ertaza.com/read-blog/5836

https://ertaza.com/read-blog/5837

https://ertaza.com/read-blog/5838

https://ertaza.com/read-blog/5823

https://9jacommunity.com/posts/5545

https://9jacommunity.com/posts/5546

https://9jacommunity.com/posts/5547

https://9jacommunity.com/posts/5548

https://9jacommunity.com/posts/5549

https://9jacommunity.com/posts/5552

https://9jacommunity.com/

https://9jacommunity.com/posts/5550

https://9jacommunity.com/posts/5551

https://9jacommunity.com/posts/5554

https://9jacommunity.com/posts/5555

https://9jacommunity.com/posts/5556

https://9jacommunity.com/posts/5557

https://9jacommunity.com/posts/5559

https://9jacommunity.com/posts/5558

https://www.bookmark4you.com/new.php?url=https%3A%2F%2Fwww.databridgemarketresearch.com%2Freports%2Fglobal-aircraft-oxygen-system-market&step=1&submit=Next...

https://www.bookmark4you.com/new.php?url=https%3A%2F%2Fwww.databridgemarketresearch.com%2Freports%2Fglobal-darlington-transistor-market&step=1&submit=Next...

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email - corporatesales@databridgemarketresearch.com

Data Bridge Market Research Pvt Ltd is a multinational management consulting firm with offices in India and Canada. As an innovative and neoteric market analysis and advisory company with unmatched durability level and advanced approaches. We are committed to uncover the best consumer prospects and to foster useful knowledge for your company to succeed in the market.

Data Bridge Market Research is a result of sheer wisdom and practice that was conceived and built-in Pune in the year 2015. The company came into existence from the healthcare department with far fewer employees intending to cover the whole market while providing the best class analysis. Later, the company widened its departments, as well as expands their reach by opening a new office in Gurugram location in the year 2018, where a team of highly qualified personnel joins hands for the growth of the company. "Even in the tough times of COVID-19 where the Virus slowed down everything around the world, the dedicated Team of Data Bridge Market Research worked round the clock to provide quality and support to our client base, which also tells about the excellence in our sleeve."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asia-Pacific Digital Payment Market Size, Growth 20.70%, Industry Analysis, Trends, Major Players and Forecast 2022-2029 here

News-ID: 3029274 • Views: …

More Releases from Data Bridge Market Research

Fire Resistant Glass Market Advances with Intumescent Coatings, Hybrid Laminates …

Fire resistant glass market is growing at a high CAGR during the forecast period 2024-2031.

Fire Resistant Glass Market is positioned for robust growth, and shifting market dynamics reshaping the competitive landscape. DataM Intelligence's new report provides data-driven insights, SWOT analysis, and marketing-ready intelligence for businesses seeking to improve market penetration and campaign ROI.

Get your exclusive sample report today: (corporate email gets priority access): https://datamintelligence.com/download-sample/fire-resistant-glass-market?vs

Fire Resistant Glass Market Overview &…

Rising Demand for Advanced Treatments to Propel Obliterative Bronchiolitis Marke …

The Obliterative Bronchiolitis Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Obliterative Bronchiolitis market forward, including increasing market share, dynamic segmentation,…

Medical-Social Working Services Market Industry Trends and Forecast to 2030

This Medical-Social Working Services Market report has been prepared by considering several fragments of the present and upcoming market scenario. The market insights gained through this market research analysis report facilitates more clear understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. It consists of most-detailed market segmentation, thorough analysis of major market players, trends in consumer and…

Global Marine Insurance Market to Grow at 4.50% CAGR, Reaching USD 39.87 Billion …

The Marine Insurance Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Marine Insurance market forward, including increasing market share, dynamic segmentation,…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…