Press release

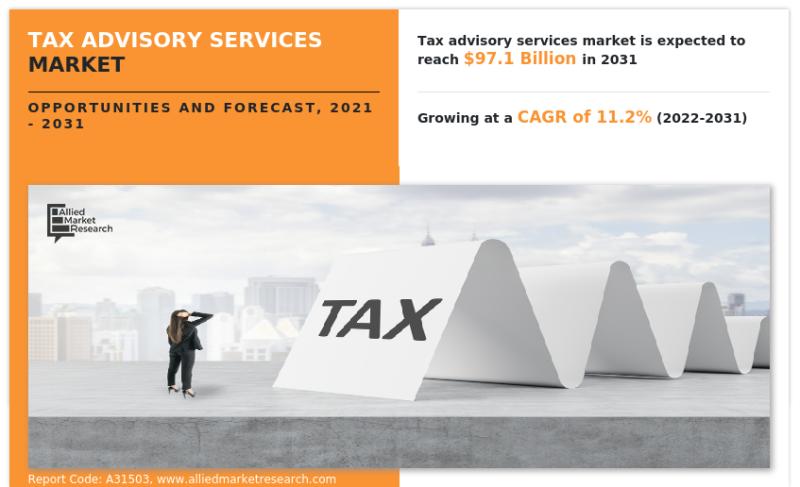

Tax Advisory Services Market to Reach $97.1 Billion by 2031 | Aon PLC., Bank of America Corporation, Citigroup Inc., CGI, Inc., Cognizant, CSC consulting services, CREDIT SUISSE GROUP AG, Deloitte, Goldman Sachs

Increase in adoption of tax advisory services for reducing additional taxational costs and optimizing operations, digitalization in the business tax advisory services industry, penetration of high-speed internet, and automation of tax consulting processes are to drive the growth of the global tax advisory services market. Prevalence of economic recession, instability in global financial sectors, and a highly unpredictable market during the pandemic negatively impacted the global market surge.The global tax advisory services market was valued at $34.6 billion in 2021, and is projected to reach $97.1 billion by 2031, growing at a CAGR of 11.2% from 2022 to 2031.

Report Sample PDF : https://www.alliedmarketresearch.com/request-sample/31953

Analysis of financial and tax issues, formulation of solutions, and formulation of suggestions are all part of the tax advisory service, which is intended to give clients-from individuals to businesses-advice on taxation.

Competitive Landscape-

Aon PLC., Bank of America Corporation, Citigroup Inc., CGI, Inc., Cognizant, CSC consulting services, CREDIT SUISSE GROUP AG, Deloitte, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, Northern Trust Corporation, PWC, Wells Fargo, Tax Scouts, Taxfyle

The report also covers their tactical developments, such as product launches, acquisitions & mergers, new collaborations, joint alliances, research & development, investments, and regional development of significant companies in the industry at a global and regional level.

Assessment of Strategic Partnerships-

The global tax advisory services market is evaluated on the premise of product or service, industry vertical, application, and region. The market has included regions from North America (Mexico, Canada, and the United States), Europe (Italy, Germany, France, Spain, the United Kingdom, and the rest of the continent), Asia-Pacific (Japan, Australia, South Korea, China, India, and the rest of the Asia-Pacific), and LAMEA (Africa, Latin America, and the Middle East).

The expert specialists at Allied Market Research keep in-depth analyses of the market environment and accurately predict the necessary driving and restraining factors. The stakeholders can build their business plans on these factors.

Key Points from the Report-

• Top players operating in the tax advisory services market

• Major revenue-generating sectors with regional trends and opportunities

• Regulations and development inclinations

• Portfolios of companies, along with their financial information and investment strategies

• Venture Entrepreneurs

Inquire before Buying this Research @ https://www.alliedmarketresearch.com/purchase-enquiry/31953

KEY BENEFITS FOR STAKEHOLDERS

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business analytics in Fintech market forecast from 2021 to 2031 to identify the prevailing business analytics in Fintech market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the business analytics in Fintech market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global business analytics in Fintech market trends, key players, market segments, application areas, and market growth strategies.

Tax Advisory Services Market Report Highlights

Organization Size

Large Enterprises

Small and Medium-Sized Enterprises

Type

Direct Tax Advisory

Direct Tax Advisory

Income Tax

Corporate Tax

Property Tax

Capital Gains tax

Others

Indirect Tax Advisory

Industry Vertical

IT and Telecom

Manufacturing

Retail and E-Commerce

Public Sector

BFSI

Healthcare

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Netherlands, Rest Of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Singapore, Rest Of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Full Report:

https://www.alliedmarketresearch.com/tax-advisory-services-market-A31503

Foreign Exchange Services Market : https://www.alliedmarketresearch.com/foreign-exchange-services-market-A07394

Credit Card Issuance Services Market :

https://www.alliedmarketresearch.com/credit-card-issuance-services-market-A31800

Management Consulting Services Market : https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Factoring Services Market :

https://www.alliedmarketresearch.com/factoring-services-market-A17187

ATM Managed Services Market : https://www.alliedmarketresearch.com/atm-managed-services-market

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Tax Advisory Services Market to Reach $97.1 Billion by 2031 | Aon PLC., Bank of America Corporation, Citigroup Inc., CGI, Inc., Cognizant, CSC consulting services, CREDIT SUISSE GROUP AG, Deloitte, Goldman Sachs here

News-ID: 3005138 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Tax

Tax Accountant Launches Expert Tax Advisory Services for Complex UK Tax Issues

Birmingham, UK - Tax Accountant, a premier provider of tailored tax solutions, is proud to announce the introduction of its new Specialist Tax Advice service. Aimed at tackling the multifaceted tax challenges faced by individuals and businesses in the UK, this service is set to revolutionize how tax compliance and optimization are approached.

As tax laws become increasingly complex and the implications of non-compliance more severe, the need for specialized tax…

Legal Tax Defense Offers Tax Relief Services to Successfully Settle IRS Tax Debt …

Legal Tax Defense provides expert guidance and strategies to navigate IRS negotiations and reduce tax liabilities.

Legal Tax Defense, Inc., a premier provider of tax resolution services, is now providing strategic assistance and professional help for those who find IRS tax debt to be stressful and intimidating. The firm assists taxpayers in understanding their alternatives for efficiently managing and lowering tax liabilities by offering a range of specialist services.

"Handling IRS tax…

Legal Tax Defense Providing Strategic Assistance to Settle Tax Debts for Tax Pay …

Fulfill Tax Obligations and Prevent Legal Issues.

Legal Tax Defense, a premier firm specializing in tax resolution, proudly announces its updated services aimed at helping clients effectively settle their tax debts. With a focus on alleviating the financial and legal pressures associated with unpaid taxes, Legal Tax Defense offers a lifeline to individuals and businesses struggling with tax liabilities.

Understanding the options available for settling tax debts [https://www.legaltaxdefense.com/settling-tax-debts/] is crucial in taking…

Bidding At The Tax Sale - Tax Sale Success Masterclass with The Tax Lien Lady

Joanne Musa, founder of TaxLienLady.com is holding a Tax Sale Success Masterclass on Bidding at the Tax Sale on Thursday, November 10 at 7:00 pm Eastern Time.

Tax lien and tax deed investing can be very profitable. Tax Lien investors can earn interest rates that are much higher than current bank rates without the risk of the stock market. Joanne Musa, known online as the tax lien lady, has been helping…

Tax Software Market – Major Technology Giants in Buzz Again | TurboTax, Tax Sl …

The Latest Released Tax Software market study has evaluated the future growth potential of Global Tax Software market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers,…

Tax Software Market to Eyewitness Massive Growth by 2026 | Tax Act, Tax Slayer, …

The latest independent research document on Global Tax Software examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Tax Software study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile and strategies.…