Press release

Fraud Detection and Prevention Market Analysis by Solution, Service, Vertical, Deployment Mode, Region and Key Players FICO, SAP, Fiserv, EMC, Microsoft Corporation

The Global Fraud Detection and Prevention Market size in 2022 was 29.68 billion USD. It is projected to reach 125.11 billion USD by 2030 with a CAGR of 19.7% for the forecast period of 2023-2030. Fraud Detection and Prevention Market by Solution (Fraud Analytics, Authentication, and GRC), Service (Managed and Professional), Vertical (BFSI, Retail and eCommerce, and Travel and Transportation), Deployment Mode) and Region (North America, Europe, Asia-Pacific, Middle East and Africa and South America)Get a FREE Sample Copy of this Report with Graphs and Charts at: https://www.delvens.com/get-free-sample/fraud-detection-and-prevention-market-trends-forecast-till-2028

The Global companies operating in Fraud Detection and Prevention Market are Total System Services, Inc.; Software AG; SAS Institute, Inc.; SAP SE; Oracle; IBM; Fiserv, Inc.; Experian plc; Equifax, Inc.; BAE Systems; ACI Worldwide, Inc.; IBM Corporation; BAE System; Uplexis, Experian Information Solutions Inc.; ACI Worldwide; and Fair Isaac Corporation.

In April 2021, SURVEIL-X, an AI-powered suitability and monitoring solution for the wealth and insurance sector, was introduced by NICE Actimize. SURVEIL-X is the name of the solution created on a comprehensive surveillance platform.

In April 2021, IBM Security partnered with HCL Technologies (HCL) to unify and streamline threat management through a modernized security operation center platform. This partnership expands on HCL and IBM's recent alliance extension to guide businesses with digital transformation.

Fraud detection and prevention refers to the process of identifying and mitigating fraudulent activities or behaviors in various domains such as financial transactions, online transactions, insurance claims, identity theft, and more. Fraud can involve deceitful or dishonest acts with the intention of gaining an unfair advantage or causing financial loss to others.

Fraud detection involves the use of various techniques, technologies, and tools to identify potential fraud or suspicious activities. These may include data analysis, statistical modeling, machine learning algorithms, and artificial intelligence (AI) techniques. Fraud prevention, on the other hand, involves taking proactive measures to prevent fraud from occurring in the first place, such as implementing robust security measures, conducting thorough background checks, and educating users or employees about potential fraud risks.

The fraud detection and prevention market is driven by various factors that contribute to its growth and demand.

Some of the key drivers of the fraud detection and prevention market include:

Increasing Instances Of Fraud: As fraudulent activities continue to evolve and become more sophisticated, there is a growing need for effective fraud detection and prevention solutions. Organizations across industries, including financial institutions, e-commerce platforms, insurance companies, and government agencies, are increasingly adopting advanced fraud detection and prevention technologies to safeguard against financial losses and reputational damage caused by fraud.

Rising adoption of digital channels: With the rapid growth of digital transactions, online banking, e-commerce, and mobile payments, the risk of fraud has also increased. The increasing adoption of digital channels has provided new opportunities for fraudsters to exploit vulnerabilities, leading to a higher demand for robust fraud detection and prevention solutions to protect against cyber fraud, identity theft, and other fraudulent activities in the digital space.

Stringent regulatory requirements: Regulatory bodies around the world have implemented stringent regulations to combat fraud and protect consumers. Compliance with these regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), General Data Protection Regulation (GDPR), and Anti-Money Laundering (AML) regulations, requires organizations to have effective fraud detection and prevention measures in place. This has driven the demand for fraud detection and prevention solutions to ensure compliance and mitigate regulatory risks.

Major and Growing Markets

In 2020, North America held the top regional market position and contributed more than 36% of global sales. The growth of the regional market was influenced by an increase in the number of instances involving payment fraud, identity thefts, and money laundering in the United States and Canada. Due to increasing investments made by several enterprises to prevent data breaches and enhance security IT infrastructure, the market will continue to develop at a steady Pace. The regional demand will continue to grow over the upcoming years as a result of the tightening of data security compliance regulations and the requirement to follow them in order to avoid costly fines.

During the course of the projected period, Asia Pacific is anticipated to become the region with the quickest rate of growth. Businesses and governments in this region have improved their security infrastructure as a result of digital acceleration. Many awareness campaigns focusing on fraud prevention and detection are supported in Asian nations as part of the security architecture. Enterprises are anticipated to embrace cutting-edge security solutions as a result of the rising fraud cases, which will support regional market expansion over the forecast period.

Market Segments

The fraud detection and prevention market can be segmented into various categories based on factors such as type of fraud, industry vertical, deployment mode, and organization size.

Let's explore some of these segments and their growth prospects:

Type of Fraud: Fraud can occur in different forms, such as payment fraud, identity fraud, insider fraud, cyber fraud, and others. Each type of fraud requires different techniques and tools for detection and prevention. The market for fraud detection and prevention solutions is expected to witness significant growth across all these segments due to the increasing sophistication and complexity of fraud schemes.

Industry Vertical: Fraud can impact various industries, including banking and financial services, healthcare, retail, e-commerce, government, insurance, and others. Each industry has its unique fraud risks and compliance requirements, which drive the demand for industry-specific fraud detection and prevention solutions. The market is expected to witness growth in all these verticals as organizations prioritize protecting themselves and their customers from fraudulent activities.

Deployment Mode: Fraud detection and prevention solutions can be deployed on-premises or in the cloud. Cloud-based solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness. The market for cloud-based fraud detection and prevention solutions is expected to grow at a faster rate compared to on-premises solutions as more organizations adopt cloud computing.

Organization Size: Fraud detection and prevention solutions cater to organizations of different sizes, including small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly realizing the importance of fraud detection and prevention to safeguard their assets and reputation. Hence, the market for fraud detection and prevention solutions for SMEs is expected to grow at a significant rate.

Conclusion

The fraud detection and prevention market is expected to witness significant growth due to increasing fraud risks, changing regulatory landscape, and technological advancements. The market can be segmented by type of fraud, industry vertical, deployment mode, organization size, and region, each with unique growth opportunities. The adoption of technologies like AI and ML will improve the accuracy and efficiency of fraud detection and prevention processes. Organizations investing in robust solutions and keeping up with market trends are likely to gain a competitive advantage.

Direct Purchase of Fraud Detection and Prevention Market Research Report at: https://www.delvens.com/checkout/fraud-detection-and-prevention-market-trends-forecast-till-2028

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

SALES@DELVENS.COM

WEBSITE: https://delvens.com/

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market Analysis by Solution, Service, Vertical, Deployment Mode, Region and Key Players FICO, SAP, Fiserv, EMC, Microsoft Corporation here

News-ID: 3001797 • Views: …

More Releases from Delvens

Flow Wrap Packaging Market with Growth, Trends and Top Key Competitors Analysis

Flow Wrap Packaging Market size was estimated at USD 22,364 million in 2024 and is projected to reach USD 37,833.8 million in 2031 at a CAGR of 7.8 % during the forecast period 2025-2031.

Flow wrap packaging is popular due to its ability to provide efficient, high-speed packaging while maintaining the integrity of the product inside. The material typically used for flow wrap packaging includes plastic films like polypropylene, polyethylene, and…

Oil and Gas Process Simulation Software Market Global Analysis by Component, Ope …

Oil and Gas Process Simulation Software Market: by Component (Software and Services), Operation Type (Off-Shore, On-Shore, Heavy Oil and Unconventional), Application (Upstream, Midstream, Oil and Gas Processing, Cryogenic Processes, Refining, Petrochemicals and Green Engineering), and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The Oil and Gas Process Simulation Software Market size was estimated at USD 1.14 billion in 2023 and is projected to reach USD…

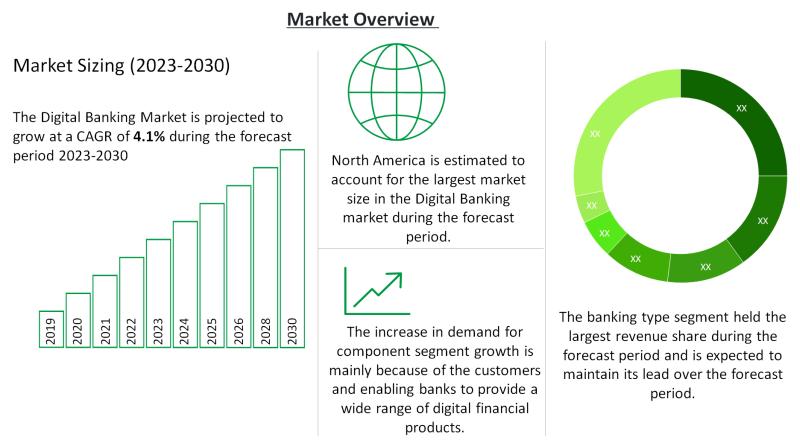

Digital Banking Market Business Growth: Alkami, Apiture, Appway, Backbase, BNY M …

Digital Banking Market Size By Service (Transactional [Cash Deposits & Withdrawals, Fund Transfers, Auto-Debit/Auto-Credit Services, Loans], Non-Transactional [Information Security, Risk Management, Financial Planning, Stock Advisory]) and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The global Digital Banking Market size was estimated at USD 8341.2 Billion in 2023 and is projected to reach USD 11374.2 billion in 2030 at a CAGR of 4.1% during the forecast…

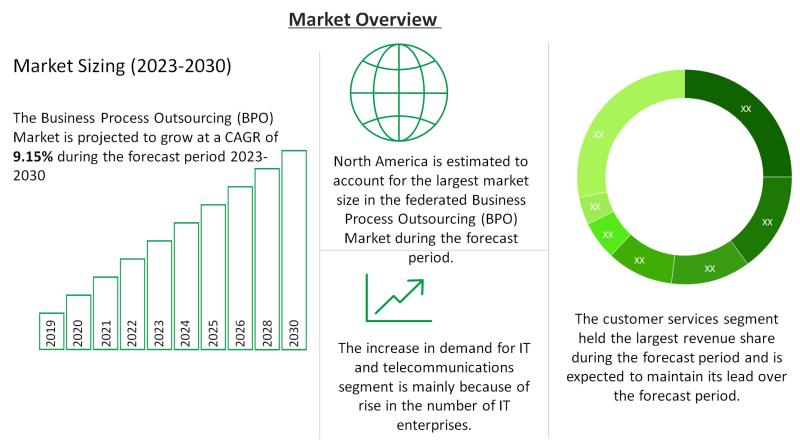

Business Process Outsourcing (BPO) Market Demands, Shares, Overview, Growth, Bus …

The market for business process outsourcing (BPO) is expanding as a result of factors such as businesses' increasing emphasis on enhancing productivity and organizational agility, cutting costs, and accelerating key capabilities to survive the rapidly changing business dynamics. Additionally, a lot of businesses are concentrating on lowering their operating expenses so they can access global resources to satisfy the rising market needs. These factors have promoted the use of market…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…