Press release

Digital Banking Market Business Growth: Alkami, Apiture, Appway, Backbase, BNY Mellon, Oracle

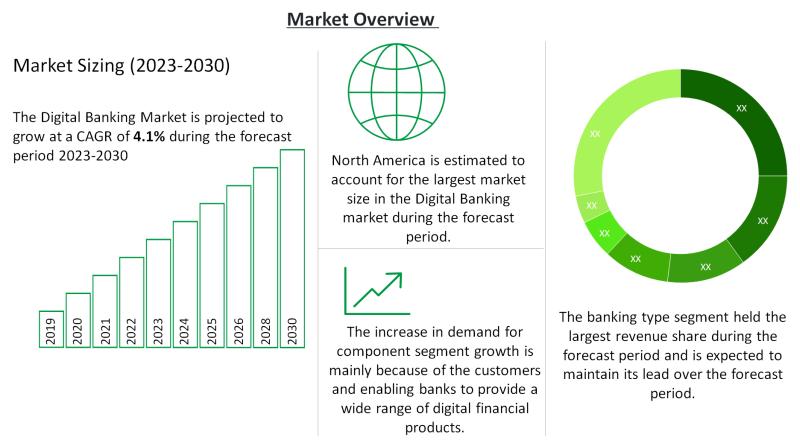

Digital Banking Market Size By Service (Transactional [Cash Deposits & Withdrawals, Fund Transfers, Auto-Debit/Auto-Credit Services, Loans], Non-Transactional [Information Security, Risk Management, Financial Planning, Stock Advisory]) and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The global Digital Banking Market size was estimated at USD 8341.2 Billion in 2023 and is projected to reach USD 11374.2 billion in 2030 at a CAGR of 4.1% during the forecast period 2023-2030.Top players covered in Digital Banking Market report: Alkami; Apiture; Appway; Backbase; BNY Mellon; CR2; EdgeVerve; ebankIT; Finastra; Fiserv; Intellect Design Arena; Mambu ; MuleSoft; nCino; NCR; NETinfo; Oracle; SAP; Sopra Banking Software; TCS; Technisys; Temenos; TPS; Velmie; Worldline.

Digital Banking Market Recent Developments:

In September 2021, TCS launched TCS BaNCS Cloud for Asset Servicing, which automates the servicing of all classes of assets across all markets, and is targeted at custodians, broker dealers, asset managers, and investment and private banks.

In April 2021, NCR and Google Cloud collaborated which would allow NCR to expand cloud availability of its digital banking software portfolio, which includes the NCR channels services for retail banking and payment processing platform.

Get a FREE Sample Copy of this Report with Graphs and Charts at: https://www.delvens.com/get-free-sample/digital-banking-market

The surge in the number of individuals utilizing the internet and the shift from conventional banking to online banking are the primary catalysts behind the expansion of the market. Additionally, the rise in the adoption of cloud-based platforms for attaining enhanced scalability further propels the market's growth. Nevertheless, the existence of security and compliance concerns within the digital lending platform poses obstacles to the expansion of the digital banking platform market. Moreover, the proliferation of machine learning and artificial intelligence within the digital banking platform, coupled with the increase in innovative banking services and the rise in corporate investors, is anticipated to present profitable opportunities for the market.

The retail banking sector is anticipated to experience the most substantial growth rate and is projected to possess a considerable market share throughout the anticipated period. This can be attributed to the considerable upsurge in the desire for digital banking platforms among individuals, as well as the increased investment by small and medium-sized enterprises in the nation's digital banking platform.

Scope of the Digital Banking Market Report:

The Digital Banking Market is segmented into various segments such as Type, Service and Region:

Based on type, the digital banking market is segmented into:

Retail banking

Corporate banking

Investment banking

Based on the service, the digital banking market is segmented into:

Transactional services:

Cash deposits and withdrawals

Fund transfers

Auto-debit/auto-credit services

Loans

Non-transactional services:

Information security

Risk management

Financial planning

Stock advisory

Based on region, the digital banking market is segmented into:

Asia Pacific

North America

Europe

South America

Middle East & Africa

Digital Banking Market Regional Analysis:

North America to Dominate the Market

North America is expected to have highest share due to the digital banking is a highly sought-after financial and banking service within the confines of North America.

Prominent regional banks are actively engaged in constructing their own internet-based banking services.

Frequently Asked Questions:

What are the years considered to study Digital Banking Market?

What is the compound annual growth rate (CAGR) of the Digital Banking Market?

Which region holds the largest market share in Digital Banking Market?

Which region is the fastest growing in Digital Banking Market?

Who are the major players in Digital Banking Market?

Direct Purchase of the Digital Banking Market Research Report at: https://www.delvens.com/checkout/digital-banking-market

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

SALES@DELVENS.COM

WEBSITE: https://delvens.com/

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Business Growth: Alkami, Apiture, Appway, Backbase, BNY Mellon, Oracle here

News-ID: 3341827 • Views: …

More Releases from Delvens

Flow Wrap Packaging Market with Growth, Trends and Top Key Competitors Analysis

Flow Wrap Packaging Market size was estimated at USD 22,364 million in 2024 and is projected to reach USD 37,833.8 million in 2031 at a CAGR of 7.8 % during the forecast period 2025-2031.

Flow wrap packaging is popular due to its ability to provide efficient, high-speed packaging while maintaining the integrity of the product inside. The material typically used for flow wrap packaging includes plastic films like polypropylene, polyethylene, and…

Oil and Gas Process Simulation Software Market Global Analysis by Component, Ope …

Oil and Gas Process Simulation Software Market: by Component (Software and Services), Operation Type (Off-Shore, On-Shore, Heavy Oil and Unconventional), Application (Upstream, Midstream, Oil and Gas Processing, Cryogenic Processes, Refining, Petrochemicals and Green Engineering), and region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The Oil and Gas Process Simulation Software Market size was estimated at USD 1.14 billion in 2023 and is projected to reach USD…

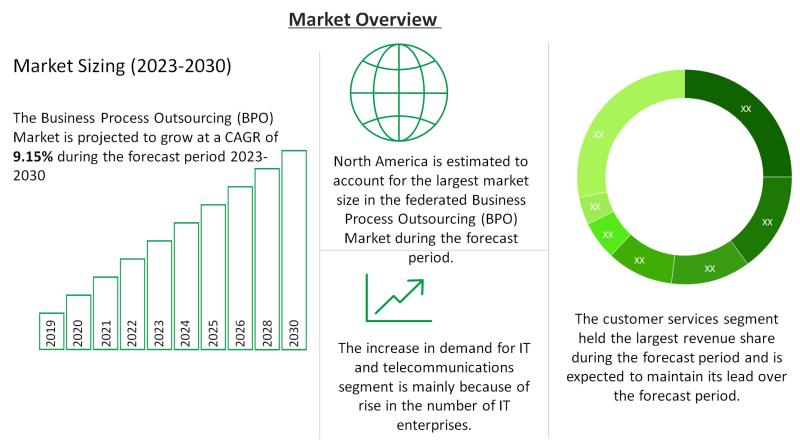

Business Process Outsourcing (BPO) Market Demands, Shares, Overview, Growth, Bus …

The market for business process outsourcing (BPO) is expanding as a result of factors such as businesses' increasing emphasis on enhancing productivity and organizational agility, cutting costs, and accelerating key capabilities to survive the rapidly changing business dynamics. Additionally, a lot of businesses are concentrating on lowering their operating expenses so they can access global resources to satisfy the rising market needs. These factors have promoted the use of market…

Data Center Outsourcing (DCO) Market 2023 Key Country Analysis: Atos SE, Capgemi …

The term "data center outsourcing" refers to a group of services offered by specialist IT companies for the implementation, upkeep, supervision, and optimal functioning of data center infrastructure and related components. The consumer group outsources these tasks to specialist IT suppliers because of their management expertise.

The Data Center Outsourcing (DCO) Market size was estimated at USD 252.99 billion in 2023 and is projected to reach USD 355.51 billion in 2030…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…