Press release

Equity Management Software Market Revenue Growth and Expected to Surpass Expectations by 2030

Global Equity Management Software Market is valued approximately USD $$ million in 2021 and is anticipated to grow with a healthy growth rate of more than $% over the forecast period 2022-2030.Request To Download Free Sample of This Strategic Report:-https://www.quadintel.com/request-sample/global-equity-management-software-market/QI037

The Equity Management Software refers to software solutions utilized to streamline and centralize the entire investment cycle, optimize processes, and enhance data and reporting. These software solutions used for tracking and management of time-consuming processes involved with issuing equity, maintaining compliance, receiving 409A valuations. The rising growth of equity investments and increasing adoption from Large and Medium-sized Enterprises as well as Strategic initiatives from leading market players are factors that are accelerating the global market demand. For instance, according to Statista - in December 2020, the total value of funds raised through private equity and venture capital deals in India was estimated at USD 2.37 billion, and this number is further increased to USD 3.04 billion in January 2022.

Furthermore, leading market players are coming up with new innovative solutions to capitalize the growing adoption of Equity Management Software. For instance, in July 2021, Massachusetts, USA based Fidelity Investment in partnership with Massachusetts, USA based Shoobx, a capitalization table management provider, launched an equity management solution for private companies. This new solution would also be helpful for companies preparing to file initial public offerings. Also, growing industrialization in developing regions and rising investment towards digitization across different industries are anticipated to act as a catalyzing factor for the market demand during the forecast period. However, risk associated with System Crashes and high deployment cost associated with these software solutions impede the growth of the market over the forecast period of 2022-2028.

The key regions considered for the global Equity Management Software Market study include Asia Pacific, North America, Europe, Latin America, and the Rest of the World. North America is the leading region across the world in terms of market share owing to the growing Private equity and venture capitalist investment and presence of leading market players in the region. Whereas, Asia Pacific is anticipated to exhibit a significant growth rate over the forecast period 2022-2028. Factors such as the thriving growth of equity market and increasing penetration of leading software vendors in the region, would create lucrative growth prospects for the Equity Management Software Market across the Asia Pacific region.

Request a Sample PDF copy of the report @-https://www.quadintel.com/request-sample/global-equity-management-software-market/QI037

Major market players included in this report are:

Carta

Certent

Capdesk

Capshare

Altvia Solutions

Preqin Solutions

Gust

Ledgy

Eqvista

Euronext

The objective of the study is to define market sizes of different segments & countries in recent years and to forecast the values to the coming eight years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within each of the regions and countries involved in the study. Furthermore, the report also caters the detailed information about the crucial aspects such as driving factors & challenges which will define the future growth of the market. Additionally, the report shall also incorporate available opportunities in micro markets for stakeholders to invest along with the detailed analysis of competitive landscape and product offerings of key players.

The detailed segments and sub-segment of the market are explained below:

By Type

Basic ($Under 50/Month)

Standard ($50-100/Month)

Senior ($Above 100/Month)

By Enterprise Size

Large Enterprises

Small and Medium-size Enterprises

Download Sample of This Strategic Report: -https://www.quadintel.com/request-sample/global-equity-management-software-market/QI037

By Application

Private Corporation

Start-ups

Listed Company

By Region:

North America

U.S.

Canada

Europe

UK

Germany

France

Spain

Italy

ROE

Asia Pacific

China

India

Japan

Australia

South Korea

RoAPAC

Latin America

Brazil

Mexico

Rest of the World

Request a Sample PDF copy of the report @-https://www.quadintel.com/request-sample/global-equity-management-software-market/QI037

Table of content

Market Overview

Market Definition and Scope

Market Dynamics

Market Industry Analysis

Market, Regional Analysis

Analysis of Leading Companies

Competitive Intelligence

Research Process

Market Analysis and Forecast, By Product Types

Some of the Key Questions Answered in this Report:

What is the Market dimension at the regional and country-level?

What are the key drivers, restraints, opportunities, and challenges of the Market, and how they are anticipated to influence the market?

What is the international (North America, Europe, Asia-Pacific, South America, Middle East and Africa) income value, manufacturing value, consumption value, import and export of Market?

Who are the world key producers of the Market Industry? How is their working state of affairs (capacity, production, sales, price, cost, gross, and revenue)?

What are the Market possibilities and threats confronted via the carriers in the world Market Industry?

Which application/end-user or product kind may also be seeking for incremental boom prospects? What is the market share of every kind and application?

What targeted method and constraints are keeping the Market?

What are the distinct sales, marketing, and distribution channels in the world industry?

What are the upstream uncooked substances and manufacturing gear of Market alongside with the manufacturing technique of Market?

What are the key market tendencies impacting the increase of the Market?

Economic have an impact on the Market enterprise and improvement vogue of the Market industry.

Request Full Report-https://www.quadintel.com/request-sample/global-equity-management-software-market/QI037

About Quadintel:

We are the best market research reports provider in the industry. Quadintel believes in providing quality reports to clients to meet the top line and bottom-line goals which will boost your market share in today's competitive environment. Quadintel is a 'one-stop solution' for individuals, organizations, and industries that are looking for innovative market research reports.

Get in Touch with Us:

Quadintel:

Email:sales@quadintel.com

Address: Office - 500 N Michigan Ave, Suite 600, Chicago, Illinois 60611, UNITED STATES

Tel: +1 888 212 3539 (US - TOLL FREE)

Website:https://www.quadintel.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Equity Management Software Market Revenue Growth and Expected to Surpass Expectations by 2030 here

News-ID: 3001255 • Views: …

More Releases from Quadintel

Smart Textiles for Military Market Business Expansion Strategies for the Market …

Quadintel's recent global " Smart Textiles for Military Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample…

China Home Appliances Market A Deep Dive into the Market: Trends, Insights, and …

Quadintel's recent global " China Home Appliances Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of…

Wireless Healthcare Market Unlocking New Growth Avenues in the Market: Strategie …

Quadintel's recent global " Wireless Healthcare Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

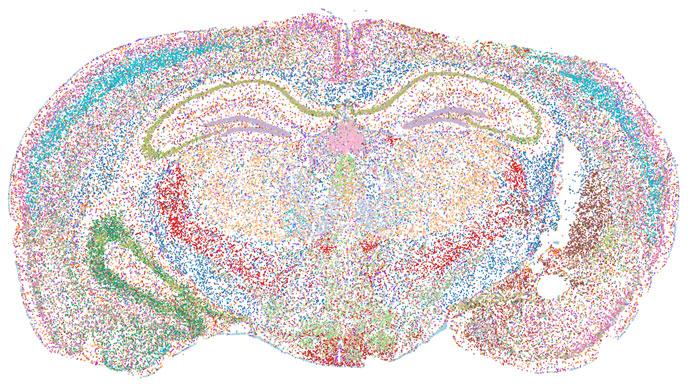

Spatial omics Market The Impact of Economic Conditions on the Market in 2023-203 …

Quadintel's recent global " Spatial omics Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

More Releases for Equity

Shah Equity Launches the World's First Integrated Global Private Equity & Hedge …

Shah Equity, a leading innovator in financial services, proudly announces the launch of the world's first integrated Global Private Equity & Hedge Fund. With a strategic focus on Commercial Real Estate, Healthcare, Home Services, and a robust Hedge Fund, Shah Equity is dedicated to maximizing value and fueling sustainable growth, all while expertly hedging investment risks.

In an era where traditional investment models face unprecedented challenges, Shah Equity steps forward with…

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Establishment Consultation,Chinese private equity company,

Pandacu China is a leading private equity firm that specializes in making long-term investments in small and medium-sized enterprises (SMEs) in China. The company was founded in China by a team of experienced finance professionals with a deep understanding of the Chinese market and a strong network of contacts in the private equity and venture capital industry.

https://boomingfaucet.com/

China Private Equity Establishment Consultation

E-mail:nolan@pandacuads.com

SMEs are the backbone of the Chinese economy, and they…