Press release

KSA is about to witness a BNPL wave which is already a USD 2 Billion reality. Explore the key trends supporting the market growth: Ken Research

• Online mode of payment will continue to dominate the BNPL industry in KSA due to Sharia compliant which promotes digital payments when compared to offline mode.• Covid-19 pandemic lead to substantial growth in the e-commerce industry, with 2.5 times faster than growth before the pandemic, leading to increasing online transactions in KSA.

• Increasing demand for extra credit line with less stringent KYC procedures without relying on CIBIL scores will be traction for consumers for utilization of BNPL services.

Surging Consumer base: With increasing participation from fintech companies in BNPL ground, its user base is making equally big strides. A major chunk of Saudi Arabian consumers have used BNPL payment methods such as Tamara in 2021 when compared to previous years, with more customers exploring the BNPL services. In just one year, the Middle East region has witnessed an upsurge in the number of companies offering BNPL solutions.

Growing Retailers: With the diminishing Covid-19 impact, the return of the offline shopping mode is being witnessed. BNPL players are not going let the opportunity pass by. They have already started collaborating with leading retailers to offer BNPL at physical stores at checkout points as a point-of-sale financing tool. The growing e-commerce market has pushed the retailers to go for different mode of user friendly payment mechanisms.

To learn more about this report Download a Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ2

Expanding Partnerships: BNPL entities are making their mark by creating value for merchants and offering straightforward financial products to customers. BNPL giant Tamara works with global retail leaders like Adidas, IKEA, L'Occitane, , as well as top regional brands like Namshi, Abyat, Faces, Niceone, and , across the GCC. In just one year, the Middle East region has witnessed an upsurge in the number of companies offering BNPL solutions.

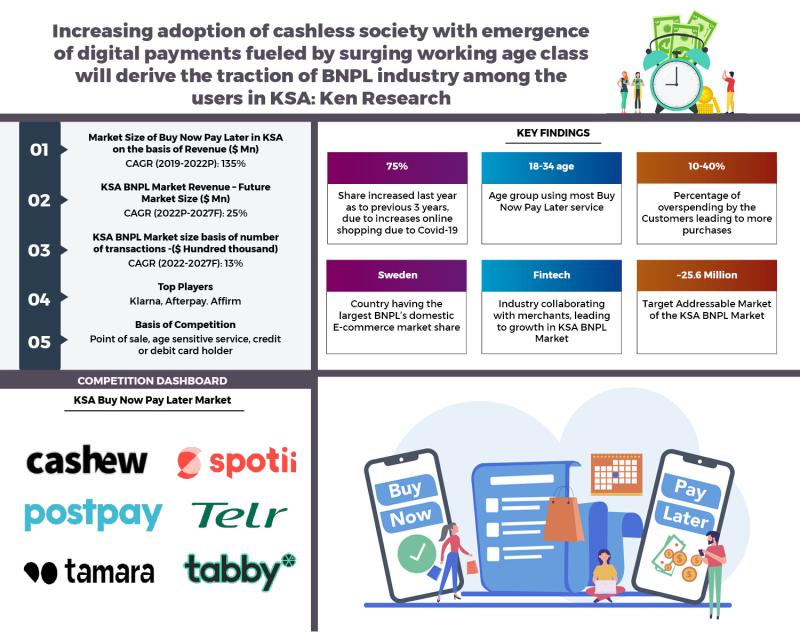

Moving to easy cashless credit: Increasing adoption of cashless society with emergence of digital payments fueled by surging working age class will derive the traction of BNPL industry among the users in KSA. With increasing demand for extra credit line with less stringent KYC procedures without relying on CIBIL scores will be traction for consumers for utilization of BNPL services.

The Report "KSA Buy Now Pay Later Market Outlook to 2027- Driven by digitalization, government support as a part of Saudi vision 2030 increasing Genz & millennials population due to influx of expatriates coupled with shifting preference towards easy interest free extra credit line sources" by Ken Research provides a comprehensive analysis of the potential Buy Now Pay Later industry in Saudi Arabia. People shifting from credit cards to BNPL as unlike credit cards, BNPL companies provide easy credit checks which are solely not based upon the CIBIL score, hence providing easy access to the services. Buy Now Pay Later Market in KSA recorded a positive CAGR on the basis of revenue generated in between 2022P and 2027E.

For more insights on the market intelligence, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/ksa-buy-now-pay-later-market-outlook-to-2027/596046-93.html

Key Segments Covered:-

KSA BNPL Market

By mode of payment

• Online

• Offline

By end user

• Ecommerce Giant

• Physical Retailers

• Travel and entertainment Merchants

• Food Merchants

By age group

• Below 24

• 24-36

• 36-50

• Above 50

Key Target Audience:-

• Fintech Companies

• BNPL players

• Retail merchants and chains

• Government and regulatory bodies

• New entrants in the BNPL space

• Associated or affiliated Banks with Insurance entities

Time Period Captured in the Report:-

• Historical Year: 2019-2021

• Base Year: 2022

• Forecast Period: 2023- 2027F

Visit this Link:- Request for custom report @ https://www.kenresearch.com/ask-customization.php?Frmdetails=NTk2MDQ2

Companies Covered:-

• Tabby

• Spotii

• Tamara

• Cashew

• PostPay

Key Topics Covered in the Report:-

• BNPL Industry positioning

• Socio demographic Outlook of Saudi Arabia

• Presence of Global BNPL Players

• Trends of BPNL Industry

• Market size of BPNL

• BNPL transaction process

• Key Features and developments in KSA BPNL

• SWOT Analysis of KSA BNPL

• Issues and Challenges in KSA BNPL

• Investment Analysis of players in BNPL Space

• Role of Government and regulations in KSA BNPL

• Porter's Five force Analysis in KSA BPNL

• Future Market Size of BNPL in KSA

Related Reports by Ken Research:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/uae-buy-now-pay-later-industry-outlook-to-2027/588867-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/malaysia-buy-now-pay-later-market-outlook-to-2027/596234-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/south-africa-buy-now-pay-later-market-outlook-to-2027/596049-93.html

Sec 49

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release KSA is about to witness a BNPL wave which is already a USD 2 Billion reality. Explore the key trends supporting the market growth: Ken Research here

News-ID: 2987643 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…