Press release

Operational Risk Management Solution Market: Report Highlights the Competitive Scenario with Impact of Drivers And Challenges 2028

The global operational risk management solution market size is expected to grow from US$ 1,656.4 million in 2021 to US$ 3,098.0 million by 2028; operational risk management solution market share is estimated to grow at a CAGR of 9.4% from 2021 to 2028.After the COVID-19 pandemic, corporate players have introduced changes in their operations by enabling flexible work schedules, allowing remote working, and enhancing the employee experience. The hybrid work models are defined as a more flexible, digital, and rewarding future for their employees. According to an article published by GENESIS INTEGRATION, 55% of the US workers want a work pattern that allows the mix of working from home and office. The article data also reveals that more than 2 in 5 working adults (42%) are willing to give up some percentage of their salary for higher flexibility at work. Further, 74% of newer generation would prefer either working from home or splitting work time between home and work, as per the article published by GENESIS INTEGRATION.

Get Exclusive Sample Pages of Operational Risk Management Market @: https://www.premiummarketinsights.com/sample/TIP00073381?utm_source=OpenPr&utm_medium=10640

The List of Companies -

1. Adapt IT Holdings Ltd

2. MetricStream, Inc.

3. RSA Security LLC

4. TPSCO LLC

5. Rombit NV

6. SAP SE

7. Shell International B.V.

8. Sphera Solutions, Inc.

9. TenForce

10. Cura Global GRC Solutions PTE LTD

The rising adoption of a potentially permanent hybrid workforce has led to an increase in operational risk management solutions due to the rise in cybersecurity attacks with remote working. Further, businesses also need to address the increasing risk of internal fraud. According to the article by Risk Management Intelligence in October 2021, employee fraud cases in Asia Pacific region have increased over the past year in the COVID-19 pandemic. Some of the essential risks include procurement fraud, cash theft, and falsification of expense claims. Further, business processes will continue to transform in hybrid working environments, thereby increasing the demand for operational risk management solutions due to high risks.

Internal controls and business continuity plans need to be reassessed and audited to ensure that operational and process risks are correctly mapped out and mitigated. Also, with increasing reliance on third-party service providers, including technology and business process outsourcing providers, organizations need to strengthen their third-party risk management strategy. Hence, with the rising adoption of the hybrid workforce model in the current scenario, several risks are also increasing, such as cybersecurity, internal fraud, and business process risks. Therefore, the growing implementation of hybrid work culture is creating significant opportunities for the future growth of the operational risk management solution market industry players.

Access full Report Description, TOC, Table of Figure, Chart, etc. @: https://www.premiummarketinsights.com/reports-tip/operational-risk-management-solution-market

TABLE OF CONTENTS

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 Global Operational Risk Management Solution Market - By Deployment

1.3.2 Global Operational Risk Management Solution Market - By Enterprises Size

1.3.3 Global Operational Risk Management Solution Market - By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Operational Risk Management Solution Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 North America

4.2.2 Europe

4.2.3 APAC

4.2.4 MEA

4.2.5 SAM

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. Operational Risk Management Solution Market- Key Market Dynamics

5.1 Market Drivers

5.1.1 Increasing Adoption of Operational Risk Management in Fintech Companies

5.1.2 Rising Instances of Cyber Attacks in Various Organizations

5.2 Market Restraints

5.2.1 Challenges Related to Operational Risk Management Solution

5.3 Market Opportunities

5.3.1 Ongoing Implementation of Hybrid Working Styles

5.4 Future Trends

5.4.1 Integration of Artificial Intelligence in Operational Risk Management

5.5 Impact Analysis of Drivers and Restraints

6. Operational Risk Management Solution Market - Global Market Analysis

6.1 Global Operational Risk Management Solution Market Overview

6.2 Global Operational Risk Management Solution Market Forecast and Analysis

6.3 Market Positioning- Top Five Players

7. Operational Risk Management Solution Market Revenue and Forecasts To 2028 - Deployment

7.1 Overview

7.2 Operational Risk Management Solution Market, By Deployment (2020 And 2028)

7.3 On-Premise

7.3.1 Overview

7.3.2 On-Premise: Operational Risk Management Solution Market Revenue and Forecast To 2028 (US$ Million)

7.4 Cloud

7.4.1 Overview

7.4.2 Cloud: Operational Risk Management Solution Market Revenue and Forecast To 2028 (US$ Million)

8. Operational Risk Management Solution Market Revenue and Forecasts To 2028 - Enterprise Size

8.1 Overview

8.2 Operational Risk Management Solution Market, By Enterprise Size (2020 And 2028)

8.3 SMEs

8.3.1 Overview

8.3.2 SMEs: Operational Risk Management Solution Market Revenue and Forecast To 2028 (US$ Million)

8.4 Large Enterprises

8.4.1 Overview

8.4.2 Large Enterprises: Operational Risk Management Solution Market Revenue and Forecast To 2028 (US$ Million)

The overall operational risk management solution market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the operational risk management solution market report. The process also serves the purpose of obtaining an overview and forecast for the operational risk management solution market forecast with respect to all the segments pertaining to the region. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data and gain more analytical insights into the operational risk management solution market analysis.

The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the operational risk management solution market.

Order a copy of this research Operational Risk Management Market research report at @: https://www.premiummarketinsights.com/buy/TIP00073381?utm_source=OpenPr&utm_medium=10640

Contact Us:

If you have any queries about this report or if you would like further information, please

Contact Person: Sameer Joshi

Phone: +1-646-491-9876

Email: sales@premiummarketinsights.com

About Us:

Premium Market Insights is a one stop shop of market research reports and solutions to various companies across the globe. We help our clients in their decision support system by helping them choose most relevant and cost-effective research reports and solutions from various publishers.

The market research industry has changed in last decade. As corporate focus has shifted to niche markets and emerging countries, a number of publishers have stepped in to fulfil these information needs. We have experienced and trained staff that helps you navigate different options and lets you choose best research solution at most effective cost.

Premium Market Insights has an extensive coverage of industry reports, company reports and country reports across all industries. In case your research needs are not met by syndicated reports offered by leading publishers, we can help you by offering a customized research solution by liaising with different research agencies saving your valuable time and money.

We provide best in class customer service and our customer support team is always available to help you on your research queries. Our commitment to customer service is best exemplified by free analyst support that we offer to our clients which sets us apart from any other provider. We also offer enterprise subscriptions which provide significant cost savings to our clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Operational Risk Management Solution Market: Report Highlights the Competitive Scenario with Impact of Drivers And Challenges 2028 here

News-ID: 2941526 • Views: …

More Releases from Business Market Insights

Laser Hair Removal Market Accelerates as Innovation, Consumer Awareness, and Aes …

The laser hair removal market is undergoing a transformative phase as evolving beauty standards, rapid technological innovation, and increasing preference for non-invasive aesthetic treatments continue to reshape the global personal care and dermatology landscape. Once considered a premium cosmetic procedure, laser hair removal is now becoming an integral part of modern grooming routines across diverse age groups and demographics.

Driven by continuous improvements in laser technology, treatment comfort, and customization capabilities,…

Veterinary Imaging Market Poised for Sustainable Growth Amid Rising Pet Humaniza …

The Global Veterinary Imaging Market continues its trajectory of steady, innovation-led expansion, fueled by rising adoption of advanced diagnostic solutions, deepening pet humanization trends, and escalating veterinary healthcare awareness worldwide. With significant developments reported in both technology adoption and service delivery, the veterinary imaging landscape is advancing to meet growing demand for higher diagnostic precision, faster clinical decision-making, and improved animal patient outcomes.

Veterinary imaging solutions - spanning X-ray, ultrasound,…

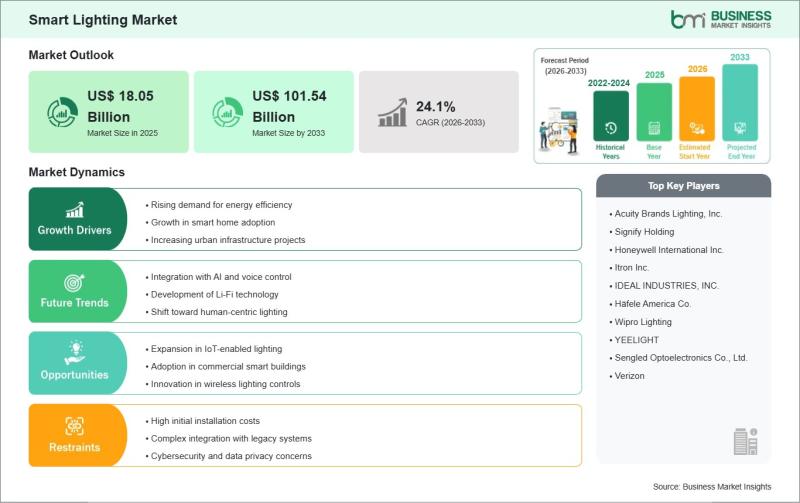

Smart Lighting Market to Skyrocket to US$101.54 Billion by 2033 from US$18.05 Bi …

The Smart Lighting Market is transforming everyday spaces into energy-efficient havens, powered by IoT, AI, and wireless controls that adapt to user needs and environments. Homeowners and businesses alike are discovering how connected bulbs and fixtures enhance ambiance while slashing energy use. The Smart Lighting Market size is expected to reach US$ 101.54 billion by 2033 from US$ 18.05 billion in 2025. The market is estimated to record a CAGR…

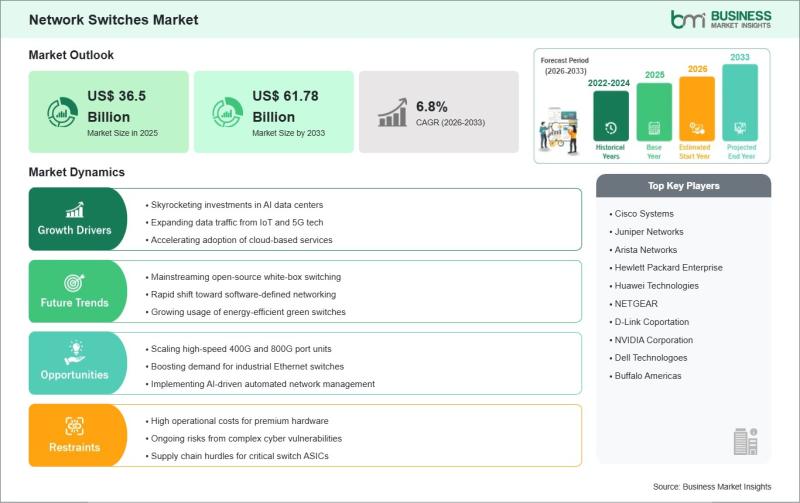

Network Switches Market Analysis: US$ 61.78 Billion Projection by 2033 at 6.8% G …

The Network Switches Market stands at the heart of digital transformation, powering seamless connectivity for enterprises embracing cloud computing, 5G, and IoT ecosystems. As businesses worldwide prioritize agile, secure networks, innovations in software-defined networking and high-speed Ethernet drive the evolution of this vital infrastructure.

Check valuable insights in the Network Switches Market report. You can easily get a sample PDF of the report - https://www.businessmarketinsights.com/sample/BMIPUB00032458?utm_source=OpenPr&utm_medium=10457

Executive Summary and Global Market Analysis:

Network…

More Releases for Risk

RiskWatch Launches Risk Management Software: Streamlined Risk Assessments and In …

RiskWatch International, a leading provider of compliance and risk management solutions, has announced the launch of its comprehensive Risk Management Software. This user-friendly platform empowers organizations of all sizes to proactively identify, assess, and mitigate risks, fostering a culture of resilience and success.

RiskWatch Risk Management Software delivers a robust suite of features, including:

● Comprehensive Risk Templates: Build a customized library of risk templates tailored to your specific needs, encompassing…

SMARTER RISK LAUNCHES REVOLUTIONARY AUTOMATED RISK CONTROL SOLUTION

Winston-Salem, N.C. - Smarter Risk, a risk control solutions provider, is proud to announce the launch of its newest product, Automated Risk Control (ARC) - a first-of-its-kind scalable risk control platform designed for the insurance industry.

ARC delivers unmatched speed, efficiency, and cost savings by automating the entire risk assessment process, from data collection to reporting. With assessments taking just 15 minutes and turnaround times of two business days, ARC…

Construction Risk Software Market is Booming Worldwide : Risk Decisions, Sword A …

2020-2025 Global Construction Risk Software Market Report - Production and Consumption Professional Analysis (Impact of COVID-19) is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Construction Risk Software Market. Some of the key players…

Future Growth In Risk Analytics Market - Segmented By Material Type (Software An …

The global risk analytics market was valued at, and is expected to reach a 2023 at a CAGR of +13%, during the forecast period (2018-2023). The market is segmented by type of offering, applications, end-user vertical, and geography. This report focuses on adoption of these solutions for various applications various regions. The study also emphasizes on latest trends, industry activities, and vendor market activities. Approximately 73% of the banks are…

Risk Analysis and Risk Management for Public Private Partnerships

Practical Seminar, 21st – 22nd March 2013, Berlin

For many public institutions that plan new projects in the sectors of public buildings, infrastructure or energy and waste, Public Private Partnerships are an attractive alternative to traditional tender and delivery strategies. However, risks in PPPs have to be identified, analysed and allocated to the right partner before embarking on a project.

• What is risk

• What types of risks exist for which type of…

Online Risk Check Analyzes Weighing Risk in Minutes

Mettler Toledo, the leading manufacturer of precision instruments, developed the Risk Check: An online tool to analyze the weighing risk of balances from all kinds of manufacturers. The Risk Check defines the weighing risk to optimize the performance and quality of a balance. It is based on the international weighing guideline Good Weighing Practice (GWP), which is appropriate for persons in charge of quality management in the pharmaceutical, chemical and…