Press release

Commercial Lending Market Latest Innovations, Impacting Factors, Growth opportunities 2031

The global commercial lending market size was US$ 9997 million in 2021. The global commercial lending market size is forecast to reach US$ 30756.8 million by 2030, growing at a compound annual growth rate (CAGR) of 13.3% during the forecast period from 2022 to 2030.A company borrowing money to cover operating costs, real estate purchases, or equipment purchases is known as commercial lending. Commercial lending also offers short-term loans to long-term real estate loans with repayment terms up to 30 years.

Furthermore, a borrower may need to provide collateral to secure a loan. When a loan defaults, the bank has an asset to fall back on. A bank also checks an applicant's credit score when approving a loan. Nonetheless, it will not be the only criterion to secure loans, as commercial loans are also valuable.

Download free sample of this report :-https://www.quadintel.com/request-sample/commercial-lending-market/QI040

Factors Influencing Market GrowthA lower interest rate on commercial loans to businesses and enterprises contributes to the market's global growth.

The rapid processing of loans and the simple sanctioning process make it a very convenient choice for businesses. Small businesses can also access substantial amounts of money by combining all their funding into a single loan through commercial lending. This is a major factor behind the market's expansion.

Technological innovation in the commercial lending market will provide major lucrative opportunities for the growth of the commercial lending market in the future.

Impact Analysis of COVID-19

An outbreak of COVID-19 has a significant impact on commercial lending. As most of the businesses went bankrupt, the number of commercial and industrial loans increased. The increased participation of small-business owners in commercial lending also contributed to this development.

Due to the increase in commercial loans during the pandemic as firms sought funding, many banks reported financial difficulties. During this pandemic, even previously hesitant internet users have turned to these channels for commercial loans because bank offices have closed and phone lines have jammed.

In turn, this has been one of the major growth factors for the global commercial lending market during the global health crisis.

Regional Insights

Asia-Pacific held dominant in the market in 2021 and is forecast to continue its dominance during the forecast period. Lenders have slowly begun to reopen their doors to provide commercial loans, which is propelling the market growth in this region. Further, rising commercial lending trends among retailers, merchants, restaurants and a surge in smartphone and internet usage among consumers are forecast to drive the regional market growth.

Request full Report Description, TOC, Table of Figure, Chart, etc : -https://www.quadintel.com/request-sample/commercial-lending-market/QI040

Leading Competitors

The leading prominent companies profiled in the global commercial lending market are:

American Express Company

Credit Suisse

Fundation Group LLC

Fundbox

Funding Circle

Goldman Sachs

Kabbage

LoanBuilder

Merchant Capital

OnDeck

Other Prominent Players

Scope of the Report

The global commercial lending market segmentation focuses on Type, Enterprise Size, Provider, and Region.

Segmentation based on Type

Unsecured Lending

Secured Lending

Segmentation based on Enterprise Size

Large Enterprises

Small & Medium Size Enterprises

Download Free Sample Report -https://www.quadintel.com/request-sample/commercial-lending-market/QI040

Segmentation based on Provider

Banks

Non-bank financial institution (NBFCs)

Segmentation based on Region

North America

The U.S.

Canada

Mexico

Europe

Western Europe

The UK

Germany

France

Italy

Spain

Rest of Western Europe

Eastern Europe

Poland

Russia

Rest of Eastern Europe

Asia Pacific

China

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Middle East & Africa (MEA)

UAE

Saudi Arabia

South Africa

Rest of MEA

South America

Brazil

Argentina

Rest of South America

Request full Report :- https://www.quadintel.com/request-sample/commercial-lending-market/QI040

About Quadintel:

We are the best market research reports provider in the industry. Quadintel believes in providing quality reports to clients to meet the top line and bottom line goals which will boost your market share in today's competitive environment. Quadintel is a 'one-stop solution' for individuals, organizations, and industries that are looking for innovative market research reports.

We will help you in finding the upcoming trends that will entitle you as a leader in the industry. We are here to work with you on your objective which will create an immense opportunity for your organization. Our priority is to provide high-level customer satisfaction by providing innovative reports that enable them to take a strategic decision and generate revenue. We update our database on a day-to-day basis to provide the latest reports. We assist our clients in understanding the emerging trends so that they can invest smartly and can make optimum utilization of resources available.

Get in Touch with Us:

Quadintel:

Email:sales@quadintel.com

Address: Office - 500 N Michigan Ave, Suite 600, Chicago, Illinois 60611, UNITED STATES

Tel: +1 888 212 3539 (US - TOLL FREE)

Website : https://www.quadintel.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Lending Market Latest Innovations, Impacting Factors, Growth opportunities 2031 here

News-ID: 2938875 • Views: …

More Releases from Quadintel

Smart Textiles for Military Market Business Expansion Strategies for the Market …

Quadintel's recent global " Smart Textiles for Military Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample…

China Home Appliances Market A Deep Dive into the Market: Trends, Insights, and …

Quadintel's recent global " China Home Appliances Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of…

Wireless Healthcare Market Unlocking New Growth Avenues in the Market: Strategie …

Quadintel's recent global " Wireless Healthcare Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

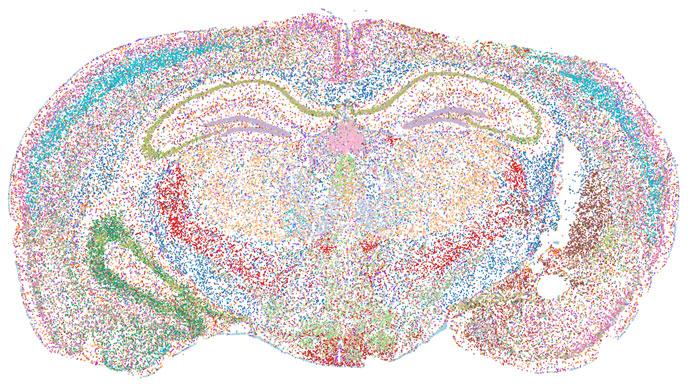

Spatial omics Market The Impact of Economic Conditions on the Market in 2023-203 …

Quadintel's recent global " Spatial omics Market " research report gives detailed facts with consideration to market size, cost revenue, trends, growth, capacity, and forecast till 2030. In addition, it includes an in-depth analysis of This market, including key factors impacting the market growth.

This study offers information for creating plans to increase the market's growth and effectiveness and is a comprehensive quantitative survey of the market.

Download Free Sample of This…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…