Press release

Payment Processing Solutions Market Growth Factors Trends, Statistics, Size 2027

the Payment Processing Solutions Market size to grow from USD 90.9 billion in 2022 to USD 147.4 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.1% during the forecast period.Get Sample of Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=751866

By Payment method, the automatic clearing house segment to have a second largest growth during the forecast period

The ACH transfer is an electronic, bank-to-bank money transfer that is processed through the Automatic Clearing House network. According to the National Automated Clearing House Association (NACHA), the ACH network is a batch processing system that banks and other financial institutions use to aggregate ACH transactions for processing, which typically happens three times each business day. The ACH Network processes two kinds of ACH transactions: direct deposits and direct payments. ACH transfers are a way to move money between accounts at different banks electronically. They enable merchants to send or receive money conveniently and securely. Business owners use ACH to pay vendors or receive payments from clients and customers.

ACH transfers are extensively used to make recurring deposits into taxable brokerage accounts, paying utility bills, interest payments, government benefits, insurance premiums, etc. ACH transfers have many uses and can be more cost-efficient and user-friendly than writing checks or paying with a credit or debit card. ACH transfers are usually quick, user friendly, and has a low processing fee in comparison to other payment modes such as credit card, debit card, and eWallets.

By Vertical, the real estate segment to account for the highest CAGR during the forecast period

The real estate industry is suffering from numerous challenges in terms of establishing trust, effectiveness of data sharing, and adequacy of automation processes. There are multiple companies, agents, eCommerce websites, and several other channels through which people can search a property for leasing, buying, or putting their own property for sale. Real estate transactions associated with buy, sell, or lease have been long-established, but the advent of digital payments in the last decade has brought the buyer and seller much closer. Digital payments made transactions more secure and transparent, thereby making investments safer and faster for stakeholders. This is expected to have a positive impact on the payment processing solutions market growth.

North America region to account for second-highest market share in payment processing solutions market

The payment processing solutions market in North America is highly competitive, as the US and Canada have a strong focus on Research and Development (R&D) and innovation. North America has been a global innovator, constantly at the forefront of payment technology along with retail and financial services. The region has always been dependent on stability and convenience of its well-established payment infrastructure. The widespread adoption of mobile devices, such as smartphones and tablets and the need to have convenient access to financial solutions have positively affected the payment processing solutions market in North America.

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/payment-processing-solutions-market-751866.html

Key and innovative vendors in the payment processing solutions market are PayPal (US), Fiserv (US), FIS (US), Square (US), Global Payments (US), Wirecard (Germany), ACI Worldwide (US), MasterCard (US), Visa (US), Stripe (US),CCBill(US), PayU (Netherlands), Authorize.Net(US), Jack Henry & Associates (US), Alipay(China), Paysafe (UK), BlueSnap(US), Secure Payment Systems(US), Worldline(France), Spreedly(US), Fattmerchant(US), PayTrace(US), Dwolla (US), PayProTec(US), SignaPay(US), Klik&Pay(Switzerland), Finix Payments(US), Due(US), PhonePe(India), Modulr(England), Pineapple Payments(US),Razorpay(India), MuchBetter(England), PayKickstart(US), Aeropay(US), Sila(US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are moulded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processing Solutions Market Growth Factors Trends, Statistics, Size 2027 here

News-ID: 2932882 • Views: …

More Releases from Markets and Markets

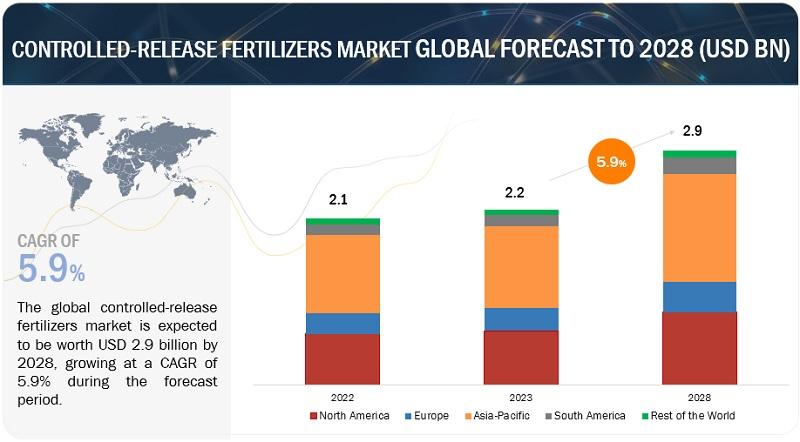

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

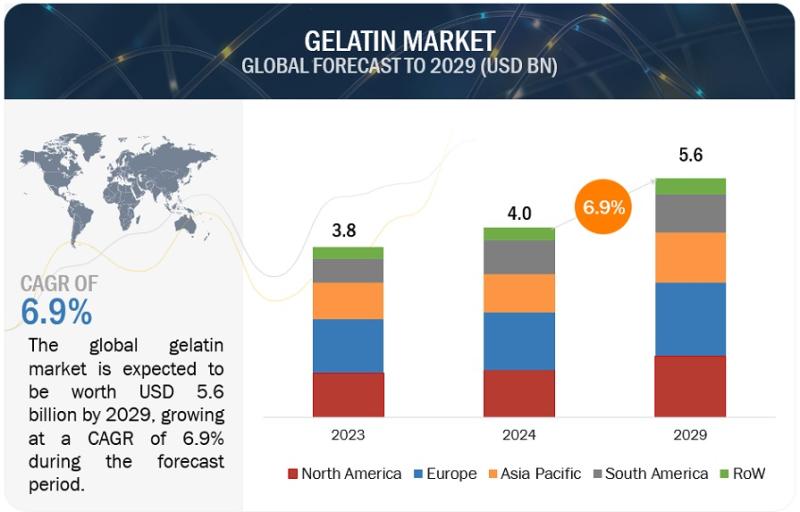

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

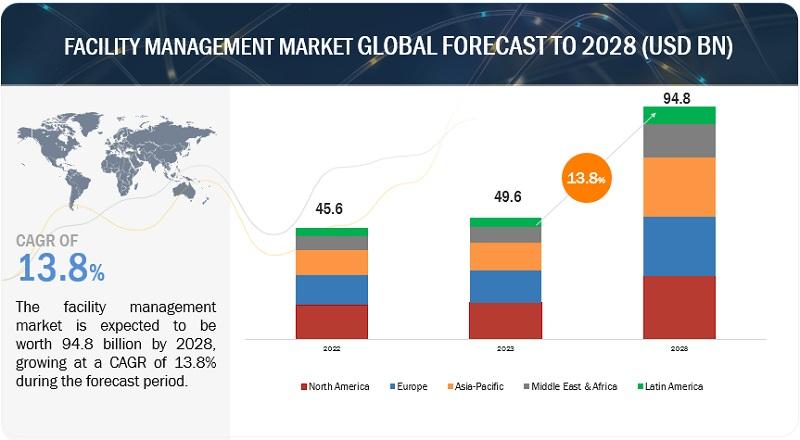

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for ACH

TCB Pay Expands to ACH Payments: The Flexible Alternative to Credit Cards

TCB Pay, a leading provider of corporate cards and payment solutions, is thrilled to announce the expansion of its services to include Automated Clearing House (ACH) payments. This new service cements TCB Pay's position as an innovator in payment technology, delivering greater flexibility, security, and efficiency for businesses managing their transactions.

ACH: The Ideal Alternative to Credit Card Payments

At TCB Pay, our ACH processing solution provides a versatile alternative for businesses…

Plasterboard Market ach US$ 46.3 billion by 2033 with CAGR 2033

The global Plasterboard Market is valued at US$ 26.65 billion in 2023 and is projected to reach US$ 46.3 billion by 2033, expanding steadily at a CAGR of 5.7% from 2023 to 2033.

Plasterboard has revolutionized interior design and building techniques, making it an important sector of the construction industry. Plasterboard, also referred to as drywall or gypsum board, is frequently utilized because of its adaptability, simplicity of installation, and affordability.…

Aircraft Soundproof Curtains Market | ACH, ACM Aerospace, Anjou Aeronautique, Av …

The global aircraft soundproof curtains market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the aircraft soundproof curtains market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Aircraft Blackout Curtains Market | ACH, ACM Aerospace, Anjou Aeronautique, Avia …

The global aircraft blackout curtains market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the aircraft blackout curtains market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Honeycomb Sheets Market | ACH Foam Technologies, BASF SE, DS Smith, EconCore

The global honeycomb sheets market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the honeycomb sheets market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth of the…

Online Check Writer Announces No Transaction Fees On Ach Processing

Online Check Writer has officially introduced no fees for processing ACH (Automated Clearing house) transactions on their All-in-One platform. Pay or Get Paid by Printable Checks, e-Check, ACH, Direct Deposit, or RTP. Unlike many financial institutions, OCW platform allows for multiple bank accounts and multi-user interface with controls on one platform.

Yesterday, OCW announced processing ACH for free without paying exorbitant fees every time you accept or make a payment.…