Press release

Global Lending Market Report 2023 | Market Size, Key Drivers And Top Trends | China Construction Bank, Agricultural Bank of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China

The Business Research Company's global market reports are now updated with the latest market sizing information for the year 2023 and forecasted to 2032As per the lending market report by The Business Research Company, banks and financial institutions are adopting digitization solutions to modernise their commercial lending business. This move is mainly a result of increased competition among banks and growing demand for a simplified and quick commercial lending process.

The global lending market grew from $7887.89 billion in 2022 to $8682.26 billion in 2023 at a compound annual growth rate (CAGR) of 10.1%. The lending market is expected to grow to $12176.98 billion in 2027 at a CAGR of 8.8%.

Read More On The Lending Market Report Here:

https://www.thebusinessresearchcompany.com/report/lending-global-market-report

Major competitors in the lending market include China Construction Bank, Agricultural Bank of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China, Citigroup, Bank of America Corporation, State Bank of India, Mitsubishi UFJ Financial Group, and Legal & General Group plc.

The lending market is segmented -

•By Type: Corporate Lending, Household Lending, Government Lending

•By Interest Rate: Fixed Rate, Floating Rate

•By Lending Channel: Offline, Online

•By Geography: Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. Western Europe was the largest region in the lending market.

Request A Free Sample Of The Lending Market Report Here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=3575&type=smp

Lending is the act of allowing a person or organization to use a sum of money in exchange for an agreement to repay it later, typically with interest.

The Table Of Content For The Lending Market Include:

1. Executive Summary

2. Report Structure

3. Lending Market Characteristics

4. Lending Market Product Analysis

5. Lending Market Supply Chain

……

19. Middle East Lending Market

20. Africa Lending Market

21. Lending Market Competitive Landscape

22. Key Mergers And Acquisitions In The Lending Market

23. Market Background: Lending And Payments Market

The "Global Lending Market Report 2023" from The Business Research Company is a comprehensive report that covers every facet of a market covering over 60 geographies and over 2500 market segments. The regional and country breakdowns section analyzes the market in each geography and the market size by region and country. Furthermore, it assesses the market's historical and projected growth and identifies significant trends and strategies that companies can leverage for business expansion.

Contact us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Latest Trending Press Releases: https://www.thebusinessresearchcompany.com/press-release.aspx

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Lending Market Report 2023 | Market Size, Key Drivers And Top Trends | China Construction Bank, Agricultural Bank of China, JPMorgan Chase & Co., Bank of China, Industrial and Commercial Bank of China here

News-ID: 2932552 • Views: …

More Releases from The Business Research company

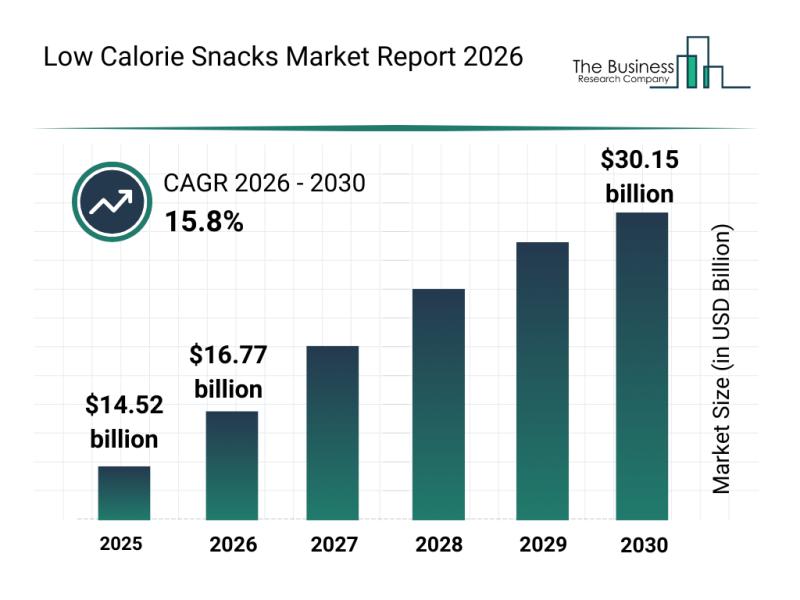

Analysis of Key Market Segments Driving the Low Calorie Snacks Market

The market for low calorie snacks is on a rapid growth trajectory, driven by changing consumer preferences and innovative product developments. As more individuals prioritize healthier eating habits, this sector is evolving with new offerings and expanding retail channels. Let's explore the current market value, prominent players, emerging trends, and key segments shaping the future of low calorie snacks.

Projected Market Size and Growth in the Low Calorie Snacks Market …

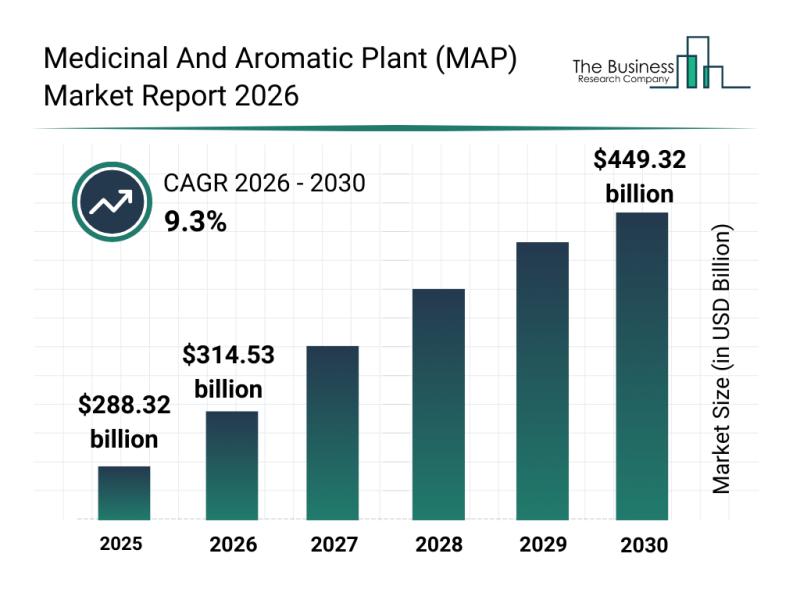

Future Perspective: Key Trends Shaping the Medicinal and Aromatic Plant (MAP) Ma …

The market for medicinal and aromatic plants is gaining substantial momentum as various industries increasingly recognize its value. With growing awareness of natural health solutions and sustainability, the sector is set to experience significant growth in the coming years. Let's explore the market size projections, key players, influential trends, and how the market is segmented for a clearer understanding of its future trajectory.

Steady Expansion Expected in the Medicinal and Aromatic…

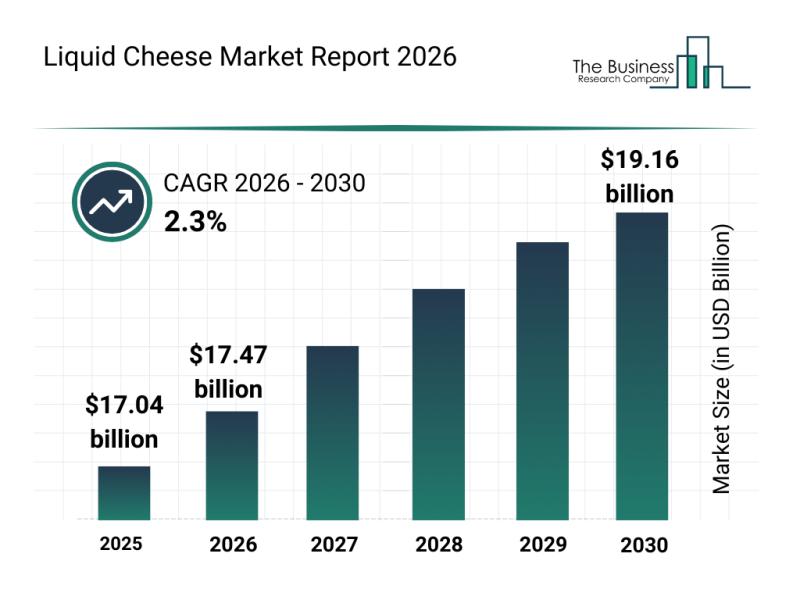

Global Trends Overview: The Rapid Evolution of the Liquid Cheese Market

The liquid cheese market is on a path of steady expansion, driven by evolving consumer preferences and innovations in product offerings. As more people seek convenient and flavorful cheese options, this sector is positioned to experience notable growth over the next several years. Let's explore the current market size, key players, industry trends, and segmentation details shaping the future of liquid cheese.

Projected Growth and Market Value of the Liquid Cheese…

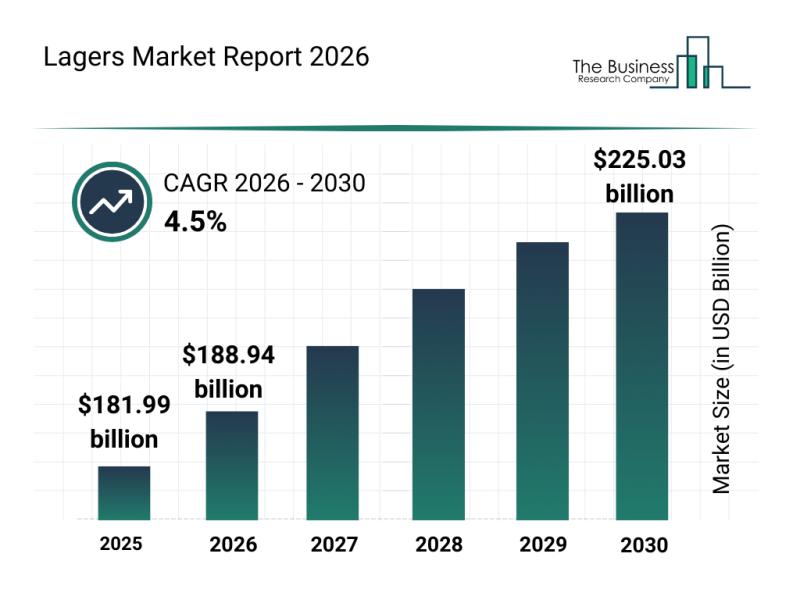

Segmentation, Major Trends, and Competitive Overview of the Lagers Market

The lagers market is set to experience consistent growth over the coming years, driven by evolving consumer tastes and expanding industry investments. As preferences shift toward premium and specialty beers, the market is adapting to meet these new demands, opening up opportunities for product innovation and wider distribution.

Forecasted Expansion of the Lagers Market by 2030

By 2030, the lagers market is projected to reach a value of $225.03 billion,…

More Releases for Lending

Mortgage Lending Market : Increased focus toward digitalizing lending process

According to the report published by Allied Market Research, the global mortgage lending market generated $11.48 billion in 2021, and is estimated to reach $27.50 billion by 2031, witnessing a CAGR of 9.5% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, value chain, key investment pockets, competitive scenario, and regional landscape. The report is a vital for leading market players, investors, new…

P2p Lending Market | Industry Overview 2021 | Worldwide Companies- CircleBack Le …

P2p Lending Market report will provide one with overall market analysis, statistics, various trends, drivers, opportunities, restraints, and every minute data relating to the Synthetic Fibers market necessary for forecasting its revenue, factors propelling & growth. The P2p Lending market study provides unique guidance in thoughtful details regarding the development factors and has used a top-down and bottom-up approach to keep it error-free and accurate. Our expert analysts have used…

Peer-to-peer Lending – Growing Popularity and Emerging Trends in the Market | …

Global Peer-to-peer Lending Market Size, Status and Forecast 2018-2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Peer-to-peer Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Alternative Lending Market Is Booming Worldwide | Lending Club, Prosper, Upstart …

The ‘ Alternative Lending market’ research report added by Report Ocean, is an in-depth analysis of the latest developments, market size, status, upcoming technologies, industry drivers, challenges, regulatory policies, with key company profiles and strategies of players. The research study provides market overview, Alternative Lending market definition, regional market opportunity, sales and revenue by region, manufacturing cost analysis, Industrial Chain, market effect factors analysis, Alternative Lending market size forecast, market…

P2P Lending Market is Thriving Worldwide | CircleBack Lending, Lending Club, Pee …

Global P2P Lending Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global P2P Lending Market. Some of the key players profiled in the study are CircleBack Lending, Lending…

Canada Peer-to-peer Lending Market 2018-2022 Overview by CircleBack Lending, Len …

with the slowdown in world economic growth, the Peer-to-peer Lending industry has also suffered a certain impact, but still maintained a relatively optimistic growth, the past four years, Peer-to-peer Lending market size to maintain the average annual growth rate of 2.94% from 22 million $ in 2014 to 24 million $ in 2017, Research analysts believe that in the next few years, Peer-to-peer Lending market size will be further expanded,…