Press release

Digital Payment Market Growth, Latest Industry Size, Future Sales Revenue and Key Drivers Analysis Research Report 2028, The Insight Partners

According to our latest market study on "Digital Payment Market Forecast to 2028 - COVID-19 Impact and Global Analysis - by Component, Deployment, Organization Size, and Industry," the market was valued at US$ 89,045.67 million in 2021 and is projected to reach US$ 243,426.71 million by 2028; it is expected to grow at a CAGR of 15.4% from 2021 to 2028. The global digital payment market is expected to grow during the forecast period due to the increasing prevalence of smartphones enabling the expansion of mCommerce. The way people access the internet has a direct impact on the growth of mobile commerce. Users prefer smartphones over PCs for internet surfing as smartphones are more affordable, and high-speed internet is no longer a premium infrastructure in many countries. Retailers develop shopping applications that have easy-to-browse catalogs and a simple checkout experience. The fact that customers are intrinsically tied to their mobile phones is not missed by bankers and payment service providers. Banks provide banking apps that allow transactions to be completed on a mobile device's screen. Mobile commerce has also shifted the way brick-and-mortar businesses work, particularly in terms of accepting cashless payments.Get Sample PDF Copy at @ https://www.theinsightpartners.com/sample/TIPRE00007577/?utm_source=OpenPR&utm_medium=10212

Scope of the Report

The digital payment market is segmented on the basis of component, deployment, organization size, industry, and geography. Based on component, the market is bifurcated into solution and services. The market for the solution segment is further segmented into payment gateway, payment processing, payment security and fraud management, point of sale, and payment wallet. The payment processing segment held the largest revenue share in 2020. Based on deployment, the digital payment market is bifurcated into on-premise and cloud-based. The cloud-based segment held a larger revenue share in 2020. Based on organization size, the market is bifurcated into small and medium enterprises and large enterprises.

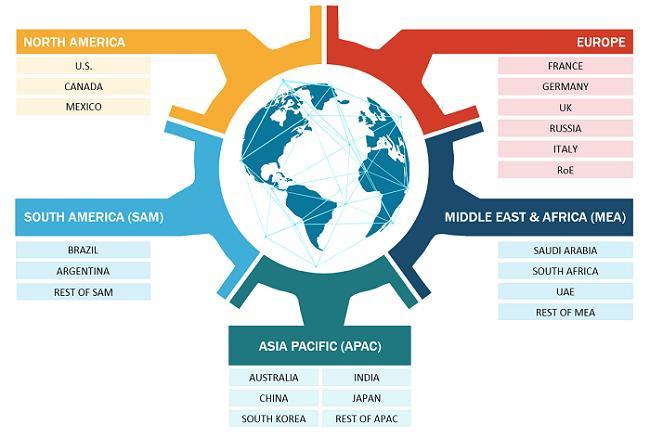

The large enterprises segment held a larger revenue share in 2020. Based on industry, the digital payment market is segmented into BFSI, retail and ecommerce, healthcare, travel and hospitality, media and entertainment, IT and telecom, and others. The BFSI segment held the largest revenue share in the market in 2020. Geographically, the digital payment market is segmented into five key regions-North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America (SAM). North America held the largest revenue share in 2020, followed by Europe and APAC. The market in APAC is projected to grow at the fastest rate from 2021 to 2028.

The Innovative Key Players Are:

•ACI WORLDWIDE, INC

•Adyen

•Financial Software & Systems Pvt. Ltd.

•Fiserv, Inc.

•Global Payments Inc.

•Novatti Group Ltd

•PayPal Holdings, Inc.

•Paysafe Limited

•Block, Inc.

•PayU

Speak To Analyst @ https://www.theinsightpartners.com/speak-to-analyst/TIPRE00007577/?utm_source=OpenPR&utm_medium=10212

Impact of COVID-19 Pandemic on Digital Payment Market

The COVID-19 pandemic has benefited the digital payment solutions industry. Businesses are facing new challenges due to the pandemic and the development of remote work environments. At least 58 governments in developing countries have adopted digital payments to give COVID-19 help, according to a World Bank survey of policy responses to the pandemic. At least 36 countries received the funds in fully functional accounts that may be used for saving or transactions in addition to withdrawing cash. Financial inclusion necessitates such extensive capability. Further, the emergence of the pandemic in 2020 has prompted a slew of challenges for global market operations. Healthcare infrastructures of developed economies have collapsed due to the rising number of COVID-19 cases. As a result, the public healthcare emergency will require the governments and market players to intervene and assist in the revival of market operations and revenue through collaborative efforts of research and development initiatives to recover the losses during the forecast period. In addition, the increased investments bode well for the industry in the following years.

Digital Payment Market Insights

Financial services companies are recognizing the importance of open banking initiatives and application programming interfaces. Traditional banks understand that they must improve their digital capabilities to compete in the sector and avoid being disintermediated by new entrants with superior offers and services. For instance, numerous financial services companies such as PayPal, Wells Fargo, and Visa are supporting Open Banking projects. Also, in Europe

Open Banking initiatives are progressively becoming the norm because banks are legally required to make account information accessible via APIs under the Revised Payment Services Directive (PSD2), effective from 2018. Open Banking APIs boost a bank's attractiveness and enable it to meet the changing expectations of existing clients and attract new ones. The APIs may also be used as a one-of-a-kind solution to boost customer interaction and respond to consumer requirements in a safe, agile, and future-proof way. Open Banking APIs are significant assets for financial services organizations because they allow them to expand service offerings, boost client interaction, and create new digital income channels, which would offer a significant opportunity for the digital payment market to expand during the forecasted period

Deployment Segment Insights

Based on deployment, the digital payment market is bifurcated into on-premise and cloud-based. The cloud-based segment led the market in 2020. Cloud-based deployment provides built-in data security, on-demand scalability, and the capacity to quickly perform intensive computing activities. The cloud is a significant enabler of digital wallets. As digital wallets become popular, these benefits might greatly improve existing functionality and even lead to new innovations. The use of remote virtual storage eliminates the need for physical servers, reducing the risk of outage and disaster. Clouds also provide robust cybersecurity protections and can meet critical regulatory standards, such as the Payment Card Industry Data Security Standard (PCI DSS), which is particularly relevant in the financial services industry.

The research provides answers to the following key questions:

1.What is the estimated growth rate of the market for the forecast period 2021-2028? What will be the market size during the estimated period?

2. What are the key driving forces responsible for shaping the fate of the Digital Payment market during the forecast period?

3. Who are the major market vendors and what are the winning strategies that have helped them occupy a strong foothold in the Digital Payment market?

4. What are the prominent market trends influencing the development of the Digital Payment market across different regions?

5. What are the major threats and challenges likely to act as a barrier in the growth of the Digital Payment market?

6. What are the major opportunities the market leaders can rely on to gain success and profitability?

Click To Buy @ https://www.theinsightpartners.com/buy/TIPRE00007577/?utm_source=OpenPR&utm_medium=10212

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market Growth, Latest Industry Size, Future Sales Revenue and Key Drivers Analysis Research Report 2028, The Insight Partners here

News-ID: 2923122 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…