Press release

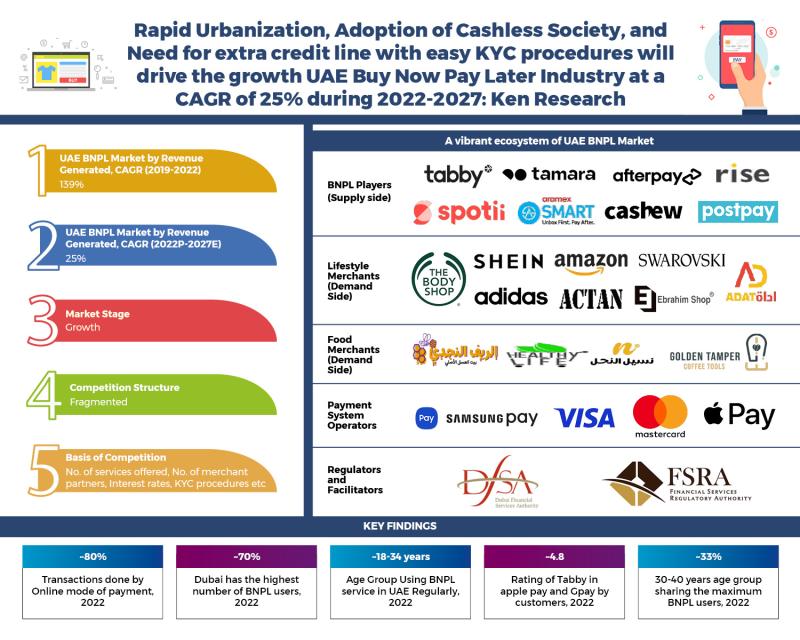

Around 80% of the BNPL Market revenue in UAE was generated by Online mode of payment fueled by the Covid-19 pandemic: Ken Research

1. The Covid-19 pandemic is a driving force in exhilarating and paving the way for newer companies to enter the BNPL space in the country, in addition to external investments made in the industryIn recent years, the UAE has seen a significant increase in digital transactions Because of the rise of e-commerce in the region, inter-governmental partnerships are being formed in order to make the UAE a digital hub. This is one of the major factors contributing to the rise of digital credit lending in the country, such as that of BNPL. Government support is also playing a significant role in the UAE's surging digital penetration. Additionally, BNPL players in the UAE have only just entered the market and have cumulatively received approximately $40 million+ in funding which is likely to boost the BNPL services in the country.

Buy Now Pay Later industry in UAE has gained significant traction growing at a CAGR of ~92% in between 2019 and 2022

The Buy Now Pay Later industry in the UAE generated multi-million dollars in revenue in 2022, growing at a CAGR of 92% between 2019 and 2022. The UAE BNPL market boomed during the COVID-19 pandemic because a large portion of the residents lost their jobs during this period and was surviving on their savings, which pushed for the need for an extra credit line, which BNPL services catered to. In 2022, the 30-40 age group was having the largest market share for BNPL services in the country. This is due to the growing working-age population, which is gradually shifting away from credit cards and toward BNPL as a mode of payment.

With an increasing consumer base and expanding partnerships with merchants and retailers, the country's BNPL players have seen a boom in a short period of time

The Middle East region has seen an increase in the number of companies offering BNPL solutions in just one year. They are making a name for themselves by adding value to merchants and providing simple financial products to customers. With so much going on at BNPL, its user base is making significant strides as well. With the decreasing impact of Covid-19, we are also seeing the return of offline shopping mode. The BNPL players will not pass up this opportunity. They have already begun collaborating with leading retailers to offer BNPL as a point-of-sale financing tool in physical stores at checkout points.

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTg4ODY3

Credit recovery, combined with customer overspending, is posing a significant challenge to the expansion of the BNPL market in the UAE

BNPL service providers face the risk of being unable to recover loan amounts that customers fail to pay on time. Although there is a carry forward charge attached to late amounts, it may continue to accumulate on the consumers' part. Regulators are concerned about the rising indebtedness and risk to consumers as the BNPL market expands rapidly. Moreover, unwise purchases are becoming more common as a result of unsecured credit risk assessment using these methods. The risks associated with the region's competition are also extremely high. Companies in the nascent or growth stage need to figure out multiple revenue streams and different methods of financing such as a card, cashback, and loans or quick financing to survive the competition.

For more insights on the market intelligence, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/uae-buy-now-pay-later-industry-outlook-to-2027/588867-93.html

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Around 80% of the BNPL Market revenue in UAE was generated by Online mode of payment fueled by the Covid-19 pandemic: Ken Research here

News-ID: 2902335 • Views: …

More Releases from Ken Research Pvt .Ltd

GCC Pharmaceutical Market - Ken Research Stated the Sector Valued at ~USD 27.7 b …

Comprehensive market analysis maps healthcare expansion, localization opportunities, and regulatory evolution shaping the Gulf's pharmaceutical ecosystem.

Delhi, India - September 2025 - Ken Research released its strategic market analysis titled "GCC Pharmaceutical Market Outlook to 2030," revealing that the current market size is valued at USD 27.7 billion, based on a five-year historical analysis. The study outlines how the market is poised to expand, driven by rising healthcare expenditure, growing prevalence…

Ken Research Stated Australia's Sports Equipment and Athletic Apparel Market to …

Comprehensive market analysis highlights strong participation-driven demand, premiumization trends, omnichannel retail evolution, and strategic growth opportunities across Australia's active lifestyle economy.

Delhi, India - August 14, 2025 - Ken Research released its strategic market analysis titled "Australia Sports Equipment and Athletic Apparel Market," revealing that the market is currently valued at USD 5 billion, based on a five-year historical analysis. The detailed study outlines how the market is positioned for steady…

Ken Research Stated India's Digital Watch Market to Reach USD 0.55 Million

Comprehensive market analysis maps accelerated adoption trends, technology-driven opportunities, and strategic imperatives for brands, manufacturers, and investors across India's rapidly evolving digital wearables ecosystem.

Delhi, India - October 15, 2025 - Ken Research released its strategic market analysis titled "India Digital Watch Market Outlook to 2029," revealing that the market was valued at USD 0.55 million in 2023, based on a five-year historical analysis. The detailed study outlines how the market…

India Cashew Market - Ken Research Stated the Sector Valued at ~USD 3.8 billion …

Comprehensive market analysis maps supply-demand dynamics, export opportunities, and strategic imperatives for industry stakeholders across India's evolving cashew processing and trade ecosystem.

Delhi, India - October 15, 2025 - Ken Research released its strategic market analysis titled "India Cashew Market Outlook to 2029," revealing that the current market size is valued at INR 172.5 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…