Press release

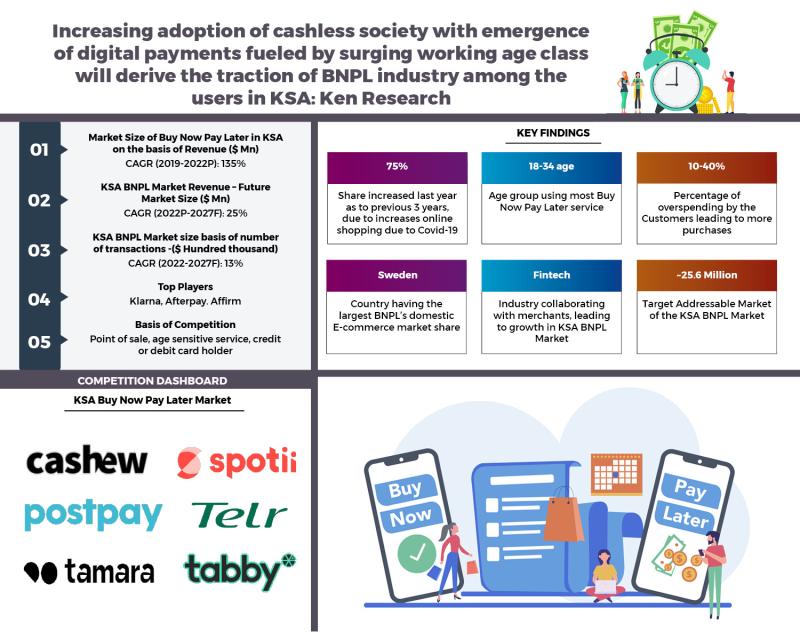

Global players and investors are rapidly expanding the BNPL industry in KSA through investment, funding, and acquisition: Ken Research

1. The Covid-19 epidemic is a catalyst for energizing and opening up the BNPL market in the nation, together with external investments made in the sectorRecent years have seen a substantial increase in digital transactions in Saudi Arabia. Which is one of the main causes for the rise of digital credit lending in the nation, including BNPL. The ideal fintech innovation, BNPL, was created in response to consumer demand for alternatives to the debt-based credit card system. BNPL participants in the region are implementing solid CX business strategies together with alliances with top regional banks, like the Saudi National Bank (SNB). Moreover, these companies are making their mark by adding value and providing customers with simple financial products.

2. The KSA market for buy now pay later has seen substantial growth by the end of 2022 and a CAGR of 135% between 2019 and 2022

The buy Now pay later industry in KSA generated several million dollars in revenue in 2022, expanding at a CAGR of 135% from 2019 to 2022P. Many residents lost their jobs as a result of the COVID-19 outbreak, leaving them to rely primarily on their savings. As a result, there was a greater need for an additional credit line, which the BNPL services could satisfy. Prior to a few years ago, the bulk of the region's population was underserved by financial services companies. Even though individuals are well-banked, credit card penetration was at an all-time low, which helped BNPL gain popularity quickly when it first started in the area.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ2

3. With an expanded consumer base and collaborations with merchants and retailers, BNPL players have seen a surge in the country in a short period of time

The number of businesses providing BNPL solutions in the Middle East has increased in only one year. Its user base is advancing at a rate that is commensurate with the amount of activity taking place there. When compared to prior years, a sizable portion of Saudi Arabian consumers used BNPL payment methods like Tamara in 2021, and more clients are now investigating BNPL services. Moreover, the impact of COVID-19 is starting to lessen, which is causing the offline shopping mode to reemerge. Players in the BNPL won't let the chance go by. They have already begun collaborating with top retailers to offer BNPL at checkout points in real locations as a point-of-sale financing option.

4. The expansion of the BNPL business in KSA faces significant challenges from credit recovery combined with excessive client expenditure supported by persistently high competition

Issuers of BNPL services run the danger of not being able to recoup loan sums if customers don't repay on time. Although there is a carry-over fee associated with the late amounts, consumers may continue to incur additional costs. With this, the regulators are concerned about the increased risk to consumers and the rapid growth of the BNPL sector, due to these methodologies' assessment of unsecured credit risk and impulsive purchases rise. In addition, the BNPL industry in KSA is also highly competitive. There are few major players operating in the landscape, which implies that other players cannot purely constrain themselves as BNPL player to operate in the market. Companies in the nascent or growth stage need to figure out multiple revenue streams and different methods of financing such as a card, cashback, and loans or quick financing. Moreover, companies have to adopt interest free model in order to adhere to Sharia Laws.

For more information on the research report, refer to below link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/ksa-buy-now-pay-later-market-outlook-to-2027/596046-93.html

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/india-buy-now-pay-later-market-outlook-to-2026/515064-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/uae-buy-now-pay-later-industry-outlook-to-2027/588867-93.html

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Market Research and Consulting Firm, based out of India, Indonesia and UAE. Since 2011, we have been assisting clients globally with our Syndicate and Bespoke Market Research and Advisory Services.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global players and investors are rapidly expanding the BNPL industry in KSA through investment, funding, and acquisition: Ken Research here

News-ID: 2891095 • Views: …

More Releases from Ken Research Pvt .Ltd

GCC Pharmaceutical Market - Ken Research Stated the Sector Valued at ~USD 27.7 b …

Comprehensive market analysis maps healthcare expansion, localization opportunities, and regulatory evolution shaping the Gulf's pharmaceutical ecosystem.

Delhi, India - September 2025 - Ken Research released its strategic market analysis titled "GCC Pharmaceutical Market Outlook to 2030," revealing that the current market size is valued at USD 27.7 billion, based on a five-year historical analysis. The study outlines how the market is poised to expand, driven by rising healthcare expenditure, growing prevalence…

Ken Research Stated Australia's Sports Equipment and Athletic Apparel Market to …

Comprehensive market analysis highlights strong participation-driven demand, premiumization trends, omnichannel retail evolution, and strategic growth opportunities across Australia's active lifestyle economy.

Delhi, India - August 14, 2025 - Ken Research released its strategic market analysis titled "Australia Sports Equipment and Athletic Apparel Market," revealing that the market is currently valued at USD 5 billion, based on a five-year historical analysis. The detailed study outlines how the market is positioned for steady…

Ken Research Stated India's Digital Watch Market to Reach USD 0.55 Million

Comprehensive market analysis maps accelerated adoption trends, technology-driven opportunities, and strategic imperatives for brands, manufacturers, and investors across India's rapidly evolving digital wearables ecosystem.

Delhi, India - October 15, 2025 - Ken Research released its strategic market analysis titled "India Digital Watch Market Outlook to 2029," revealing that the market was valued at USD 0.55 million in 2023, based on a five-year historical analysis. The detailed study outlines how the market…

India Cashew Market - Ken Research Stated the Sector Valued at ~USD 3.8 billion …

Comprehensive market analysis maps supply-demand dynamics, export opportunities, and strategic imperatives for industry stakeholders across India's evolving cashew processing and trade ecosystem.

Delhi, India - October 15, 2025 - Ken Research released its strategic market analysis titled "India Cashew Market Outlook to 2029," revealing that the current market size is valued at INR 172.5 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…